Debate sobre TSLA

Puestos

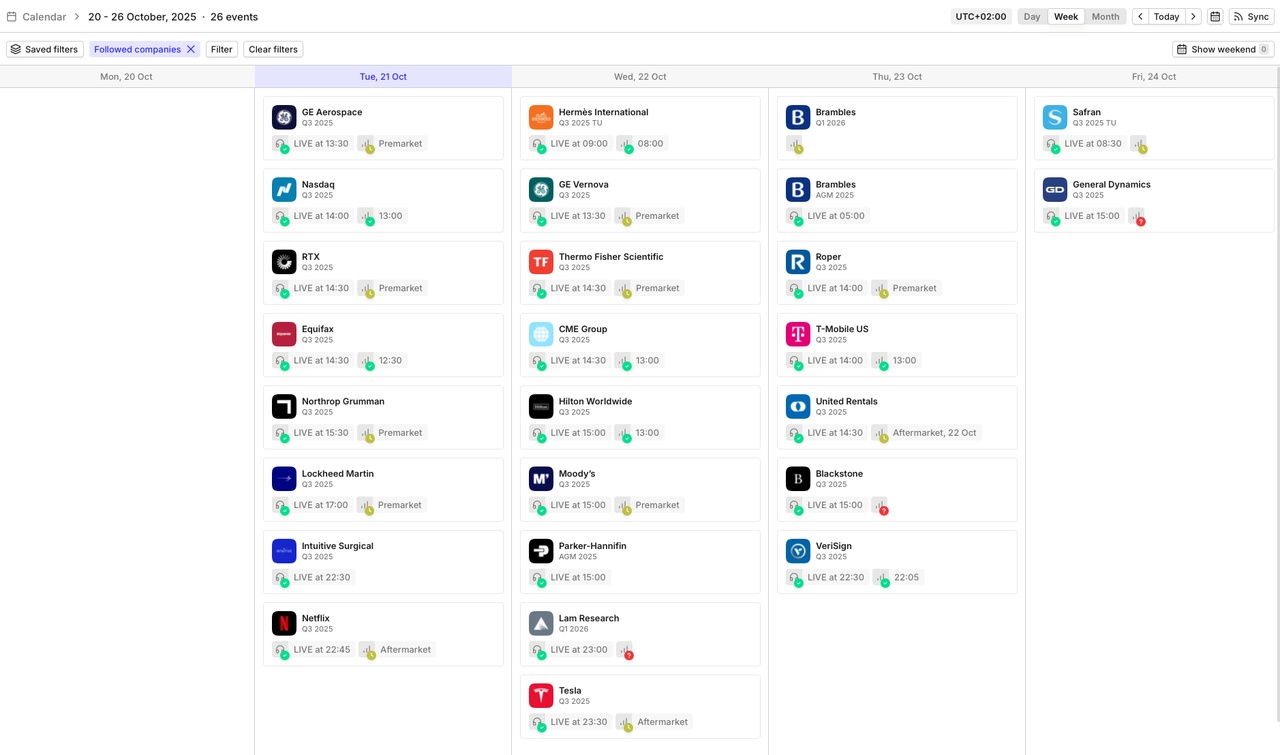

1375Quartalsberichte 21.10-24.10.25

$NDAQ (+3,83 %)

$RTX (+7,72 %)

$KO (+3,79 %)

$MMM (+5,05 %)

$NOC (-0,8 %)

$LMTB34

$OR (+0,3 %)

$TXN (+0,5 %)

$NFLX (+0,25 %)

$HEIA (-0,96 %)

$SAAB B (-1,16 %)

$UCG (-0,51 %)

$BARC (+1,2 %)

$GEV (-0,59 %)

$TMO (+3 %)

$T (+0,2 %)

$MCO (+2,01 %)

$IBM (+0,52 %)

$SAP (+0,9 %)

$TSLA (+0,38 %)

$AAL (+1,55 %)

$FCX (-1,75 %)

$HON (+1,84 %)

$DOW (+1,61 %)

$NOKIA (-0,82 %)

$TMUS (-0,19 %)

$INTC (-0,67 %)

$NEM (-9,3 %)

$F (+5,15 %)

$PG (+0,04 %)

$GD (+0,99 %)

"Be the Bottom you want to see"

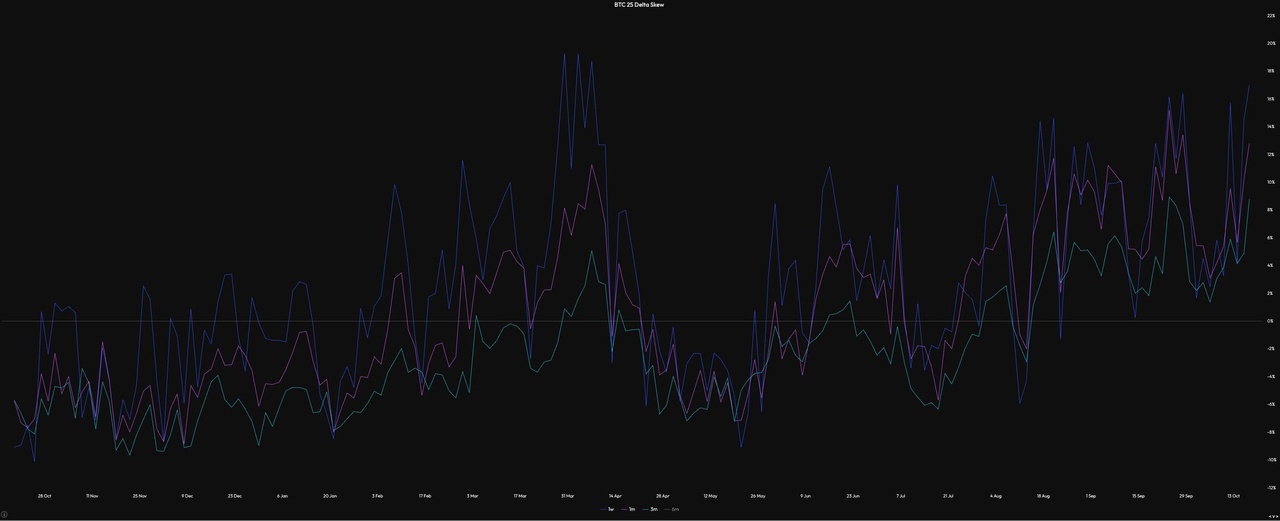

My $BTC (+2,93 %) Thesis: Swing Long.

At the beginning of October, I sold around 20-25% of my BTC spot position at around $124,000. The reason for this was my system, which among other things consists of an order flow algorithm that generated a bearish reversal signal on a high timeframe (HTF).

After we saw an open interest unwind (liquidation of leveraged positions) on October 10, I have now bought back the first €20,000 in BTC. I have placed a further €50,000 via scaled limit orders up to $96,000. This is where the 365d rVWAP is located, which serves as multi-year support.

In this bull market, you rarely get both:

1) Price within 10% of the 350d MA

2) Drawdown of more than -10 % within the last 10d

→ Currently we see both.

Fear and Greed Index: (even though I am not a fan of it, it reflects, among other things, option skew, i.e. the current sentiment):

Options Skew (buying panic puts): at a level we last saw on April Low or September 2024 (both marked the bottom).

Bullish Key Points:

- post deleveraging event

- Extreme Fear on F&G

- BTC skew to multi-year highs

- Commodities look topped

- Q4 seasonality

- FED about to pause QT

- Rate cuts in stocks ATH - $NVDA (-0,26 %)

$TSLA (+0,38 %)

$MSFT (+0,04 %)

$META (-0,04 %)

$AMZN (+2,92 %)

$AAPL (+0,89 %)

$GOOG (-3,77 %)

Derivative trades in difficult market phases

Hello dear community,

With 2,200 followers by now (wow, what a number and thank you for your interest), I would like to show you a practical example of how I try to achieve above-average returns with a good C/R ratio using derivatives, even in uncertain times.

To do this, I bought 2 different derivatives with the same underlying $TSLA (+0,38 %) purchased.

A discount warrant, which I already presented here when I bought it.

At that time, the price was $TSLA (+0,38 %) still well below 400$ and the warrant will then show its full potential when $TSLA (+0,38 %) above 400$ in January. Then the price will be $3.00. So the warrant is more likely to benefit from rising or even sideways prices, since $TSLA (+0,38 %) has already exceeded $400.

I also bought an inliner last week. This will bring 10€ if $TSLA (+0,38 %) between 280$ and 520$ until 18.12. At the time of purchase and even now, the bill is closer to the upper limit than to the lower limit. It therefore benefits more from sideways/downward moving prices than when $TSLA (+0,38 %) rises sharply.

The full profit potential therefore develops from these positions if $TSLA (+0,38 %) the next 3 months fluctuates between 400 and 500$. However, as the profit potential from the current level is greater with the inliner, I can live with it if the price dips below $400. $TSLA (+0,38 %) dips below 400$, as only the price on the valuation date in January counts for the discounter. I have therefore chosen to invest twice as much in the inliner as in the discounter.

In my opinion, the return opportunity at the time of purchase was very good for both at 110% and 200% and there doesn't have to be any price increases. Even slight losses are hedged.

I hope I have been able to explain the logic behind these trades to you, as I am asked more and more often how I intend to be successful with my strategy and achieve these returns if things don't just go up.

If you have any questions, please feel free to ask

And I have another one for the strongly represented

$TSLA (+0,38 %) Faith community. Not quite as lucrative, but also somewhat less risky. The price here will be $3 in mid-January 26 if $TSLA (+0,38 %) then stands at at least 400$. So at least an almost 200% chance.

Here, too, I entered with the same initial position.

🚨 Morgan Stanley just dropped a list of 39 “National Security” stocks

This isn’t your typical watchlist — it’s a who’s who of the companies the U.S. needs to stay ahead in energy, defense, and AI supply chains.

Let’s break it down 👇

⚛️ Nuclear Energy & Uranium:

The U.S. wants energy independence — and that means uranium.

Names like $UUUU (-8,06 %) , $LEU (-4,39 %) , $CCO (-3,82 %) , and $NXE (-5,05 %) are at the center of the nuclear revival. Even micro-reactor plays like $OKLO are making noise as America rebuilds its atomic backbone.

🔋 Batteries & Energy Storage:

$TSLA (+0,38 %) is still here, but the real upside could come from lesser-knowns like $AMPX (next-gen lithium-ion) and $MVST (-0,64 %) (solid-state tech).

These are the quiet enablers of the EV and grid storage boom — and every megawatt stored is national security now.

🪨 Rare Earths & Strategic Metals:

China controls 70%+ of this market — and the U.S. wants out.

Morgan Stanley highlights $MP (-6,44 %) , $CRML (-11,52 %) , $IVN (-3,59 %) , and $WPM (-7,96 %) as key players in securing rare earth supply chains critical for chips, missiles, and EVs.

⚡ Lithium:

Without lithium, there is no clean energy transition.

Watch $ALB (-3,9 %) , $LAC (+1,88 %) , $SGML , and $SLI (-4,42 %) — these are the lifelines for the world’s next battery superpowers.

💡 The takeaway:

This “National Security Index” isn’t just about defense — it’s about control of the future’s raw power: energy, data, and materials.

And the firms on this list aren’t just suppliers — they’re the gatekeepers of U.S. sovereignty in a world of rising geopolitical tension.

If you’re betting on where the big government money flows next… this might be your roadmap.

My eToro Portfolio vs. The Market: A 1-Year Review (+53.63% vs. S&P 500's +16.40%) 🚀

I'm excited to share an in-depth performance review of my eToro portfolio today. I've analyzed the last 12 months, and the results clearly show that a focused strategy can significantly beat the market.

Here are the final numbers, from October 2024 to today:

- 📈 My eToro Portfolio: +53.63%

- 💻 Nasdaq 100 ($NSDQ100): +24.40%

- 📊 S&P 500 ($SPX500): +16.40%

- 🏭 Dow Jones ($DJ30): +9.78%

As the chart shows, not only did I beat the market, I more than doubled the performance of the strongest benchmark index, the Nasdaq 100! This result is proof that a targeted, high-conviction strategy can make a huge difference.

So, how did this happen? Let's break down the key pillars of my winning strategy:

1. Going Beyond the Benchmark

This year, passively investing in a Nasdaq ETF would have been a great move. But my strategy aimed higher. I focused on specific disruptive stocks within the biggest tech megatrends—names with a higher potential for exponential growth than the giants that dominate the index. This active selection is what created the real performance gap.

2. Using Volatility as Fuel

The chart is honest: during the market correction in April, my portfolio dipped lower than all the indices. That's the price of a concentrated growth portfolio. Many would have sold. I held firm, confident in my long-term thesis. The explosive recovery starting in May proved that patience and conviction were rewarded.

3. Active Selection, Not Passive Investing

These results don't come from just buying an ETF. They require active management: studying fundamentals, understanding the macro environment, and having the courage to invest in innovative companies like $RKLB, $OKLO, and $RGTI before they become mainstream.

4. Understanding the Market Narrative

The indices tell a clear story: tech ($NSDQ100) led the market, while industrial stocks ($DJ30) lagged. My strategy fully embraced this trend, concentrating capital where the real growth was happening.

Conclusion

Beating the market is tough. Beating its strongest sector is even tougher. This +53.63% return demonstrates the power of a focused strategy that accepts calculated risk to aim for extraordinary returns.

I'm proud of these results and will continue to share my journey and analysis with full transparency.

PS: The past is a lesson, not a guarantee. But the strategy remains the same: find the companies that will build our future and invest in them with conviction.

⚠️ Disclaimer: Past performance is not an indication of future results. Investing involves risks, including the loss of capital.

https://www.etoro.com/people/farlys

$SPX500 $NSDQ100 $DJ30

$AAPL (+0,89 %)

$MSFT (+0,04 %)

$GOOGL (-3,83 %)

$AMZN (+2,92 %)

$NVDA (-0,26 %)

$TSLA (+0,38 %)

$META (-0,04 %)

$RKLB (-1,28 %)

$OKLO

$RGTI (+1,53 %)

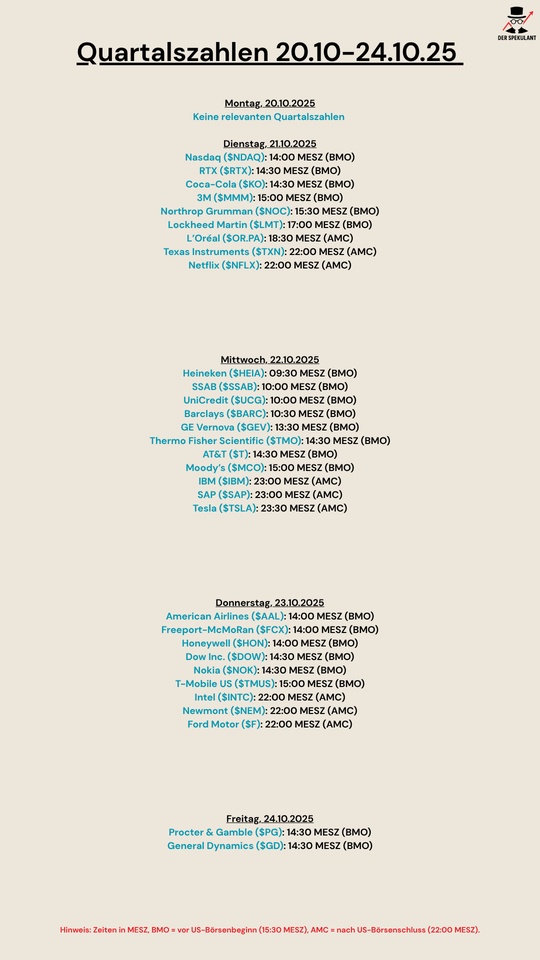

Dates week 42

As every Sunday, the most important news from the past week, as well as the most important dates for the coming week.

Also as a video:

https://youtube.com/shorts/fOHKdrQwBvc?si=tosLS135n4xV06eQ

Monday:

🚗 Car registrations in September:

The German new car market is picking up again! 📈 With 235,528 new registrations there were +13 % compared to the previous year.

🔋 E-cars are growing strongly - almost +33 % to 45,495 vehiclesMarket share 19,3 %.

⚡️ $TSLA (+0,38 %)

Tesla on the other hand, with a decline of -9,4 %.

Overall, the market remained slightly below the previous year from January to September (-0,3 %).

Wednesday:

FOMC minutes show Fed members divided on the way forward. The Fed has cut the key interest rate by 25 basis points. However, some wanted 50 basis points, others wanted no cut at all. Among others, Stephen Miran, who was appointed by Trump, wanted a cut of 50 basis points. Overall, however, most were of the opinion that there should be further rate cuts by the end of the year.

Thursday:

A solution seems to have been found in another conflict. Hamas accepts Trump's plan and releases all hostages 2 years after the massacre.

🔍 Black-Red has just decided this:

✋ Citizen's income is passé - in future the system will be called basic security

⚖️ Stricter sanctions for non-appearance at the job center:

- No reduction after first appointment

- at the 2nd appointment → - 30 %

- at the 3rd appointment → complete deletion

- Rent payment can go directly to the landlord

💸 Property rules tightened, waiting periods no longer apply

👴 Active pension for older employees: up to 2.000 € "tax-free" additional income (from 2026)

🚗 E-car premium returns - with around €3 billion by 2029

🚧 Road construction: additional 3 billion (from microchip fund) for expansion & maintenance

❌ There is still disagreement on phasing out combustion cars

$UMICY (-2,86 %) Umicore has already increased significantly in value this year, but Goldman Sachs still sees potential. In particular, the sale of the recycling company's gold holdings reduces the debt ratio and should therefore have a positive impact on earnings in the long term, according to Goldman. The target price is 21 euros.

Friday:

Donald Trump escalates the trade conflict with China again and depresses share prices just in time for the weekend.

These are the most important dates for the coming week:

Monday: 14:30 Current account balance (DE)

Thursday: 14:30 Producer prices (USA)

Friday: 11:00 Inflation data (EU)

Can you think of any other dates?

The Humanoid 66 - The next industrial turning point

Good morning dear Getquin community 👋

Today I would like to introduce you to The Humanoid 66 and what it's all about. The market for humanoid robotics is just taking off and is facing one of the biggest upheavals since the advent of the automobile. Morgan Stanley and Goldman Sachs expect the market to be worth between 38 billion and three trillion US dollars by 2035. By 2050, over 60 million humanoid robots could be in use in the USA alone.

With The Humanoid 66, Morgan Stanley has compiled a list of 66 companies that are likely to benefit directly or indirectly from this development. These include not only the manufacturers themselves, but also suppliers and technology groups that provide the necessary infrastructure, from semiconductor and battery producers to sensor technology and software through to platform operators for artificial intelligence.

The leading players include $TSLA (+0,38 %) Tesla with Optimus, Figure AI with Figure 02, Agility Robotics with Digit, Boston Dynamics with Atlas and Unitree with H1 and G1. Tesla is already planning to use more than a thousand Optimus robots in its own factories by 2024. The goal is clear: to make humanoid machines suitable for mass production at prices between 20,000 and 30,000 US dollars. Figure AI works closely with $MSFT (+0,04 %) Microsoft, OpenAI and $BMW (+0,12 %) BMW and was able to raise over 675 million US dollars in a financing round.

Technological progress is the key driver of this development. Multimodal generative AI enables humanoid robots to understand speech, communicate with humans and perform tasks autonomously. Advances in actuator technology, LiDAR systems, force sensors and battery technology are making the machines more efficient and more human-like. The energy density of modern lithium-ion cells is increasing by around 20 percent every two years, while the cost per kilowatt hour is expected to fall to 80 US dollars by 2030.

At the same time, wage costs for human labor are rising significantly. In the USA, they currently stand at just under 40 US dollars per hour, while in China they are around 6.50 US dollars and in India 4.45 US dollars. Studies show that automation can reduce labor costs in industrialized countries such as Germany, Japan and the USA by up to a third by 2025. Sectors such as agriculture, construction, care, logistics and manufacturing, where millions of jobs remain unfilled today, will be particularly affected.

The Humanoid 66 shows that this change goes far beyond individual companies. A new industrial ecosystem is emerging that links hardware, software, energy and data. Price reduction, scalability and integration into existing value chains will determine who will be among the winners.

Takeaway: Humanoid robotics is no longer a vision of the future, but the beginning of a structural reorganization of the global economy. Those who invest early in key areas such as AI chips, batteries, sensor technology and automation are positioning themselves in a sector that is likely to have a similarly profound impact as the invention of the car. The crucial question is just how far society is prepared to accept and integrate this new form of workforce.

For those who want to delve deeper: These are the companies featured in the Morgan Stanley report Humanoids @Tenbagger2024

@Multibagger

1. Tesla - USA - $TSLA (+0,38 %)

2. Toyota - Japan - $7203 (+1,51 %)

3. Xpeng - China - $XPEV (+1,63 %)

4. Naver - South Korea - (not listed)

5. CATL - China - $3750 (+3,44 %)

6. LG Energy Solution - South Korea - $373220 Subsidiary of LG

7. Samsung / Samsung SDI - South Korea - $SMSN (-2,02 %)

8. SK Innovation - South Korea - $096770

9. HD Hyundai Infracore / Doosan (component) - South Korea - $042670

10. Hengli Hydraulic - China - $601100

11. NTN - Japan - $6472 (+0 %)

12. NSK - Japan - $6471 (-0,46 %)

13. Sanhua - China - $002050

14. Siemens - Germany - $SIE (-0,82 %)

15. Top Group ("Topu") - China - $601689

16. Ambarella - USA - $AMBA (+0,48 %)

17. Synopsys - USA - $SNPS (+1,23 %)

18. NXP - Netherlands / USA - $NXPI (+1,99 %)

19. Qualcomm - USA - $QCOM (+0,92 %)

20. TSMC - Taiwan - $TSM (-0,68 %)

21. Wolfspeed - USA - $WOLF

22. ARM - UK - $ARM (+0,2 %)

23. onsemi - USA - $ON (+1,03 %)

24. cadence - USA - $CDNS (+1,53 %)

25. STMicroelectronics - Netherlands - $STM (+2,7 %)

26. NVIDIA - USA - $NVDA (-0,26 %)

27. SK hynix - South Korea - $HY9H (-3,95 %)

28. sociionext - Japan - $6526

29. SMIC - China - $0981

30. infineon - Germany - $IFX (+3,34 %)

31. Renesas - Japan - $6723 (+3,22 %)

32. Dassault Systèmes - France - $DSY (+1,49 %)

33. Mobileye - Israel / Intel ecosystem - $MBLY

34. Hexagon - Sweden - $HEXA B (+1,25 %)

35. Knight Transportation - USA - $KNX (+0,98 %)

36. DSV - Denmark - $DSV (-1,33 %)

37. Werner Enterprises - USA - $WERN (+3,29 %)

38. DHL Group - Germany / international - $DHL (-0,4 %)

39. Kuehne + Nagel - Switzerland - $KNIN (+0,53 %)

40. Obayashi - Japan - $1802 (-1,37 %)

41. China State Construction Engineering Corporation (CSCEC) - China - $601668

42. RBG (presumably an Asian construction company) - (not listed)

43. Shimizu - Japan - $1803 (-2,18 %)

44. Taisei - Japan - $1801 (-0,81 %)

45. Baker Hughes - USA - $BKR (-1,03 %)

46th SLB (Schlumberger) - USA - $SLB

47. Tenaris - Luxembourg / multinational - $TEN (+0,23 %)

48. Halliburton - USA - $HAL (+8,58 %)

49. amazon - USA - $AMZN (+2,92 %)

50th Coupang - South Korea $CPNG (-0,53 %)

51. JD.com - China - $JD (-1,89 %)

52. BMW - Germany - $BMW (+0,12 %)

53rd Mercedes-Benz - Germany - $MBG (+0,52 %)

54th General Motors - USA - $GM (+16,35 %)

55. BYD - China - $1211 (-1,66 %)

56. Stellantis - NL / multinational - $STLAM (+3,78 %)

57. Ford - USA - $F (+5,15 %)

58. McDonald's - USA - $MCD (+0,34 %)

59th Domino's - USA - $DPZ (-0,8 %)

60. BGF Retail - South Korea - $282330

61. GS Retail - South Korea - $007070

62nd Lotte - South Korea - $004990

63. Yum China - China - $YUMC (+0,86 %)

Source: Morgan Stanley Research Bluepaper Humanoids Investment Implications of Embodied AI and Stock3 drumbeat of Germany's humanoid robot manufacturers The Humanoid 66, 05.10.2025

Taking profit on Tesla or not?

for the moment I am currently +/-120% in profit on $TSLA (+0,38 %) and 9,54% allocation of my total portfolio.

would you take your profit and let it run?

would you wait and leave it there?

sell it all?

I like to hear your opinion on this matter.

if I would sell, I would relocate to more dividend paying stocks to increase my income and reinvesting budget.

Love to hear what you would do in this case and where would you relocate your profit.

thanks in advance

getquin community

🚘 Breaking: Tesla presents new entry-level variants! 🚘

Today $TSLA (+0,38 %) made headlines with the unveiling of its new standard versions of Model 3 and Model Y - a strategic response to declining demand and increasing competitive pressure.

🔍 What's new?

- The Model 3 Standard starts at around 36,990 USD, the Model Y Standard at 39,990 USD.

- To reduce costs, various features will be removed or slimmed down: fewer speakers, simpler interior materials, no FM/AM radio, elimination of Autosteer in the basic version, among others.

- Range: Both models should be able to travel around 321 miles (≈ 517 km).

- Deliveries will begin between November 2025 and January 2026

- Despite the more moderate prices, Tesla shares slipped significantly after the models were announced - many investors had expected more.

- The reason: these "budget versions" remain far removed from the often-cited goal of a truly affordable electric car (e.g. under USD 30,000).

- In addition, Tesla's previous unique position is dwindling: competition from China and other markets is putting pressure on prices and margins.

I really like the cars myself. Beautiful design and a pioneering car in electromobility. I have been invested in Tesla for a long time and will remain so.

What do you think of the new models and the company?

Valores en tendencia

Principales creadores de la semana