Hello my dears,

The US. Market is quite volatile right now, and many are looking for a growth stock outside the tech sector.

That's why I took a look around our neighboring country Belgium.

And I found Cenergy Holdings for you $CENER (-1,77 %) .

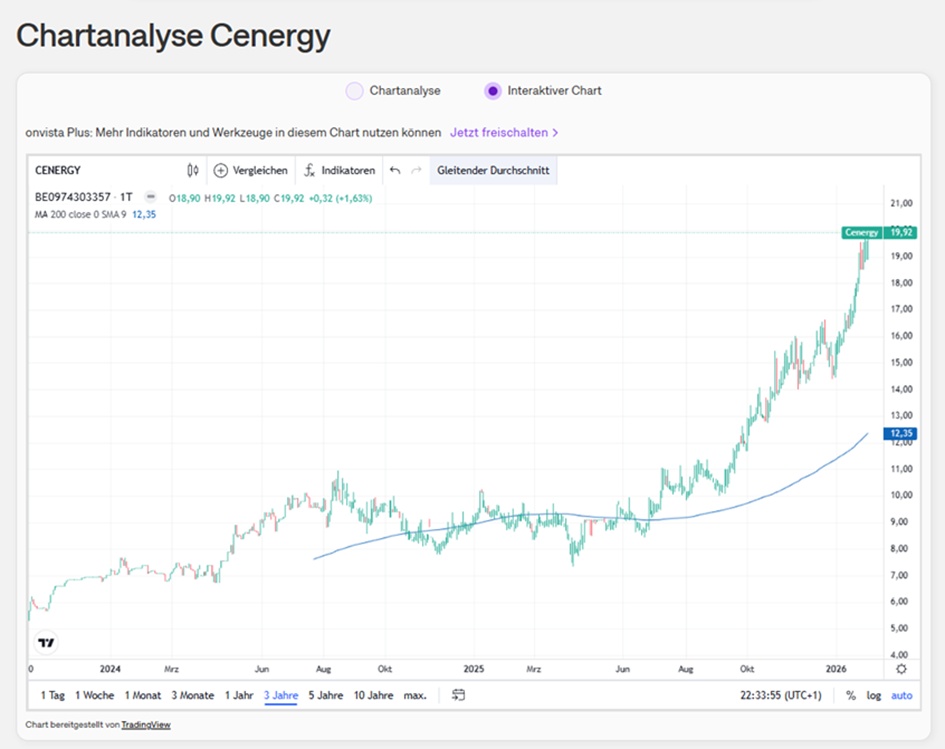

The 5-year performance of +1.153,90 % is impressive. Do you think it will continue like this?

I look forward to many comments

Cenergy Holdings based in Belgium, was founded in 2016 and is listed on Euronext Brussels and the Athens Stock Exchange (Athex).

The company focuses on long-term value creation by investing in leading industrial companies, taking into account the growing global demand for energy transfer, renewable energy and data transmission.

The company invests in industrial companies at the forefront of high-growth sectors such as energy and telecommunications. Cenergy Holdings is a subsidiary of Viohalco S.A., a holding company of several leading metal processing companies in Europe. Viohalco's subsidiaries specialize in the production of aluminum, copper and steel products, steel tubes and cables and other technologically advanced industrial applications. They have production facilities in Greece, Bulgaria, Romania, the United Kingdom, North Macedonia and Turkey.

Cenergy Holdings' portfolio consists of Corinth Pipeworks and Hellenic Cables, companies positioned at the forefront of their respective high-growth sectors. Hellenic Cables is one of the largest cable manufacturers in Europe, producing power and telecommunication cables as well as submarine cables. Corinth Pipeworks is a world leader in steel pipe production for the energy sector and a major manufacturer of hollow steel sections for the construction sector.

Markets

ELECTRICITY

GAS AND LIQUID FUEL

WIND

HYDROGEN

TELECOMMUNICATIONS AND DATA TRANSMISSION

CONSTRUCTION & INDUSTRY

customers

BP, Chevron, EDF, eni, equinor, Exon Mobil, OMV, RWE, Shell, Total Energy, Saudi Aramco

NEWSLETTER OCTOBER 2025

Cenergy Holdings reports strong first half 2025 results with record margins and robust profit growth

IR Newsletter Okt. 2025 Ausgabe – CENERGY HOLDINGS

Why invest in Cenergy Holdings?

The industrial companies of

Cenergy Holdings

provide long-term value by offering innovative transmission solutions for the key pillars of the energy transition such as electricity, wind, solar, hydrogen, gas, fuel and CCS.

5 main pillars supported by 2 business streams:

We maintain our leading position in the power transmission market with a wide range of products and solutions for infrastructure and industrial applications

We strengthen our position in the fast-growing market for power cables for offshore wind farms and offer solutions in dynamic cables for promising floating wind energy floating wind energy to

We maintain our leading position as a Tier 1 manufacturer of steel pipes for the transportation of gas fuel to the most demanding onshore and deep offshore applications worldwide

Leading RDI initiatives in high-pressure transportation of hydrogen in pure form or in a mixture with gas, through hydrogen-certified steel pipes, using existing gas grid infrastructure or new construction

We utilize our many years of experience inCO2 pipelines for the developing market of carbon capture and storage projects worldwide

Strong production presence

5 main production units and 5 supporting facilities in 3 countries, a global sales network, successful implementation of complex large-scale projects in more than 70 countries, market leader positions.

Financial robustness

Sales of approx. EUR 1.8 billion, operating profitability (adjusted EBITDA) of over EUR 270 million for 2024, with continued investments (over EUR 770 million in the last 10 years)

Innovation on the move

Our businesses are well positioned both to meet current customer needs and to capture the transformation of the global energy sector from fossil fuel generation and consumption systems to renewable energy sources.

We maintain our deep and long-standing commitment to innovation in all of the above areas.

Responsible operation and growth

Cenergy Holdings firmly believes that its subsidiaries must demonstrate the same responsibility and share the same principles and commitments on sustainability issues in order to promote resilient and sustainable growth and employment, provide transparency to all stakeholders (including employees and customers) and preserve long-term value for shareholders.

Commitment to ESG principles

- We are committed to reducing our environmental impact by proactively working to improve our performance and achieve our goals of actively contributing to the fight against climate change.

- We are committed to working responsibly in all our business activities, but at the same time expect the same responsibility from our business partners.

- We conduct our business with honesty and integrity and always in compliance with all relevant laws. Our companies ensure transparency in all interactions and recognize that they have a moral and legal obligation to act responsibly in all jurisdictions.

Cenergy Holdings ranked 22nd among the world's best companies for sustainable growth in 2026 according to TIME Magazine

Brussels, December 11, 2025 - 17:45 CET

Cenergy Holdings announces that Hellenic Cables, its cable segment, has signed a consortium agreement with DEME Offshore for the engineering, procurement, construction and installation (EPCI) of the offshore export cable system for the BC-Wind offshore wind farm in Poland.

Brussels, December 16, 2025

Corinth Pipeworks selected as strategic provider for Gasunie's next-generation energy infrastructure framework

Cenergy Holdings announces that Corinth Pipeworks, its steel pipe segment, has been selected as one of the key suppliers in Gasunie's large-scale European tender process for the supply of onshore pipelines to support the energy transition in the Netherlands and Germany.

Following a comprehensive evaluation, with sustainability as a key criterion, Gasunie Netherlands and Gasunie Germany awarded new multi-year framework agreements to six manufacturers for the production and supply of critical pipeline materials for hydrogen, natural gas, CO₂ and other energy infrastructure. The addition of Corinth Pipeworks reaffirms its leading position in the supply of high-quality, sustainable steel pipeline solutions for major European energy networks

The framework agreements, with a potential total value of €2.5 billion, will initially run for four years with options to extend. Under these contracts, Corinth Pipeworks will support Gasunie's ambitious program to develop a future-proof energy network, including projects related to the Dutch Hydrogen Backbone, the Delta Rhine Corridor and several infrastructure projects in Germany.

Company presentation

Präsentationen – CENERGY HOLDINGS

2025.11-Cenergy-Holdings-Updated-Corporate-Presentation.pdf

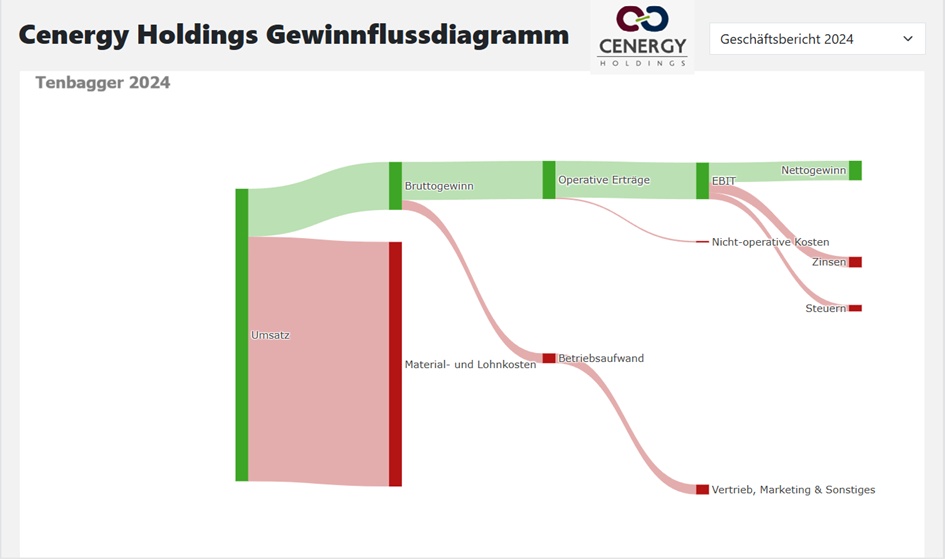

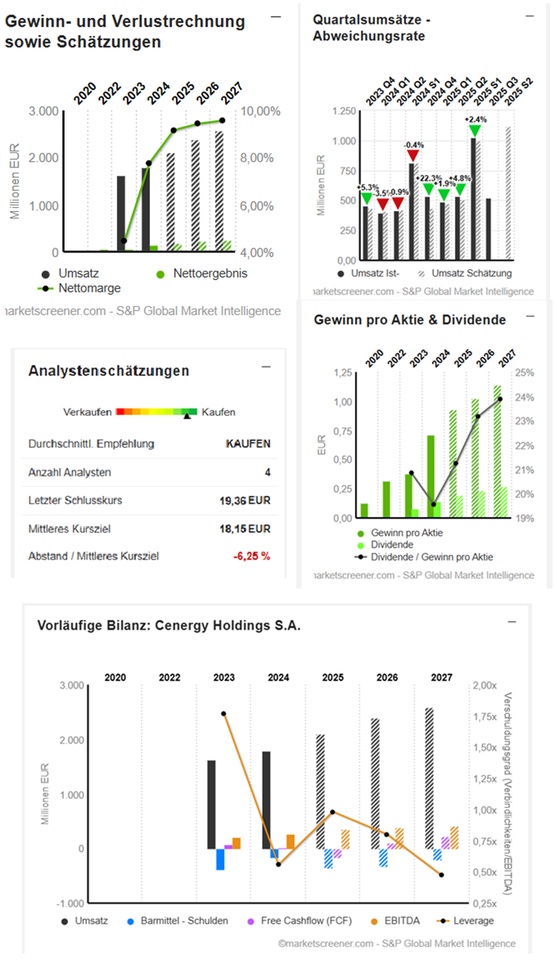

EUR in millions

Estimates

Year Turnover Change

2024 1.796 10,37 %

2025 2.107 17,28 %

2026 2.389 13,38 %

2027 2.586 8,26 %

Year EBIT Change

2024 237,5

2025 315 36,62 %

2026 336 6,67 %

2027 369 9,82 %

Year Net result Change

2024 139,4 91,08 %

2025 193 38,47 %

2026 225,4 16,75 %

2027 247,5 9,82 %

2028 20,53 %

Year Net debt CAPEX

2024 152 248,1

2025 345 239,4

2026 314 176

2027 200 110,6

Year Free cash flow Change

2024 23,46 -69,13 %

2025 -166,4 -809,02 %

2026 109,1 165,58 %

2027 224 105,27 %

Year EBIT margin ROE

2024 13,22 % 24,98 %

2025 14,95 % 24,7 %

2026 14,07 % 23,27 %

2027 14,27 % 21,43 %

Year Earnings per share Change

2024 0,7154 86,48 %

2025 0,93 30 %

2026 1,025 10,22 %

2027 1,14 11,22 %

Year Dividend Yield

2024 0,14 1,5 %

2025 0,1975 1 %

2026 0,2375 1,2 %

2027 0,2725 1,38 %

Year P/E ratio PEG

2024 13.1x 0.2x

2025 21.2X 0.7x

2026 19.3x 1.9x

2027 17.3x 1.5x

2028 14,90x -0,15

Market value 4,191

Number of shares (in thousands) 212,313

Date of publication 05.03.2025

Performance

1 week +2.30 %

1 month +23.74 %

6 months +92.91 %

1 year +109.40 %

3 years +451.93 %

5 years +1,153.90 %