After 400 years: The end of history?

Diageo's history dates back to 1627, for example.

The company has therefore already been through a number of crises and is likely to survive this one too.

Today, more than 200 brands belong to the Portfolioincluding Guinness beer, Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Gordons, Tanqueray and Ciroc, to name but a few.

In the last ten years, turnover has increased significantly from GBP 14.00 billion to GBP 20.25 billion.

Most recently, the operating margin was over 20 %. Diageo is therefore still highly profitable even "in the middle of the crisis".

For this reason, the company's management is unimpressed and has Dividendeincreased consistently.

In the last two years, the dividend has been increased from USD 3.65 to USD 4.14 per share. Diageo therefore achieves a Dividendenrendite of 4.40 %. The last time the dividend yield reached a similar level was during the 2008/2009 financial crisis.

Historically favorable?

The KGV looks similar. By this yardstick, the valuation is currently at its lowest level for more than a decade.

Either Diageo's success story has come to an end after around 400 years, or it could be an opportunity.

If you look at previous crises, a clear pattern emerges. Each of the three profit collapses in the last 20 years has been followed by a rapid recovery.

If this pattern repeats itself for a fourth time, there will be considerable upside potential.

Diageo's earnings are currently expected to rise by 4% to USD 6.80 per share this year.

This would be by far the slowest recovery after a crisis - in the previous three cases, earnings jumped by 8%, 21% and 15%.

Possible price target

It is in the nature of things that the pendulum swings so sharply. Diageo's running costs are largely fixed, so relatively small changes on the demand side lead to disproportionately large jumps in profits.

If Diageo performs similarly to each of the previous crises in the coming months, there is considerable upside potential. For example, let's assume that profits rise by 8% instead of the expected 4%.

In this scenario, the market would be surprised, which could lead to a revaluation of the share.

Diageo's P/E ratio has hovered around 19.7 for many years. Even with a P/E ratio of 18, there is a potential upside of Kursziel of USD 127.72

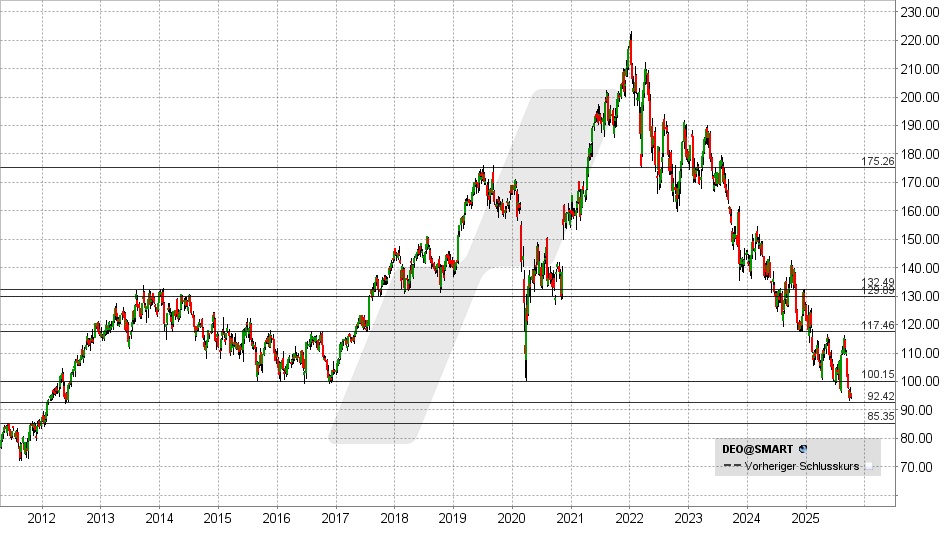

Diageo share: Chart from 07.10.2025, price: USD 94.38 - symbol: DEO | Source: TWS

From a technical perspective, a return above USD 100 would be the prerequisite for this. As long as this does not happen, the bulls are in a losing position. If it manages to rise above USD 100, this could trigger a recovery towards USD 115.00 - 117.50.

However, if the share falls below USD 92.50, further price losses towards USD 85.50 or USD 80 must be expected.

Source