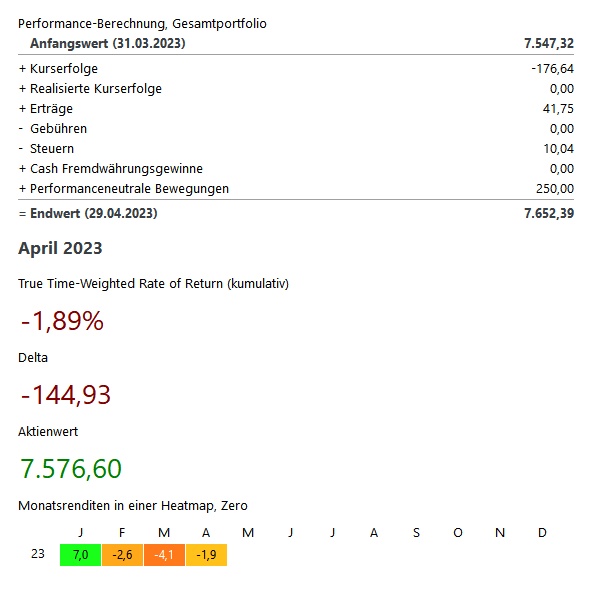

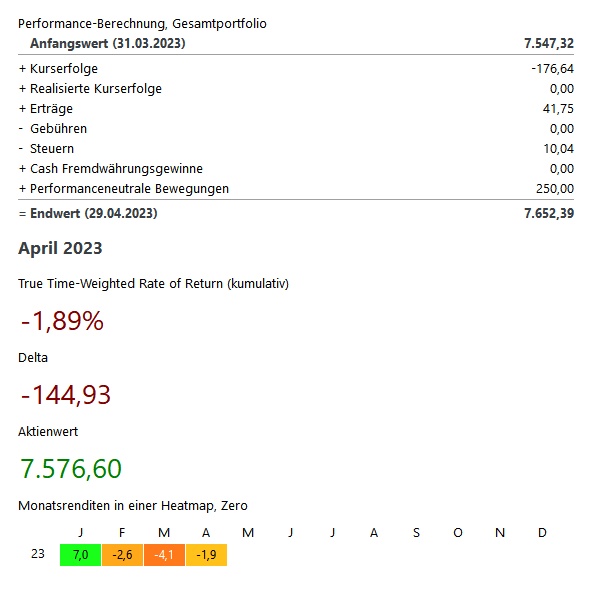

Depot Performance: April 2023 -1.89 % 📉

Top Action: PKN Orlen $PKN (+0%) +13,81% 📈

Flop Action: Lakeland Industries $LAKE (-0.62%) -18,27% 📉

Net Dividends: €31.71

Depot Performance: April 2023 -1.89 % 📉

Top Action: PKN Orlen $PKN (+0%) +13,81% 📈

Flop Action: Lakeland Industries $LAKE (-0.62%) -18,27% 📉

Net Dividends: €31.71