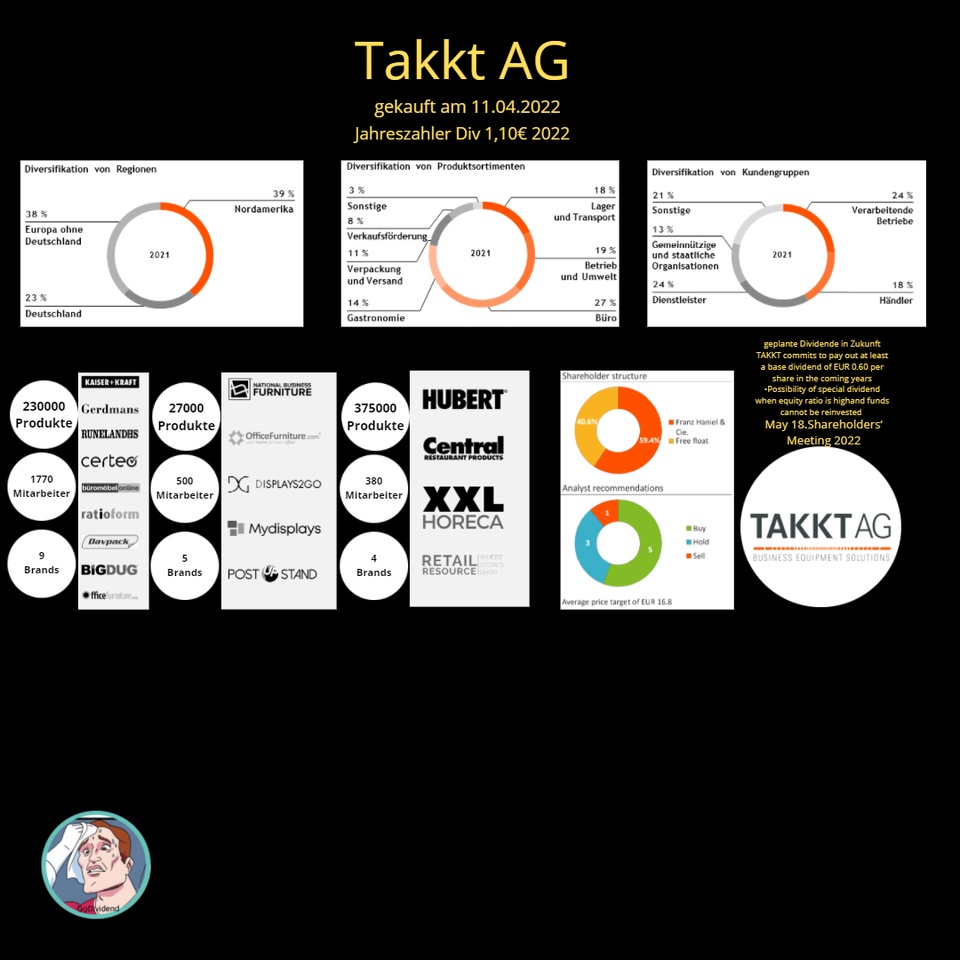

I opened a small position on 11.04.22 with the 𝐓𝐚𝐤𝐤𝐭 𝐀𝐆 which I would like to introduce to you today.

TAKKT is listed in the SDAX index of Deutsche Börse.

Takkt only makes office furniture and sells in B2b, this is not a market for the future in the fast moving world in which everyone is currently pushing into the home office. NO!

Takkt makes far more share of office products in sales in 2021 were 27%.

Takkt is active in Germany, Europe and America.

On a regional level, TAKKT differentiates between Germany, Europe excluding Germany and North America. This has proven to be a pillar of TAKKT Group in the past. Economic fluctuations in certain target markets have thus been partially offset by contrary developments in other regions. In the future, TAKKT will continue to rely on its presence in Europe and North America and will strengthen its activities in these regions, both organically and through acquisitions.

Distribution of turnover 2021 D=23% EU (excl. D)=38% Americas= 39%

𝑫𝒊𝒆 𝑻𝒂𝒌𝒌𝒕 𝑨𝑮 𝒊𝒔𝒕 𝒊𝒏 3 𝑫𝒊𝒗𝒊𝒔𝒊𝒐𝒏𝒔 (𝑩𝒆𝒓𝒆𝒊𝒄𝒉𝒆𝒏) 𝑺𝒕𝒓𝒖𝒌𝒕𝒖𝒓𝒊𝒆𝒓𝒕 :

𝐈𝐧𝐝𝐮𝐬𝐭𝐢𝐚𝐥 & 𝐏𝐚𝐜𝐤𝐚𝐠𝐢𝐧𝐠:

9 brands 230000 products 1770 employees

In Europe, the I&P division offers a focused product portfolio for the working environment of the factory floor and warehouse in manufacturing or logistics. Typical customers include manufacturing companies such as machine builders or automotive suppliers, as well as companies in the retail and service sectors and public institutions.

The KAISER+KRAFT brand supplies a wide range of products from the areas of factory, warehouse and office equipment. This includes, for example, pallet trucks, universal cabinets or swivel chairs, but also special products such as environmental cabinets or hazardous material containers. The Certeo and Büromöbelonline brands sell office and business equipment to smaller corporate customers. The product range of packaging specialists Ratioform and Davpack includes folding cartons, packaging pads, shipping pallets and stretch film. BIGDUG and OfficeFurnitureOnline offer a wide range of office furniture and business equipment in the UK.

𝐎𝐟𝐟𝐢𝐜𝐞 𝐅𝐮𝐫𝐧𝐢𝐭𝐮𝐫𝐞 & 𝐃𝐢𝐬𝐩𝐥𝐚𝐲𝐬:

5 brands 27000 products 500 employees

At the OF&D division, the range includes products for the world of service providers. These include office equipment for everyday use in the company or work at home, but also products for sales promotion at the point of sale or at events. This makes OF&D's customer spectrum very broad and includes office operators as well as companies that want to present themselves or their products in an attractive way. These include large industrial groups, smaller service providers such as lawyers and architects, as well as public institutions such as government agencies and schools.

The division's activities are focused on the American market. The brands National Business Furniture (NBF) and OfficeFurniture.com offer a comprehensive range of office furniture. This includes office chairs and desks, conference tables and furniture for reception areas. Examples of Displays2Go products include advertising banners, stands for digital displays, mobile exhibition stands and display stands. The Mydisplays brand sells similar products in Germany.

𝐅𝐨𝐨𝐝𝐬𝐞𝐫𝐯𝐢𝐜𝐞:

4 brands 375000 products 380 employees

The FS division offers its customers all the products needed in the preparation and presentation of food and beverages. The product portfolio for the working world in the HoReCa sector (hotels, restaurants and catering) includes smaller products such as pots and pans as well as larger appliances such as an ice maker or deep fryer. Customers include canteens in schools or universities, catering businesses in event locations such as sports venues, food retailers, and also small family-run restaurants. The division has its main focus in North America. The Hubert brand's product range includes equipment for the food service and food retail sectors, as well as items for sales promotion. Exemplary products for this are products for buffet equipment

such as serving trays and presentation baskets. The range of the Central brand includes all the equipment needed for the operation of small to medium-sized restaurants, for example, kitchen stoves and freezers.

XXL Horeca offers in Europe catering products with a focus on large equipment

𝑼𝒏𝒕𝒆𝒓𝒏𝒆𝒉𝒎𝒆𝒏𝒔𝒛𝒊𝒆𝒍𝒆

From the English company presentation from the homepage and the 2021 annual report :

"We expect to increase our organic growth rate to ten percent on average over the long term as a result of the transformation."

Strategic goals until 2025

GROWTH - sales of two billion euros

OneTAKKT - EBITDA of EUR 240 million -Free TAKKT cash flow of EUR 150 million

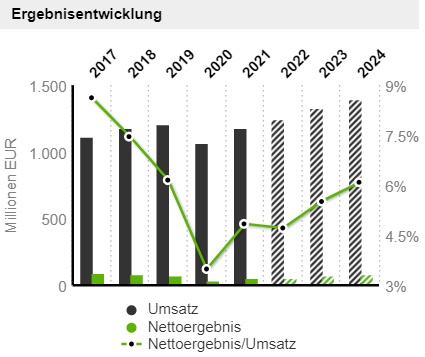

𝐃𝐚𝐭𝐞𝐧 𝟐𝟎𝟐𝟏

Stock market value 1.001 billion

P/E RATIO 17.7

KUV 0.85

PEG ratio (0.36 in 2020) 5.05 in 2021

Dividend 7.14

Gross profit margin increased to 40.2% in the reporting year Price increases could be passed on

Earnings per share €0.87

Sales per share €17.95

Sales per employee 471,944€

next Annual General Meeting 18.05.2022

Proposed dividend 1.10€ at current share price of 15.48€.

𝙈𝙚𝙞𝙣 𝙁𝙖𝙯𝙞𝙩:

In the long run, I believe I have found a stable stock from the SDax. A broadly positioned company that is active far beyond the borders of Germany, diversified in its products and customers. However, one should not be deceived by this year's planned dividend payout.

Supplement quarterly figures reported 07/2022

TAKKT reports Q2 turnover of €328.6 million (PY: €291.0 million), Ebitda of €34.6 million (PY: €25.4 million) and an Ebitda margin of 10.5% (PY: 8.7%). In the outlook for 2022, the company expects organic sales growth in the high single-digit range and Ebitsa of €120 to €130 million (previously: €110 to €130 million).

Source Notes:

Data from www.traderfox.com,

https://www.boerse.de/