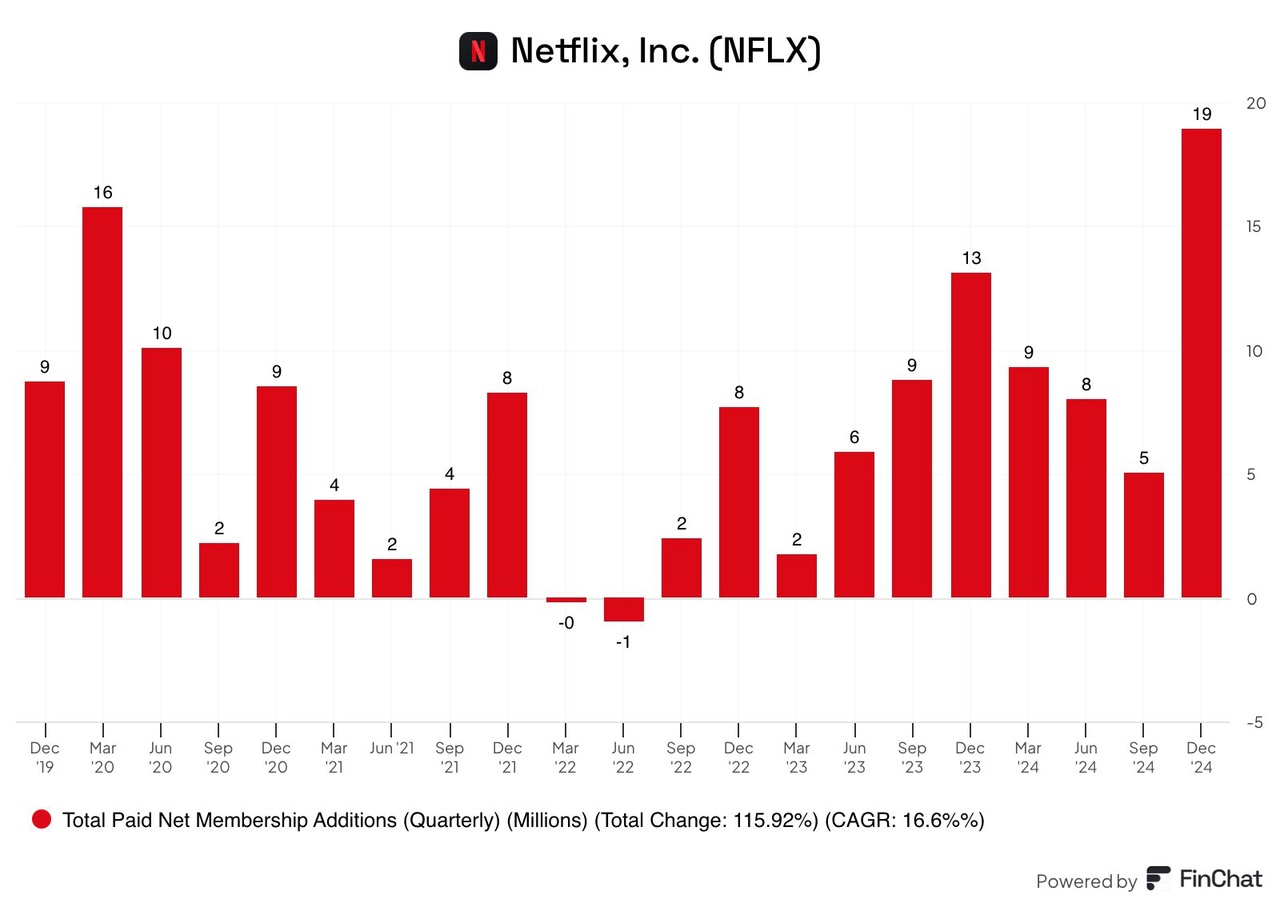

Netflix has gained more new subscribers than in any other quarter in its history.

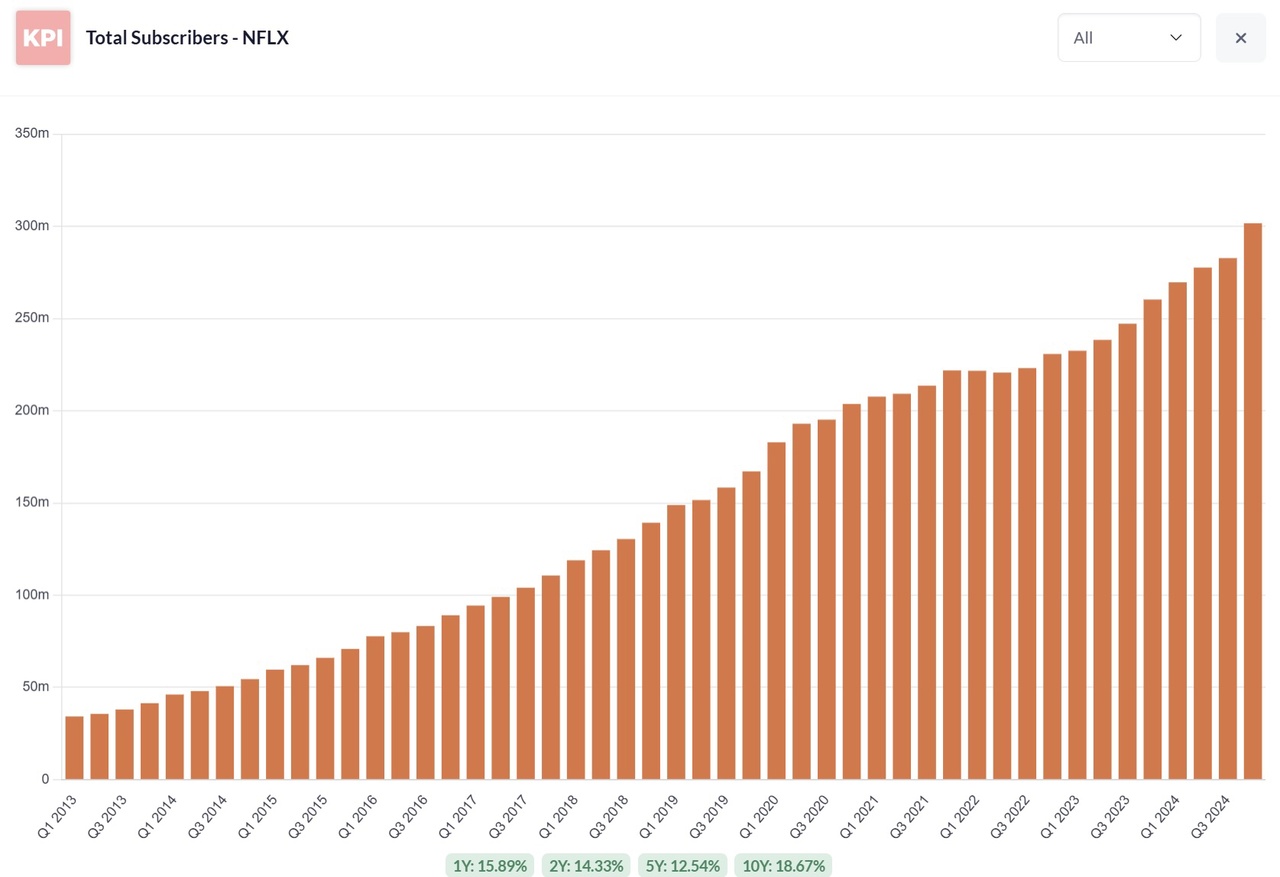

Netflix subscribers over time.

$DIS (-0,8 %) , $AMZN (-2,43 %) , $WBD (-0,85 %) , $PARA (-0,09 %) , $FUBO

Puestos

81Netflix has gained more new subscribers than in any other quarter in its history.

Netflix subscribers over time.

$DIS (-0,8 %) , $AMZN (-2,43 %) , $WBD (-0,85 %) , $PARA (-0,09 %) , $FUBO

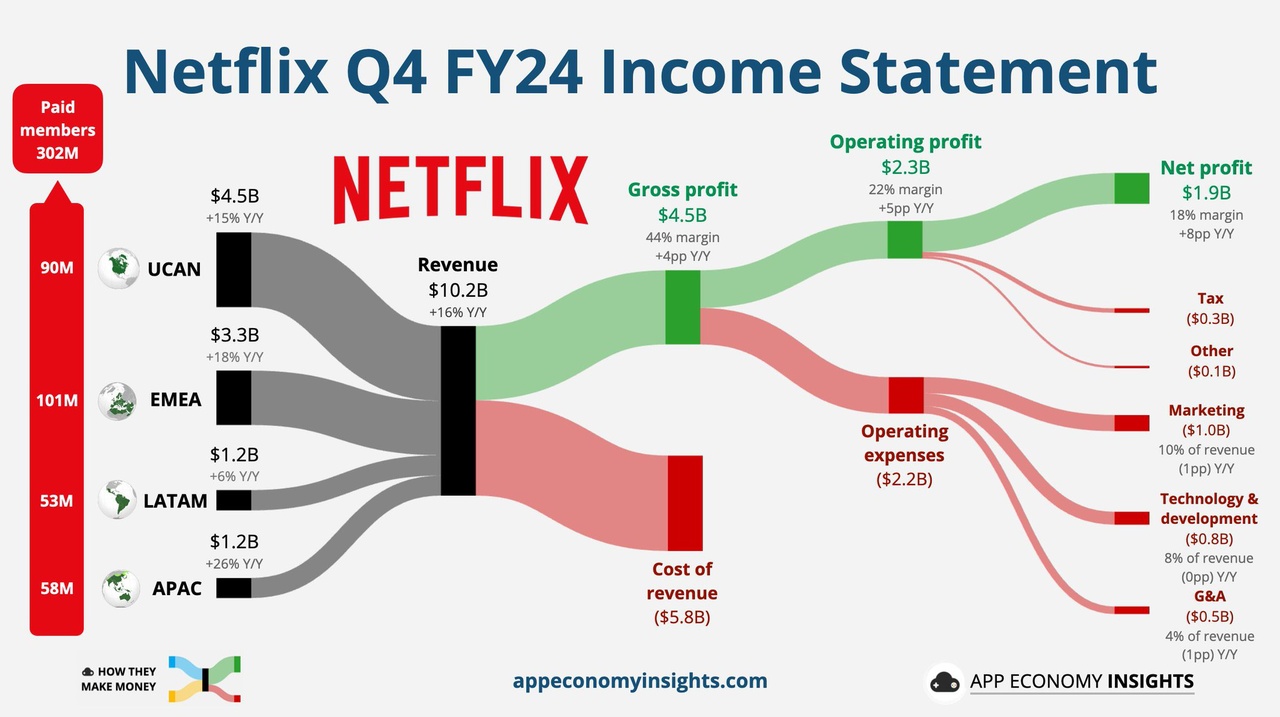

Segment performance:

United States and Canada (UCAN):

Europe, Middle East and Africa (EMEA):

Latin America (LATAM):

Asia-Pacific (APAC):

Content performance:

Forecast for the first quarter of 2025:

Forecast for the full year 2025:

CEO's comment:

Strategic updates:

Segment performance:

United States and Canada (UCAN):

Europe, Middle East and Africa (EMEA):

Latin America (LATAM):

Asia-Pacific (APAC):

Content performance:

Forecast for the first quarter of 2025:

Forecast for the full year 2025:

CEO's comment:

Strategic updates:

Warner Bros. Discovery $WBD (-0,85 %) has extended its media partnership with the NBA by 11 years extended. The deal provides the company with continued comprehensive broadcast rights to NBA games and includes both traditional TV formats and digital streaming platforms. The extension underscores Warner Bros. Discovery's commitment to delivering high-quality sports content and expanding the reach of its platforms.

The partnership is seen as strategically significant as it takes place in a changing media environment where streaming is becoming increasingly important. Warner Bros. Discovery plans to modernize its sports broadcasts and offer them across multiple channels to meet new viewer needs.

Personal opinion:

Strong move, as the NBA in particular, along with the NFL, dominate the sports industry in the US. However, it has not been announced how much the whole thing will cost.

Source:

The news is based on what I personally consider to be reputable sources. However, I do not guarantee their accuracy. No advice.

$WBD (-0,85 %) | Warner Bros. Discovery Q3'24 Earnings Highlights:

🔹 EPS: $0.05 (Est. -$0.11) 🟢

🔹 Revenue: $9.62B (Est. $9.8B) 🔴; DOWN -3% YoY

🔹 Adj EBITDA: $2.41B; DOWN -18% YoY (ex-FX)

Studios:

🔹 Revenue: $2.68B; DOWN -17% YoY

🔹 Adjusted EBITDA: $308M

Networks:

🔹 Revenue: $5.01B; UP +3% YoY

🔹 Adjusted EBITDA: $2.115B

Direct-to-Consumer (DTC):

🔹 Subscribers: 110.5M (Est. 109.2M) 🟢, UP 7.2M QoQ

🔹 Revenue: $2.63B; UP +9% YoY

🔹 Adjusted EBITDA: $289M

🔹 Global DTC ARPU: $7.84; UP +1% YoY

Key Operational Highlights:

🔸 Strong DTC growth with 7.2M additional subscribers, reaching 110.5M total.

🔸 Successful content performance from The Penguin on Max platform.

🔸 Renewed Charter carriage agreement and generated 215M Olympic Games views.

Financial Position:

🔹 Cash on hand: $3.5B

🔹 Gross debt: $40.7B

🔹 Net leverage ratio: 4.2x

🔹 Debt reduction of $0.9B in Q3

CEO David Zaslav's Commentary:

🔸 "Despite extraordinary disruptions, our Q3 results underscore the success of our strategic repositioning efforts, positioning Warner Bros. Discovery for future growth and resilience."

Very exciting assessment of the shares.

https://www.high-tech-investing.de/post/echtgeld-tv-waldhauser-paypal-vimeo-warnerbros

Both positions are going into my "speculative portfolio". They will remain there for 2-4 years and we will see whether the investment case works out

Do you think that the companies' quarterly figures will still make a big difference?

$BNTX (+0,18 %) , $IFX (-1,79 %) , $8001 (+3,88 %) , $PLTR (-1,41 %) , $O (+1,41 %) , $WMB (+0,94 %)

$ABNB (-0,57 %) , $AMGN (+3,61 %) , $BAYN (+3,03 %) , $CAT (+0 %) , $UBER (-0,24 %) , $ZAL (-1,09 %)

$CBK (-1,59 %) , $DIS (-0,8 %) , $OXY (-0,97 %) , $MNST (+1,25 %) , $NOVO B (+1,73 %) , $PUMA , $SHOP (-1,69 %) , $ENR (+2,7 %) , $6758 (+0,34 %) , $WBD (-0,85 %)

$ALV (-0,26 %) , $DTE (+2,53 %) , $LLY (+1,93 %) , $MUV2 (+1,71 %) , $RHM (+4,48 %) , $SIE (-0,34 %)

I got moves 🕺🕺🕺🕺

I dare to do something that usually goes against my nature, RISIKOO 🎰.

but only a little. A 3 lever short on $NVDA (-1,26 %) (already at +18% since Monday) and long on $WBD (-0,85 %) (just bought still +-0).

But why?

quite simple for me, $NVDA (-1,26 %) can reach the targets, but it will be difficult to meet the market's experience, so there will be a short-term disappointment. I expect -10/-15% and that's where I want to strike on Thursday morning after the figures come out today after the close.

$WBD (-0,85 %) The stock has been strong this year and therefore I expect results that will drive the price up in the short term. These figures are due on 23.02, so a sale is planned for Monday 26.02.

Generally speaking, leverage is a rarity for me, but I'm not going to miss out on the opportunity and have set myself fairly conservative stop-loss limits.

With that in mind, let's see what happens.

PS: Caution is the mother of the porcelain box 😉📈📈📈

Next week will be quite nice:

Monday:

Tuesday:

Wednesday:

Thursday

Friday:

$VZ (+2,32 %) cooperates with $NFLX (+2,43 %) and $WBD (-0,85 %) to offer a "discount streaming bundle" for about $10 per month that includes ad-supported versions. The agreement includes minimum revenue guarantees for Netflix and Warner Bros. Discovery.

Principales creadores de la semana