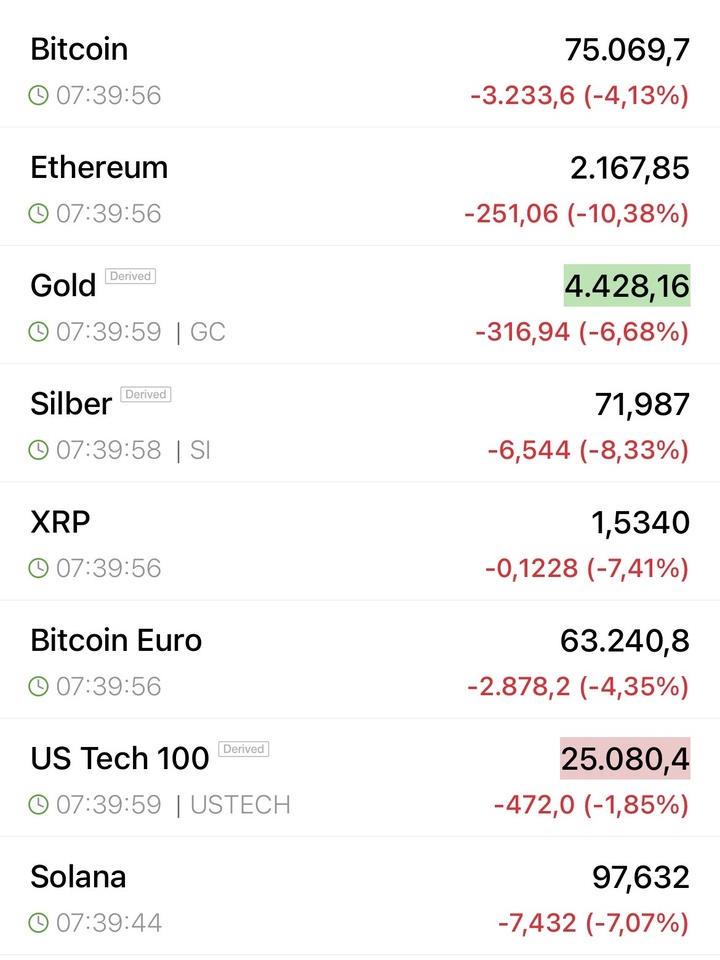

$MU (-3,79 %)

$VUSA (-0,93 %)

$CSNDX (-1,62 %)

If doing nothing sounds easier than it is in reality, it can sometimes be the best idea to do what you find hardest...

In my view, the following is very valuable help from our Mr. Krieg, especially for those who are still quite new to the stock market

The discrepancy between the index level and the actual state of the market has never seemed as great as it does today. Is something brewing?

The silent crash

At the moment Börse is currently experiencing a veritable massacre, even if a glance at the indices would not suggest it.

But beneath the surface, countless Aktienare being sold off with an intensity rarely seen before.

Almost half of all stocks listed in the USA are trading below the SMA200. For the S&P 500 this would correspond to a price of 5,090 points, i.e. almost 2,000 points or 27 % lower - and then the S&P 500 would only just have reached the SMA 200.

The mood among many investors is correspondingly gloomy.

For a long time, it looked as if the market was divided between AI winners and AI losers. One category was blindly bought, the other mercilessly punished.

But this picture is now crumbling more and more.

Is this the real dividing line?

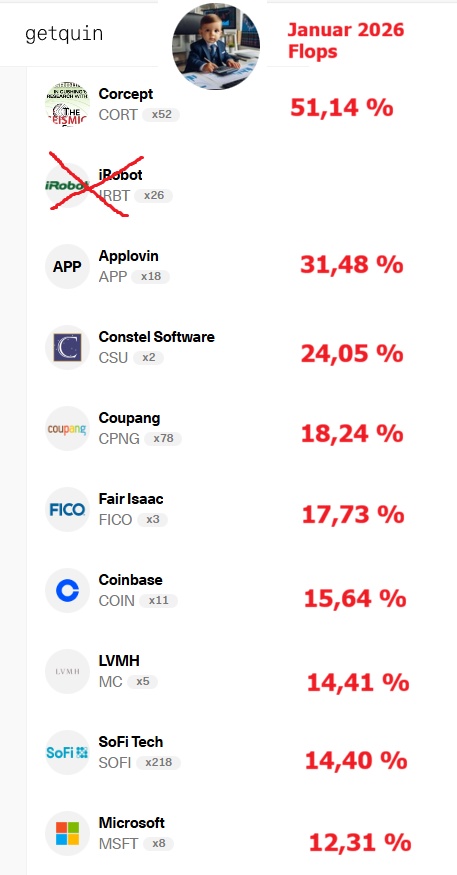

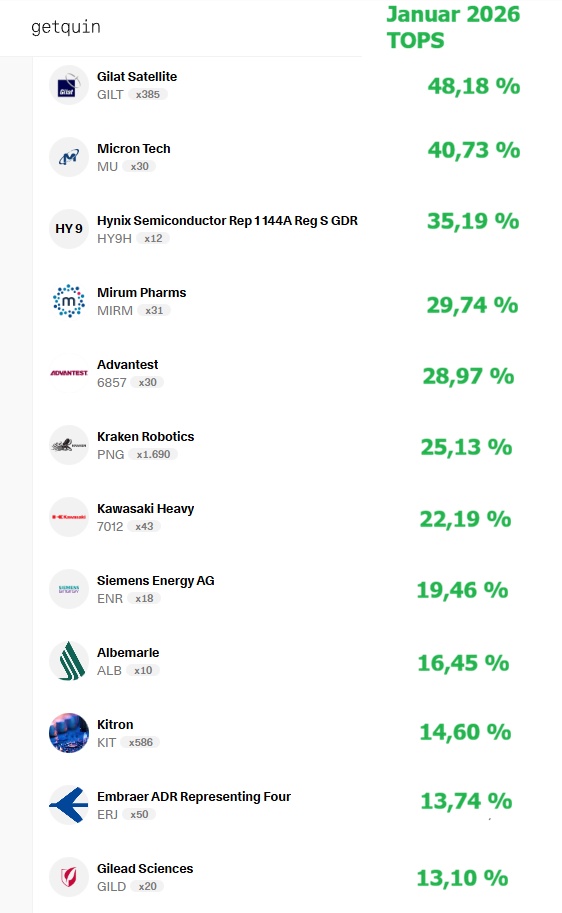

The market can be divided into two completely different blocks: Stocks that have already performed poorly in recent months are being sold off further.

Those that have already done well are still being bought.

It looks as if the algo traders have completely taken over the market. Ongoing trends are being blindly continued and there has been a complete disconnect from the fundamentals.

A look at the top and flop lists of the S&P 500 underpins this thesis. The five weakest stocks over the past year are, for example, Trade Desk, Fiserv, Gartner, Lululemon and GoDaddy.

The shares were already weak last year and have been sold off further since the turn of the year - the drop is between 13% and 36%.

The same applies vice versa. The top performers over the past year are Western DigitalSeagate, Micron, Lam Research and Comfort Systems. These stocks were already strong last year and have continued to rise significantly since the turn of the year.

Personally, I am involved in both camps, as I own one of the five flop stocks and three of the top performers.

What conclusions can be drawn?

The question now is how to deal with this. What conclusions can we draw and how should we position ourselves?

The market is not behaving irrationally at the moment, but is following a clear, albeit extreme, regime that is strongly characterized by liquidity and trend-reinforcing strategies.

In such an environment, traditional valuation benchmarks and fundamentals lose considerable importance at times because capital is not allocated according to quality or fair value, but instead mechanically follows existing trends.

At the same time, mean reversion hardly works any more: shares that have fallen are not picked up due to favorable valuations, but are often sold on, while rising stocks continue to attract capital regardless of their valuation level.

The decisive factor here is that momentum does not end due to overvaluation, but only ends when the trend itself breaks.

Cash and classification of the current market phase

This market phase feels sick, because it is. But it may stay that way for quite some time.

In my view, those who are currently holding cash are not missing out on any opportunities. Liquidity creates freedom of action, reduces psychological pressure and allows you to react to real trend changes or market distortions instead of having to react permanently.

Especially in strongly trend-driven markets, it often makes more sense to deliberately do nothing than to hope for a quick normalization in unfavourable market segments.

The current market phase feels so unpleasant because it is structurally unhealthy. However, those who recognize which regime the market is in and make their decisions adaptively rather than ideologically will gain a decisive advantage.

It's less about hitting the turning point precisely and more about being mentally and structurally positioned in such a way that you remain capable of acting when the environment actually changes - and it will.

The regime is crucial

We have seen several clearly recognizable regime changes in recent years.

From the "everything hype" in 2021, when hardly any price could be too high, especially for growth stocks.

This was followed by a tech depression in 2022/2023, in which shares were sold off further, even if the business figures were good.

The years 2024 and 2025 were characterized by a gradual improvement in general conditions - falling inflation risks, falling interest rates and the absence of a recession.

These factors boosted the indices despite the general pessimism.

Last year, the US market became increasingly fragmented and this has intensified considerably this year.

It is impossible to predict how long this trend-driven regime will last. However, such phases usually end with a bang.

The imbalances that have built up on the stock market in recent months are considerable.

Finally, I would like to talk about one of the stocks I have already mentioned. You could have told a nice story about each of them - there are reasons for a continuation of the trend in each case, but also very good arguments against it.

However, if you look at Micron's situation, for example, it seems quite unlikely that the rally will not continue

Micron Technology share: Chart from 04.02.2026, price: USD 420 - symbol: MU | Source: TWS

The price gains are well underpinned by fundamentals. Having already multiplied profits in the last financial year, they are set to rise by a further 295% to USD 32.70 per share this year.

This would give Micron a forward P/E of 12.8.

As profits are also expected to rise in the coming financial year, which begins in September, the rally could continue for some time to come

Source

https://www.lynxbroker.de/boerse/boerse-kurse/aktien/micron-technology-aktie/micron-technology-analyse/?a=3355991664&utm_medium=email&utm_source=newsletter&utm_campaign=newsletter-boersenblick&newsletter=true&mc-rss-cache-bypass=2026020507&goal=0_d93daae099-0c8a167c83-410756260#einige-gedanken-zum-aktuellen-zustand-der-boerse-sp-500-und-micron