Double-digit growth in orders on hand - and AI is the driving force

The order backlog increased by 17.6% to USD 25.37 billion. The value of orders to be fulfilled in the next 12 months climbed by 16.4% to USD 7.91 billion.

Growth is likely to continue or accelerate in the near future.

The forecast for subscription sales in the current financial year was increased slightly from USD 8.80 billion to USD 8.82 billion. In addition, Workday is forecasting an operating margin of 29.0% instead of 28.5%.

According to the Management Board, more than three quarters of all new orders and around one third of all new orders from existing customers now include one or more AI products.

The order value of AI products has more than doubled over the course of the year.

In the last quarter, Workday won several major customers in the AI segment, including Trinity Health, Chipotle and Cox Health.

To further fuel growth in this area, Workday is acquiring Paradox, a specialist in simplifying application and recruitment processes. This acquisition provides Workday with an AI-powered suite that simplifies the entire process, from employee sourcing to hiring to onboarding.

Outlook and valuation

According to consensus estimates, free cash flow is expected to increase by 22% to USD 8.90 per share this year. As FCF rose by 25 % in the first half of the year, this seems plausible.

Despite the strong quarterly figures and the increase in the forecast, the share is trading vorbörslich 4.09 % in the red at USD 218.28.

Workday thus has a forward P/FCF of 24.5, which is easily justifiable in view of the double-digit growth rates and the high predictability of the business.

In the last five years, the P/FCF has averaged 60, which was certainly a bit too much of a good thing, but it also shows how much the share was loved at times and how out of fashion it has become.

Fundamentally, relatively little has changed during this time. Sales growth has been almost stable at 12-13% per year since the 2021 financial year (1/2021) and FCF growth has averaged 18%.

The current financial year is therefore average or just above, but the valuation is not, as Workday is currently being traded as an AI loser. There is a fear that software companies will be disrupted by the dozen in the future

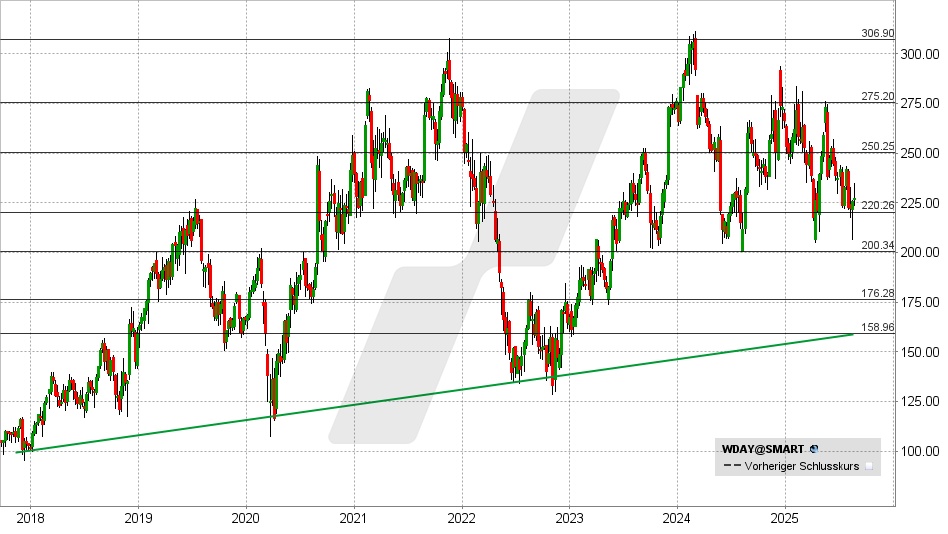

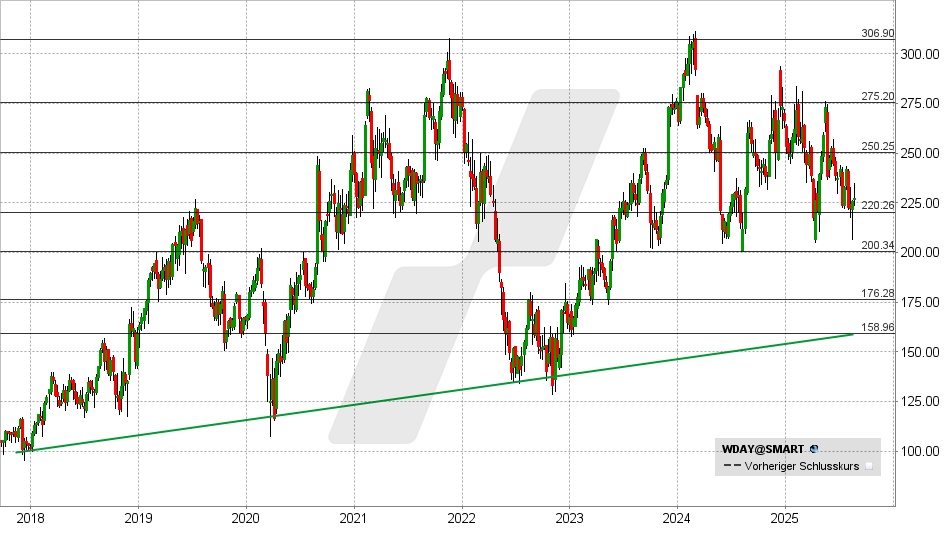

Workday share: Chart from 22.08.2025, price: USD 227.58 - symbol: WDAY | Source: TWS

If the share falls below USD 220 in regular trading, further losses towards USD 210 or USD 200 must be expected.

Below USD 200 there would be a Verkaufssignal with possible price targets at USD 176 and 159.

If, on the other hand, the stock quickly returns above USD 220, the bulls will once again have the advantage. Possible Kursziele on the upside are USD 240 and 250.