I worked with Bitpanda in #gold and #silber but these positions are not transferred via the API. As you buy in grams on Bitpanda, I track the gold price with $4GLD (+0,98 %) is there a more elegant solution for silver than $965310 (+1,51 %) and then convert?

Silver

Price

Debate sobre 965310

Puestos

24📈 COMMODITIES 2024: PROSPECTS FOR INVESTORS 🛢️

This year will be extremely exciting for commodity prices.👀📈

Even if you are not interested in investing directly, the original article is definitely worth the 2 minutes of reading time.

Analysts predict that prices could rise again for the time being.

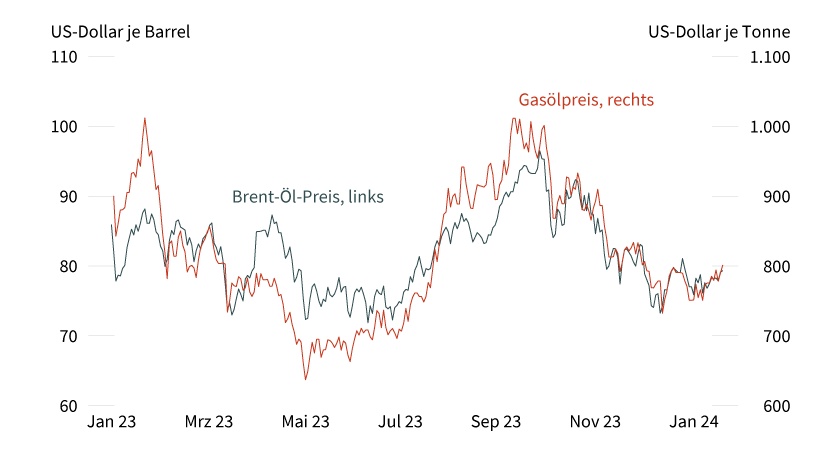

For example, the current weakness on the oil market ($IOIL00), caused by demand concerns and an oversupply, could stabilize by mid-2024 according to experts and lead to a price recovery. (1)

Precious metals such as gold ($EWG2 (+0 %) / $965515 (+0,85 %) / $4GLD (+0,98 %) ) and silver ($965310 (+1,51 %) ) could also benefit from changing interest rate expectations. In particular, the prospect of interest rate cuts by the US Federal Reserve will have a strong influence on the price of gold. (2) (Image 1)

The situation with industrial metals such as copper, whose prices were under pressure in 2023, is particularly exciting for me. A possible shortage of supply could drive prices up again. (3) Similarly with the CO2 price, although the situation here looks rather modest in the short term. (4)

Do you agree with this or has something important been overlooked?

(1) Section "Exaggerated concerns on the oil market"

(2) ibid. "Precious metals under the spell of interest rate expectations"

(3) ibid. "Better times on the industrial metals markets in sight?"

(4) ibid. "CO₂ price in EU emissions trading"

#rohstoffe

#finanzen

#marktausblick

#commodities

#marketsentiment

#finance 📊

This article is part of an advertising partnership with Societe Generale

Proud 🥹

All opinions welcome 😉

Hello, a little question for the community:

Do you find precious metals interesting at the moment?

Or do you think you would invest in silver, copper, platinum, etc.?

Evil traded companies in my professional life

Thanks to @Koenigmidas for linking and for the nomination! #börsengehandelteralltag

#boersengehandelteralltag

Exchange traded companies in my professional everyday life in precious metals and foreign exchange trading:

- Umicore $UMI (+1,47 %) (refinery)

- Prosegur $PSG (+0,66 %) (security, logistics, cashrecyling)

- Johnson Controls $JCI (+0,05 %) (security)

- Swiss National Bank $SNBN (+0,84 %) (foreign exchange trading)

- National Bank of Japan $8301 (foreign exchange trading)

- FedEx $FDX (+0,04 %) (logistics)

- United Parcel Service $UPS (+0,05 %) (logistics)

- Cloudflare $NET (+0,47 %) (IT Security, Web)

- Fortinet $FTNT (-0,56 %) (IT Security)

- Teamviewer $TMV (-0,19 %) (Software)

- Microsoft $MSFT (-0,03 %) (Software)

- Cancom $COK (+0,13 %) (IT system house)

- Kyocera $6971 (-0,27 %) (printer and scan hardware)

- Alphabet $GOOGL (+0,93 %) (Who doesn't know it...?, research)

Naturally, I still have to do with various things which are traded on the stock exchange, but are not companies... these include: $965515 (+0,85 %) (gold), $965310 (+1,51 %) (silver), platinum and the various currency pairs like $965275 (+0 %) (EUR/USD) but also all other currencies (AUD, NOK, GBP, JPN, SEK, PLN, CZK, SAR, etc. etc. etc.). Subordinately, we also have to deal with $BTC (+1,26 %) (Bitcoin), although it is rather negligible.

In our other parts of the company we also deal with $UHR (+0,42 %) (SwatchGroup).

What strikes me personally when I look at my professional environment:

There are dozens of companies in this sector, which are not traded on the stock exchange. Among them are some refineries (partly huge company constructs), service providers and luxury goods manufacturers. Also in the area of analysis technology (physical), equipment and software, there are some well-known manufacturers who have so far shied away from the stock exchange or are family-run.

In my private environment I have to do of course like each of you with various products and brands. A separate listing should be interesting for the fewest...

But the most extraordinary might be $RI (-0,33 %) (Pernod Ricard), which is not least due to one of my hobbies: ABSOLUT VODKA bottles in the various designs and Limiteditions collect.

Basically I nominate all Getquin friendsbut especially @Der_Dividenden_Monteur , @Staatsmann

@Simpson !

Does getquin understand "silver" to mean an ounce of real (i.e. physical) silver?

Valores en tendencia

Principales creadores de la semana