Hello my dears,

After my commodities special, I have now delved even deeper into the world of gold mining.

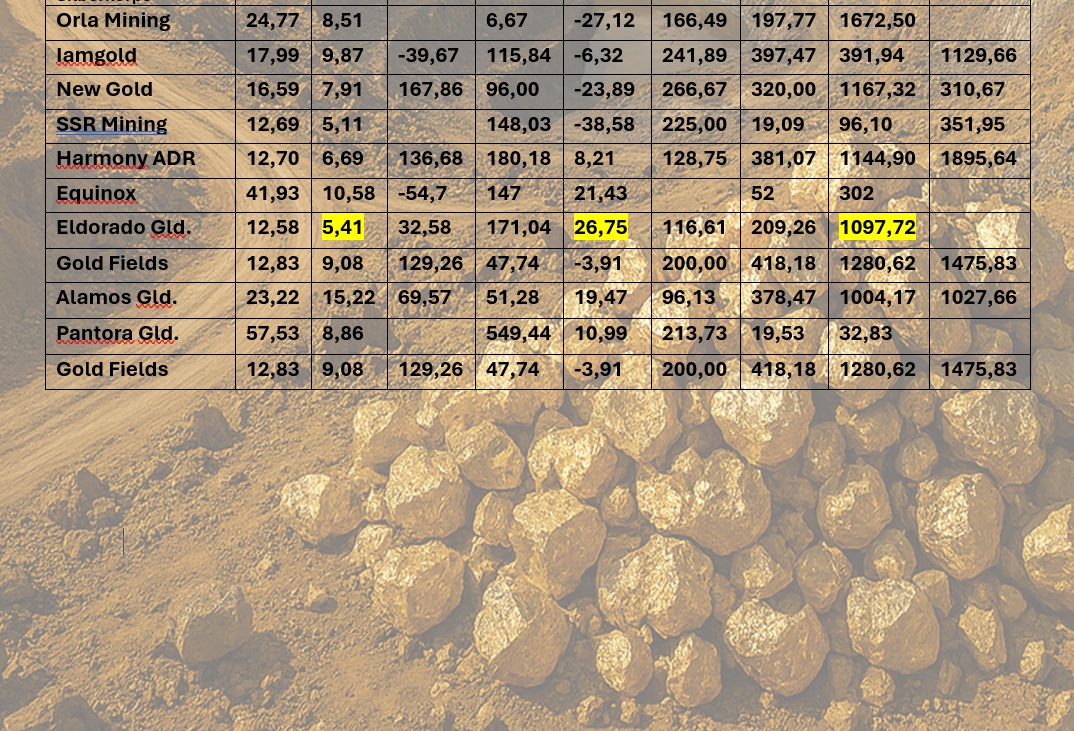

I have picked out 27 mines, and now I have focused less on the P/E ratio ( @Dividendenopi ). Instead, I mainly looked at earnings growth in 2027.

As with my first presentation, what stands out here

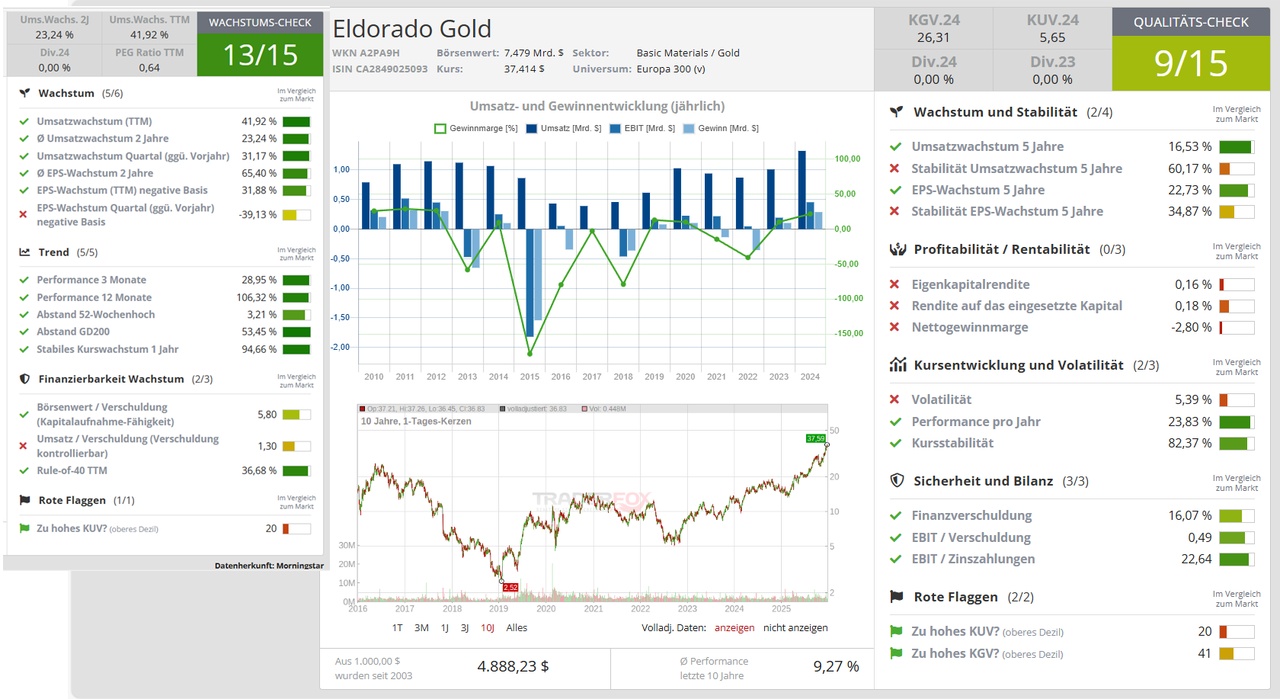

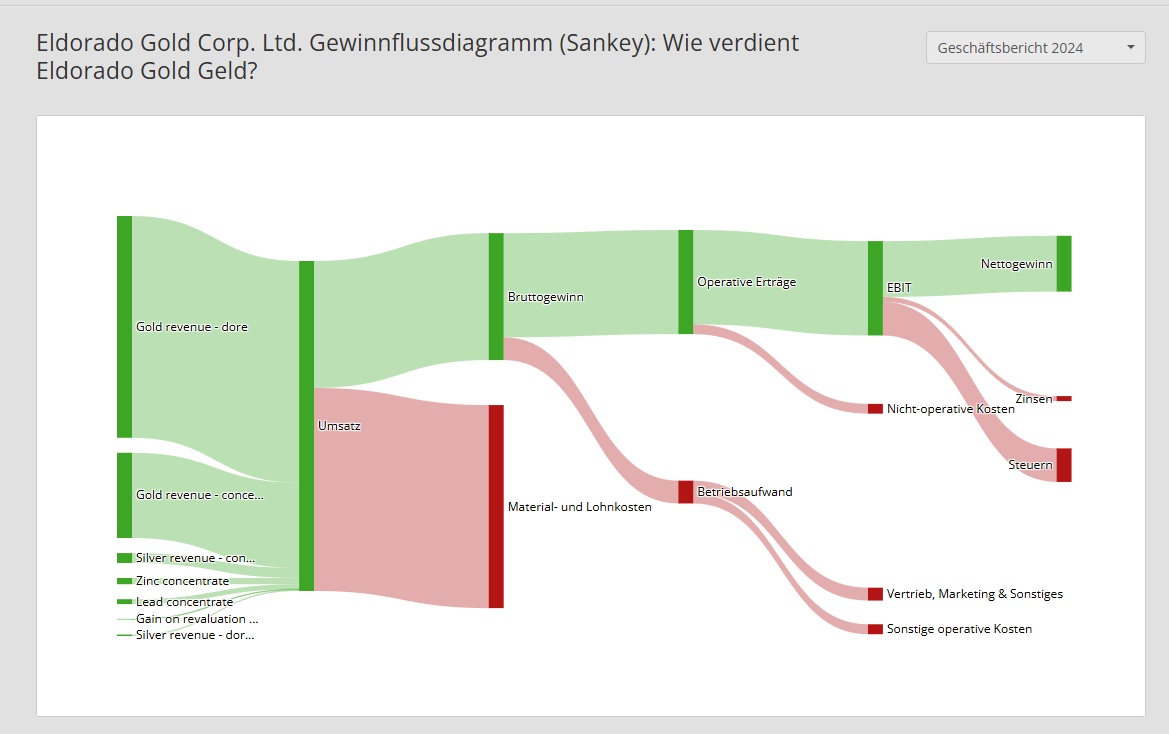

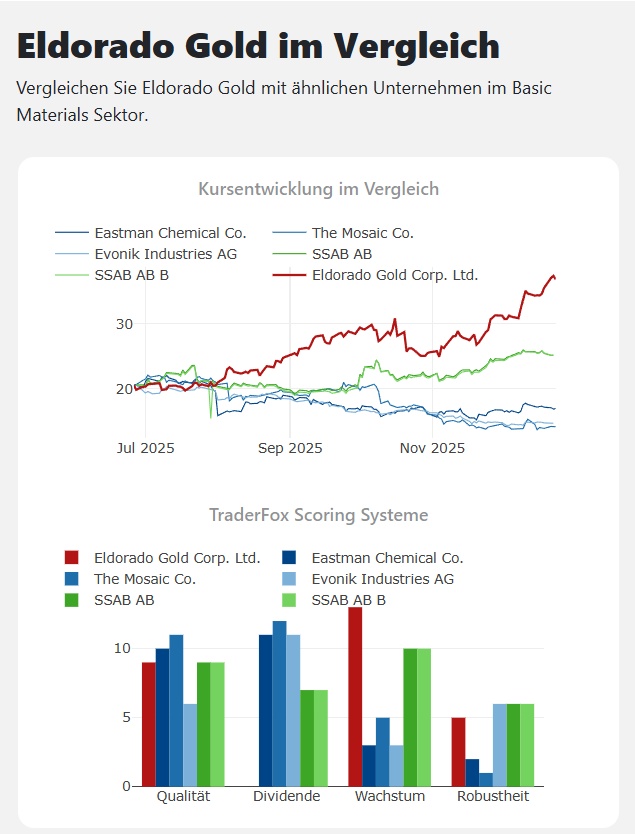

Eldorado Gold

$ELD (+1,58 %) stands out with 26.75 % earnings growth.

But completely new mines are also being added, such as

OR Royalties $OR (+0,5 %) with

24.79 % profit growth

B2Gold $BTO (-0,57 %) with 33.11 % profit growth

and front runner

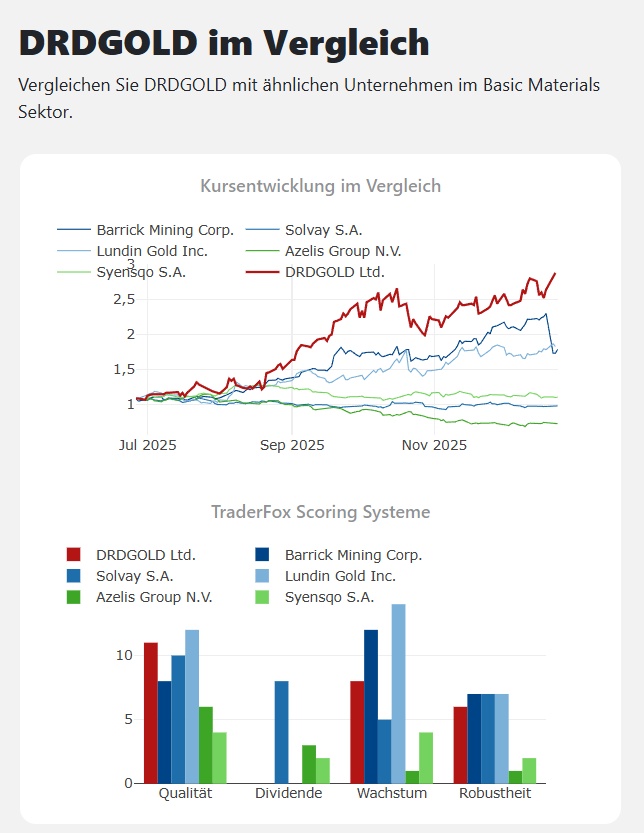

DRD Gold $DRD (+5,14 %) with 42.26 % earnings growth

I refer to consistency in performance I would be at

Eldorado Gold and DRD Gold

My dears, what would be your 1 choice and why would you choose which gold mine?

Eldorado Gold is a Canadian mid-tier gold and base metal producer with over 30 years of experience building and operating mines in Europe and the Americas.

We are breaking new ground in everything we do - in mining, sustainability, community relations and innovation. We are not afraid to open doors to new opportunities and find a better way forward.

Our vision is to build a safe, sustainable and high quality company in the gold mining sector that creates value today and for future generations. Every day, our team of approximately 5,800 employees and contractors put our vision into action at our mines in Québec, Greece and Turkey. Their commitment to our values of integrity, courage, collaboration, agility and drive positions Eldorado for growth and transformation to meet the needs of a changing world.

Across Eldorado, everywhere we operate, we have roadmaps to promote inclusivity and diversity while respecting the unique histories and cultures of our regions. We innovate and deliver sustainable benefits to our host communities while promoting growth and prosperity.

We aim to make things better and break new ground every day.

Dec. 17, 2025

Eldorado Gold kauft zusätzliche Anteile an Amex Exploration

Nov. 26, 2025

October 30, 2025

Sep 09, 2025

Eldorado Gold erreicht 2025 TSX30-Ranking für Top-Performance

Investor presentation - December 2025

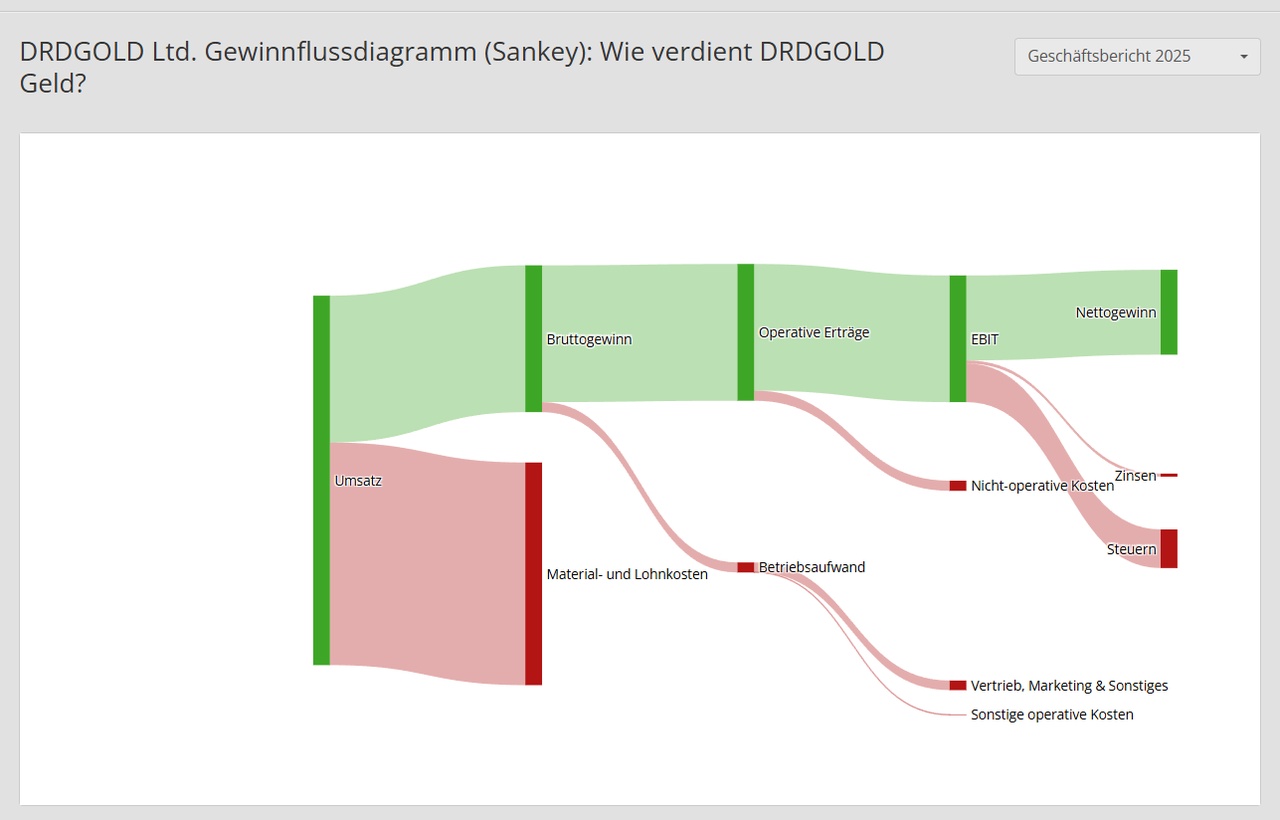

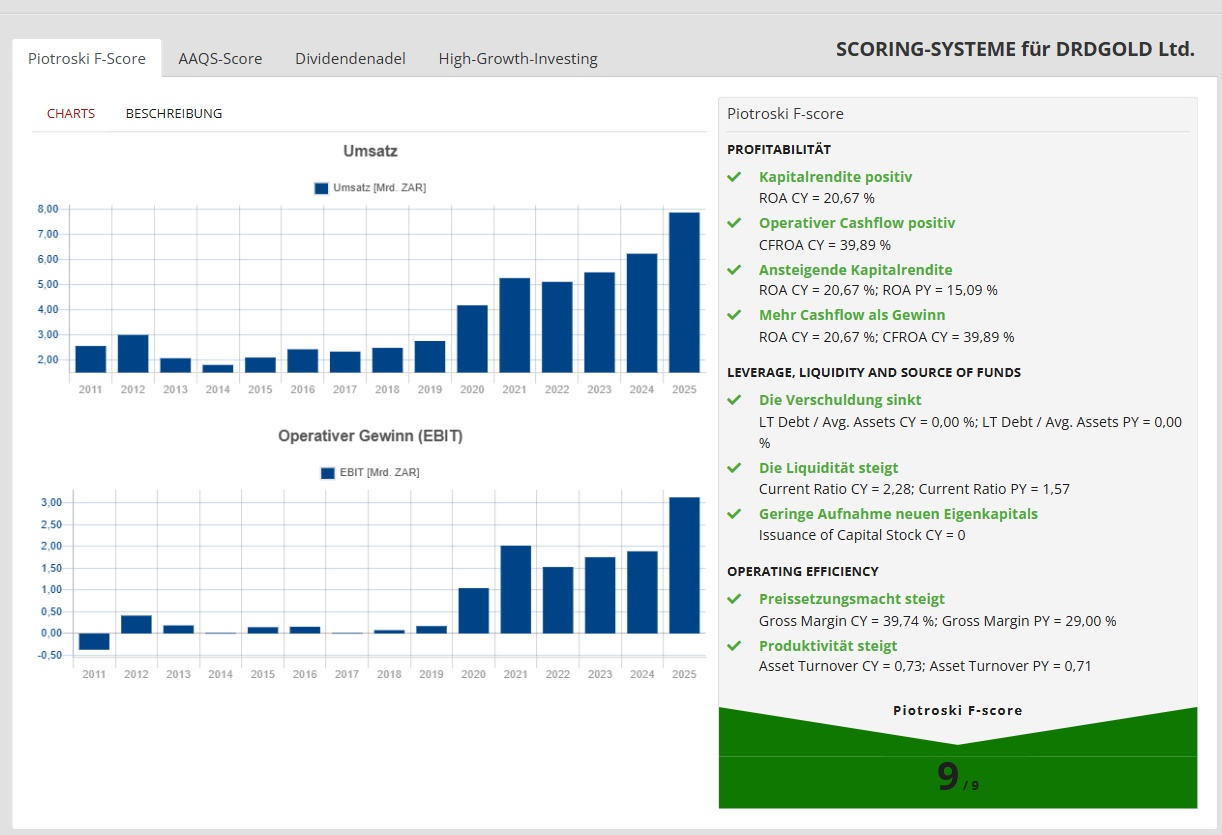

DRDGOLDalso known as Durban Roodepoort Deep, is a mining company from South Africa and is mainly active in the gold mining segment. The main business is the extraction of gold from gold production residues, i.e. from tailings resulting from previous mining activities. DRDGOLD relies on the reprocessing of these old tailings in order to extract gold and other valuable minerals from them. This process is an example of the environmental practice of urban mining, where existing tailings are used as resources instead of developing new mines.

The company is also active in the mineral processing segment and uses advanced technologies to increase the efficiency of gold extraction. Technologies include methods such as flotation processing and pressure leaching. DRDGOLD ADR operates several plants in South Africa that are equipped for the processing of ores and the extraction of gold. The company specializes in creating economic value from existing tailings while helping to reduce environmental impact.

DRDGOLD's main subsidiaries are Ergo Mining Proprietary Limited (Ergo), our flagship metallurgical plant about 50 km east of Johannesburg in Brakpan; and Far West Gold Recoveries (FWGR) near Carletonville, west of Johannesburg.

Ergo and the Knights plant in Germiston are probably the world's largest recycling plant for gold tailings. Together with the mill and pump station at Crown Mines and City Deep (both former plants), these facilities treat approximately 1.7 Mt per month.

FWGR was acquired by Sibanye-Stillwater in July 2018. The acquisition was instrumental in the company's growth strategy and increased our gold reserves by 90%. FWGR comprises Plant 2 in Driefontein with a capacity of 600,000 tpm and the Dryfontein 4 tailings storage facility with a capacity of 500,000 tpm.

At the end of the 2024 financial year, DRDGOLD provided 2,956 jobs, of which 903 were permanent employees. The remaining 2,053 people worked for the specialized service providers engaged by the company to provide the expertise required for tailings exploitation and tailings dam management.

DRDGOLD Integrated Report 2025

Published: October 28, 2025

DRDGOLD berichtet von stabiler Entwicklung im ersten Quartal des Geschäftsjahres 2026

Published: October 16, 2025

Published: August 20, 2025

DRDGOLD meldet einen Anstieg des goldpreisgetriebenen Umsatzes um 26 %

Published: August 14, 2025

Published: May 07, 2025