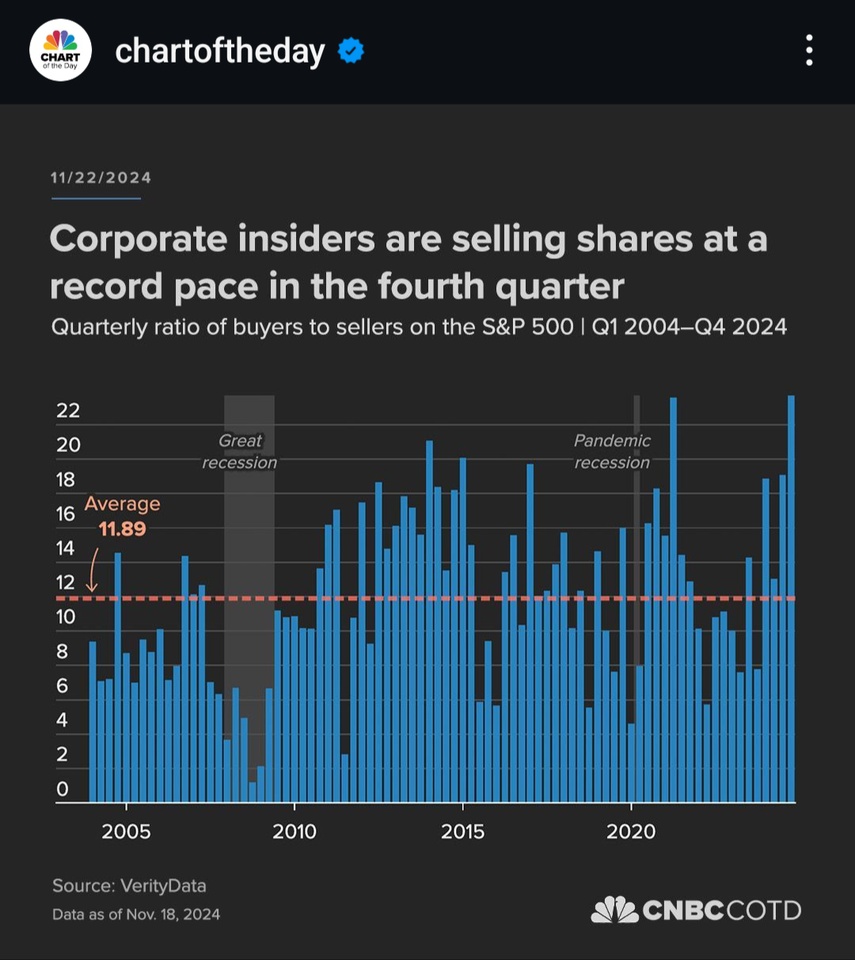

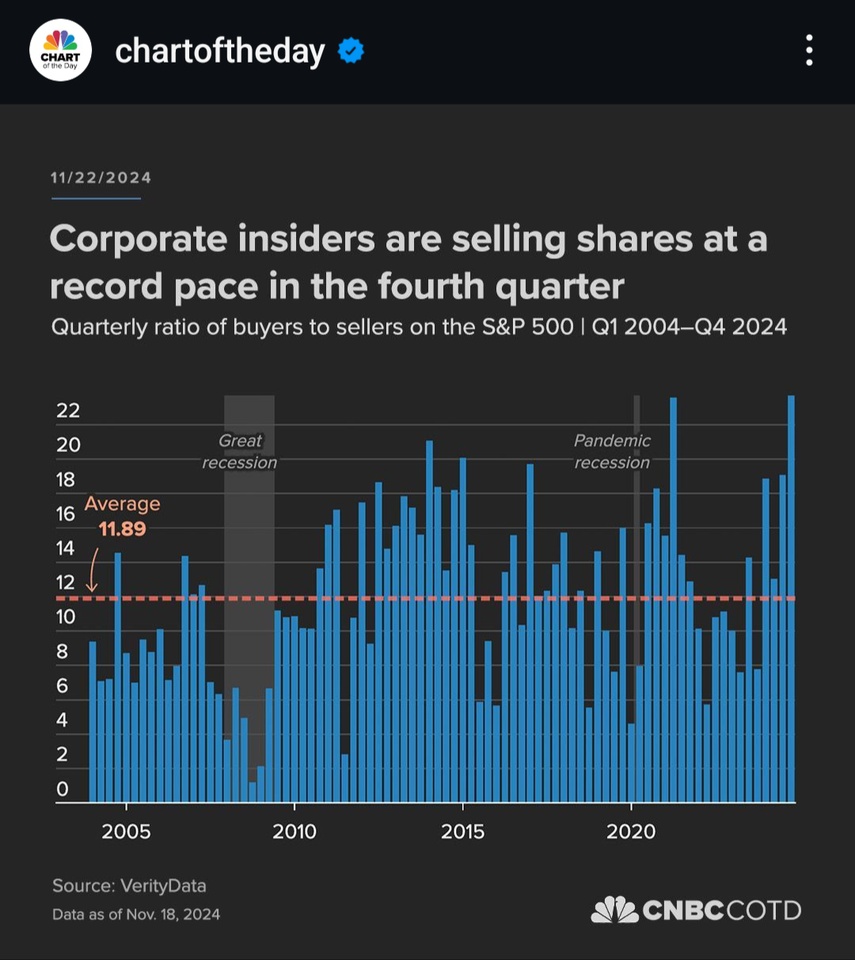

I'm increasingly seeing posts about investors building up strong cash positions. Any recommendations about this from the brilliant minds of getquin community?

I'm increasingly seeing posts about investors building up strong cash positions. Any recommendations about this from the brilliant minds of getquin community?