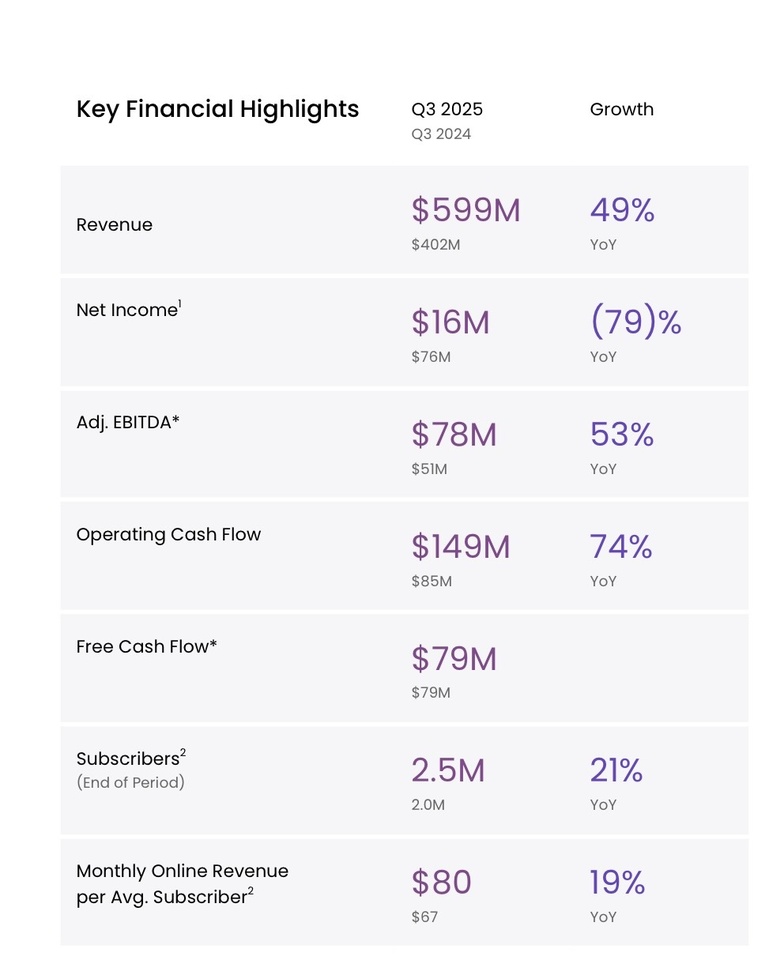

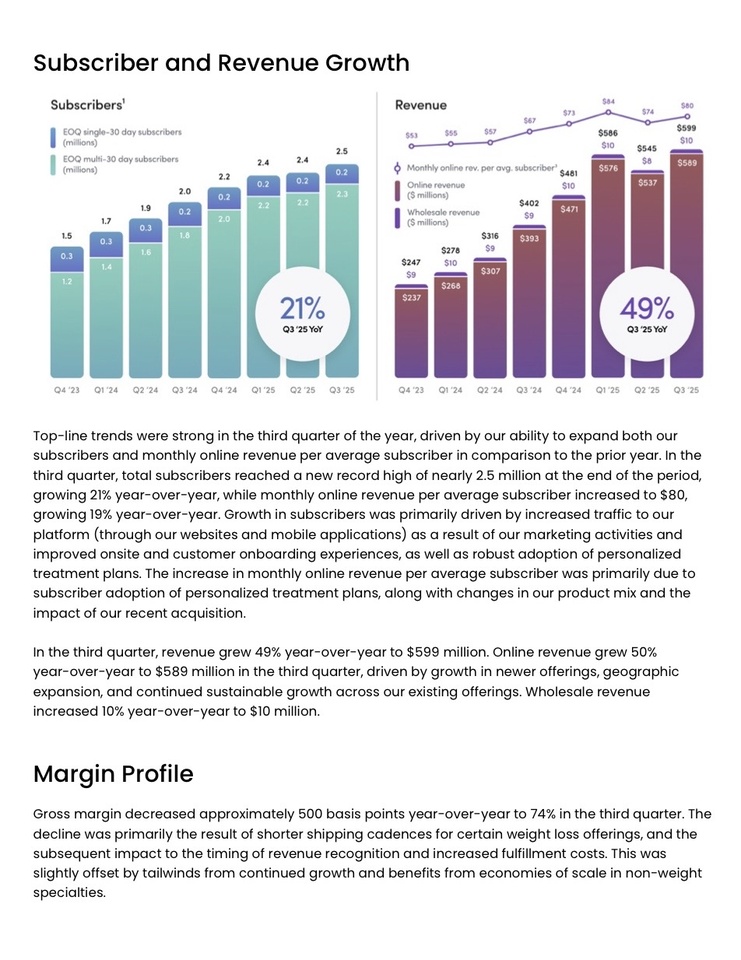

- Revenue: USD 599.0 million (estimated USD 580.4 million) ✅ ; increase of +49 % compared to the previous year

- Earnings per share: $0.06 (forecast: $0.10) 🟥

- Subscribers: 2.47 million; +21 % compared to the previous year

- Monthly online revenue per average subscriber: USD 80; +19 % compared to the previous year

- Online revenue: USD 589.1 million; +50% compared to the previous year

- Wholesale sales: USD 9.9 million; +10% compared to the previous year

Guidance:

- Q4 revenue: USD 605m to USD 625m (estimated USD 629.7m)

- Q4 Adj. EBITDA: USD 55-65 million; margin 9-10%

- Sales in financial year 2025: USD 2.335 billion - USD 2.355 billion; margin 13%

- Adjusted EBITDA for the financial year 2025: USD 307 million - USD 317 million

- Outlook for the adjusted EBITDA margin in the financial year 2025: approx. 13%

Further key figures:

- Net income: USD 15.8 million; decrease of 79% compared to the previous year (previous year included tax benefit of USD 60.8 million)

- Adjusted EBITDA: USD 78.4 million (forecast: USD 51.1 million compared to the previous year); +53% compared to the previous year

- Gross profit margin: 74% (compared to 79% in the previous year)

- Free cash flow: USD 79.4 million; unchanged from the previous year

- Cash flow from operating activities: USD 148.7 million; +74% compared to the previous year

- Cash and cash equivalents: solid balance sheet maintained

CEO commentary - Andrew Dudum:

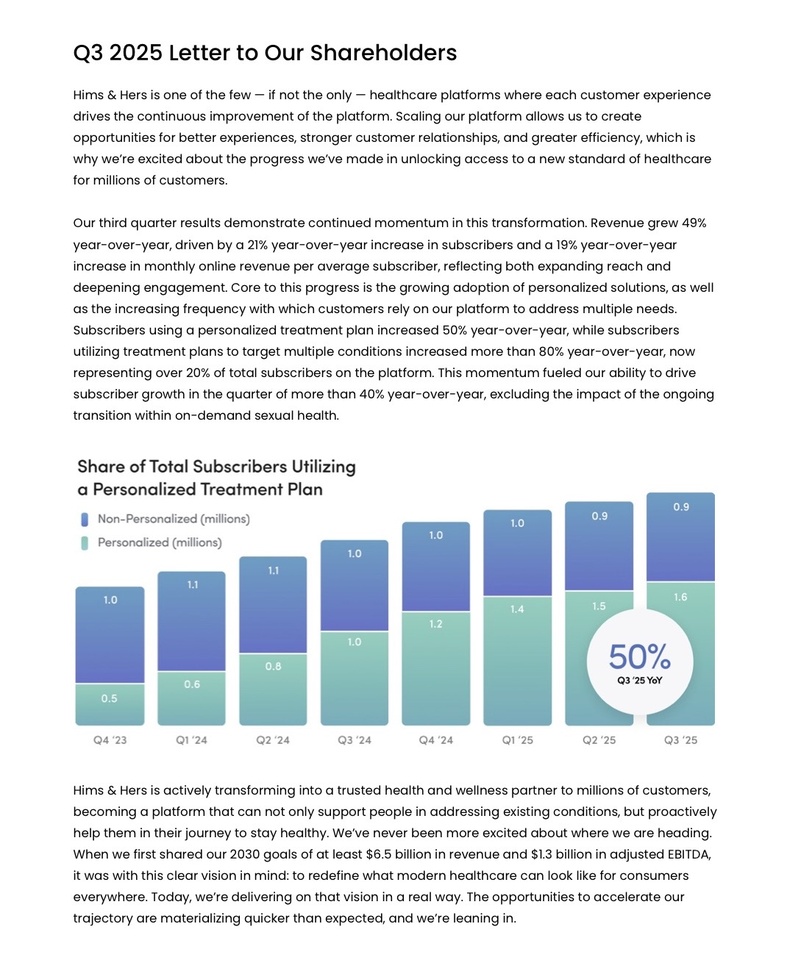

🔸 "We're building a platform that becomes more personalized and proactive as it grows and appeals to more and more people."

🔸 "We are launching new specialties, partnering with leading healthcare companies and making significant progress in building Hims & Hers into a global brand."

CFO comment - Yemi Okupe:

🔸 "We delivered another quarter of strong, profitable growth - sales up 49% and adjusted EBITDA up 53% year-on-year."

🔸 "We are confident that we will exceed the ambitious targets for 2030 that we set ourselves at the beginning of this year."

Strategic update:

🔸 Active discussions are ongoing with Novo Nordisk on offering Wegovy injections and future oral versions via the Hims & Hers platform (subject to agreement).

CEO Comment - Andrew Dudum:

The third quarter results are in and here are the key points:

We are growing quickly and efficiently. Sales have increased by 49 % compared to the previous year. Adjusted EBITDA has increased by 53%. We are increasingly confident that we can achieve and even exceed our 2030 targets of USD 6.5 billion in sales and USD 1.3 billion in adjusted EBITDA.

Growth is becoming increasingly diversified. Hims is recording annual growth of 40 %, not including the generic PRN business, from which we are withdrawing. Hers is targeting high double-digit to triple-digit growth and is expected to achieve sales of over USD 1 billion next year.

- The scale of our customer platform allows us to bring you the best offerings in healthcare. From advanced diagnostics to early-stage biotechnology. We are committed to bringing you the best products at affordable prices.

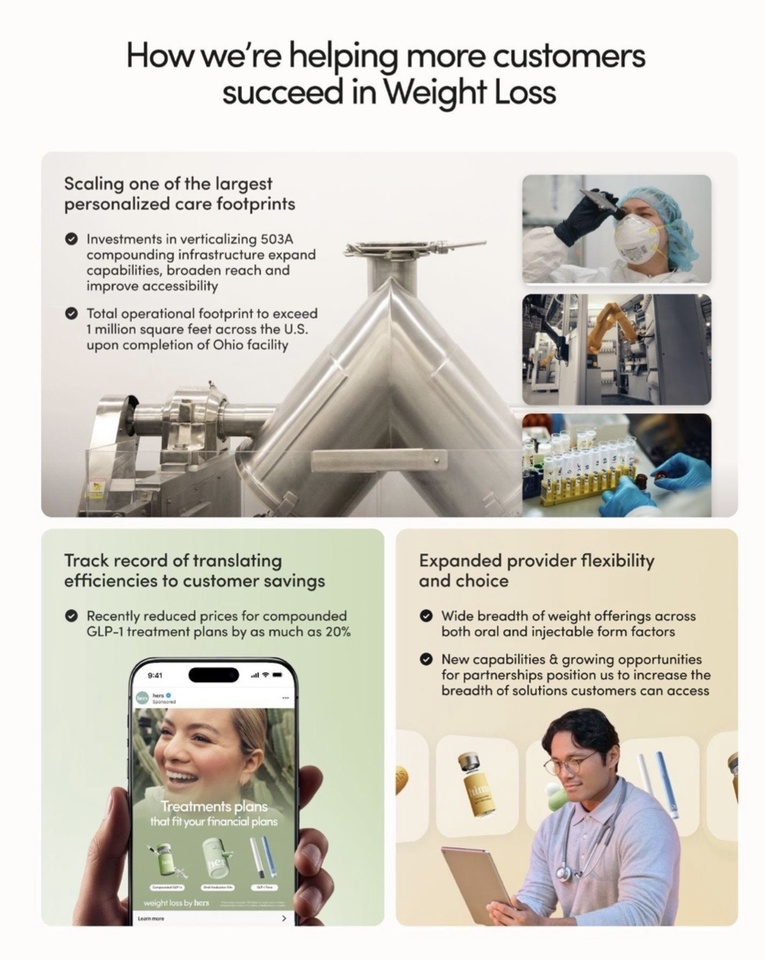

As we grow, we pass the savings on to the consumer. We started the year with approximately 400,000 square feet of vertically integrated manufacturing space and expect to end the year with over 1 million square feet. Consumers will benefit the most from our expansion. State-of-the-art infrastructure, FDA-registered production facilities and GreenList-certified suppliers for GLP-1 products mean real benefits for consumers.

New categories such as testosterone and menopause are expected to be growth drivers next year. Excellent initial signals and a good product-market fit. Now we are focusing on optimizing business processes.

The comprehensive laboratory tests are on schedule to be launched by the end of the year at a fraction of the cost of comparable sophisticated tests today. We are talking about hundreds, not thousands. Over time, we will continue to expand this laboratory infrastructure vertically to keep costs as low as possible.

Longevity will start next year. The plan is to integrate peptides, coenzymes, GLP/GIP, supplements and tracking capabilities. If celebrities have access to these cutting-edge precision therapies, we want you to benefit too. Our California facilities are working hard to develop core peptides.

International expansion is imminent. Canada will follow shortly and we are in intensive discussions with leading generic manufacturers to offer semaglutide as a generic in Canada and Brazil from 2026. We continue to invest in the UK and Germany and are exploring other international markets such as Australia and other Latin American and Asian countries.

Our goal has not changed: We want to help make the world feel great.