$IWM (+1,1 %) $IWM either we reclaim 202.7, push for 217, and confirm a reversal...

or we fail here, lose 192, and start a massive measured move down toward 173.

Puestos

9$IWM (+1,1 %) $IWM either we reclaim 202.7, push for 217, and confirm a reversal...

or we fail here, lose 192, and start a massive measured move down toward 173.

$IWM needs a monthly close above 203 to shift back to bullish structure. Otherwise, IWM could chop or revisit the Fib base at 192. Keep an eye on small-cap relative strength vs SPY and tech to confirm rotation.

Weekly close above 203 or back under 197 will likely dictate May’s path.

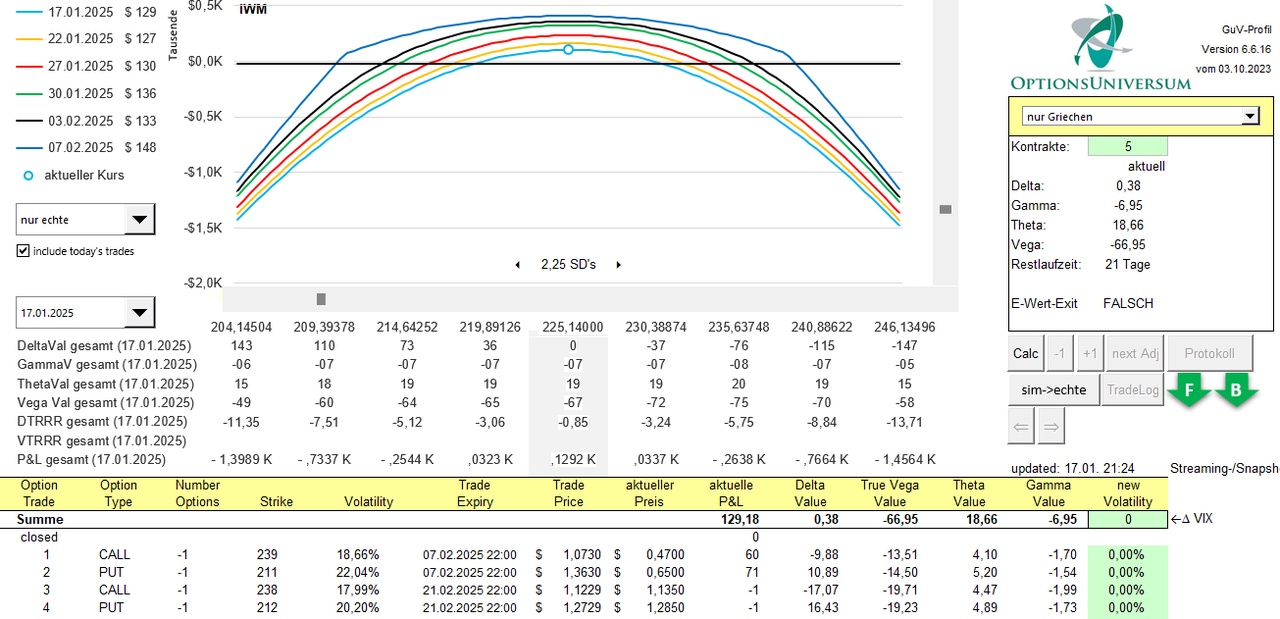

$IWM (+1,1 %) Strangle 2nd tranche opened

trade what you see... calm VIX and a RUT in sideways correction. So perfect setup to take a neutral position in the market.

If it goes well, I will earn another max $241 premium in the next 30 days. If not, I'll keep you posted on any changes 🚨🚨🚨🚨

have a successful trading week

🚨🚨UsBourse closed today 20.01. 🚨🚨🚨

Returns since election...

Coinbase $COIN (+9,84 %) : +32%

Tesla $TSLA (-3,07 %): +18%

Bitcoin $IBIT: +10%

Banks $KBE: +8.3%

Small Caps $IWM (+1,1 %): +5.4%

S&P 500 $SPY (+0,67 %): +3.3%

China $FXI (+0,23 %): +2.4%

US Dollar $UUP: +0.8%

International Stocks $VEA (+0,22 %): +0.2%

Oil $USO : -0.1%

Gold $GLD (-0,34 %) : -1.5%

Long-Term Treasury Bonds $TLT : -1.6%

Trump Media $DJT (+0,37 %): -18%

Volatility $VIX: -26%

up/down and closing price predictions for Monday - machine opinion not advice

$NVDA (+2,31 %) added to DOW - so prediction likely affected...

52.4 % chance down Monday

probable closing price $ 219.34

__________________________

53.8 % chance down Monday

probable closing price $ 139.59

__________________________

54.7 % chance up Monday

probable closing price $ 200.9

__________________________

50.5 % chance down Monday

probable closing price $ 373.51

__________________________

52.0 % chance up Monday

probable closing price $ 185.44

__________________________

54.6 % chance down Monday

probable closing price $ 94.28

__________________________

53.1 % chance up Monday

probable closing price $ 173.86

__________________________

51.0 % chance down Monday

probable closing price $ 23.59

__________________________

51.6 % chance down Monday

probable closing price $ 215.51

__________________________

54.1 % chance down Monday

probable closing price $ 558.09

__________________________

53.7 % chance down Monday

probable closing price $ 403.8

__________________________

54.0 % chance up Monday

probable closing price $ 767.44

__________________________

52.7 % chance down Monday

probable closing price $ 133.2

__________________________

53.3 % chance down Monday

probable closing price $ 41.27

__________________________

55.3 % chance down Monday

probable closing price $ 479.63

__________________________

51.2 % chance down Monday

probable closing price $ 561.88

__________________________

55.6 % chance up Monday

probable closing price $ 252.71

Hello community.

As some of you have already noticed, the grandpa is very dividend-oriented and cash flow is the maxim. My portfolio with currently just under 250k consists of 64% equities, 21% Bund and US short-dated bonds, some ETFs, some bonus certificates and physical gold. As the majority of my income comes from interest, dividends and rental income, I have been able to live very well with my additional high cash holdings from overnight and fixed-term deposits. Slowly but surely, this comfortable time is coming to an end for a security-conscious old man and he is starting to rethink and restructure. I may be 60 and no longer have a long-term investment horizon, but I can still plan for the medium term of 5 to 10 years. 250k is still tied up for 1 to 4 years at good fixed deposit interest rates for me (3.8 to 4.5%) with an annual payout. Now ING has come across me and is offering 3.3% overnight money via an extra account for 6 months, which I'll take. The free custody account too. And that brings us to the topic. I put 150k in the call money account (yes, I know deposit protection) and set up savings plans on ETFs with 8k per month for the next 1.5 years.

Of course I can't get away from cash flow completely, but a little growth with a manageable sum can't hurt. The basic idea is 50% in the world, 20% in dividends, 10% emerging, 10% Europe and 10% Russel.

US should already be appropriately weighted, I am not directly invested in tech, this should improve via world ETFs and I would also like to consider the rest of the world and a few dividends.

I have made the following pre-selection (as I said, it's about 8K per month in the savings plan):

50% world, half of this in $XDWL (+0,46 %) and the other half in$HMWO (+0,43 %) . Both very similarly structured, TER ok, both distributing, but in different months.

20% dividend ETF, half of which is in $TDIV (+0,07 %) and the other in $SEDY (+0,47 %) The latter one-fifth in China, the risk is manageable, otherwise a bit of a watering can and overall a small US share in both, which I cover via direct investments as I said.

10% in $IMEU (+0,04 %) which covers areas in which I have no exposure apart from $NOVO B (+0,13 %) and $HSBA (+0,87 %) I have no positions worth mentioning.

10% in $HMEF (+0,56 %) China, yes over 20%, the rest is ok for me and also includes information technology and financial services, which are very underrepresented in my portfolio.

10% in $IWM (+1,1 %) I am sticking to my US weighting and speculating on further effects from future interest rate cuts, even if some of this has already been priced in.

Finally, I would like to point out that I am not interested in the decimal place of the TER.

Overnight money will yield significantly less in the near future, growth does not harm my investment strategy, but it does not have to be the maximum return that can be achieved.

Putting everything into dividend stocks is suboptimal, so why not go "relatively risk-reduced" into ETFs in the medium term with part of my money.

Please give me your valued opinion on the approach and the chosen stocks, thanks for reading and have a sunny weekend.

Your dividend topi

https://www.tradingview.com/x/vmTtaCeS/

New trading position for the EOY rally. I think the trunk can break out soon.

Principales creadores de la semana