Good evening my dears, or rather good morning,

The many great comments on my last company presentation motivated me so much that I put in another night shift for you.

So that I could present another hidden champion from Japan straight away on Sunday morning.

The focus was on this one again.

- Financially well positioned

- Double-digit sales growth

- Double-digit profit growth

- Double-digit EBIT margin which is being increased

- Positive free cash flow

I look forward to just as many comments as last time.

My thanks for this go to @GHF , @HoldTheMike , @Anderle , @toscho , @Creutzfeldt_Jakob , @Darkwingduck , @Nemesis1990 , @Klein-Anleger and the dear @Dividendenopi

You are simply MEGA. It's so much fun when we talk about the company after the show.

Since it's Japan again this time, I would also appreciate an assessment from @PikaPika0105 would be very welcome.

Kokusai Electric Corp is a Japan-based company mainly engaged in the manufacture, sale and maintenance of semiconductor production equipment. The company is engaged in the manufacture and sale of semiconductor manufacturing equipment. Its main products include batch film deposition equipment, processing equipment for improving film quality, equipment for measuring instruments and cleaning equipment, and others. The company is also active in the provision of services for semiconductor production equipment, such as the sale of consumables and other components, new and used equipment, and the relocation and modification of equipment.

Number of employees: 2,540

Core businesses of the Group

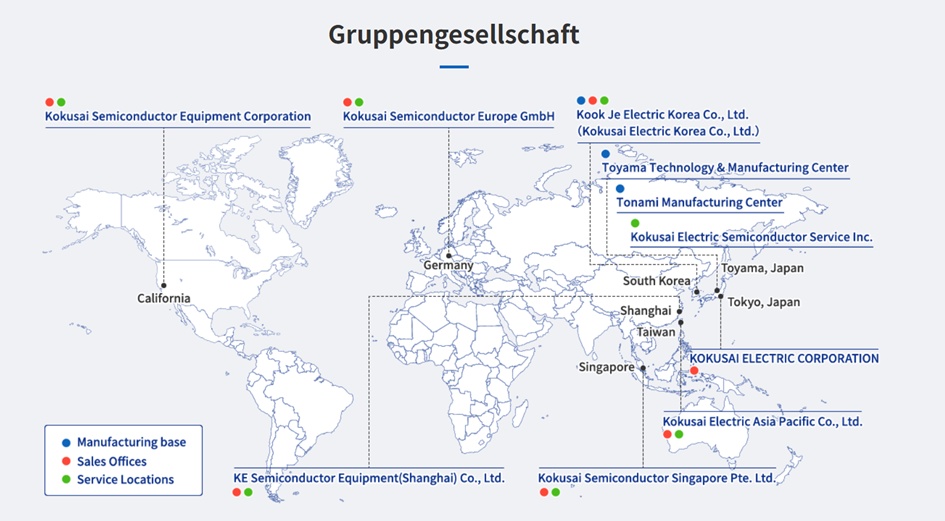

The Group consists of KOKUSAI ELECTRIC CORPORATION and seven other companies. The core business is the development, manufacture, sale and installation of semiconductor manufacturing equipment as well as services such as maintenance, repair and spare parts sales of this equipment.

Deposition process equipment

Deposition processes form thin films such as polysilicon and insulating film, which are used as materials for circuits in the manufacture of electronic circuits on wafers. The deposition process plays an important role in the production of circuits on wafers, so advanced technologies and highly reliable products are essential for devices. KOKUSAI's batch deposition systems - the Group's flagship products - have received high praise from semiconductor manufacturers worldwide and have among the highest market shares globally.

Competitive analysis

Briefly:

- Kokusai is the specialist for batch processes.

- ASM dominates single-wafer ALD.

- TEL is the broadest supplier.

- Lam is the king in etching and memory scaling.

Why Kokusai shines here

3D NAND continues to grow (AI, data centers, cloud). The more layers, the more important it becomes:

- HAR uniformity

- Low temperature processes

- Productivity per tool

Kokusai delivers exactly that: Batch ALD + Batch LPCVD + Plasma/Thermal Treatment for HAR structures >200 layers.

This is a moatthat neither ASM nor Lam nor TEL have in this form.

Kokusai is a clear hidden champion in an extremely valuable niche: Batch ALD & Batch LPCVD for 3D NAND scaling.

- Not as broad as TEL

- Not as logic-heavy as ASM

- Not as etch-dominant as Lam

- But irreplaceable and technologically superior in its niche

This makes Kokusai a highly attractive specialty stockthat benefits from the structural growth of AI memory.

Kokusai Electric's customers are primarily the major 3D NAND manufacturers:

- Samsung

- SK Hynix

- Micron

- Kioxia / Western Digital

- (with restrictions) YMTC

Foundries such as TSMC or Intel only buy supplementary tools.

My dears, these are the memory chip manufacturers that have delivered excellent figures so far. So on March 30, Kokusai's numbers shouldn't be the worst either.

What do you think of my thesis?

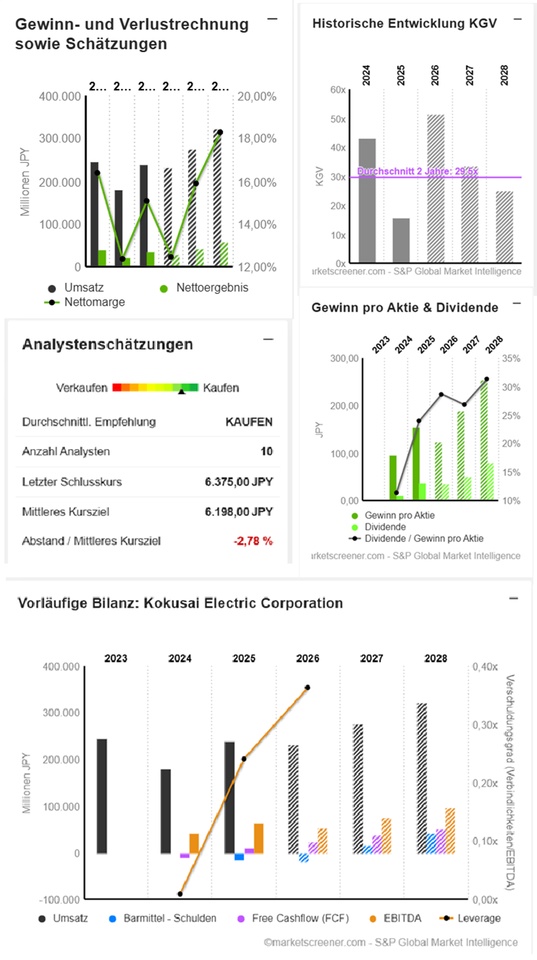

In the last financial year, Kokusai Electric Corp. increased its sales by 32.1% from JPY 180.8 billion to JPY 238.9 billion. At the same time, profits rose by 60.9% from JPY 22.4 billion to JPY 36.0 billion. The net profit margin was thus 15.1% compared to 12.4% in the previous year. On June 27, 2024, Kokusai Electric Corp. reported its Q3 figures for the quarter ending March 31, 2024. Sales in the earnings period amounted to JPY 49.2 billion (-18.2% compared to the same quarter of the previous year) and profit to JPY 5.6 billion (-32.3% compared to the same quarter of the previous year).

JPY in millions

Estimates

Year Turnover Change

2025 238.933 32,13 %

2026 232.166 -2,83 %

2027 276.178 18,96 %

2028 322.820 16,89 %

Year EBIT Change

2025 51.320 66,92 %

2026 41.283 -19,56 %

2027 61.517 49,01 %

2028 82.854 34,68 %

Year Net result Change

2025 36.004 60,92 %

2026 28.915 -19,69 %

2027 43.930 51,93 %

2028 59.031 34,37 %

Year Net debt CAPEX

2025 15.429 25.482

2026 19.537 19.140

2027 -16.422 13.283

2028 -42.286 12.033

Year Free cash flow Change

2025 10.771 219,57 %

2026 22.764 111,34 %

2027 38.477 69,03 %

2028 52.098 35,4 %

Year EBIT margin ROE

2025 21,48 % 18,8 %

2026 17,78 % 14,5 %

2027 22,27 % 20,4 %

2028 25,67 % 24,88 %

Year Earnings per share Change

2025 154,6 59,68 %

2026 123,6 -20,05 %

2027 189,2 53,04 %

2028 254,8 34,7 %

Year Dividend Yield

2025 37 1,53 %

2026 35,44 0,56 %

2027 50,75 0,8 %

2028 79,75 1,25 %

Year P/E ratio PEG

2024 43,3x

2025 15.7x 0.3x

2026 51.6x -2.6x

2027 33.7x 0.6x

2028 25x 0.7x

Market value 1,488,177

Number of shares (in thousands) 233,440

Date of publication 13.05.2025

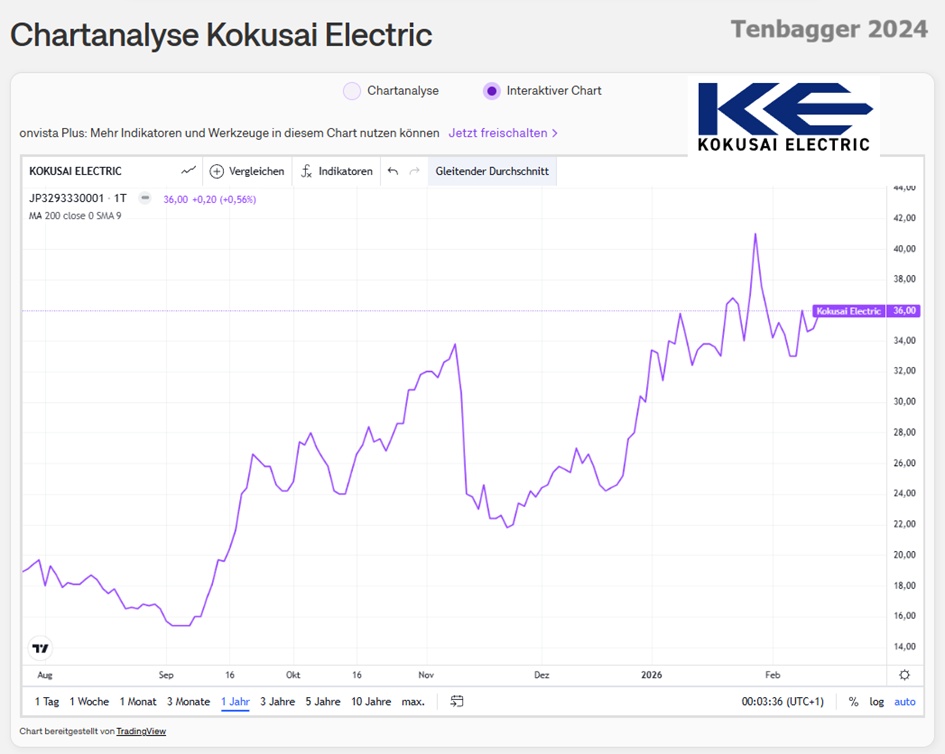

Performance

1 week +9.09 %

1 month +11.11 %

6 months +92.51 %