It won't get any cheaper?

P/E RATIO 13

Earnings growth/26: 14%

Artificial intelligence is getting loud Börse Online (issue 24/2024), artificial intelligence will bring about a major change in numerous industries that investors are far from thinking about. The change will be accompanied by profit increases. One potential beneficiary of this development is the IT provider to the financial sector, GFT Technologies [WKN: 580060, ISIN: DE0005800601].

In 2019, GFT Technologies was dependent on two major banks. And the industry crisis had fully impacted the IT service provider's operating business and put the Group in trouble.

Five years later, the cost-cutting measures introduced at the time and the investment freeze at the banks are long gone. The banks' business has recovered and the financial institutions are now ready to make up for the deficits in data processing.

GFT Technologies is in a promising position to benefit from the banks' next investment cycle thanks to its existing industry expertise. In order to save money when using IT systems, the use of AI will also become important in this area.

GFT Technologies has already launched its EnterpriseGPT solution. It is a solution that also fulfills regulatory requirements. GFT Technologies is targeting financial service providers with this application. The component of the GFT AI platform is intended to accelerate processes such as purchasing decisions and analyze large volumes of data for clients.

GFT Technologies is also entering the race as the operator of the systems and customers and thus has a trump card in its hand. This is because banks and insurance companies would be able to access GFT services without having to invest in hardware or software themselves.

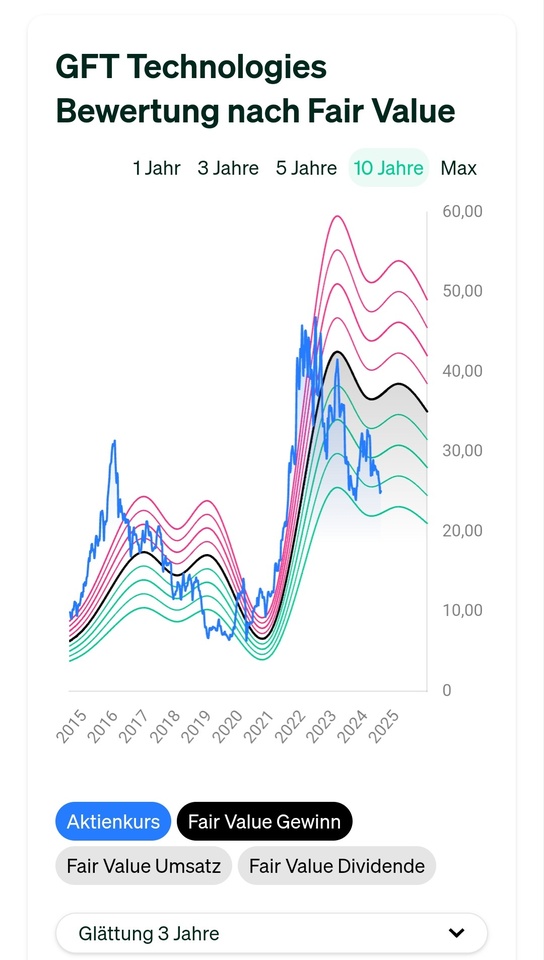

This perspective is exciting because GFT Technologies is active worldwide. This enables high economies of scale and should have a positive effect on profit growth. However, this growth perspective is still being ignored on the stock market. Stock Exchange Online advises with a target price of 40 euros to enter the market (50 % potential).