The notion of a four-year crypto cycle is usually associated with Bitcoin halving, a protocol event that reduces new supply at regular intervals. While this mechanism remains important, its direct influence has diminished over time as market liquidity has grown and become increasingly embedded in global capital markets. #bitcoin increasingly embedded in the global capital markets. Today, halving acts less as a mechanical shock and more as a structural reference point for investor behavior.

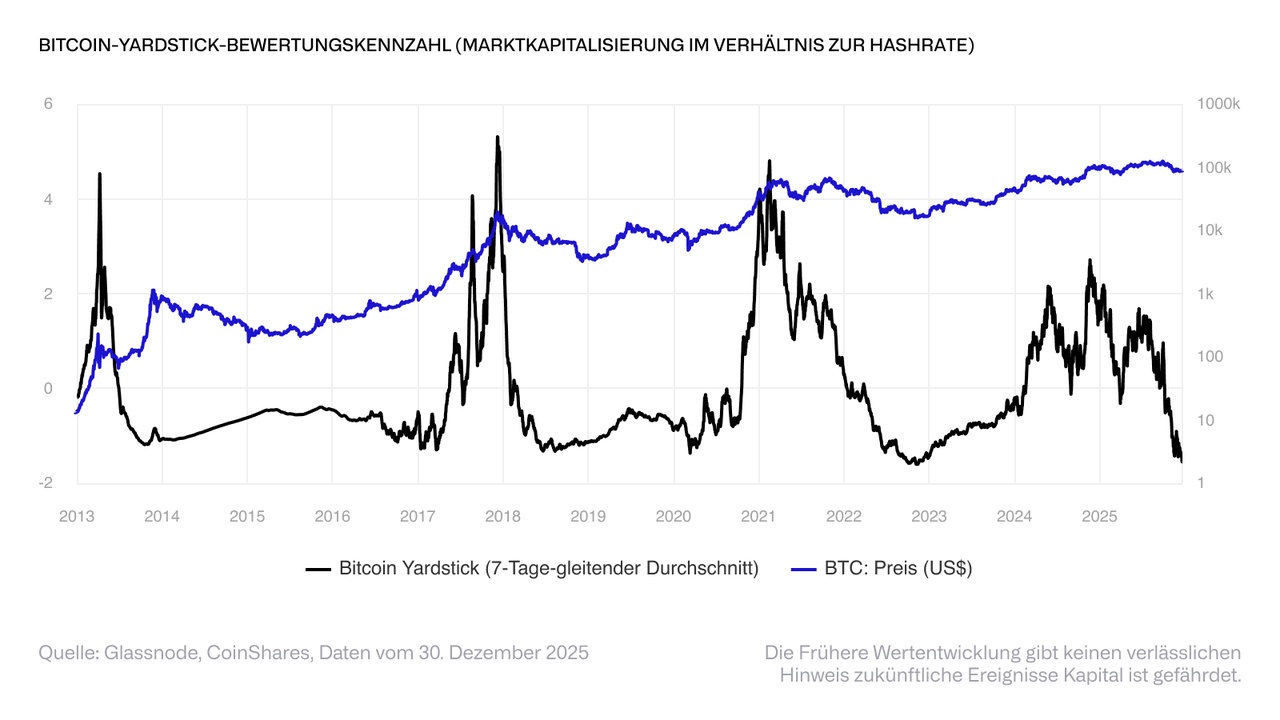

Positioning and psychology play an important role here. In recent months, strong selling pressure from large holders has weighed on price performance and contributed to a feeling of late-cycle fatigue. This pattern has existed before: A period of distribution typically transitions into a tighter supply environment once the selling pressure subsides. In this sense, halving can continue to coordinate expectations rather than dictate outcomes.

The current cycle also reflects significant changes. Spot Bitcoin ETFs have created a new demand channel, and prices reached new highs for the first time in 2024 ahead of a halving. This change alone suggests that the cycle is evolving rather than disappearing.

Ultimately, the four-year cycle remains a useful framework, but not a rule. Liquidity, positioning and macroeconomic conditions are becoming increasingly crucial and should be considered in conjunction with the halving, not subordinate to it.