Doubts? Not at all!

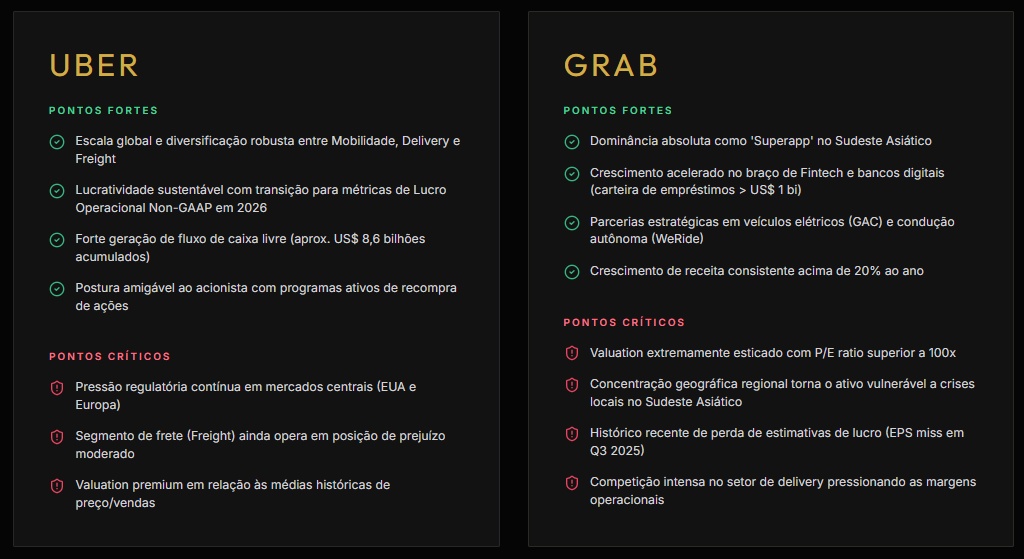

Uber ($UBER (-1,47 %) ) wins the duel by presenting a more balanced risk-return profile. While Grab trades at very high valuation multiples (P/S > 5x) and still struggles with net profit consistency, Uber has consolidated its GAAP profitability, has greater global scale and offers greater financial resilience. Uber is seen as a 'Blue Chip' of the mobility sector, while Grab remains a high-growth, high-volatility bet in emerging markets.

The case for GRAB!

A look at Grab Holdings ($GRAB (-2,16 %)

) in January 2026 is to observe one of the most interesting transformations in the post-pandemic technology sector: the transition from a "cash-burning" company to a profitable financial and logistics ecosystem.

Grab is the rare example of a local company defeating a global giant. Operating in Singapore, Malaysia, Indonesia, the Philippines, Thailand and Vietnam, Grab holds more than 50% of the delivery market and an almost monopolistic position in ride-hailing in several cities.

Grab's true value in 2026 is not just in the cars, but in the GrabFinancial.

- Complete Ecosystem: For millions of "unbanked" people in Southeast Asia, Grab is the first financial experience.

- GrabPay & Loans: The company uses data from millions of daily transactions to perform ultra-precise credit scoring, offering loans to drivers and small traders with controlled risks.

- Fintech as a margin engine: While transportation has low margins, financial services (insurance, wealth management and credit) are what's driving Grab to sustainable net profitability.

#GRAB