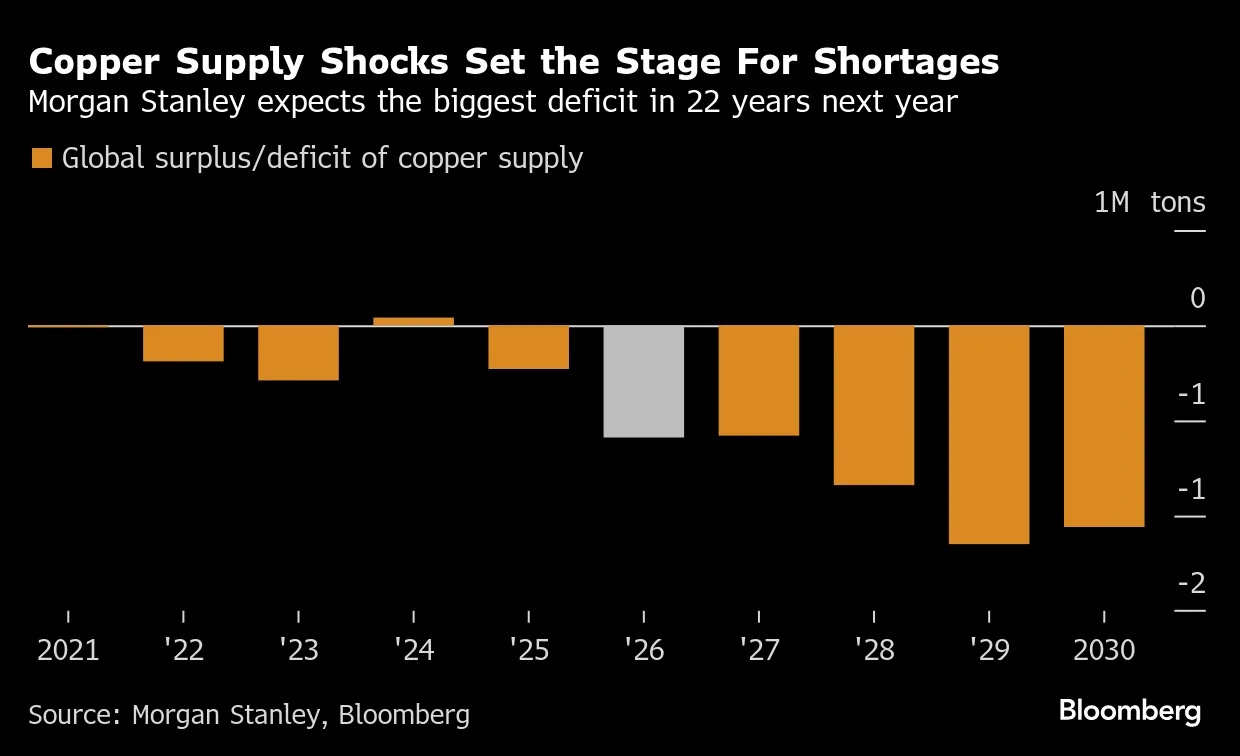

Copper prices in London have reached a new record high. The rally is being driven primarily by supply disruptions at fairly large mines in Chile and Indonesia as well as lowered production guidance from the likes of $GLEN (-0,25 %) & $AAL (-1,23 %) . In parallel, demand drivers such as transportation, EV, AI and renewables continue to drive consumption. The International Copper Study Group has drastically adjusted its forecast for the coming year and now expects a deficit of 150k tons. Prices are receiving additional support from hopes of a rate cut by the FED and positive signals from the trade talks between the USA and China.