Depot review July 2023 - Eerie, but still green figures 🤔🚀

July 2023 is a special month for me, as it marks the 119th month of my stock market career - This means there is nothing standing in the way of the 10th anniversary in August.

July was (to my surprise) another very strong month in the portfolio.

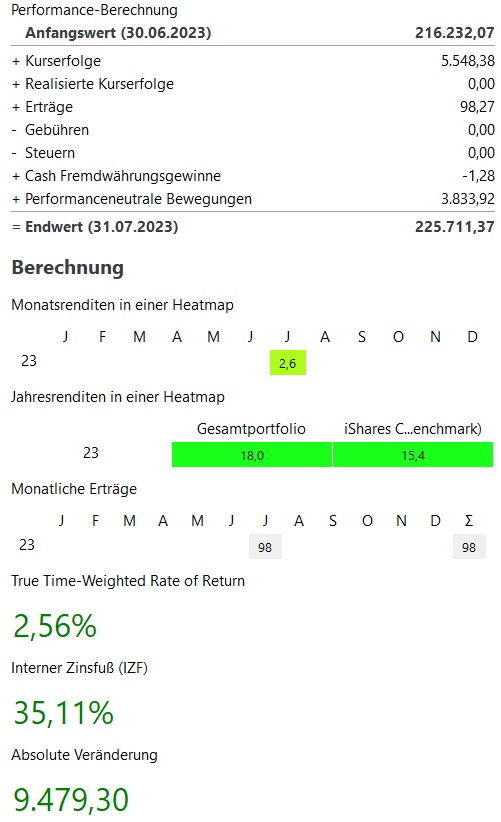

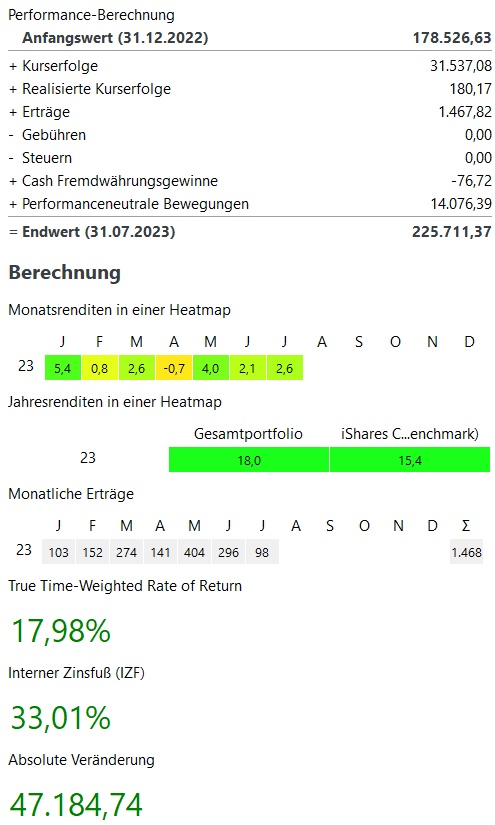

In July, my portfolio could +2,6% increase. In contrast to July 2022 with +8.7% but a weaker development.

In the current year, my performance is currently +18,0% and thus continues to outperform my benchmark (MSCI World +15.4%).

In July, NVIDIA again $NVDA performed extremely strongly in July with +12% / +€1,200. In percentage terms, Sartorius $SRT (+0,59 %) Block $SQ (+0,8 %) and Meta $META (+0,07 %) only 3 shares performed even better.

On the losing side, there were no spectacular developments in July. With Stryker $SYK (+0,46 %) and Hershey $HSY (+0,25 %) there are rather defensive stocks to be found.

In total, my portfolio stands at just under ~226.000€. This corresponds to an absolute growth of ~47.000€ in the current year in the current year 2023. ~32.000€ come from price increases, ~1.500€ from dividends / interest and ~14.000€ from additional investments.

However, there are still ~6,000€ of price gains missing to make up for the ~38,000€ of price losses from 2022.

Dividend:

- Dividend +15% compared to previous year

- Current year dividends are +23% over first 7 months 2022 at ~€1,350 after 6 months

Purchases & Sales:

- Bought in May for ~€3,800

- Executed mainly my savings plans:

- Blue ChipsLVMH $MC (-0,88 %) Novo Nordisk $NOVO B Apple $AAPL (+0,17 %) Home Depot $HD (+0,09 %) Microsoft $MSFT (-0,03 %) Nike $NKE (+0,16 %) Starbucks $SBUX (-0,07 %) Stryker $SYK (+0,46 %) Texas Instruments $TXN (+0,33 %)

- GrowthCrowdstrike $CRWD (+0,43 %) Mercadolibre $MELI (+0,71 %)

- ETFsMSCI World $XDWD Nikkei 225 $XDJP and the Invesco MSCI China All-Shares $MCHS

- Crypto: Bitcoin $BTC and Ethereum $ETH

- Sales there were none in July. For August, however, possibly flies the iShares Healthcare Innovation

$2B78 (+0,19 %) out of my portfolio. This is the only sector ETF that I own and have saved for a while. All in all, though, I'm more convinced by the Big Pharma companies I already have in the portfolio.

This will be followed in August by Alimentation Couche-Tard

$ATD (+0,13 %) another new stock. The stock has been on my watchlist for a long time and is now finally available at Trade Republic.

Advantages from my point of view: My first stock from Canada, which is strongly represented especially there and in the Scandinavian countries. Regularly increasing profits and cash flow, which consequently lead to extremely strong dividend increases (for years over 20% p.a.). In addition, one of the few long-running stocks that has known only one path for years: from bottom left to top right.

And the crowning glory: With a P/E ratio of 16.5, it is also not overly expensive.

In Germany, the company is rather unknown or poorly represented. Exception since this year: The company has bought the entire German service station network of Total.

Looking ahead, I am very curious when we will see the first major setback in 2023? Probably in August on my 10 year stock market anniversary 😂.

But no matter what happens next, I will continue to stay fully invested and keep buying every month. I have already experienced enough crises in the ~10 years (Euro crisis, Syria, Crimea, Brexit, Trump election, Corona, inflation, Ukraine,...).

How did your portfolio perform in July? And when do you expect the first setbacks on the markets? Do you remain fully invested or do you currently reduce your share quota?