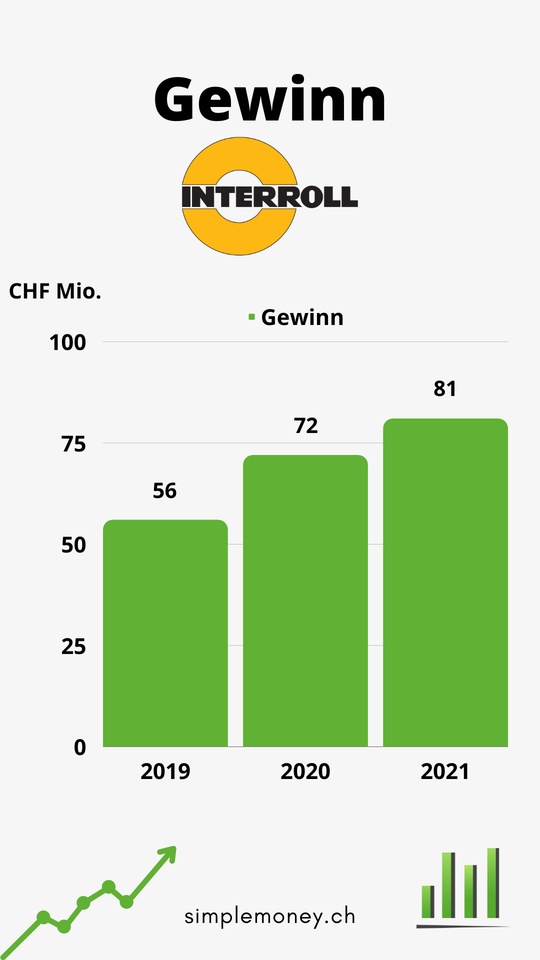

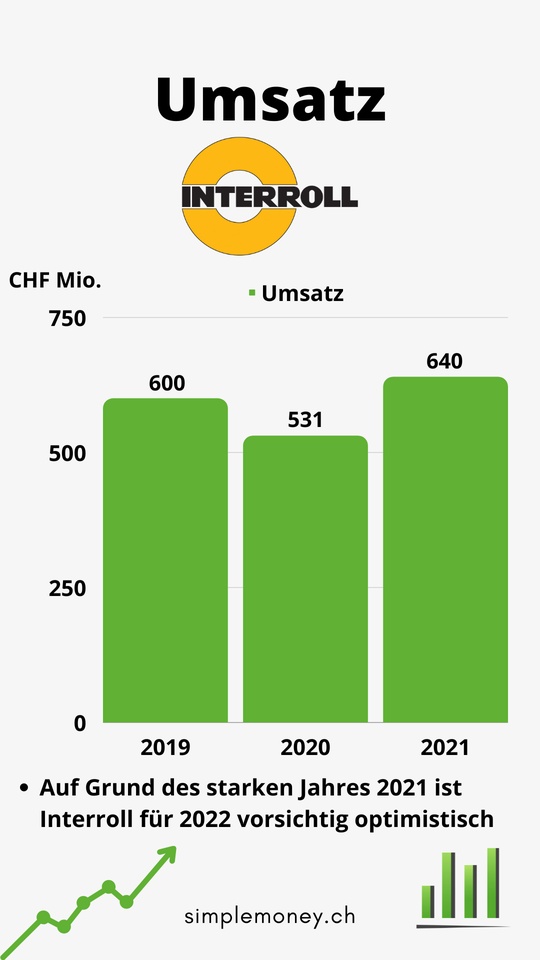

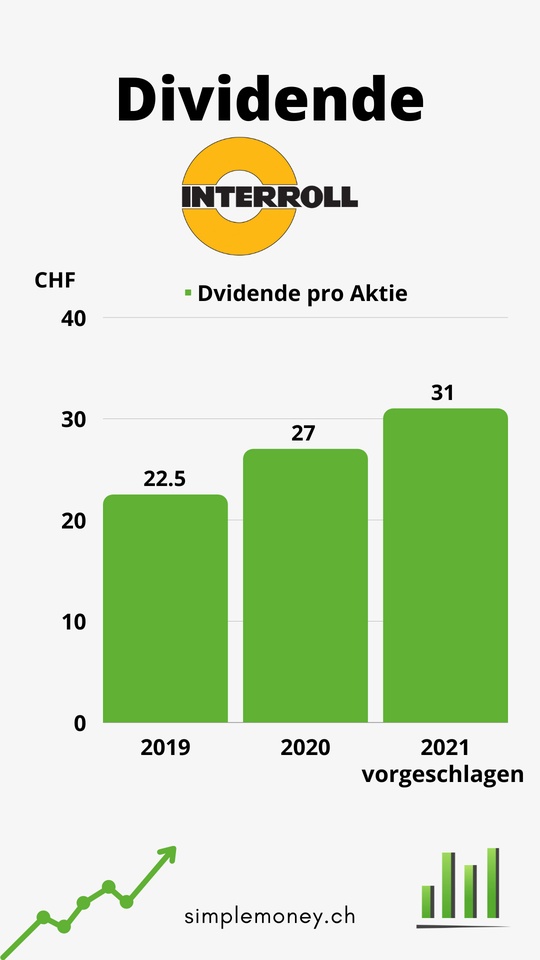

Brief presentation and summary of the annual figures of the Swiss company Interroll.

For me definitely a candidate for the watchlist, the sector is extremely exciting and Interroll is the market leader.

The balance sheet is also really 1A. The only thing that has kept me personally from an investment is the current valuation, which is also above the historical average.

Did you already know the company from Switzerland?