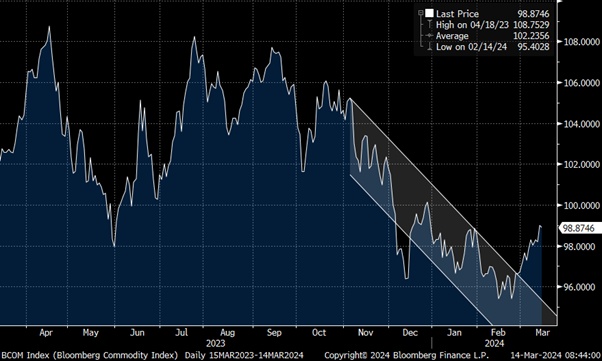

Current developments in the commodities sector show a number of new changes. Copper ($B4NQ ) yesterday reached a 11 month high yesterday after major smelters in China agreed to control their capacities.

This is part of an agreement between 19 smelterswho have agreed to this, maintenance work to restructure maintenance work, operating times reduce operating times and delay the start of new projects and delay the start of new projects. This shows China's efforts to reduce its dependence on imported copper and to meet the increasing demand from the green energy sector.

At the same time, mining companies are increasingly facing environmental audits. There are currently massive protests against the closure of the First Quantum Mine in Panama, which has led to its closure. The Cobre Panama copper mine is one of the world's largest sources of copper.

The oil prices ($IOIL00 (-0,13 %) ) are also rising after drone strikes by Ukraine disrupted the operation of oil refineries in Russia have been disrupted. The attack has disrupted the operation of 3 oil refineries including the Rosneft PJSC plant in Ryazanwhich is one of the largest refineries in Russia.

In addition, the weekly inventory of the EIA report¹, which showed a decline in crude oil inventories in the USA by 1.5 million barrels in the first quarter. This was the first decline in crude oil inventories for almost two months.