+++ Palantir Technologies Inc. (PLTR) - A brief analysis +++

$PLTR (+0,83 %) is a leading data analytics and artificial intelligence (AI) company characterized by its innovative technology and strong focus on safety-critical applications in both the public and private sectors. Since its IPO in 2020, Palantir has attracted both enthusiasm and criticism - not only because of the disruptive nature of its business model, but also because of its dependence on government contracts and its sometimes aggressive valuation on the stock market.

In 2024, Palantir has made significant progress, both in its financial results and by increasing its market presence in the field of artificial intelligence. However, the stock has become a point of contention as it is currently at historically high levels, while many analysts point to potential risks and overvaluation.

After Palantir has generated more than 300% returns in one year, there is such fomo in the market but also on getquin, is this justified?

1. business areas and products

Palantir specializes in providing complex data analytics to help businesses and governments make critical decisions. The company offers two main platforms:

1.1 Palantir Gotham

- Target group: Primarily governments, security agencies and the military.

- Function: Facilitates the evaluation of large, unstructured data volumes in order to detect threats at an early stage and optimize decisions in security-relevant areas.

- Areas of application: Counter-terrorism, military operations, national security.

1.2 Palantir Foundry

- Target group: Companies in various industries, including energy, healthcare and finance.

- Function: Enables integration and analysis of disparate data sources to optimize processes and make strategic decisions.

- Growth: Foundry has grown in importance in recent years as companies increasingly rely on data-driven decisions.

1.3 Apollo

- Target group: Both public and private clients.

- Function: Provides real-time AI-driven decision-making processes and ensures that Palantir's software can be continuously updated and scaled.

- Significance: This platform is considered a key product driving Palantir's expansion in the field of artificial intelligence.

2. market position and competitive environment

Palantir operates in a highly competitive market. Its main competitors include:

- Snowflake $SNOW (+3,81 %)

: Focus on cloud-based data platforms. - Databricks $DBRX Specialized in machine learning and big data analytics.

- Google Cloud and Microsoft Azure $GOOGL (-1,39 %) & $MSFT (+1,68 %) Also offer AI and data analysis solutions, but benefit from their broader product portfolio

Strengths of Palantir:

- Proprietary technology: Palantir develops customized solutions that are deeply integrated into customers' workflows.

- High barriers to entry: Palantir's complex and specific applications create long-term customer loyalty.

- Strong customer base: Over 60% of sales come from long-term contracts with governments and large corporations.

- Huge market: The AI market has huge expected CAGR over the next few years (and we are still at the beginning of this journey)

Weaknesses:

- Dependence on the public sector: Significant portion of revenue comes from government contracts, making the company vulnerable to budget cuts.

- High cost structure: Despite the scalability of the products, the cost base remains relatively high due to high development spend and customer acquisition.

- Share dilution: In recent years, Palantir has increased its outstanding shares by 20%

3. recent developments and strategic initiatives

3.1 New contracts and partnerships

- Contract with the US Department of Defense: Palantir was awarded a contract worth USD 36.8 million in December 2024 to support the U.S. Special Operations Command. This strengthens market leadership in the defense sector.

- Partnerships with AWS and L3Harris: These collaborations aim to extend the reach and functionality of Palantir's platforms in the military and commercial sectors.

- Healthcare sector: Palantir is working with leading pharmaceutical companies to provide AI solutions for clinical trials, drug discovery and supply chain optimization.

3.2 Artificial intelligence as a growth driver

The integration of generative AI and advanced analytics into the existing platforms has contributed significantly to the increase in sales in 2024. Customers are increasingly relying on Palantir to automate AI-driven decision-making processes.

3.3 International expansion

Palantir has strengthened its presence in Europe and Asia. The company is becoming increasingly important, particularly in the area of critical infrastructure analysis, as governments and companies arm themselves against cyber threats.

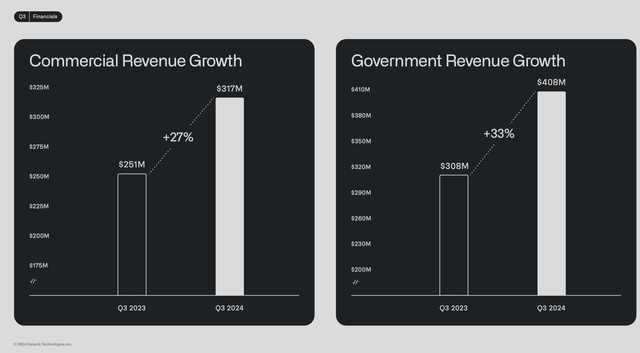

4.1 Current results (Q3 2024)

- Revenue: USD 725 million (+30% compared to the previous year).

- Gross margin: Over 80%, underlining the high scalability of the business model.

- Net result: Fourth consecutive GAAP-positive quarter, a milestone in the company's history.

- Free cash flow: Over USD 300 million, indicating strong operational efficiency.

4.2 Forecasts for 2024

- Total expected revenue: Over USD 3 billion.

- Growth drivers: Increase in government contracts, rising adoption of AI solutions and expansion in the commercial sector.

4.3 Valuation

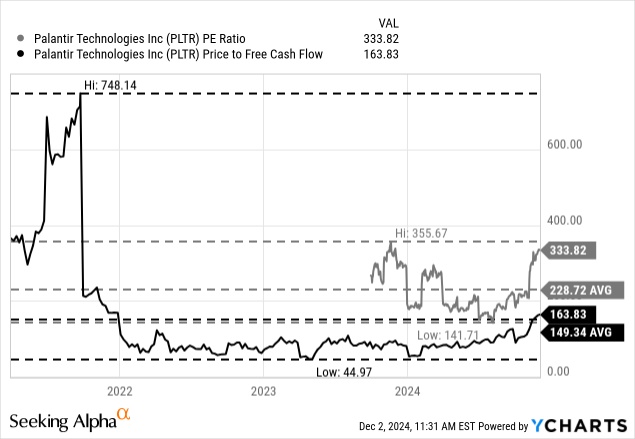

The share is currently valued at a price/earnings (P/E) ratio of over 400, based on expected earnings for 2025 in bullish scenarios at 150. This indicates a very optimistic market expectation.

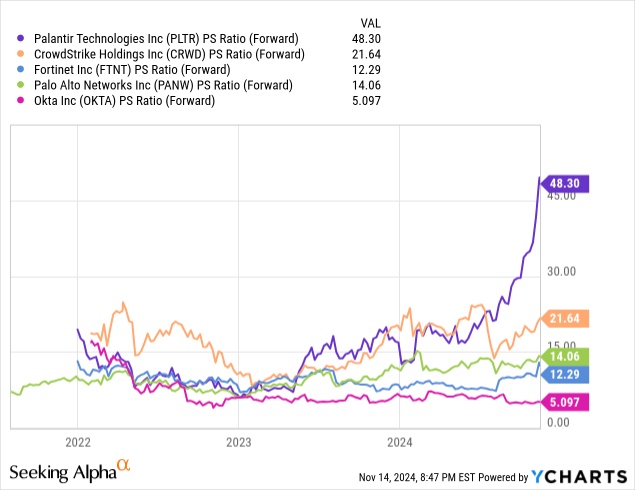

This shows that Palantir is currently valued historically (very expensive), given the status quo growth!

Here is a comparison of the dotcom ratings of well-known companies (P/S ratio) - Palantir currently has a 60 P/S ratio.

5 Valuation

With a current price of around USD 72 (as at December 2024), the share is trading well above its fair value of USD 19 as estimated by Morningstar. This could lead to sharp price losses in the event of disappointing results or negative news, but also shows how wide the discrepancy in valuation currently is!

6. fair value estimate

Based on the discounted cash flow model (DCF) and taking into account a conservative growth rate of 20%, the fair value amounts to USD 25. This estimate takes into account the long-term opportunities offered by AI, but also the risks of a potential slowdown in growth and the high dependence on government contracts, but with old valuation schemes that are not always based on growth values!

Conclusion

In my opinion, PLTR is currently historically expensive, with lower growth opportunities than other companies in the market e.g. $HIMS (-1,68 %)

For this reason, I am currently waiting for healthy profit-taking and continue to look at Palantir's business model!

👍 = I am not invested

❤ = I am invested

If this article has provided you with any added value, I would be delighted to receive a few Getquin coins :)