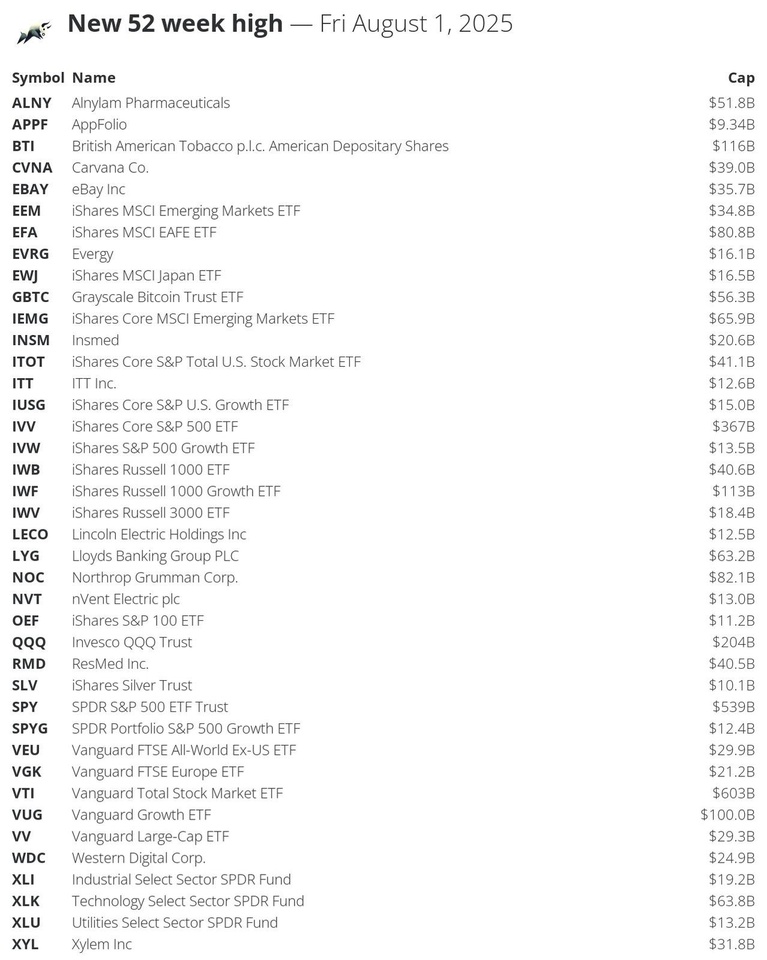

🔝 Stocks that made a new 52-week high today: $VTI (+0,68 %)

$SPY (+0,67 %)

$IVV (+0,69 %)

$QQQ

$BTI (+0 %)

$IWF (+0,77 %)

$VUG (+0,85 %)

$NOC (-0,1 %)

$EFA

$IEMG (+0,52 %)

$XLK

$LYG

$GBTC

$ALNY (-0,18 %)

$ITOT (+0,71 %)

$IWB (+0,65 %)

$RMD (-2,32 %)

$CVNA (+3,03 %)

$EBAY (+1,83 %)

$EEM

$XYL (+0,1 %)

$VEU (+0,29 %)

$VV (+0,7 %)

$WDC (+3,12 %)

$VGK (+0 %)

$INSM (-0,36 %)

$XLI

$IWV (+0,68 %)

$EWJ (+0,25 %)

$EVRG (+0,94 %)

$IUSG

$IVW

$XLU

$NVT

$ITT (+0,33 %)

$LECO (+0 %)

$SPYG

$OEF (+0,83 %)

$SLV

$APPF (+1,26 %)

#52weekHigh

iShares Core S&P 500 ETF

Price

Debate sobre IVV

Puestos

6Market News

BlackRock vs T.Row Price

Introduction:

BlackRock and T. Rowe Price are two prominent asset managers that offer both active funds and ETFs. When deciding whether to invest in these companies' stocks, their active funds or their ETFs, it is important to understand the differences and characteristics of these investment vehicles.

Shares of asset managers:

- BlackRock ( $BLK

): Current share price: USD 973.92. BlackRock is the world's largest asset manager with $11.6 trillion in assets under management as of the fourth quarter of 2024. The company offers a wide range of investment products, including ETFs and active funds. - T. Rowe Price ( $TROW (+0,73 %)

): Current share price: USD 107.17. T. Rowe Price had USD 1.61 trillion in assets under management as of December 2024 and is known for its active investment strategies. Unlike BlackRock, T. Rowe Price does not currently offer any crypto-related products.

Active funds vs. ETFs:

- Active funds: These are actively managed by fund managers who try to outperform the market by making targeted investment decisions. Active funds usually have higher fees due to the intensive management. T. Rowe Price is known for its active funds and has recently begun to transition some of these strategies into active ETFs. Example $TTEQ

ETFs (Exchange Traded Funds): ETFs are mutual funds that trade on exchanges and typically track an index. They offer diversification and often have lower fees. BlackRock is a leading provider of ETFs, including active ETFs that have the potential to outperform the market. Example $IVV (+0,69 %) or the crypto ETFs $IBIT

Cost comparison:

- Passive ETFs: Typically below 0.20% total expense ratio (TER) for standard products.

- Active ETFs: Between 0.20% and 0.85% TER for equity ETFs.

- Active funds: Well above 1% ongoing charges.

Performance comparison:

Some studies show that actively managed funds can outperform passive ETFs in certain market phases. For example, actively managed growth funds from T. Rowe Price and Fidelity outperformed the Vanguard Growth ETF over a short period.

Bottom line:

Choosing to invest directly in BlackRock or T. Rowe Price stocks offers the benefit of participating in the success of these asset managers, including their exposure to the crypto space, particularly BlackRock. However, this comes with specific business risks. Buying ETFs from these providers allows for broader diversification but reduces direct exposure to cryptocurrencies. The choice should be made based on the investment period and risk appetite.

I would be interested to know how you see this and why you chose the exact asset you have in your portfolio?

Ps: If there are any spelling mistakes or anything else, please let me know. Should be an attempt to have a discussion at a higher level.

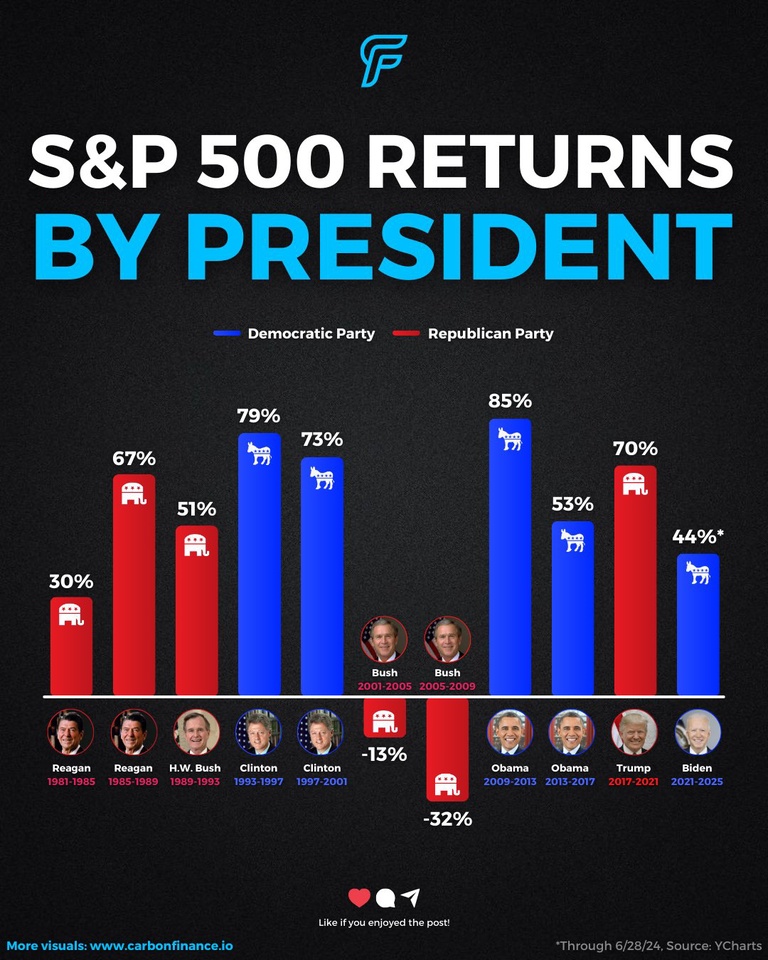

Does the stock market really care whose in office?👇

Based on historical data, the answer is not really.

Over the long term, the stock market has done well under both Democratic and Republican administrations, per data from The Motley Fool.

From a mean perspective, the S&P 500 $SPX has grown annually at 9.8% under Democratic presidents, outpacing the 6% under Republicans since 1957.

However, looking at median growth rates, the market has seen 10.2% growth under Republicans and 8.9% under Democrats.

While either party could make the case that the stock market performs better during their party, the direct impact of policy remains hard to quantify.

Furthermore, presidential terms are susceptible to unforeseen events like the dot-com bubble, the 2008 financial crisis, and Covid-19, to name a few.

As always, the name of the game is time in the market, not the president’s political party.

The S&P 500’s compounded annual growth rate of 10.26% is a clear testament to that.

Valores en tendencia

Principales creadores de la semana