Here is a weekly update from my holiday address, not ideal but still wanted to give a small update.

#dividend

#dividends

#dividende

#invest

#investing

Puestos

30Here is a weekly update from my holiday address, not ideal but still wanted to give a small update.

#dividend

#dividends

#dividende

#invest

#investing

Today I bought the $JEGP (-2,16 %) etf, 11 shares at an average price of €23,010 each (including transaction costs).

I currently own 210 shares, which currently yields +- €357 per year in dividends.

Today I bought the $JEGP (-2,16 %) etf, 11 shares at an average price of €22,870 each (including transaction costs).

I currently own 199 shares, which currently yields +- €339 per year in dividends.

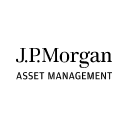

Today I bought the $JEGP (-2,16 %) etf again, 13 shares at an average price of €23,086 each (including transaction costs).

I currently own 188 shares, which currently yields +- €319 per year in dividends.

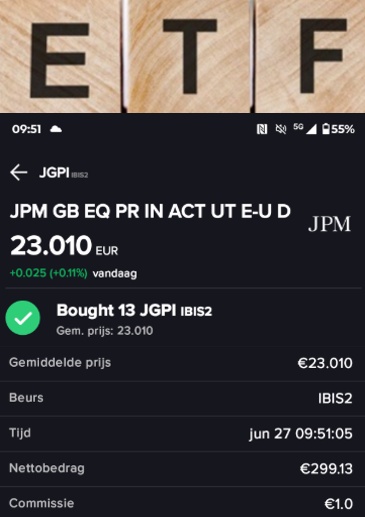

Today I bought the $JEGP (-2,16 %) etf again, 10 shares at an average price of €23,45 each (including transaction costs).

I currently own 175 shares, which currently yields +- €297 per year in dividends.

New weekly update with 2 purchases.

#dividend

#dividends

#dividende

#etfs

#etf

#stocks

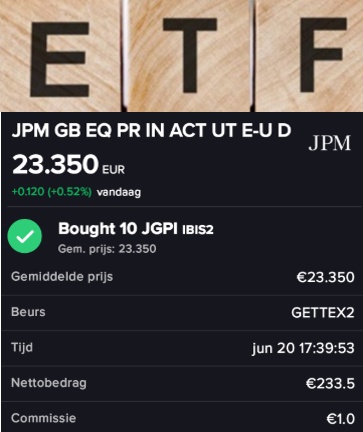

Today I bought the $JEGP (-2,16 %) etf again, 19 shares at an average price of €23,877 each (including transaction costs).

I currently own 165 shares, which currently yields +- €280 per year in dividends.

I made this transaction with the money that was still on DeGiro that was received from the sale of $VFEM (-4,17 %) and the dividends of the month of May.

(transferred to my own account and then booked to Mexem, this ETF is cheaper to buy there)

Principales creadores de la semana