I have taken the plunge and started investing - a topic that has interested me for some time, but which I am now finally actively pursuing.

This journey will certainly have its ups and downs. But that's exactly what it involves: learning, sticking with it and thinking long-term. Here on getquin, I would like to share this journey with you in all its comprehensiveness and transparency.

The first building block is the investment of my side income from my second job. It is the $ETF210 (-0,38 %)

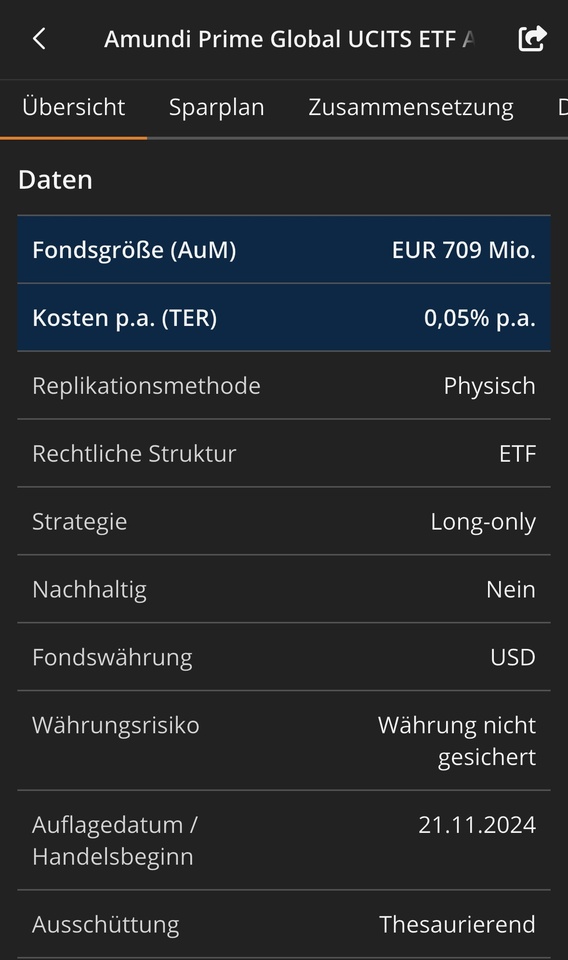

Amundi Prime Global UCITS ETF (ISIN: IE0009DRDY20) - a globally diversified ETF with over 1,400 companies from 23 developed countries.

What convinced me:

- Broad diversification

- Ultra-low costs (0.05% TER)

- Accumulating - dividends are reinvested

- Physical replication (i.e. real shares in the fund)

{There are also 2 negative aspects to mention: Launch date not until 11/2024 - fund size at 709m }

It contains big names such as Apple, Microsoft, NVIDIA, Amazon & Co - and is therefore a solid basis for long-term wealth accumulation.

I'm excited to see where the journey takes us - and will regularly share my learnings here.

Let's grow!