Hello my dears,

by now I can roughly estimate what you are looking out for. And especially for the very critical friends @Get_Rich_or_Die_Tryin , @Klein-Anleger it is becoming increasingly difficult to find a company.

That's why I started looking for a hidden champion in Europe today. Because I read in some of the comments that people would like to reduce the USA somewhat. But I've also read that people still want to have the classic US growth sectors in their portfolios. However, some uncertainty is slowly spreading with AI. And due to the sometimes high valuations, it is no longer so easy for me to find a suitable stock for you.

That's why I took a deep dive into the engine room today.

And have focused on a growth sector. And I'm really proud that I've found a stock that doesn't swim in this AI bubble. And should still benefit from investments in data centers. We should also benefit greatly from the autonomous driving revolution that is yet to come.

But what I find really exciting is that they are involved in quantum research.

My dears, that was the story. But I know that nobody here buys on the basis of a good story. That's why I'm still focusing on increasing sales, double-digit profit growth and, most importantly, a rising EBIT margin.

And of course you want all this at an acceptable valuation.

In terms of the chart, however, I would definitely wait for the correction until upward momentum becomes apparent again.

The most exciting thing for me now will be your comments on the company. I am looking forward to it.

RIBER fulfills almost all the criteria of a hidden championeven if the company is small and less well known in Germany.

Market leadership in a clearly defined niche → YES

RIBER is, according to its own presentation and industry knowledge:

- World market leader for MBE systems

- World market leader for MBE components (evaporation sources, plasma sources etc.)

- The only supplierthat covers research, pilot production and industrial MBE production

This is an extremely well-defined, highly specialized niche.

Result: ✔️ Hidden champion criterion fulfilled.

1. company profile

RIBER S.A. is a world leader in the manufacture of equipment and services for molecular beam molecular beam epitaxy (MBE). The company has decades of expertise in ultra-high vacuum technology (since 1964) and has focused on MBE since 1977.

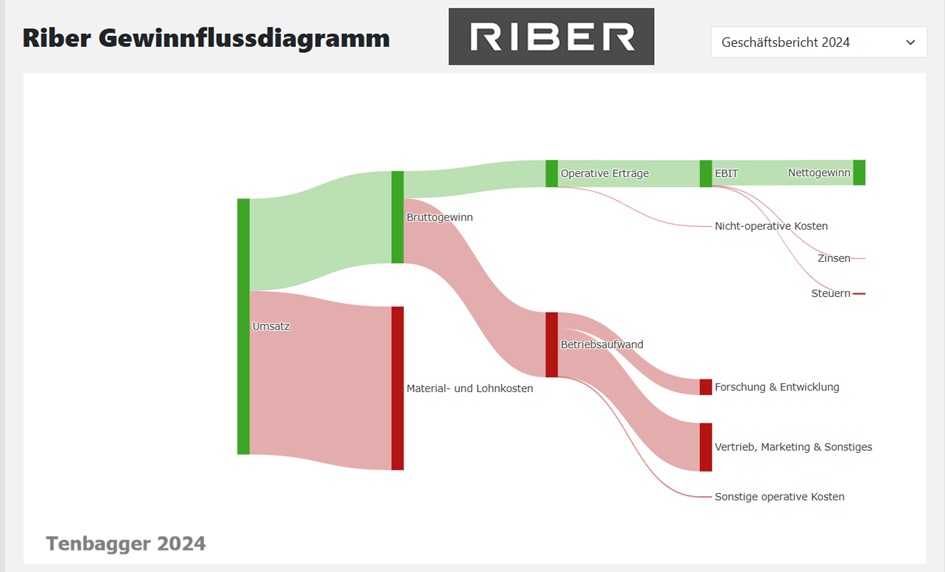

These high-tech materials are essential for the production of composite semiconductor materials and new materials for numerous general applications, including new information technologies, OLED flat panel displays and new generation solar cells. The breakdown of net sales by product family is as follows:

- MBE systems (75.3%);

- Components and services (24.7%).

The geographical breakdown of net sales is as follows: Europe (35.7 %), Asia (55.3 %), North America (7 %) and Turkey (2 %).

Number of employees: 119

2. technology & importance

MBE enables the precise application of extremely thin semiconductor layers - layer by layer, with:

- atomic thickness control (up to monolayer),

- high purity,

- excellent uniformity and reproducibility.

This technology is essential for the production of modern components such as:

- LEDs

- laser diodes

- solar cells

- High-speed transistors

- Photonics and sensor systems

3. customers & markets

RIBER supplies worldwide:

- Universities

- Materials research institutes

- Semiconductor foundries

- Epiwafer manufacturers

Demand is growing particularly in areas such as

- Data communication

- 5G/6G

- VCSEL lasers (e.g. for 3D sensing)

- photonics

- sensor technology

- displays

4. product portfolio

RIBER offers:

- MBE research and production systems (e.g. MBE 49 for 150-200 mm wafers)

- MBE components such as RF plasma sources, evaporator sources, low temperature injectors

- Material vaporization sourceswhich are used for:

- Thin-film solar cells

- OLED displays

- modern silicon transistors.

5. positioning

The company emphasizes

- its technological leadership,

- the versatility of the systems,

- the close connection to future technologies,

- and that the creativity of the customers is the only limiting factor.

6. competitive overview (Global MBE Market Landscape)

The MBE market is small, highly specialized and dominated by a few providers. RIBER is indeed the market leader, but not without competition.

A. Main competitors

1. Veeco Instruments (USA)

Strength:

- Largest US manufacturer of epitaxy equipment (MBE + MOCVD).

- Strong in III-V materials, GaN lasers, VCSEL production.

Weakness:

- Stronger focus on MOCVD; MBE is only a sub-area.

- Fewer modular systems than RIBER.

Positioning:

- Industrial production, high-volume manufacturing.

2. Scienta Omicron (Sweden/Germany)

Strength:

- Extremely strong in UHV research systems.

- Very precise, scientifically oriented MBE tools.

Weakness:

- Hardly any industrial production systems.

- Focus on research, not on foundries.

Positioning:

- Premium research equipment for materials science.

3. DCA Instruments (Finland)

Strength:

- Flexible, robust MBE systems for research and pilot production.

- Good reputation in II-VI materials and oxide MBE.

Weakness:

- Smaller, less globally scalable.

- Weaker in service network.

Positioning:

- Niche provider with solid technology.

B. Why RIBER remains the leader

Based on the site and market knowledge:

- Largest portfolio of MBE systems worldwide (research + production).

- Strongest global installation base (universities, foundries, epiwafer manufacturers).

- Broadest range of sources & components (evaporation sources, plasma sources etc.).

- Technological depth through 60 years of UHV expertise.

- Strong position in growth areas such as VCSELs, photonics, 5G/6G.

RIBER is the only providerthat simultaneously:

- Research,

- pilot production,

- industrial series production.

This is a massive strategic advantage.

7 Classification of market opportunities

MBE technology is a niche market, but with disproportionately high growthbecause it is indispensable for many future technologies.

A. Growth drivers

1. VCSELs & 3D sensing

- iPhone-FaceID, AR/VR, Automotive-LiDAR.

- VCSEL epitaxy is MBE-dominated.

- RIBER is extremely strongly positioned here.

2. 5G/6G & high-frequency electronics

- GaAs, InP, GaN heterostructures.

- MBE enables more precise HEMT and HBT structures than MOCVD.

3. photonics & quantum

- Single-photon emitter

- Quantum dots

- Topological materials

MBE is here without alternative.

4 OLED displays & thin-film solar cells

RIBER supplies evaporation sourceswhich are used for:

- OLED TVs

- CIGS solar cells

- organic electronics.

This is a second, often underestimated mainstay.

B. Market size & dynamics

The MBE market is small but highly profitable:

- Estimated market size: $300-500 million annually

- Growth: 8-12% CAGR

- Drivers: photonics, sensor technology, quantum, 6G research

RIBER is estimated to hold >50 % market share in the MBE segment for research & pilot production.

C. Strategic opportunities for RIBER

1. expansion of industrial MBE production

VCSEL foundries are scaling up → RIBER benefits disproportionately.

2. components business (recurring revenue)

Evaporation sources, plasma sources, spare parts → Recurring revenuehigh margins.

3. geopolitical fragmentation

USA, EU, China build up their own semiconductor capacities → More demand for MBE systemsas research & pilot lines are localized.

Riber Inc. is the North American subsidiary of Riber S.A.the world's leading provider of MBE products and services.

The China subsidiary of RIBER is called:

磊备半导体科技(上海)有限公司

4. new material classes

- 2D materials (graphene, MoS₂₂)

- Topological insulators

- Quantum materials

MBE is the standard technology here.

3. risks (brief, but relevant)

- Cyclical investment budgets in research & foundries

- Export controls (USA-China)

- Concentration on a few major customers

- Small overall market → Limited economies of scale

But: RIBER is in a segment that is growing structurally.

4. conclusion

RIBER is in a highly profitable, technologically indispensable niche market. market. The combination of:

- Market leadership,

- broad portfolio,

- strong future markets (VCSEL, photonics, quantum),

- and recurring revenues from components

makes the company strategically very attractive.

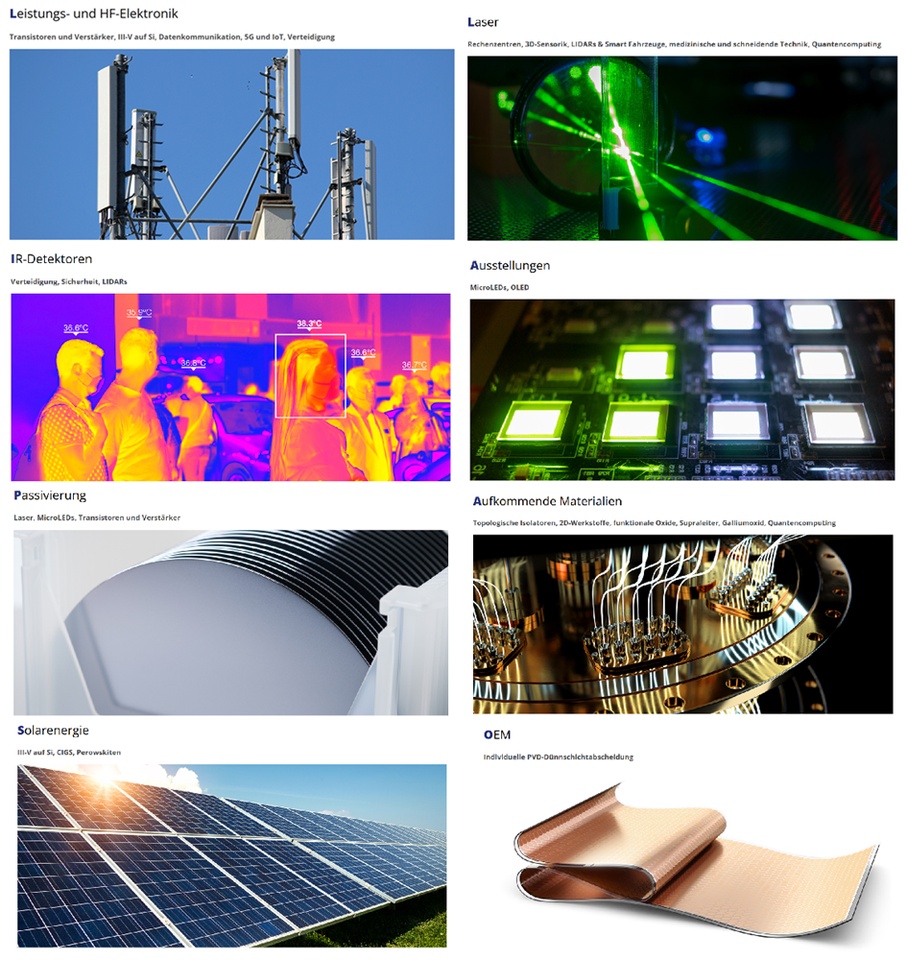

Applications & markets

TECHNOLOGIES

⭐ 1. VCSEL (Vertical-Cavity Surface-Emitting Laser)

What is it? A VCSEL is a tiny laser that emits vertically from the chip surface. It is extremely efficient, fast and can be produced millions of times on a wafer.

What is it needed for?

- FaceID / 3D sensing (iPhone, iPad, AR glasses)

- LiDAR (autonomous driving)

- High-speed data transmission (data centers, fibre optics)

- Industrial sensors

Why is MBE important? VCSELs consist of precise layer stacks (Distributed Bragg Reflectors), which can only be produced in this quality with MBE.

Relevance for RIBER: VCSEL epitaxy is one of the biggest growth drivers for MBE systems

⭐ 2. photonics

What is that? Photonics is the technology that light instead of electrons for information processing. It is the basis for modern optical systems.

What is it needed for?

- Fiber optic communication (Internet, data centers)

- Lasers for industry & medicine

- Optical sensors

- AR/VR displays

- Silicon Photonics (Intel, Nvidia, Broadcom)

Why is MBE important? Photonic components are based on III-V semiconductors (GaAs, InP), which require extremely precise layer structures → MBE is ideal for this.

Relevance for RIBER: Photonics is a megatrendthat will grow exponentially in the long term.

⭐ 3. quantum (quantum materials & quantum devices)

What is this? "Quantum" here means technologies that quantum mechanical effects use quantum mechanical effects, e.g:

- Quantum computers

- Single photon sources

- quantum dots

- Topological materials

What is it needed for?

- Quantum computer (qubits)

- Quantum cryptography

- Highly sensitive sensors

- Research into new classes of materials

Why is MBE important? Quantum materials require atomic precisionoften layer by layer in the range of a few atomic layers. MBE is here without alternative.

Relevance for RIBER: Universities and research institutes buy MBE systems specifically for quantum materials research → stable, growing market.

Why these three areas are so important for RIBER

VCSEL:

- Exploding through 3D sensing & LiDAR

- One of the biggest growth drivers

Photonics:

- Data centers, fiber optics, AR/VR

- Stable demand, many customers worldwide

Quantum:

- Research is booming

- Universities & institutes buy MBE tools

All three require extremely precise semiconductor layerswhich only MBE can supply. This puts RIBER right at the center of these future technologies.

RIBER does not supply mass semiconductor manufacturers such as TSMC or Samsung, but rather high-value specialty and research customerswho require precise III-V epitaxy.

The most important customer segments are:

- Photonics and VCSEL manufacturers

- Epiwafer producers

- Universities & Institutes

- Quantum labs

It is precisely these segments that are growing structurally - a clear advantage for RIBER.

In 2025, the geographical breakdown of annual sales developed as follows: Europe accounted for 45.1% year-on-year (compared to 35.7% in 2024), Asia 39.7% (compared to 57.3%) and North America, also year-on-year, at 15.2% (compared to 7.1%). These changes reflect an increased diversification of the markets served

Outlook

Against the backdrop of large-scale investment programs in artificial intelligence, data infrastructure and quantum technologies, RIBER benefits from a pioneering technological positioning at the core of the semiconductor value chain.

For 2026, RIBER:

- continued strong demand driven by the need for MBE production systems for quantum dot lasers used in data centers;

- the industrialization and gradual expansion of the ROSIE platform, a breakthrough technology in silicon-based integrated photonics that covers high-potential markets.

- In 2026, the production of ROSIE 2, the dual-chamber version, and the availability - through the partnership with NQCP* - of the first samples of BTO/STO* thin films on silicon wafers to the scientific and industrial community will represent an important milestone in RIBER's technological roadmap.

Given the visibility offered by the order book and subject to obtaining the necessary export licenses to realize the identified opportunities in its systems and services businesses, RIBER aims to achieve revenue growth compared to 2025.

Next date: RIBER will announce its full-year results for 2025 on April 8, 2026 (before the start of trading).

Riber receives a new order from Japan for the MBE 6000 to scale quantum dot laser production for datacom.

QD Laser bestellt den Riber MBE 6000 zur Skalierung der Quantenpunktlaserproduktion für Datacoms

RIBER receives a major order in Europe for two MBE 6000 production systems, including related services

The customer is a European company with fully vertically integrated production facilities, specializing in the design and manufacture of a broad portfolio of photonic devices serving several fast-growing markets. These include optical connectivity for AI data centers, high-power light sources for LiDAR applications, as well as expanding medical, industrial and scientific markets. This high-value investment marks a new phase in the expansion of the customer's industrial production capacity and enables it to better meet the increasing demand for high-performance optical sources.

Riber receives Taiwanese order for the Compact 21 DZ research MBE system

Riber erhält taiwanesische Bestellung für das Compact 21 DZ Forschungs-MBE-System

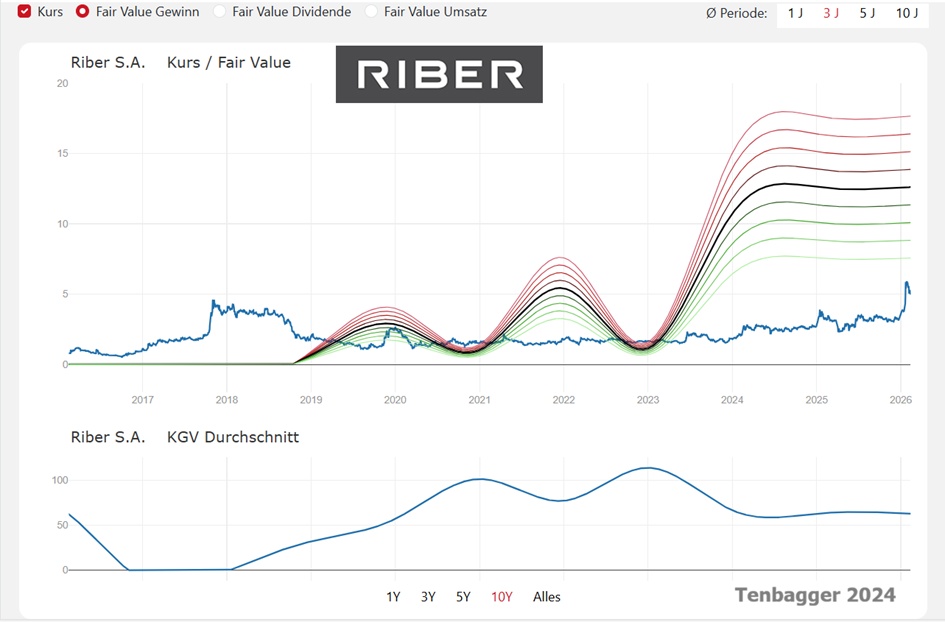

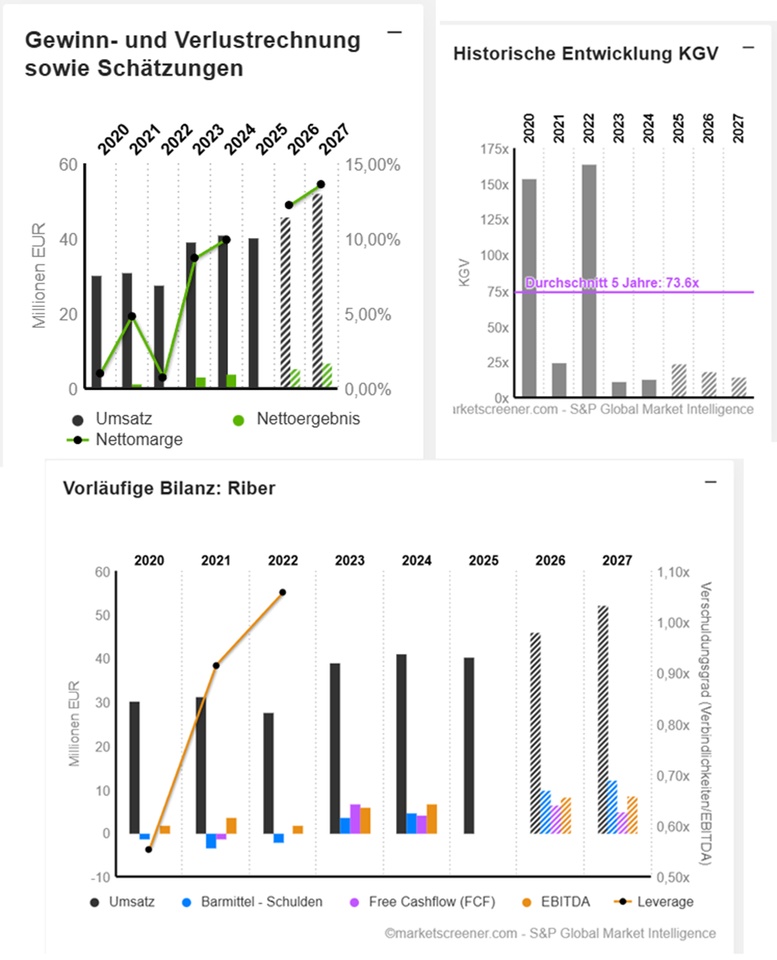

In the last financial year, sales at Riber S.A. rose by 4.8% from EUR 39.3 million to EUR 41.2 million. Profit rose by 21.4% from EUR 3.4 million to EUR 4.1 million. The net profit margin was therefore 10.0% compared to 8.7% in the previous year.

EUR in millions

Estimates

Year Turnover Change

2024 41,2 5,1 %

2025 40,3 -2,18 %

2026 45,99 14,11 %

2027 52,18 13,47 %

Year EBIT Change

2024 4,5 15,38 %

2025 4,604 2,31 %

2026 5,923 28,65 %

2027 7,507 26,75 %

Year Net result Change

2024 4,1 20,59 %

2025 4,372 6,64 %

2026 5,614 28,4 %

2027 7,088 26,26 %

Year CAPEX Free cash flow change

2024 2,26 4,249 -36,31 %

2025 2,2 2,1 -50,58 %

2026 2,45 6,45 207,14 %

2027 2,6 4,95 -23,26 %

Year EBIT margin ROE

2024 10,92 % 18,31 %

2025 11,28 % 16,25 %

2026 12,88 % 17,91 %

2027 14,39 % 19,68 %

Year Earnings per share Change

2024 0,2 25 %

2025 0,2049 2,43 %

2026 0,2653 29,52 %

2027 0,3318 25,03 %

Year Dividend Yield

2024 0,08 2,95 %

2025 0,08 1,61 %

2026 0,08 1,61 %

2027 0,08 1,61 %

Year P/E ratio PEG

2024 13.6x 0.5x

2025 24.3x 10x

2026 18.7x 0.6x

2027 15x 0.6x

Market value 103.4

Number of shares (in thousands) 20,805

Date of publication 09.04.2025

Sector comparison 2025

Company P/E ratio

RIBER 24.26x

ASML Holding 47.81x

LAM RESEARCH 44.97x

TOKYO ELECTRON 36.29x

AMCOR TECHNOLOGY 37.73x

Performance

1 week -1.19 %

1 month +31.83 %

6 months +60.32 %

1 year +58.28 %

3 years +188.95 %

5 years +216.56 %