In the last 24 hours, the attacks between Iran and Israel have intensified further. Iran has once again fired several missiles at Israel, most of which were intercepted, but there were still hits. Israel, in turn, again attacked targets in Iran, including suspected missile launching pads and facilities in the center of the country. The Israeli Air Force also attacked Iranian nuclear facilities and media centers, while Iran announced further massive attacks and ruled out negotiations during the ongoing Israeli attacks.

Trump called on the population of Tehran to evacuate and threatened further measures if no agreement was reached on the nuclear program. The situation remains extremely tense, with ongoing air alerts and significant civilian and infrastructural damage on both sides. In the sea area near the Strait of Hormuz, the oil tankers Adalynn and Front Eagle collided.

On the Front Eagle a fire broke out, but it was extinguished. According to the British security company Ambrey, however, the incident was not safety-related and is not directly connected to the military conflict between Iran and Israel.

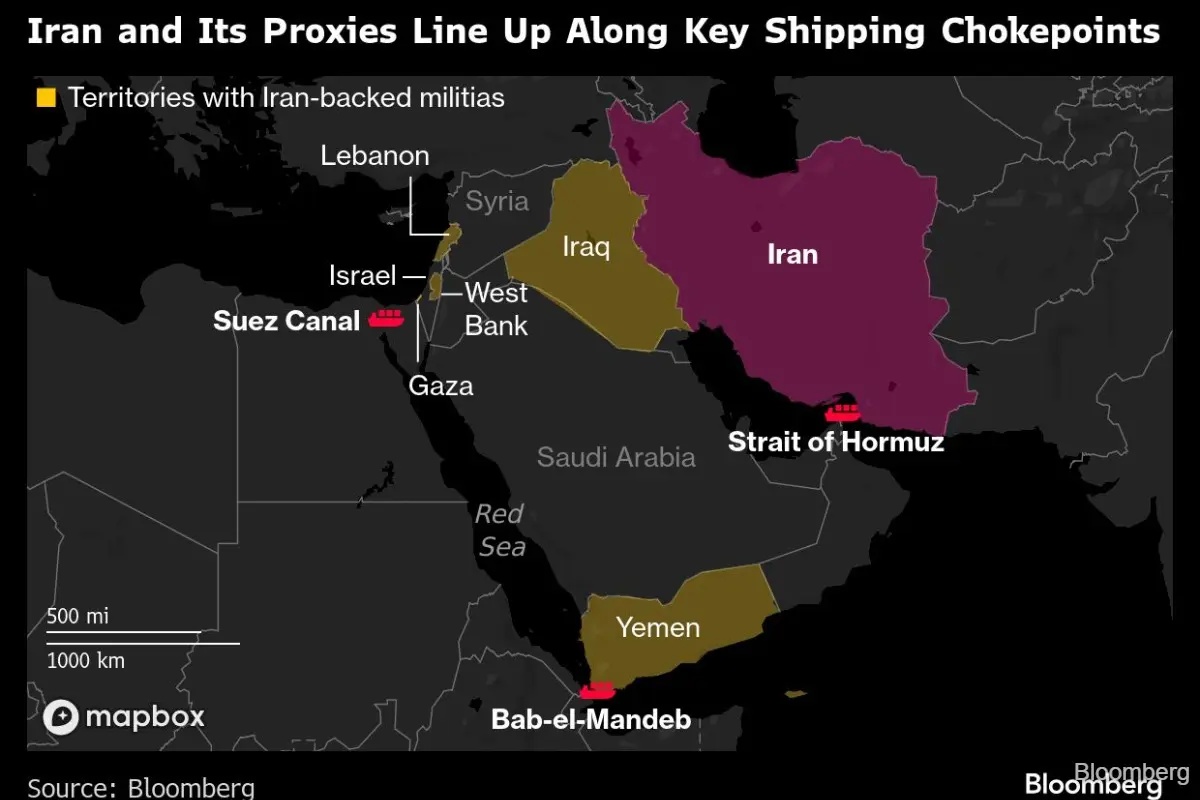

𝖣𝗎𝗋𝖼𝗁 𝖽𝗂𝖾 𝖪𝗈𝗇𝗍𝗋𝗈𝗅𝗅𝖾 𝖽𝖾𝗋 𝖲𝗍𝗋𝖺ß𝖾 𝗏𝗈𝗇 𝖧𝗈𝗋𝗆𝗎𝗓 & 𝖽𝖺𝗌 𝖭𝖾𝗍𝗓𝗐𝖾𝗋𝗄 𝗏𝗈𝗇 𝖬𝗂𝗅𝗂𝗓𝖾𝗇 (𝖧𝗎𝗍𝗁𝗂𝗌 𝗂𝗆 𝖩𝖾𝗆𝖾𝗇, 𝖧𝗂𝗌𝖻𝗈𝗅𝗅𝖺𝗁 𝗂𝗆 𝖫𝗂𝖻𝖺𝗇𝗈𝗇) 𝖾𝗇𝗍𝗅𝖺𝗇𝗀 𝖲𝖼𝗁𝗂𝖿𝖿𝖿𝖺𝗁𝗋𝗍𝗌𝖾𝗇𝗀𝗉ä𝗌𝗌𝖾𝗇 𝖡𝖺𝖻 𝖾𝗅-𝖬𝖺𝗇𝖽𝖾𝖻 & 𝖲𝗎𝖾𝗓-𝖱𝗈𝗎𝗍𝖾 𝗄𝖺𝗇𝗇 𝖨𝗋𝖺𝗇 𝖻𝗂𝗌 𝗓𝗎 40% 𝖽𝖾𝗌 𝗀𝗅𝗈𝖻𝖺𝗅𝖾𝗇 Ö𝗅𝗁𝖺𝗇𝖽𝖾𝗅𝗌 𝖻𝖾𝖽𝗋𝗈𝗁𝖾𝗇

$IOIL00 (+0,04 %) rises significantly in the face of geopolitical tensions. Oil is trading at around USD 74-75 per barrel, with bullish momentum building up. A sustained breakout above the 80 mark could trigger a trend booster, with potential targets above USD 85.

𝖤𝗂𝗇 𝖡𝗋𝖾𝗇𝗍-𝖣𝗎𝗋𝖼𝗁𝖻𝗋𝗎𝖼𝗁 ü𝖻𝖾𝗋 80 𝖴𝖲-𝖣𝗈𝗅𝗅𝖺𝗋 𝗐ü𝗋𝖽𝖾 𝖫𝗈𝗇𝗀 𝖯𝗈𝗌𝗂𝗍𝗂𝗈𝗇𝖾𝗇 𝗂𝗆 𝖢𝖳𝖠 𝗍𝗋𝗂𝗀𝗀𝖾𝗋𝗇.

The Implied Volatility Rate is also exciting. In short, it shows the market expectation for future turbulence. A high IV value indicates increased expected uncertainty and stronger price fluctuations. If the expected volatility increases, options become more expensive. Normally, implied volatility falls when prices rise, but currently it remains at 51% despite the Brent rise.

𝖨𝗆𝗉𝗅𝗂𝗓𝗂𝗍𝖾 𝖵𝗈𝗅𝖺𝗍𝗂𝗅𝗂𝗍ä𝗍 𝖺𝗆 Ö𝗅𝗆𝖺𝗋𝗄𝗍 𝗂𝗆 𝖩𝗎𝗇𝗂 2025 𝗌𝗈 𝗁𝗈𝖼𝗁 , 𝗐𝗂𝖾 𝖻𝖾𝗂𝗆 𝖴𝗄𝗋𝖺𝗂𝗇𝖾-𝖪𝗋𝗂𝖾𝗀