I have been working intensively on my fixed costs recently and would like to openly discuss the topic of cars here today.

The car is one of the biggest items in my current living costs. Unfortunately, I can't do without a car due to my living and working situation, otherwise I would have switched to the so-called climate ticket a long time ago. This allows you to use all public transport within Austria for €1,300 a year (i.e. around €110 a month). Although it would be more like €180, as there would also be the odd seat reservation and coffee to go.

..........................................................................................................................................................................

I had also considered selling my $BMW (-1,06 %) and using the proceeds to buy a young Hyundai or something similar. I would have put the rest in the depot. 😎

But I rejected this idea again. Because my car is very reliable, safe and, contrary to what you might think, very economical.

The long-term consumption is somewhere around 5 l/100 km, service costs are kept within limits as I bring the oil myself and there is no timing belt.

The only thing that is expensive are the summer tires, but here I could switch to smaller wheels, as I do in winter, and reduce the costs even further.

..........................................................................................................................................................................

What is the estimated maintenance cost for a year:

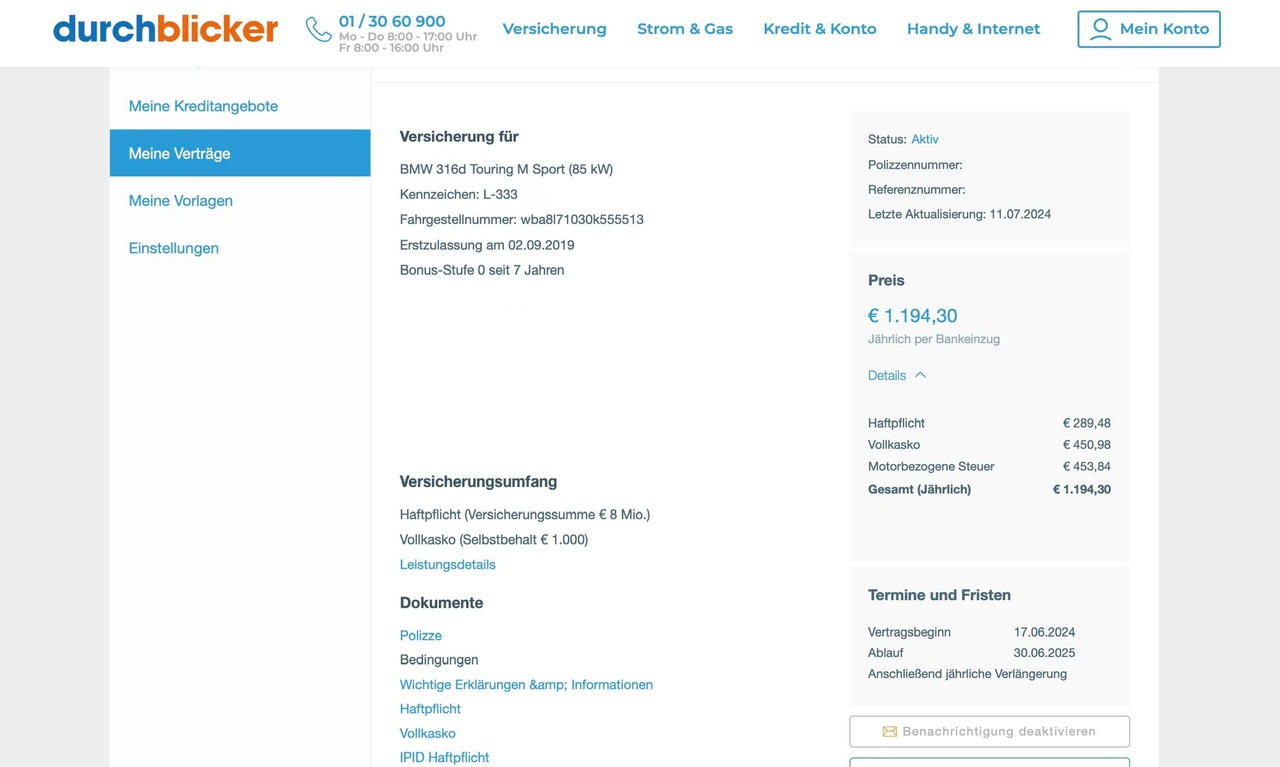

Insurance, tax and automobile club (ÖAMTC): ---1370 €/a

Diesel, vignette (toll), parking fees, washing: --- 1430€/a

Service, tires, unforeseen repairs: --- 2200€/a

Total costs: approx. 5000 € per year, i.e. around 415 € per month 🤯

..........................................................................................................................................................................

Where else can you save?

I only use the car for essential journeys, so I don't see much potential for savings here.

As mentioned above, I also believe that changing cars would not result in any significant cost savings on balance. Or am I missing something here?

That leaves the insurance companies:

I have already canceled the automobile club (ÖAMTC) for the next due date. That saves me €170 a year.

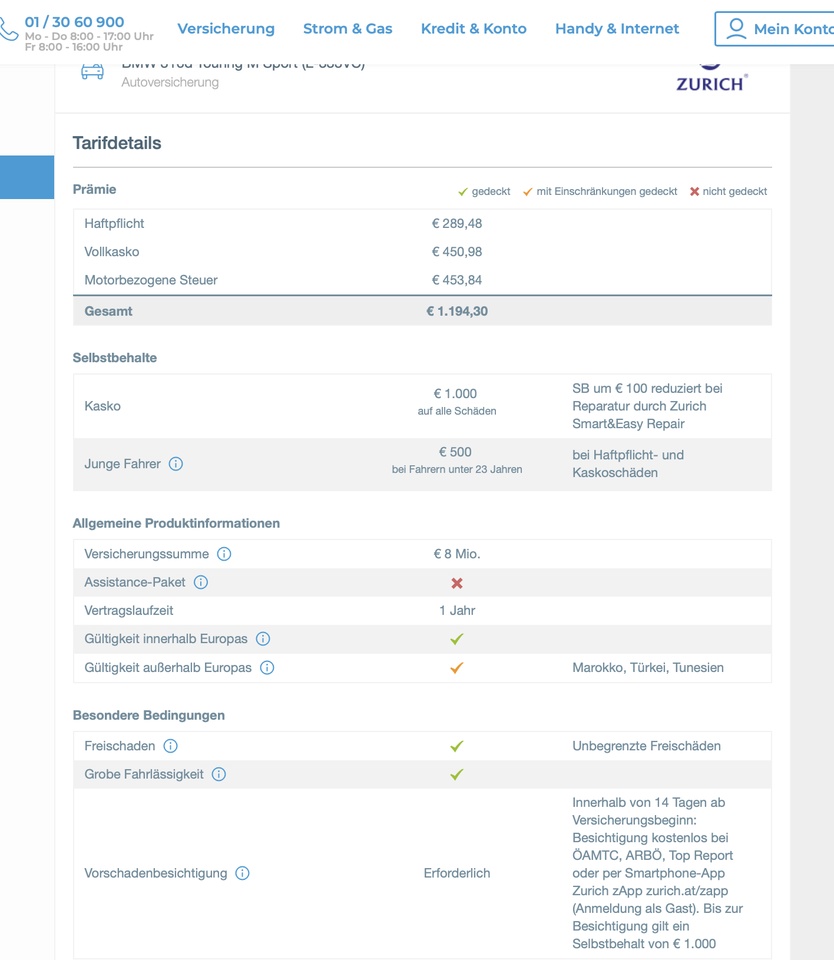

However, I think that towing without insurance cover can quickly become expensive. That's why I'll probably insure this service through my car insurance, where I understand it costs between €30 and €50 per year.

Another point concerns my fully comprehensive insurance. With an annual premium of around €450, it doesn't seem expensive at first glance, but considering the €1000 excess. In the event of damage, I question whether it makes sense

Because without fully comprehensive cover, I would have got away with up to €1450 in the first year, up to €1900 in the second year, up to €2350 in the third year and up to €2800 in the fourth year. Provided, of course, that nothing serious happens.

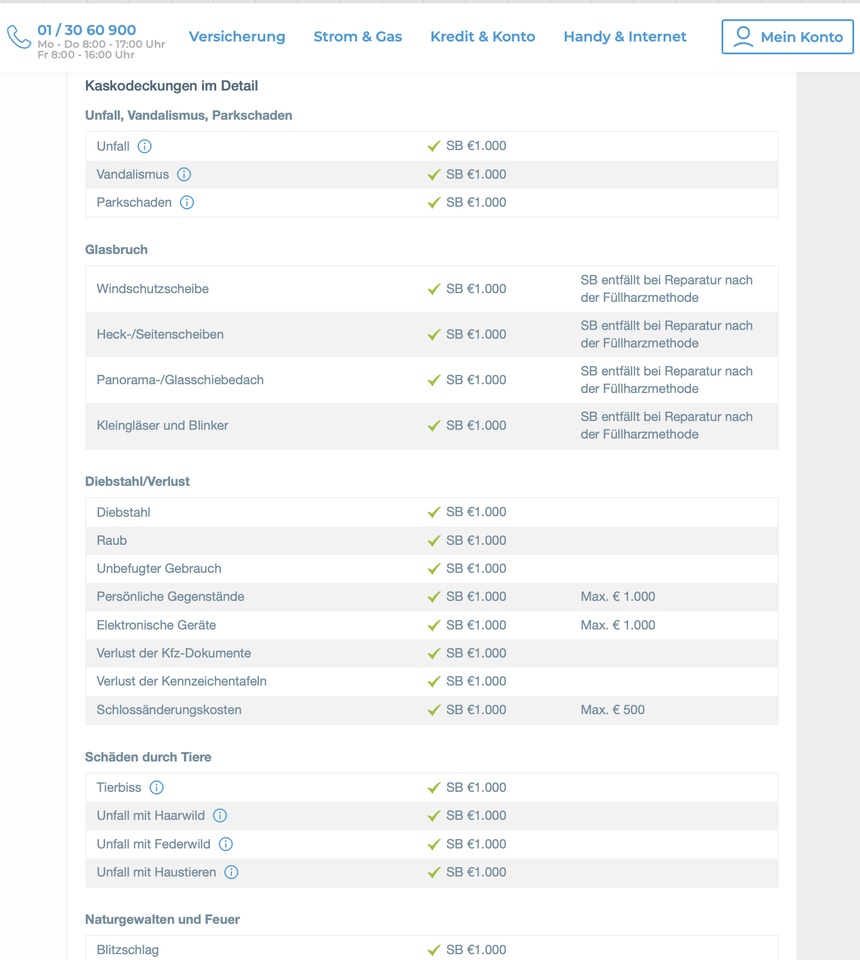

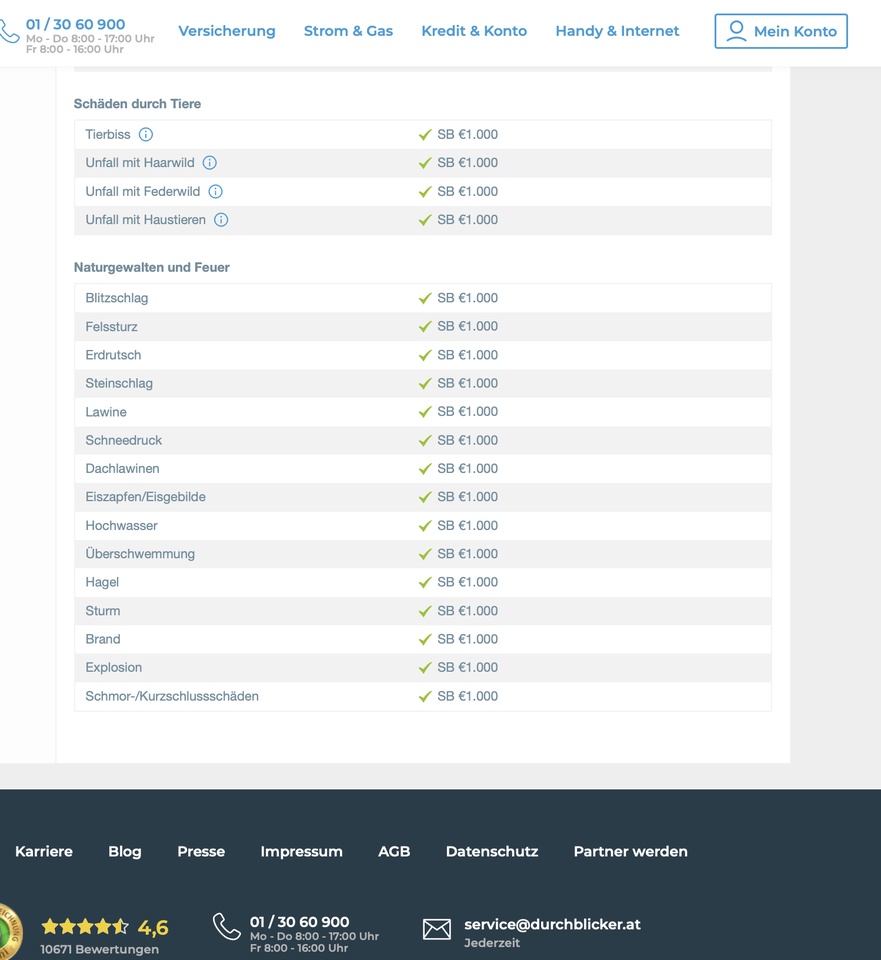

Here is an overview of benefits:

What do you think? Am I missing something or would you do something differently in my position?

I look forward to your opinions and assessments.