The question of the right broker comes up here at least once a week... I, too, have hardly made up my mind and am always wavering back and forth. However, as I am now registered with the usual brokers, perhaps I can summarize the main pros and cons for me. This should help newcomers on the one hand, but also more experienced people who might want to switch, and last but not least myself, to find the right broker for me based on your opinions.

Scalable (I'm talking about the "new Scalable")

-> This is probably where most of the community's portfolios are located

-> Premium ETFs are always free of charge in the order

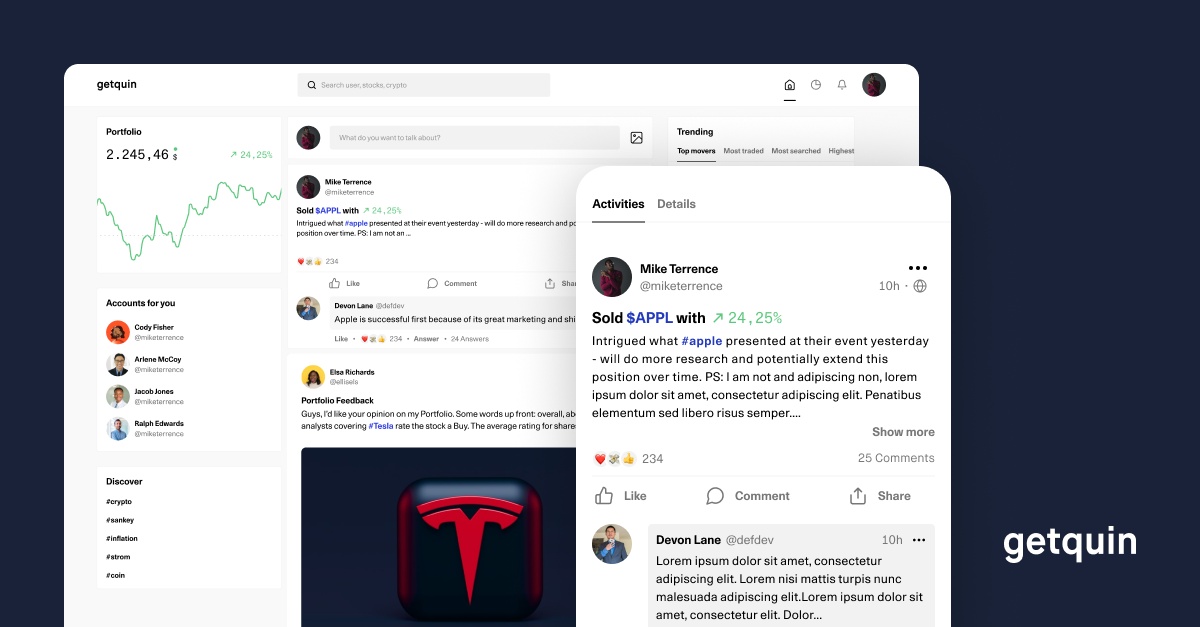

-> by the way, there is a TradingFlat for 5 € pM, from 250 €: No fee (I find this attractive for tranche purchases with a smaller custody account volume). The premium version also includes an analysis tool from BlackRock. The sector analysis, which Getquin also offers you free of charge, is really useful.

-> A large number of shares and ETFs, also in the savings plan. Exotic stocks are also included. Even Swiss shares

-> Dividends are included in the new Scalable, at least currently even on ex-days

-> In the Premium version, it is possible to divide the custody account into groups, free of charge only 1 group.

-> Free of charge only 3 price alerts; Premium unlimited.

-> Two stock exchanges: gettex and EIX; XETRA probably only by instruction

-> Shortest interval for savings plans: monthly. Execution on various days

-> Support seems strong to me. They always don't understand what I want by e-mail, but I got great help on the phone.

-> No fractional trading

-> Interest on clearing account: 0.25% below ECB

(A lot of me sees Scalable as the leader, but I personally need at least two brokers)

Trade Republic (https://app.getquin.com/de/post/lkrguLJhwa/trade-republic)

-> I'm done with them. Their support is below par and my account is currently blocked because I didn't upload a document about my source of funds to their satisfaction. Allegedly "technical problems". Nobody is responding. Well, there are a few thousand euros lying around. (Not an isolated case: search for TradeRepublic blocks accounts due to technical problems => article from Golem. It took seven months for the colleague concerned).

-> Otherwise: Probably the largest range of savings plans, at least that's how it looks to me, as Scalable and TR seem quite comparable to me, but TR adds the Swiss in the savings plan.

-> If you like the gimmick with the card, please (gimmick because I don't want any consumer spending from my WP account and don't want to be encouraged to do so)

-> Each order costs 1 €

-> One stock exchange: Lange&Schwarz

-> Weekly savings plan execution, starting at the beginning or middle of the month.

-> The "best" fractional trading, as you can simply buy an amount and you're done (contrary to the ex-ante, this only costs €1 and not €2).

-> Clearing account with ECB interest rate

Zero

-> BaaderBank in the background - seem to be improving somewhat

-> great support via chat

->great (in my opinion) statistics functions - for me especially the dividend statistics and forecast, which at least take into account the next three years of growth and not - as here - first forecast the dividends of the previous year.

-> I like the watchlist, because you can enter your "entry price" there and thus set a target price for buying and see your distance at any time

-> only 50 price alerts

-> One stock exchange: gettex

-> Savings plans more limited than the above, but usually sufficient. No Swiss, also some exotic stocks

-> Executions on almost every day, weekly as the smallest interval.

-> Several savings plans per share possible

-> Interface is moderately appealing (shares have no pictures, so everything is very text-based)

-> Provides an earnings overview per share that summarizes dividends and price earnings

-> Many of the information is linked to finanzen.net, which I find totally annoying because you are then chased into the browser again and again and finanzen.net would not be my first port of call now

-> Orders cost 1€; over 500€ always free of charge.

-> Fractional trading solala. Only ever runs on a day on which savings plans are also executed. However, this is quite often the case, so it's not that bad.

-> Multi-folder function. Very useful, especially when creating several savings plans!

-> Trailing stop-loss and OCO order

-> No interest (only via "call money ETF")

-> Unfortunately, my favorite ETFs are not available here (in case I want to have ETFs after all: JPM Global Research Enhanced, OssiamShiller and Invesco Quantitative Strategies (greetings go out to @Stullen-Portfolio ) The last two are not even available

Smartbroker

-> Is the main reason for me to consider a second custody account

-> Offers numerous currency accounts (however, apart from USD and GBP, they are somehow not particularly easy to use, as there is no Japanese stock exchange available, for example)

-> Offers a number of stock exchanges, which of course cost fees.

-> gettex: 1 €, over 500 € free of charge

-> Up to 3 securities accounts possible (my main reason (besides US trading) why I find it exciting, because I only need one broker)

-> NO savings plan collection by direct debit

-> Smallest monthly savings plan interval

-> Limited savings plan dates (only 4)

-> Interface looks really bad.

-> Support: no experience

-> compared to Zero: less appealing statistics

-> Thanks to the US stock exchanges, I can easily display the dollar exchange rate at any time, which is very useful at the moment.

-> Interest 0.25 % below the ECB interest rate

-> Unfortunately, my favorite ETFs are not available here (in case I want to have ETFs after all: JPM Global Research Enhanced, OssiamShiller and Invesco Quantitative Strategies (greetings go out to @Stullen-Portfolio ).

=> At the moment I mainly use the USD currency account and deposit USD there.

ING

-> Classic bank

-> at 4.90 + 0.25 % of the market value not exactly cheap. (The larger the order, the less important, as the maximum fee of around €70 is reached from around €25,000)

-> Share savings plans are at 1.25 %

-> ETFs are free. However, I have no chance with my "exotics".

-> Various stock exchanges with corresponding fees

-> Runs stable, support available. Lightning-fast securities account transfer

-> I think there is currently 0.75 %. That's so little that I always forget :D

=> For me, price and limited availability are clear and strong reasons against ING.

Apart from ING and TR, they all offer a securities loan in the traditional sense.

Conclusion

Which one do you choose now? As my second custody account for share savings plans, Zero is probably very popular.

Otherwise:

-> If you want to buy tranches and don't have thousands of euros available => Scalable

-> If you want savings plans: Scalable

-> If you want a broad ETF selection: Scalable

-> A dividend-oriented portfolio: Zero (the statistics on dividends just catches me :D)

-> If you need trailing stop loss and OCO: Zero

-> If you want to separate your portfolio: Scalable or Smartbroker, depending on your needs. If, like me, you want a pure savings plan portfolio and a "normal" one, then the Smartbroker seems better because there is also a separate clearing account for each secondary portfolio and you can separate them really cleanly.

-> If you want to trade in foreign currency (note the fees!): Smartbroker

It says Scalable quite often...

How do you see the whole thing? Have I forgotten something (I'm sure I have, as everyone finds different things important)? Where would you put your money in my case? Where would you implement savings plans?

Quite frankly, TR has been the most attractive savings plan for me so far. But what they are doing right now is a reason to cancel immediately