Trump's U-turn in the tariff dispute + tonies achieves targets for the 2024 financial year + Manipulation accusations against Trump

Trump's U-turn in the tariff dispute

- On Wednesday, the New York stock exchanges reacted with a veritable price explosion to the US President's decision to suspend the recently imposed country-specific special tariffs for 90 days.

- During this period, a flat tariff rate of 10 percent.

- As a result, the leading US index Dow Jones Industrial closed up almost 8 percent and the technology-heavy Nasdaq 100 even rose by 12 percent.

- Prices also rose sharply in most Asian trading centers.

- This was particularly true of the Nikkei 225 Index, the most important stock market barometer in the export-oriented country of Japan.

- It had previously suffered particularly badly from the trade conflict triggered by Trump.

- In contrast, Trump stepped up the confrontation with China by increasing the tariffs on Chinese imports to 125% once again.

- Nevertheless, the most important indices on the Chinese stock exchanges rose slightly, with the Hang Seng Index of the Hong Kong Special Administrative Region performing even more strongly.

- Chinese counter-tariffs on US goods will also come into force this Thursday.

- EU counter-tariffs will also come into effect next week.

- They are a reaction to US tariffs on steel and aluminum imports imposed around a month ago.

tonies $TNIE (-0,28 %)achieves targets for the 2024 financial year

- significant sales growth and improved profitability - positive free cash flow and net profit achieved.

- Group sales increase by 33.1% to EUR 480.5 million in FY 2024, driven by double-digit growth in all markets

- North America becomes tonies' largest market with sales of EUR 210.4 million (+49.9% YoY) and a profitable EBITDA margin (2.5%)

- DACH region with double-digit sales growth of 11.1% to EUR 184.3 million and significantly increased EBITDA margin of 23.1% (FY 2023: 16.3%)

- Adjusted EBITDA margin increases by 350 basis points to 7.5%, EBITDA margin by 460 basis points to 7.0%; both driven by operating leverage and improvement in gross margin

- Break-even achieved with free cash flow of EUR 33.1 million (EUR +37.9 million compared to previous year) and net profit of EUR 13.1 million (EUR +24.9 million compared to previous year)

- tonies is convinced that 2025 will be another year of profitable growth; forecast will be published when visibility on the global customs situation improves

Manipulation allegations against Trump

- Democrats want to investigate possible insider trading by the president and his confidants

- Trump's abrupt change of course on customs policy on Wednesday afternoon - namely a 90-day pause on new tariffs for all countries except China - is provoking questions.

- The US President posted on his Truth Social platform shortly after the start of trading on Wall Street at 9:30 am on Wednesday: "Stay cool! Everything will be fine.

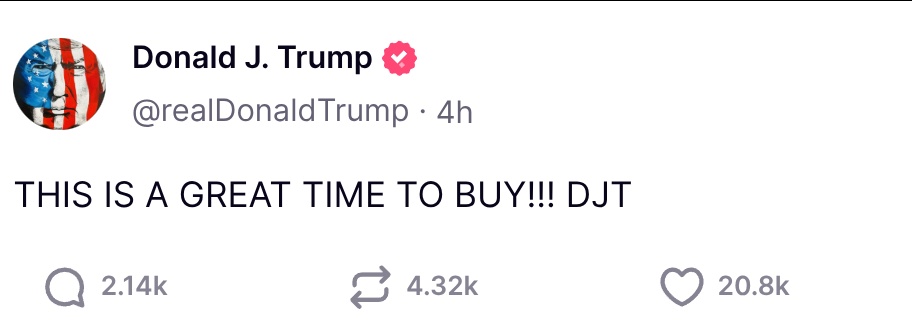

- The USA will be bigger and better than ever before!" Four minutes later, he followed up with, "THIS IS A GOOD TIME TO BUY!!!! DJT".

- DJT is the acronym for his heavily loss-making company behind Truth Social (link), but also the abbreviation of his name.

- Shortly before 1:30 p.m., Trump announced the suspension, triggering a 12 percent price explosion on the Nasdaq.

- DJT, meanwhile, gained over 20 percent.

- https://www.tachles.ch/artikel/news/manipulations-vorwuerfe-gegen-trump

Thursday: Stock market dates, economic data, quarterly figures

- ex-dividend of individual stocks

- Deutsche Telekom EUR 0.90

- Verizon Communications USD 0.68

- AT&T USD 0.28

- Salesforce USD 0.42

- General Mills USD 0.60

- Oracle USD 0.50

- Quarterly figures / company dates Europe

- 07:00 Docmorris Trading Update 1Q & Outlook 2025 | Givaudan quarterly figures

- 11:00 Docmorris Analyst and Press Conference

- 14:00 BMW Pre-Close Call 1Q

- 14:30 Curevac Annual Results

- 15:00 Curevac Call

- 18:00 Schaeffler Pre-Close Call 1Q

- 18:10 Patrizia detailed annual results

- Economic data

01:50 JP: Producer prices 3/25

03:30 CN: Producer prices March PROGNOSE: -2.3% yoy previous: -2.2% yoy | Consumer prices March PROGNOSE: -0.1% yoy previous: -0.7% yoy

08:00 DE: Construction prices for residential buildings February

10:00 DE: Economic research institutes, spring forecast

14:00 PL: ECB Banking Supervisor Buch, speech at SGH Warsaw School of Economics

14:30 US: Initial jobless claims (week) FORECAST: 223,000 previous: 219,000 | Real Income March

14:30 US: Consumer Prices March PROGNOSE: +0.1% yoy/+2.6% yoy Previous: +0.2% yoy/+2.8% yoy Core Consumer Prices PROGNOSE: +0.2% yoy/+3.0% yoy Previous: +0.2% yoy/+3.1% yoy

16:00 US: Fed-Kansas President Schmid, speaks at Secured Finance Network Event

18:00 US: Chicago Fed President Golsbee, speech at Economic Club of New York event

No time given: CN: Chinese import tariffs on US goods come into force