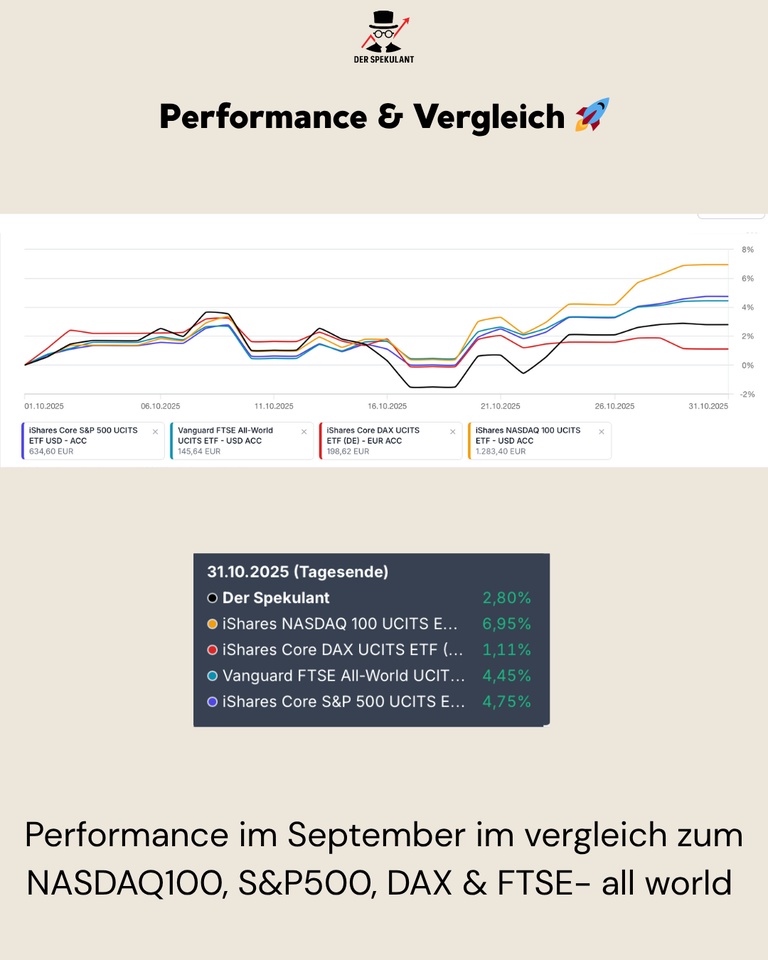

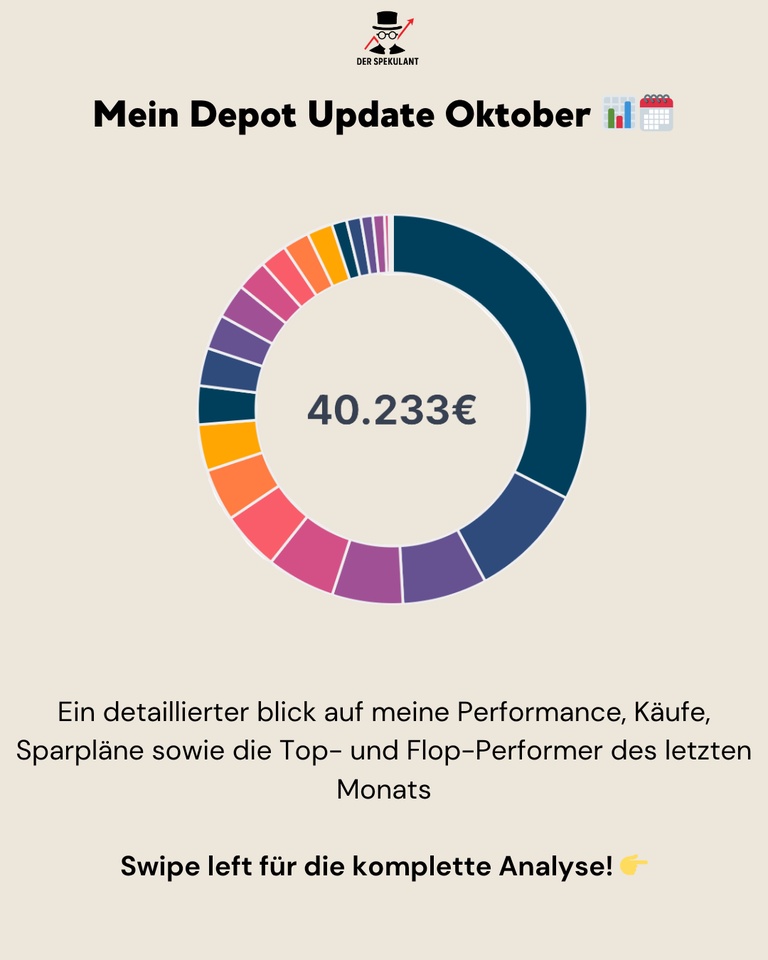

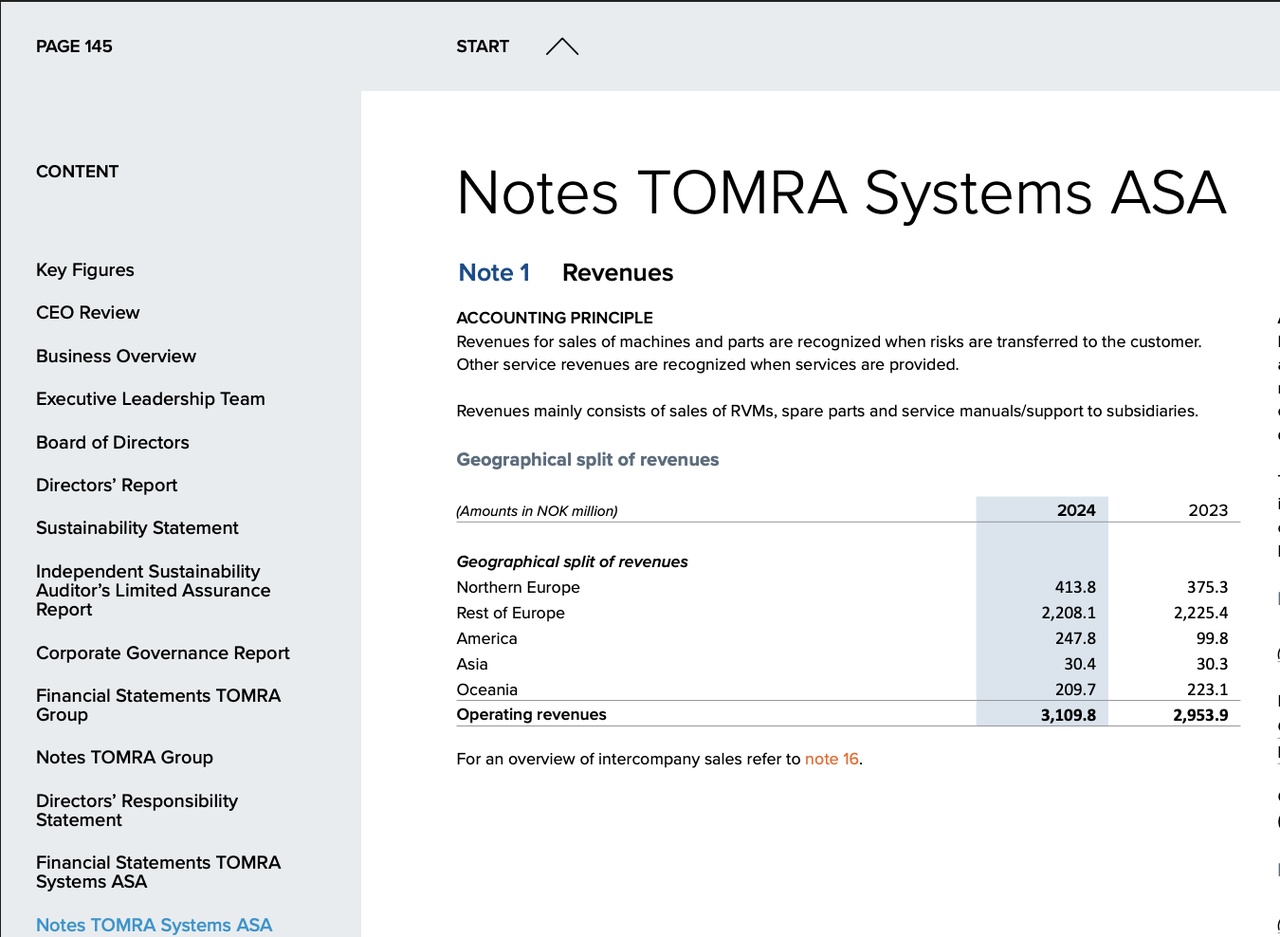

After a stable October (+6.2%), there was a clear countermovement in November.

My portfolio fell to 39.328€ and was thus -3,9% compared to the previous month.

The main drivers were the strong sell-offs in AI software, uranium, mining and defense - precisely those areas that are overweighted in my allocation.

Despite the setback, the year as a whole remains strong:

👉 Year-to-date I am still at +20.4% - solidly in the green.

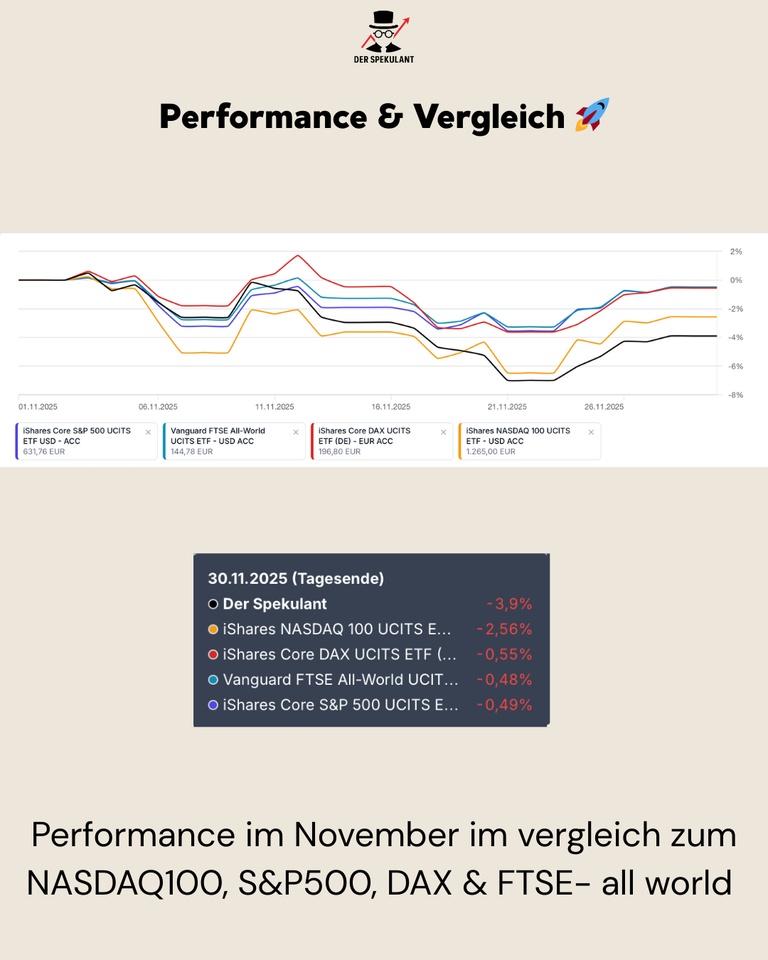

1st performance & comparison 🚀

November was clearly characterized by risk-off mode. While broader indices remained stable, highly volatile future themes corrected much more strongly.

My portfolio:

-3,9%

NASDAQ 100:

-2,56%

S&P 500:

-0,49%

DAX:

-0,55%

FTSE All-World:

-0,48%

The underperformance is fully explainable:

Uranium, AI software, bitcoin mining and defense were under pressure - all segments that my portfolio partly tracks. But we remain calm and use attractive setbacks to buy.

Positive:

The long-term trend structure remains intact, YTD +20,4% clearly show: The overall path is right.

2. my savings plans & allocation 💶

The focus remains unchanged on strategic liquidity and consistent allocation.

Important in November:

👉 I bought Bitcoin for the first time.

This expands my structure specifically in the direction of digital assets - a building block that has shown relative strength despite market volatility. We entered at €74665 and are trying to use the 30% drop since the ATH to build up a small anti-cyclical position.

My savings plans are continuing as usual and remain the tactical tool for exploiting market opportunities in a disciplined and unemotional manner.

3rd top mover in November 🟢

The month was led by Nubank ($NU (+0,74 %)), which was up +8,06 % benefited from strong user numbers and continued high demand for credit in Latin America. Berkshire Hathaway ($BRK.B (+0,27 %)) gained +7,40 % driven by solid insurance profits and defensive positioning in the current market environment.

American Lithium (+4.44 %) showed a technical recovery, while the Bitcoin purchase ($BTC (-2,57 %)) in my portfolio with +3,39 % had a direct positive effect. Also small caps (MSCI World Small Cap ($WSML (-0,04 %)) +1.31 %) also performed stably. Tomra Systems ($TOM (-0,15 %)) rounded off the list of winners with a slight gain of +0,28 % driven by an incipient recovery in demand in the recycling segment.

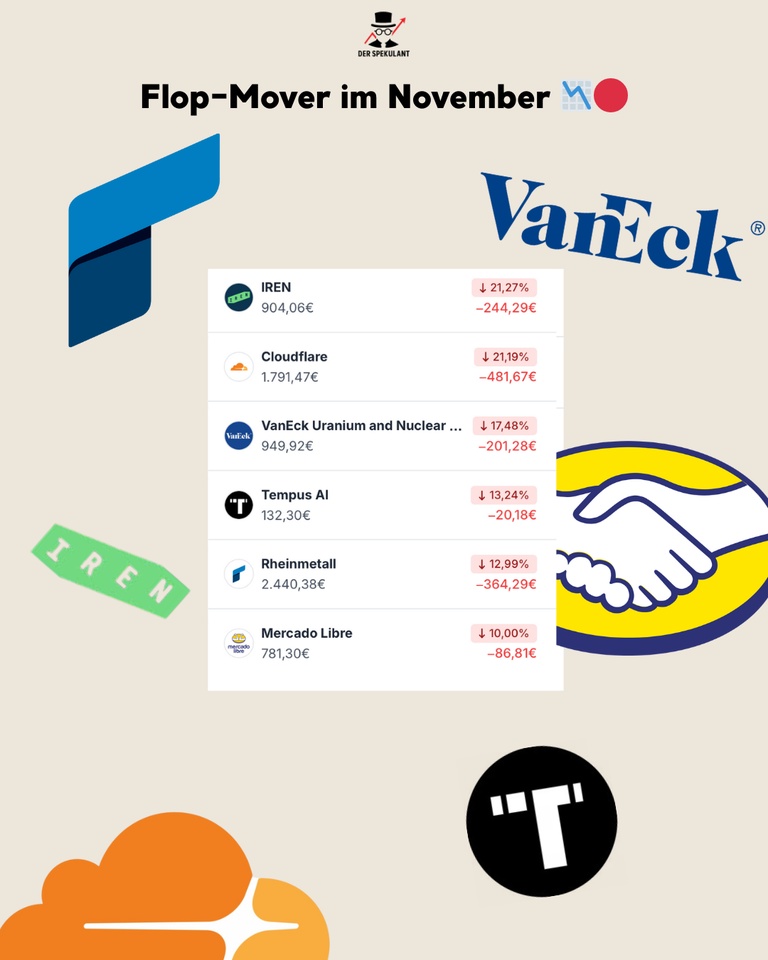

4th flop mover in November 🔴

The month was much weaker for my highly volatile AI and energy segments.

IREN ($IREN (-0,76 %)) fell by -21,27 % the strongest - burdened by pressure in the mining sector and falling BTC margins. Also Cloudflare ($NET (+0,95 %)) also fell -21,19 % triggered by risk-off in the entire software/infrastructure tech sector.

The VanEck Uranium ETF ($NUKL (-0,01 %)) slipped -17,48% after falling spot prices and geopolitical uncertainties led to widespread profit-taking.

Tempus AI ($TEM (+0,21 %)) (-13,24%) and Rheinmetall ($RHM (+0,87 %)) (-12,99%) suffered from a general revaluation of growth and defense stocks. Mercado Libre ($MELI (+1,73 %)) closed the month with -10,00 % also significantly weaker, weighed down by consumer data from Latin America.

5. conclusion 💡

November was a classic rotation month: risk-off in speculative future themes, stability in value, fintech and more defensive positions.

❓Question for the community

Which position surprised you the most in November - positive or negative?

👇 Write it in the comments!