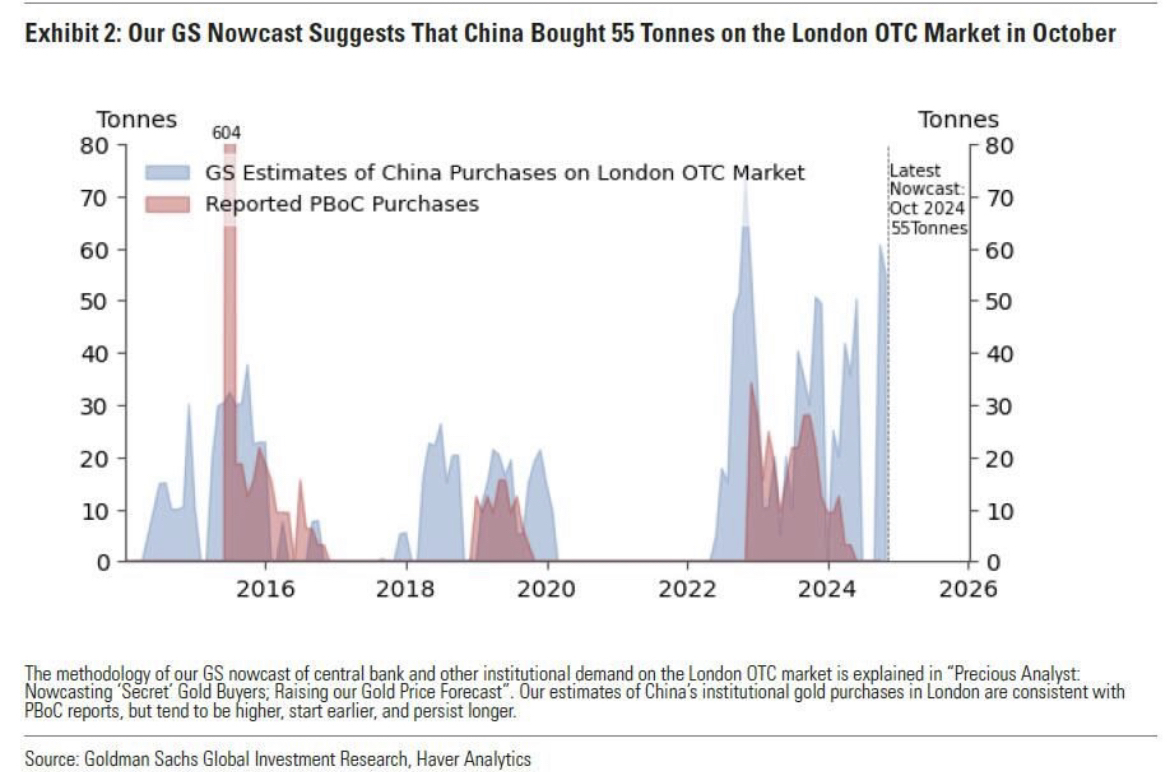

🚨 🚨 According to Goldman, China Secretly Buying Up Massive Amounts Of GOLD, 10x More Than Officially ‼️

• According to the Goldman Sachs nowcast of central bank and other institutional gold buying on the London OTC market, October saw centralbanks buy a whopping 64 tonnes in October (vs. pre-2022 average of 17 tonnes), with China once again the largest buyer adding 55 tonnes, which is striking since the official number reported by the PBOC was one-tenth that, or just 5 tonnes. In other words, China is secretly buying up ~10x more gold than it admits.

• Commenting on the surge in purchases, the Goldman analyst writes that "surveys and history suggest that EM central banks buy gold as a hedge against financial and geopolitical shocks" and adds that "central bank purchases will remain elevated because fears about geopolitical shocks have structurally risen since the freezing of Russian reserves in 2022, and because relatively low gold shares in EM central banks reserves vs. DMs leaves room for growth." In fact, 81% of the central banks surveyed by the World Gold Council expect global central bank gold holdings to rise over the next 12 months, with none anticipating a decline.

🚨 As shown on the chart below, what is far more striking is the staggering (and growing) divergence between the modest amounts of gold purchases reported by the PBOC and the far greater amount China has actually purchased on the London OTC market, in a clear attempt to mask its staggering demand for the precious metal, and be extension, its diversification away from the dollar...

Source; www.zerohedge.com