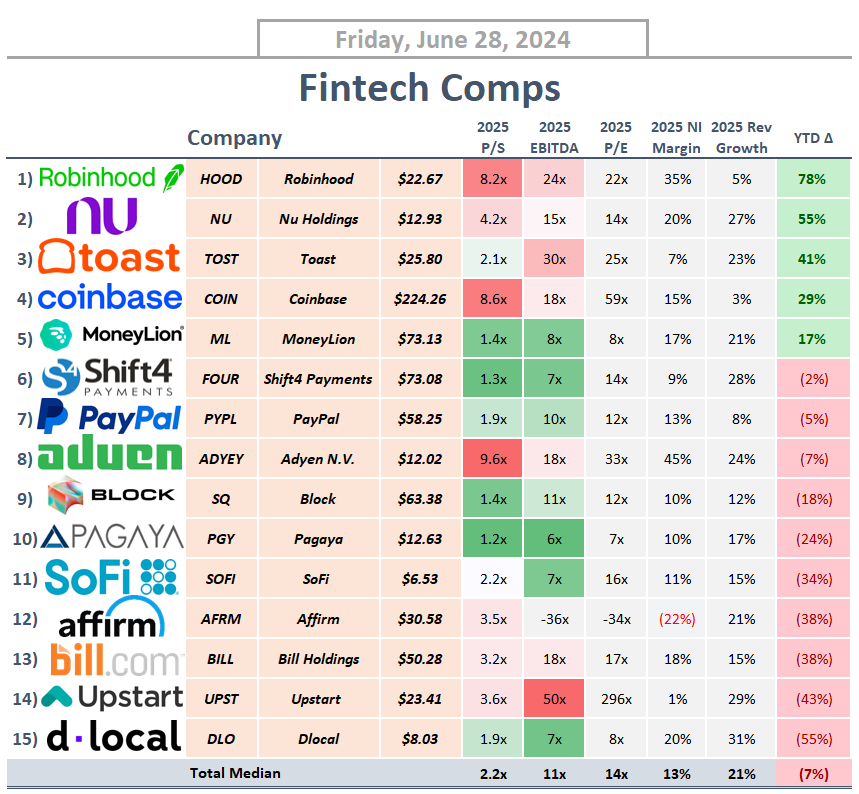

#fintech - I found a nice overview here

Neobanking is forecast to grow at a compound annual growth rate of around 55% to $2 trillion by 2030 - Let's take a look at where fintech stocks stand based on 2025 metrics

Who do you favor? ☺️

$NU (-0,63 %)

$COIN (-1,74 %)

$FOUR

$HOOD (+0,23 %)

$DLO

$TOST (+0,57 %)

$PYPL (-1,14 %)

$BILL (+1,03 %)

$ADYEY (+0,67 %)

$SQ (+0,97 %)

$SOFI (+1,11 %)

$PGY

$ML

$AFRM (+0,55 %)

$UPST (+0,53 %)

$SOFI (+1,11 %) - Company presentation and personal opinion: