Dear getquin community,

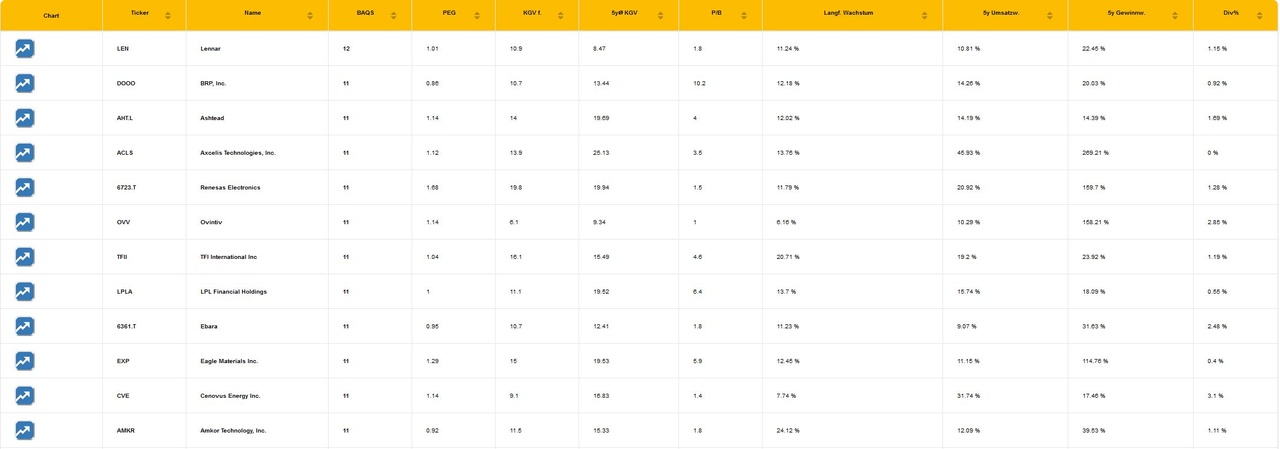

It's been a while since I introduced myself here and it's time to take stock of my scoring again, including a focus on $LEN (-3,97 %) the current top scorer of the Best Stock Quality Score (BAQS) (besteaktien.net).

Since we started with the BAQS, Lennar Crop. ($LEN) (-3,97 %) has always been at the top and the performance of the share over the last few years speaks for itself. Lennar, together with its subsidiaries in the United States, is a homebuilding company. Its activities include the construction and sale of one- and two-family homes; the purchase, development and sale of residential land; and the development, construction and management of multifamily rental properties. The company also provides residential mortgage financing, title, insurance and closing services to homebuyers and others, and originates and sells securitized commercial mortgage loans - so it's pretty well diversified for a company that is classified in the construction industry.

Due to its reasonable valuation, stable growth, stable margins (25% in construction, 52% for financial services) and excellent outlook (continued growth, falling mortgage rates, housing shortage in the US), Lennar is therefore a hot candidate for my wikifolio.

I found one of the best analyses of Lennar on Gurufocus: https://www.gurufocus.com/news/2471142/lennar-is-a-market-leader-at-a-good-price

What is your opinion on $LEN (-3,97 %) ? Did you already know this company?

As always, your feedback is important to me! Feel free to leave a comment.

Thank you for your support, evergreen depots and

Best regards Felix