In an article published yesterday, Handelsblatt calculated the long-term performance of investing in a broadly diversified portfolio.

4 variants were selected.

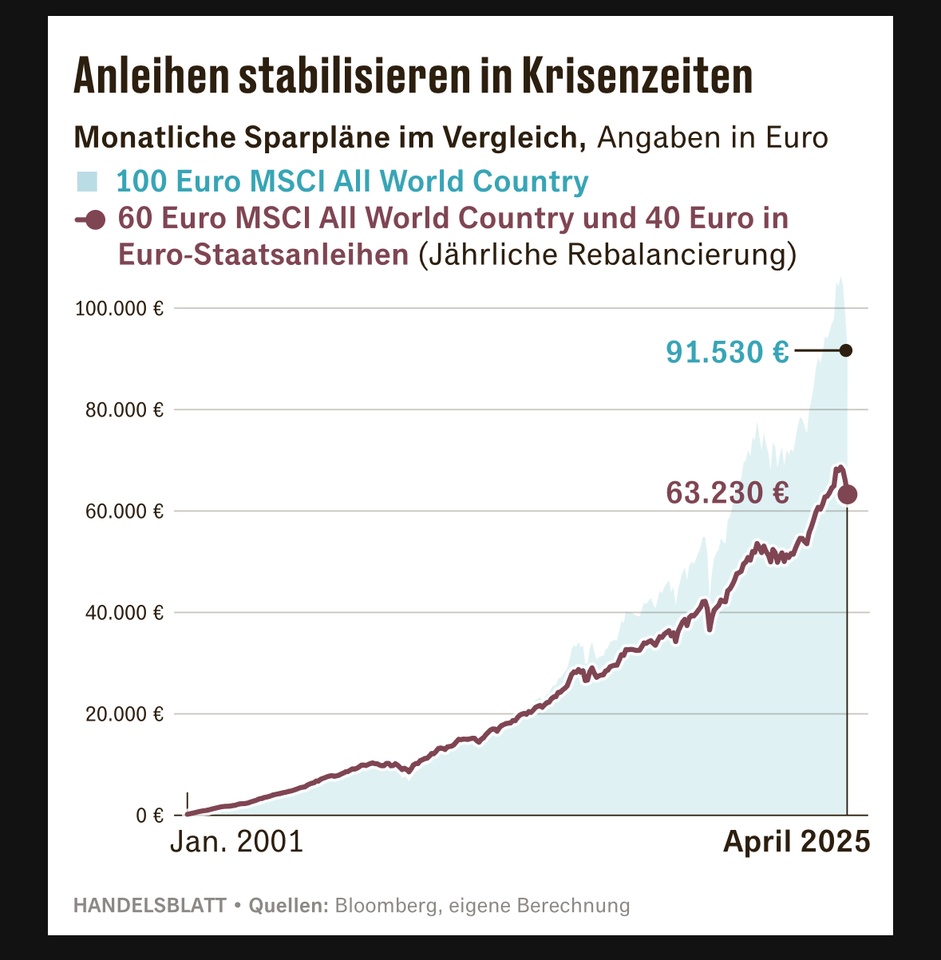

Variant 1: Equities plus government bonds

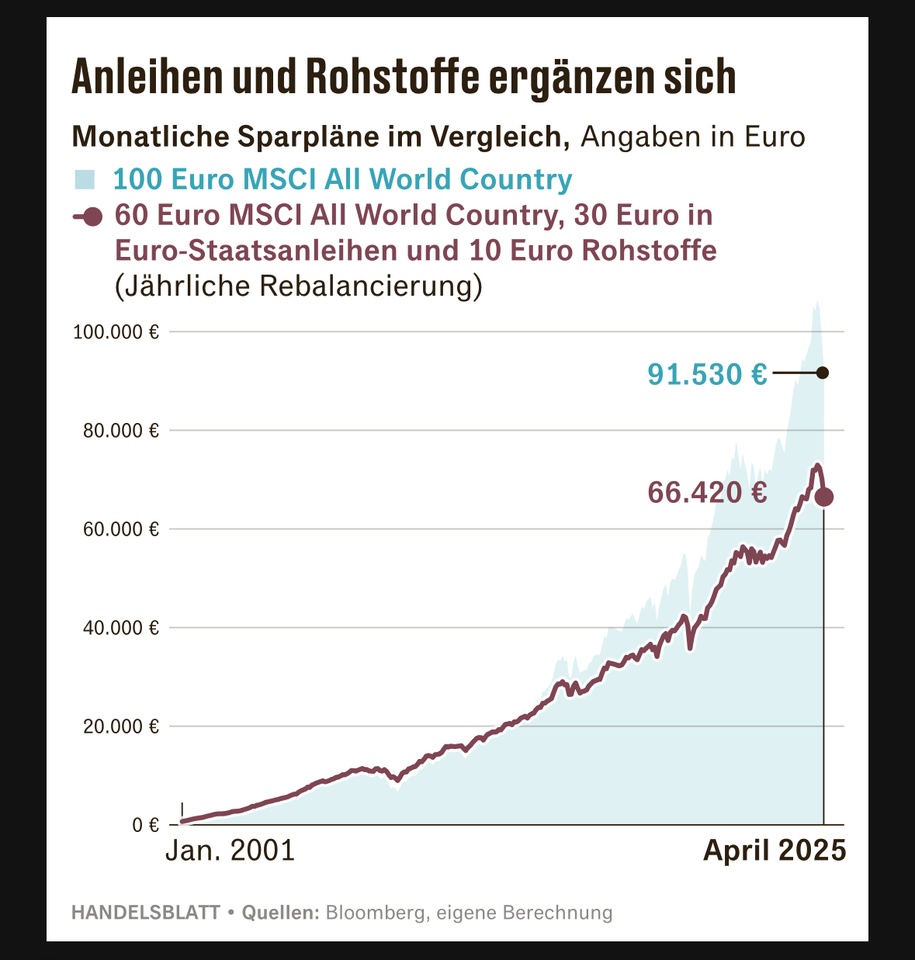

Variant 2: Equities plus government bonds and commodities

Variant 3: Increase the proportion of emerging markets in the portfolio

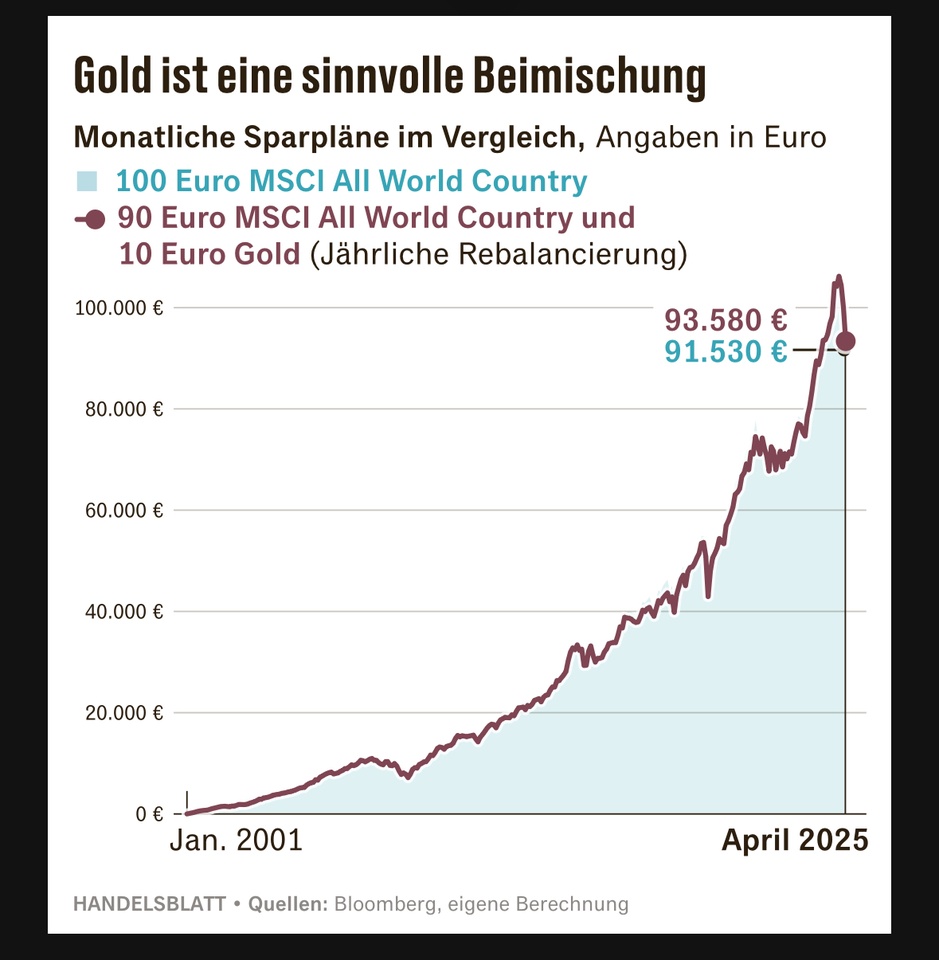

Variant 4: Equities plus gold

The basis for the equity side was the MSCI All Country World Total Return Index in EUR, in this case the ETF $ISAC (+0,4 %)

Period under review: 2001 to date

Variant 1: 60% equities / 40% government bonds

For the government bonds, the "iBoxx EUR Sovereigns Eurozone 1-3 Total Return Index" was selected for the calculation.

In order to depict the 60/40 portfolio mentioned above, it was assumed for the calculation that investors have invested 60 euros in the ACWI and 40 euros in euro government bonds every month since the beginning of 2001. The portfolio was rebalanced after each year to restore the ratio of 60 percent equities to 40 percent bonds.

The result: Overall, investors with a 60/40 investment would have saved just under 66,000 euros over the past 24 years with a good 29,000 euros invested. But with a 100% ACWI savings plan, they would have saved just under 92,000 euros today. The result would therefore have been 45 percent better.

Variant 2: Equities plus government bonds and commodities

For a further calculation, commodities were added to the portfolio consisting of the ACWI and euro government bonds. The "Bloomberg ex-Agriculture and Livetock Index", calculated in euros, was chosen for this. The calculation assumes a savings planner who invests EUR 60 per month in the ACWI, EUR 30 in government bonds and EUR 10 in commodities.

Here too, the portfolio was rebalanced at the turn of the year to restore the 60/30/10 ratio.

The result: The outperformance amounts to five percent. Today, savings planners using this strategy would have saved a good 66,000 euros. However, an ACWI savings plan alone would have produced a 38 percent better result.

Variant 3: Increase the proportion of emerging markets in the portfolio

In this calculation, investments were no longer made in the ACWI, but separately in shares from industrialized nations and emerging markets. The "MSCI World Total Return Index" in euros and the "MSCI Emerging Markets Total Return Index" in euros were selected for this purpose.

With a savings plan variant that invests EUR 70 per month in the MSCI World and EUR 30 in the MSCI Emerging Markets, emerging markets would therefore be more strongly represented.

The result: Until well into the 2000s, savings planners using this strategy would also have beaten the ACWI. However, this changed from the mid-2010s. This was mainly due to the strong performance of US and, in particular, tech stocks. Due to the lower weighting of emerging markets in the ACWI, American tech stocks have a higher weighting there.

Option 4: Equities plus gold

In another calculation, a savings plan on the ACWI was combined with a savings plan on gold. Every month, 90 euros would have been invested in the world share index and 10 euros in a gold ETC. The gold price in euros was chosen to replicate its price performance.

The result: Gold is in demand this year in particular due to the major geopolitical risks. The price has already risen by a good 30 percent in dollar terms. Therefore, the ten percent addition this year would have cushioned the losses from the stock market somewhat. Instead of around twelve percent for the ACWI, investors would only have lost a good nine percent.

Investing in gold would also have paid off in the long term. Anyone who has invested 90 euros in the ACWI and ten euros in gold every month since 2001 and regularly rebalanced their portfolio would now have almost 94,000 euros - that is, over two percent more than with the ACWI savings plan alone.

Conclusion:

Diversification reduces price fluctuations. If you invest in a combination of bonds and commodities, your portfolio will lose less value in times of crisis.

However, this security comes at a cost in terms of returns: in the long term, equities rise so sharply during rallies that they more than make up for losses from price falls.

The outperformance of equities is not only evident in the analyzed period from 2001 to the present, but also over the long term. In its Global Wealth Report, UBS analyzes the performance of various asset classes over more than 100 years every year. It shows that equities outperform all other assets over the long term - despite world wars, pandemics, economic crises and other disasters.

In the UBS analysis, equities also outperform gold over the long term. In the above calculation, the situation is different - although this is mainly due to developments this year. At the turn of the year, the variant of the ACWI savings plan alone was still on a par with the combination of ACWI and gold.

You can read the full article in the Handelsblatt here (€): https://hbapp.handelsblatt.com/cmsid/100119887.html