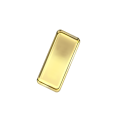

Since a lot has happened here in the last year, be it from @Tenbagger2024 or @Multibagger etc., I would like to give my ideas a little more fullness and become more active again.

2 years ago I introduced the company $NVLH (-2,14 %) where I am still actively buying. The plans for the first reduction are to take place at the beginning of 2028, i.e. it will still take some time before the first positive sales. During this time, however, I will keep buying more. My average purchase price is currently €0.16 and is currently the only share in my trading portfolio. As soon as $UAA (-0,16 %) becomes technically more interesting again, it may also be a company for my trade portfolio.

My portfolio is currently divided into 4 parts.

Growth portfolio with $SOFI (+0,63 %) and $ZETA (+1,31 %) ,

Trade-Depot: $NVLH (-2,14 %)

Precious metals: $965515 (+2,26 %) and $965310 (+0,72 %)

Small change deposit: $TDIV (+0,18 %) (everything that is spent in cash and comes back in small change is put into the ETF from €250+ without exception).

You can find more information about Nevada Lithium in my profile.

You can find an introduction to the company here. https://app.getquin.com/de/post/PsKSiDnzoA

And now to the actual article...

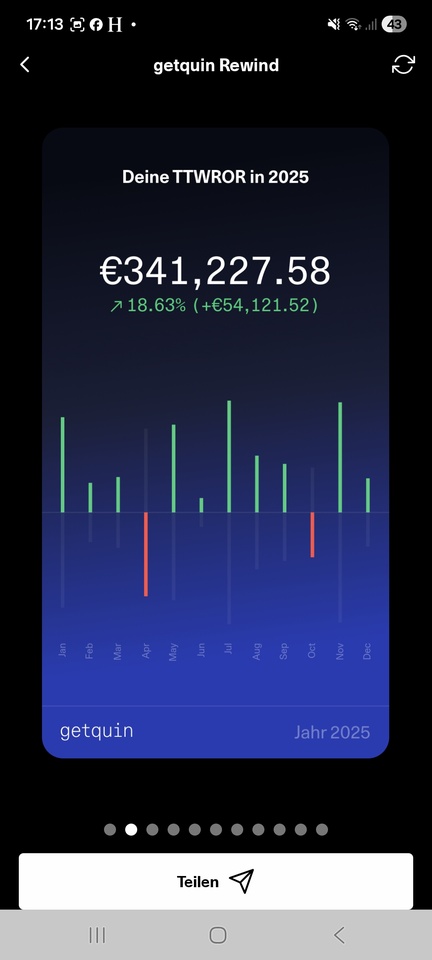

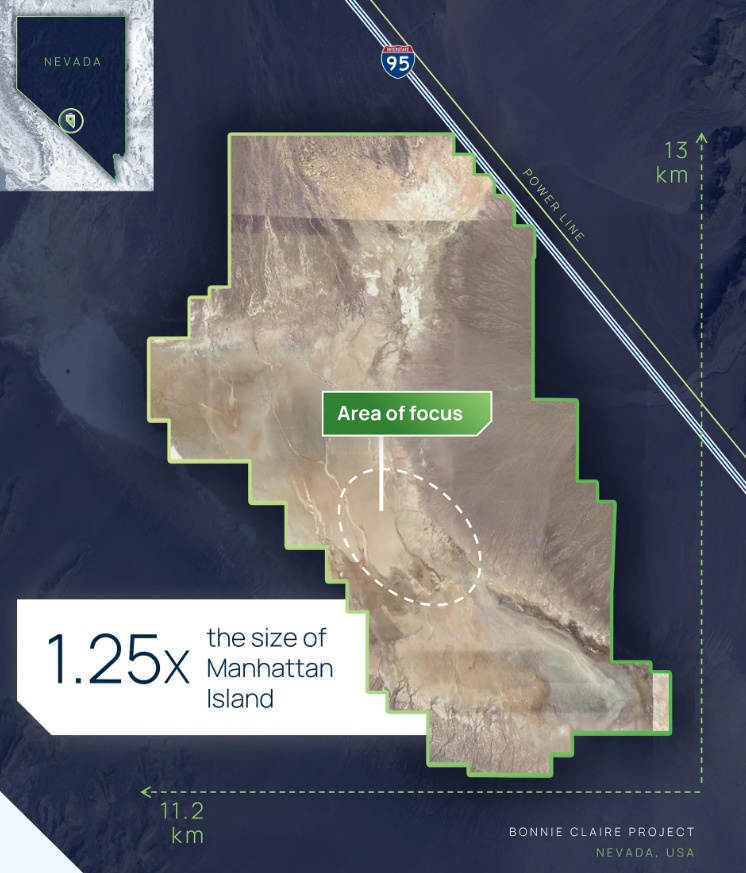

$NVLH (-2,14 %) is pleased to announce the commencement of several individual projects at its 100% owned Bonnie Claire Lithium Project (" Project " or " Bonnie Claire ") in Nye County, Nevada. This winter work program is designed to investigate specific issues that have arisen from the Project's 2025 Preliminary Economic Assessment (" PEA ") and to further evaluate the potential for the extraction of additional critical minerals at Bonnie Claire.

Nevada Lithium's CEO, Stephen Rentschler, commented as follows:

We are pleased to report that a multi-faceted work program is underway. We anticipate that the individual projects will quickly provide valuable technical information with potential positive economic impact. In particular, the potential to extract additional critical minerals offers a promising opportunity to enhance the value of Bonnie Claire through additional revenue streams beyond lithium and boron.

The Company considers third-party due diligence to be an important milestone in minimizing risk associated with the hydraulic well mining method selected for Bonnie Claire. This project has the potential to significantly and positively impact the completion of the preliminary study.

A better understanding of the extremely high-grade lithium and boron deposits at Bonnie Claire was also a priority for our technical team. The identification of the lithium residence is expected to provide further information that will allow for even more precise targeted exploration of the highest grade lithium and boron mineralization layers at Bonnie Claire. This knowledge has the potential to positively impact economics through increasingly selective mining and increase future deposit size through improved exploration strategies.

Highlights

- Investigation of cesium and rubidium recovery from the current flowsheet

- Technical due diligence of the hydraulic borehole hoisting method ("HBHM")

- Petrological analysis of claystone samples to determine lithium retention

The Company has commenced implementation of a number of recommendations from its Preliminary Economic Assessment (PEA) to lay the foundation for a larger work program in 2026. The 2026 work program is designed to advance the project towards a Pre-Feasibility Study.

Caesium and rubidium recovery

In its press release dated September 17, 2025, the Company announced that significant cesium (Cs) and rubidium (Rb) mineralization has been identified at Bonnie Claire. Initial test work indicated that these elements had passed through the lithium/boron leach stages of the project's PEA flowsheet and were present in the enriched leach solution (" PLS ").

The Company is pleased to announce that it has engaged Kemetco Research Inc. (" Kemetco ") of Richmond, British Columbia to conduct a feasibility study to evaluate the recovery potential of cesium (Cs) and rubidium (Rb) from the Project. Previous work confirmed the presence of significant Cs and Rb mineralization and demonstrated that both elements penetrate the PLS layer according to the current flowsheet.

The metallurgical program includes characterization of a composite sample, confirmatory leach tests to quantify cesium and rubidium extraction, and preliminary ion exchange and adsorbent screening to evaluate recovery potential. The goal of this work is to determine if cesium and rubidium can be effectively recovered along with lithium and to generate initial data that can support future process optimization and economic evaluations.

Technical due diligence of HBHM

The Company's Preliminary Economic Assessment (PEA) is based on a mine plan that identifies HBHM as the preferred method for recovering high-grade lithium and boron mineral material at Bonnie Claire. Although HBHM has been used in various projects for many years, it is a relatively new extraction method in this environment. Therefore, the company wishes to obtain independent validation of this mining method from experts in the field. This due diligence will provide feedback on the methods, assumptions and results of the PEA.

The Company has engaged a global engineering firm to conduct a technical due diligence review of the proposed HBHM mining method to confirm its suitability for the extraction of mineralized materials at Bonnie Claire. To this end, the firm will conduct a mine design review to determine if the equipment and infrastructure required to extract the mineralized layer using HBHM is adequately considered.

The global engineering firm will also review the characterization of the mechanical behavior of the rock, with a focus on the anticipated geotechnical conditions within the mineralized lens. This review will focus on evaluating the applicability of the HBHM method to the Bonnie Claire geology.

Lithium Residence

The Company's 2025 Preliminary Economic Assessment (PEA) identified several opportunities for lithium storage at Bonnie Claire, including:

- Li substitution in the octahedral layer of fine-grained K-mica (e.g. muscovite-illite series)

- Li in swelling clay layers from illite-smectite intercalations

- Possible Li uptake through ion exchange or structural substitution in analcime

- Lithium can occur as lithium salt (e.g. LiCl, Li2SO4).

The 2025 Preliminary Economic Assessment (PEA) is preliminary and includes Inferred Mineral Resources that are considered too speculative geologically to be categorized as Mineral Reserves. There is no certainty that the results of the PEA will materialize.

To investigate these possibilities, the Company has entered into a research agreement with the Department of Geosciences ("DiSTAR") of the University of Naples Federico II in Naples, Italy.

The proposed research project aims to better understand the distribution of lithium in clay minerals at the Bonnie Claire deposit. Initial analyses include X-ray diffraction analysis ( XRD ) of the whole rock to determine the mineralogy of the samples. Scanning electron microscopy with energy dispersive X-ray spectroscopy (SEM-EDS) will be used on thin sections and resin-embedded blocks to examine ore textures and perform microchemical analyses of the clays in situ.

The selected clay-rich samples will be subjected to separation of the fine-grained fraction and subjected to specialized XRD analysis and high-resolution whole rock geochemistry to determine the lithium clay mineralogy and concentrations of lithium and other key elements (Rb and Cs).

It is hoped that the results from the Lithium Resident Project will be available in time to be incorporated into a technical analysis to be prepared by the Prospectors and Developers Association of Canada (" PDAC ") for presentation. Dr. Jeff Wilson, PhD, FGC, P.Geo, Vice President Exploration at Nevada Lithium, will present the project "The Bonnie Claire Volcano-Sedimentary Lithium Boron Deposit" as part of the "Exploration Insights" session at the 2026 PDAC Conference in Toronto, Ontario.

About Nevada Lithium Resources Inc.

Nevada Lithium Resources Inc. is a mineral exploration and development company focused on creating value for shareholders through its core asset, the Bonnie Claire Lithium Project in Nye County, Nevada, in which it holds a 100% interest.

The Company recently completed a Preliminary Economic Assessment (" PEA ") for the Bonnie Claire project. The PEA has an effective date of March 31, 2025 and shows an after-tax net present value of $6.829 billion at an 8% discount rate. This value is based on a lithium carbonate price of USD 24,000 per tonne, a boric acid price of USD 950 per tonne and an after-tax internal rate of return of 32.3%. The results of the PEA were published in the Company's press release dated August 6, 2025.