YieldMax Big Tech Option Income UCITS ETF USD

Price

Debate sobre YieldMax Big Tech Option Income UCITS ETF USD

Puestos

11Further acquisition before the dividend

I'm currently a big fan of this ETF because it pays out monthly, and there's a good sum of money, and the price is currently well in the green, so the dividend isn't the only plus.

Dividend announcement

$IE000MMRLY96 (+1,41 %) the Big Tech ETF has just announced the dividend for this month (September) and shows an increase of 0.0027$cents compared to the last payout in early September where the ex-dividend date was in August, and thus the dividend is 1.0768$ per share.

Ex-day 22.09

Distribution: 26.09

Review August 2025 and forecast increase 2025

Hello my dear ones....now that my REHA has ended after 4 weeks and the rocky road ahead has begun, it's time to look further ahead and spend a little more time in the portfolio again...

🟢 Top 3 August

$HSBA (+0,87 %) +5,40 % (+10,64%)

$3750 (+2,68 %) +4,65% (+26,46%)

$RIO (-0,48 %) +3,69% (-1,73%)

🔴 Flop 3 August

$1211 (-0,58 %) -4,95% (-15,90%)

$VAR (-0,27 %) -1,45% (+4,79%)

$PETR4 (-0,87 %) +1,54% (-6,89%)

》Upgraded ✅️

...measured against August, things actually went quite well, including dividends, and April has long since been put to bed, even with Trump's whims...

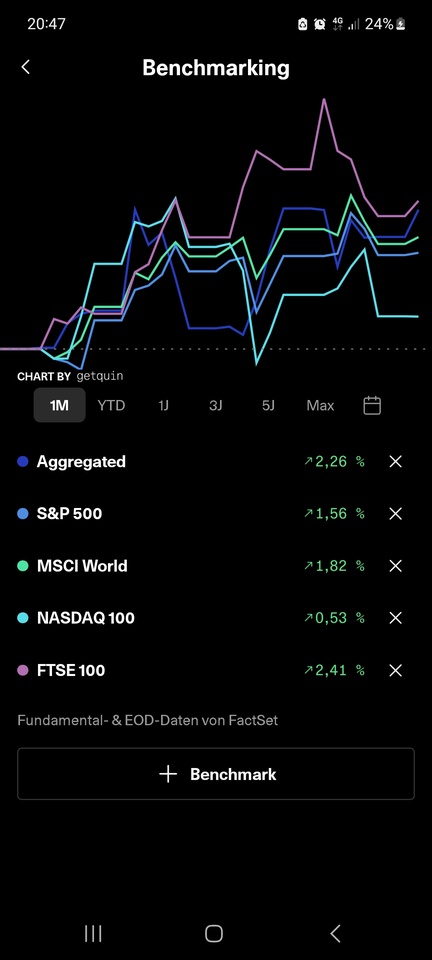

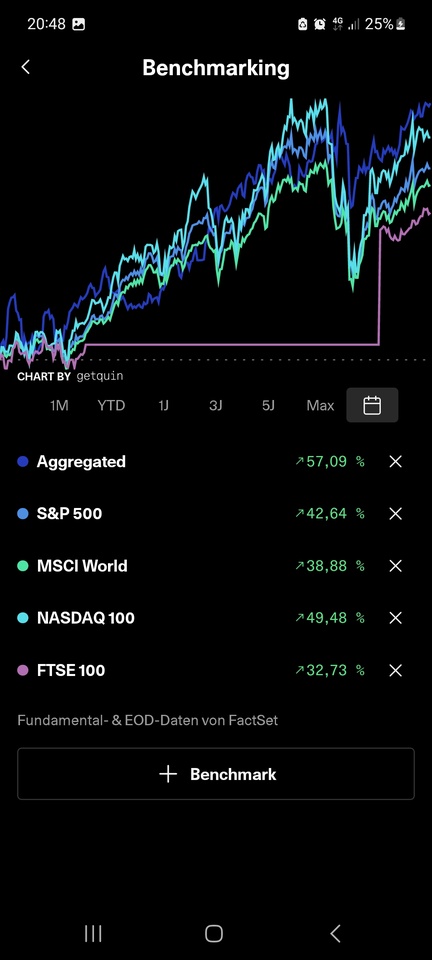

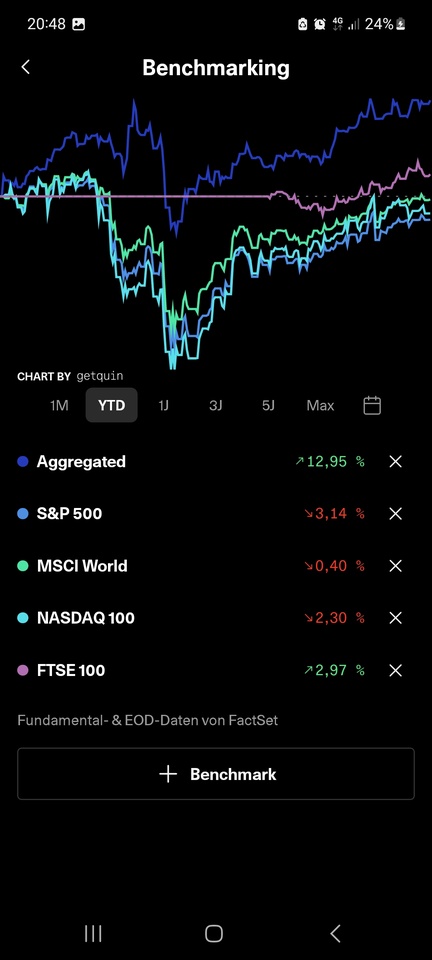

...YTD and overall the figures continue to fit quite well and my high-yield dividend strategy continues to work even after all the capers.

A pro po dividends, there were € 107.21 gross and € 104.67 net last month, which corresponds to an increase YTD of 29.73 %, but on the other hand also represents one of my weaker months.

Compared to my portfolio value ~23100 € but still acceptable.

This month looks better again and with ~300 € dividends a good reinvest 🫠

A small drop of bitterness: contrary to my forecast, my FSA will be torn tomorrow and from then on, unfortunately, the ailing state system will also cash in again. But shit happens, I'm getting married next year and still have enough left for the further expansion of the story with a net dividend of ~€1700 this year, in contrast, I don't have to sell anything and so I see my portfolio easily in the 6-digit range within the next 4-5 years at the latest even with the wrecking ball (better late than never) 💪🏻

Another small component of this is my forecast increase for 2025...I had planned between 23-25k at the end of the year, but since things sometimes go well and develop differently than expected, I am now raising my target to 25-28k and am thus on a very good and realizable path.

With this in mind, here's to another month...📈

And nice to have you back.

Did everything work out for you with BYD?

Next dividend announcement...

...also in August YieldMax $IE000MMRLY96 (+1,41 %) continues to keep the dividend level constant 👍🏻

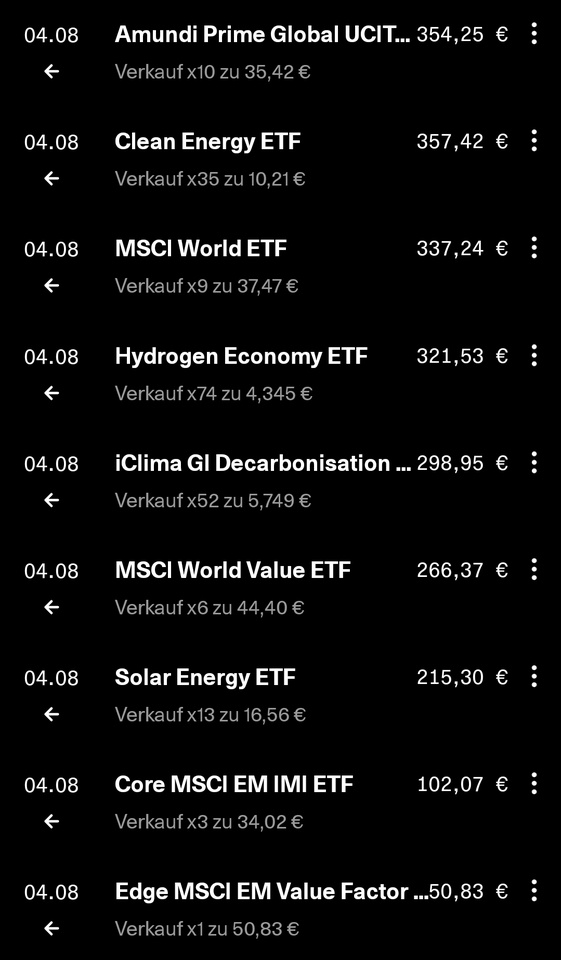

Reallocation

I still had a number of unallocated assets in a custody account at Comdirect that I couldn't sell because of the fees there. Now that I've transferred the custody account to scalable, it's time to clean it out a bit.

All in all, they've been treading water for two years. That's why the earnings are coming in here. In principle, I expect something similar, but at least some money is coming in every month.

My new monthly treat...

...even if it is still too early to draw an overall conclusion after 4 months, it is probably the "only" CC that has fully recovered from the drop in April (-17%) and continues to do what a CC does.

In addition, it continues to perform quite stably in the current reporting season and despite the weak dollar....

I also like the fact that the physical portfolio here is not based solely on the magnific 7, as is usually the case, but is instead equally spread across 25 companies in the sector and is also actively managed.

And the 30% tax exemption (in Germany) also fits in well with the concept...

...so all in all, a lucrative and sensible addition to the portfolio so far 👍

Valores en tendencia

Principales creadores de la semana