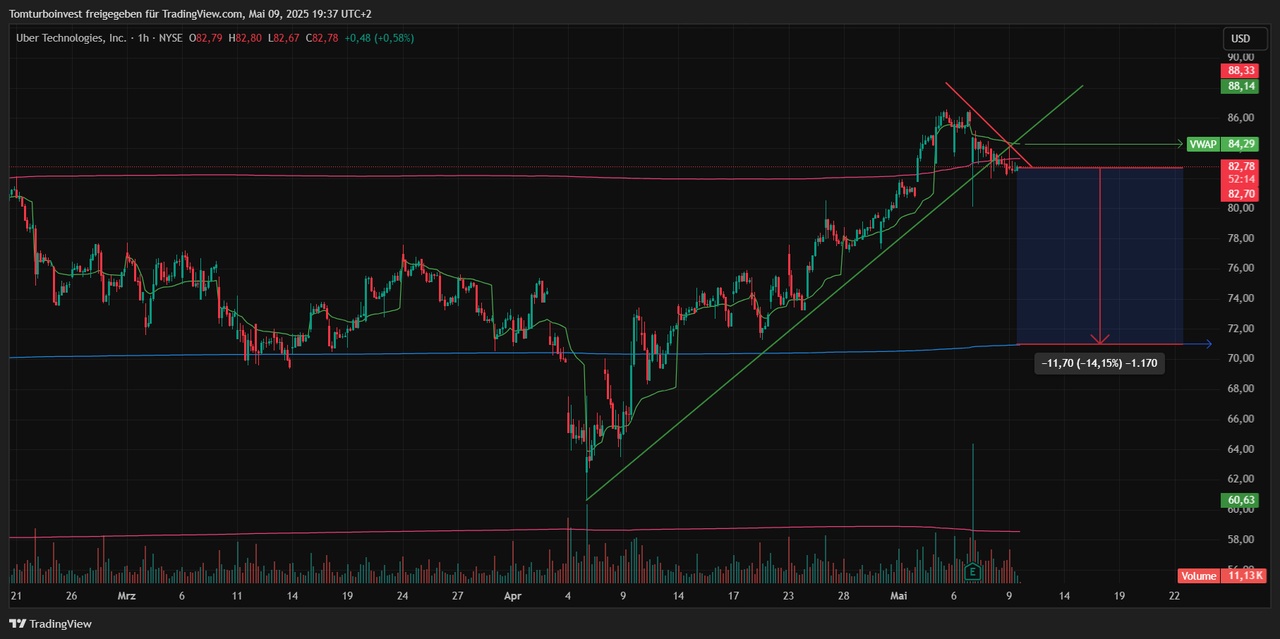

$UBER (-0,79 %) As already described and feared 3 days ago "...after such a long sideways phase it needs a "good" momentum to break out of the range sustainably". The earnings were not enough....

From a trader's point of view, it was the right decision not to enter yet. The question now is whether this resistance can attract enough new buyers to become future support 🧐

The next few trading days will show. Patience is required - if the current area does not hold, it may well run back to the anchored VWAP (blue line) - area around USD 71.

Currently, the average volume of the weekly session is still slightly above the current price level of 84$ (green arrow) - the bulls have not given up yet 😁

Detailed view 1h chart NYSE

1T Chart NYSE

I'll stay on the sidelines - let's see if I set a stop-buy a little above the ATH for next week?

Edit May 12: the ATH was broken today and I got in with a small position. It's good that there was no sell-off at the close of trading - tightly hedged, let's see what the week brings 😉