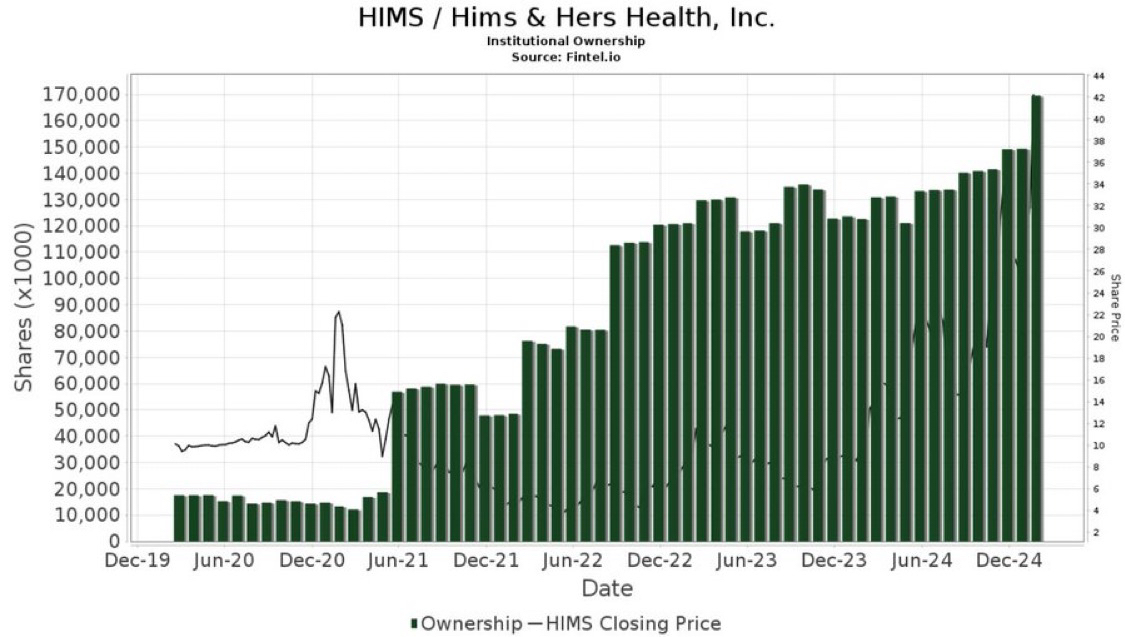

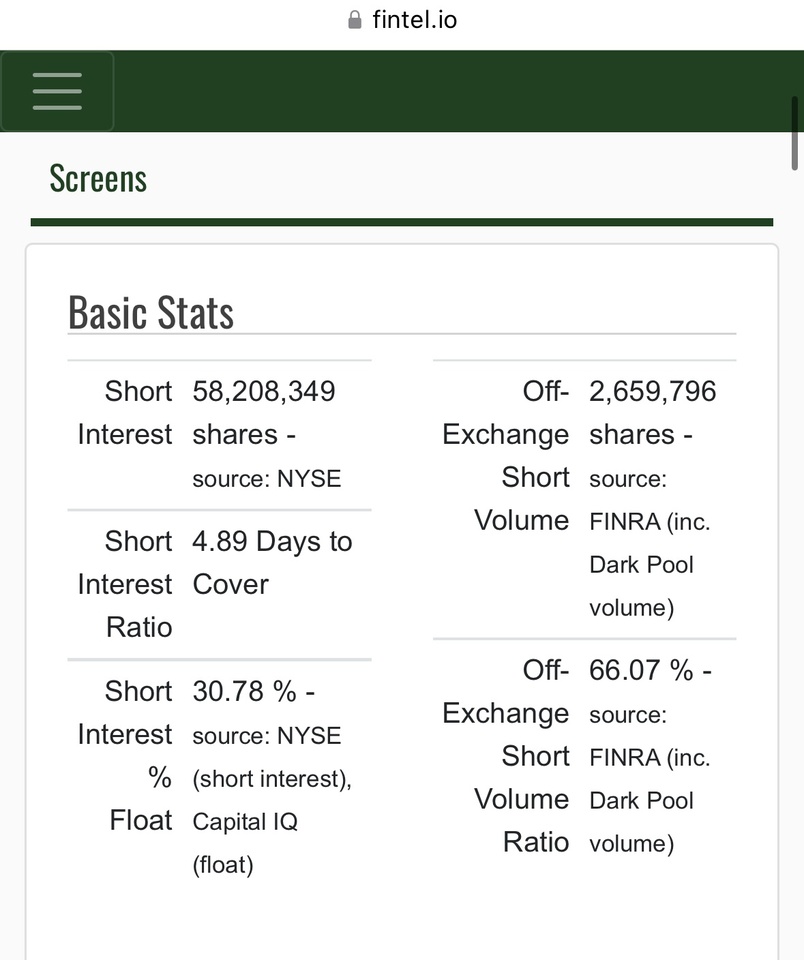

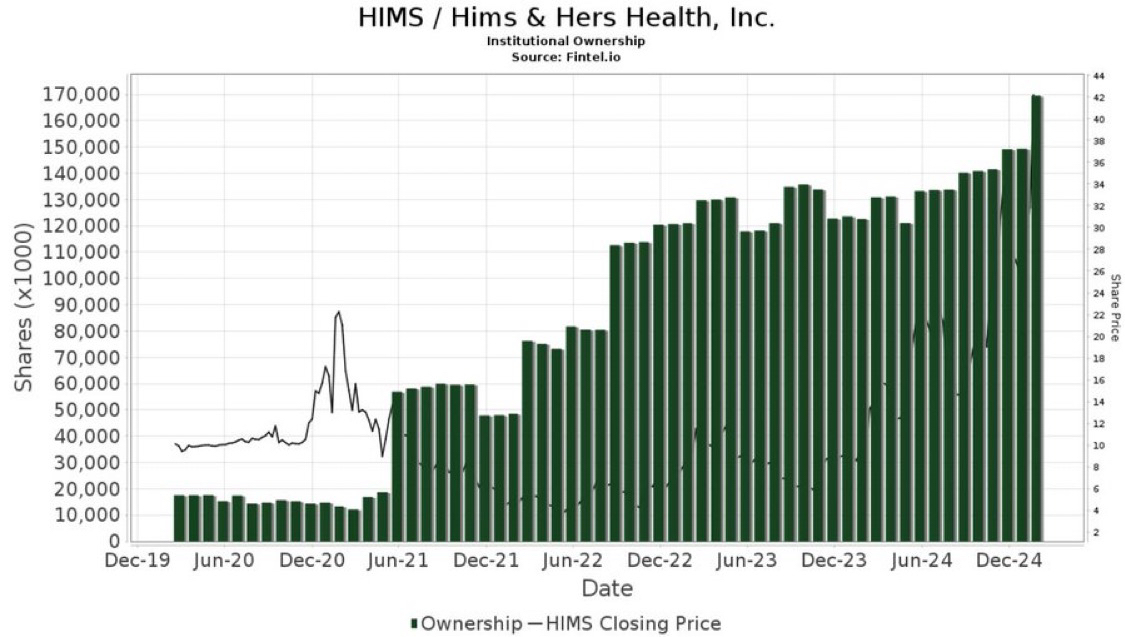

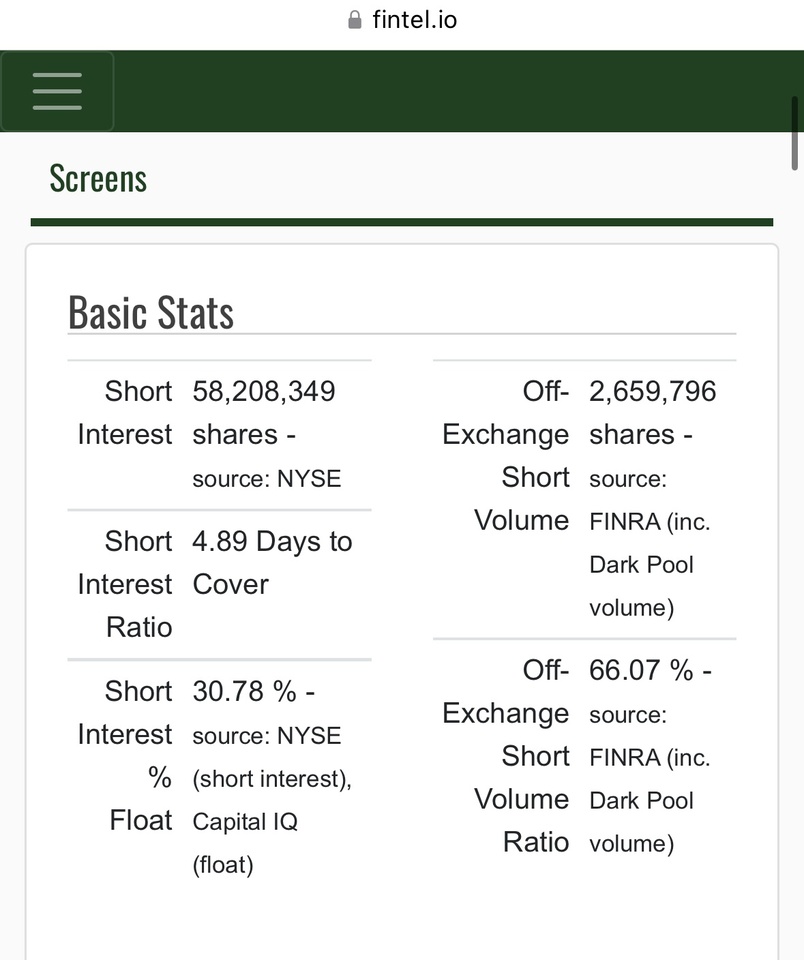

Institutional ownership has reached a new high, but 30% are still sold short.

Will this work out well for the short sellers?

It remains exciting, the earnings and outlook will probably be decisive.

Institutional ownership has reached a new high, but 30% are still sold short.

Will this work out well for the short sellers?

It remains exciting, the earnings and outlook will probably be decisive.