Vår Energi ASA $VAR (-1,02 %) will publish its financial report for the fourth quarter of 2025 on February 10.

Today, the company is providing updated information on production, sales volumes and other relevant points.

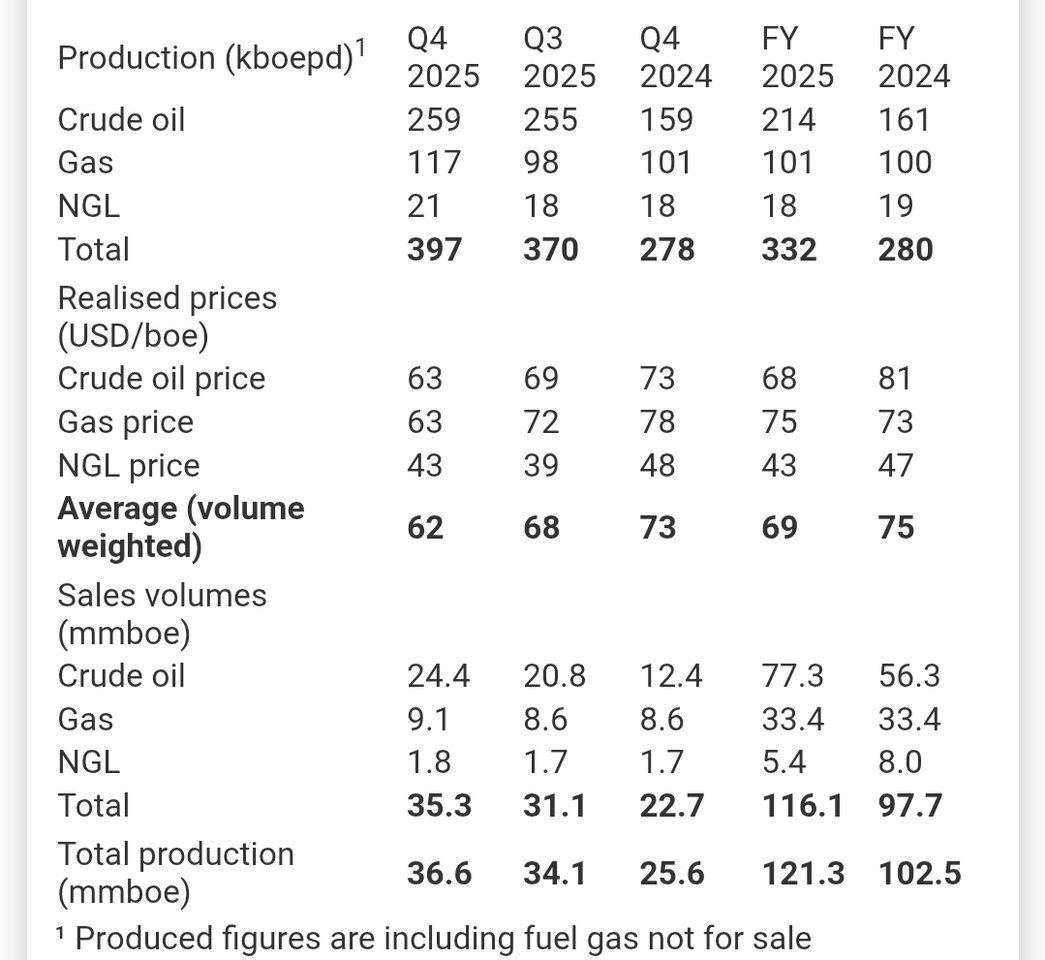

Vår Energi's net production of oil, liquids and natural gas averaged 397 thousand barrels of oil equivalent per day (kboepd) in the fourth quarter of 2025, an increase of 7% compared to the third quarter and an increase of 43% compared to the fourth quarter of 2024.

Total production for the year as a whole averaged 332 kboepd, which is within the range forecast for the year.

The operational issues at Johan Castberg and Jotun FPSO reported in December were resolved in early January and production is now back to the expected level.

The production split in the fourth quarter was 71% oil and NGL (liquids) and 29% gas.

The total production volume amounted to 36.6 million barrels of oil equivalent (mmboe), while the sales volume in the quarter was 35.3 mmboe. The shortfall is mainly due to the timing of LNG deliveries in the quarter.

Vår Energi achieved an average realized price (volume weighted) of USD 62 per boe in the quarter.

The realized crude oil price was USD 63 per barrel.

The realized gas price of USD 63 per boe is around USD 4 above the average reference price on the spot market.

Fixed-price contracts accounted for around 15 % of the gas volumes sold in the fourth quarter, at an average price of USD 75 per boe.

》Other items《

Vår Energi's functional currency is NOK, while interest-bearing loans are denominated in USD and EUR. The weakening of the NOK in the fourth quarter of 2025 resulted in a net exchange rate loss of around USD 40 million.

Due to the company's history of mergers and acquisitions, Vår Energi has several assets that are measured at fair value in the balance sheet. Changes in assumptions, cost and production profiles can lead to impairment losses and reversals of impairment losses.

The non-cash impairment of technical goodwill in the fourth quarter is estimated at around USD 70 million before tax (around USD 70 million after tax) and is related to Njord Area, Gjøa and Snorre.

An adjustment following a revaluation process at Snorre, which reduced Vår Energi's equity share from 18.55% to 18.16%, accounts for most of the impairment in the quarter.

The net impairment for the full year amounted to USD 26 million after tax.

As previously disclosed, the following items impacted free cash flow in the fourth quarter:

3 cash tax payments totaling approximately NOK 8.2 billion (approximately USD 820 million) and a third quarter dividend payment of USD 300 million paid in November.

In addition, the company paid around USD 180 million in the quarter in connection with the acquisition of TotalEnergies' stake in the "Ekofisk Previously Produced Fields" project. This includes a cash payment of USD 147 million and a cash settlement payment for costs incurred in the period from January 1, 2025.

The above information is based on a preliminary assessment of the Company's financial results for the fourth quarter of 2025 and is subject to change until the financial statements are finally approved and published by the Company.