Employees Shares

Hello everyone,

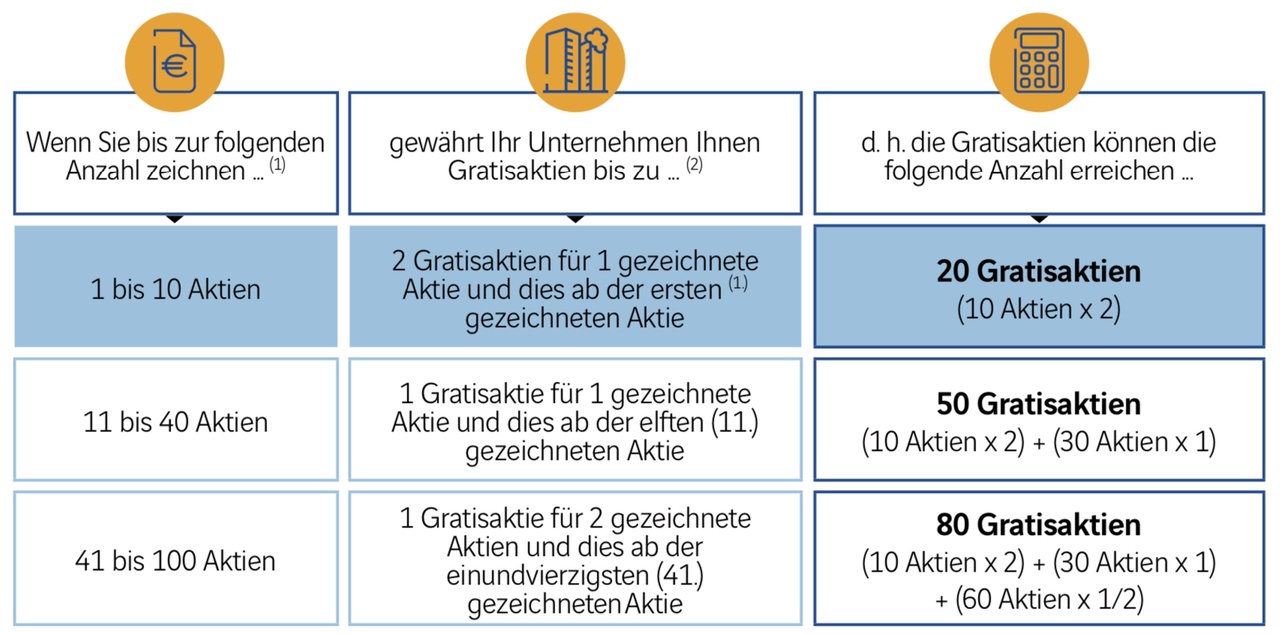

The company where I work $DG (+1,01 %) offers employee shares every year. The offer is very attractive in my opinion, you get free shares after a 3-year vesting period.

After the 3 years, you can sell anything you want. If you have to sell earlier than 3 years, you can, but of course you lose the free shares.

I'm still a dual student (civil engineering) and have "only" subscribed to 20 shares, but I'll fill up to 100 in the future if possible.

How is it with you? Do you have an employee share program and if so, what does it look like? Why do you participate, or why not?

I would be happy to hear what other share programs look like :)