I am convinced of the share $TEM (+3,96 %) I am convinced of the share and will certainly buy it again, but I have reduced my AI risk in the derivatives area somewhat further.

Debate sobre TEM

Puestos

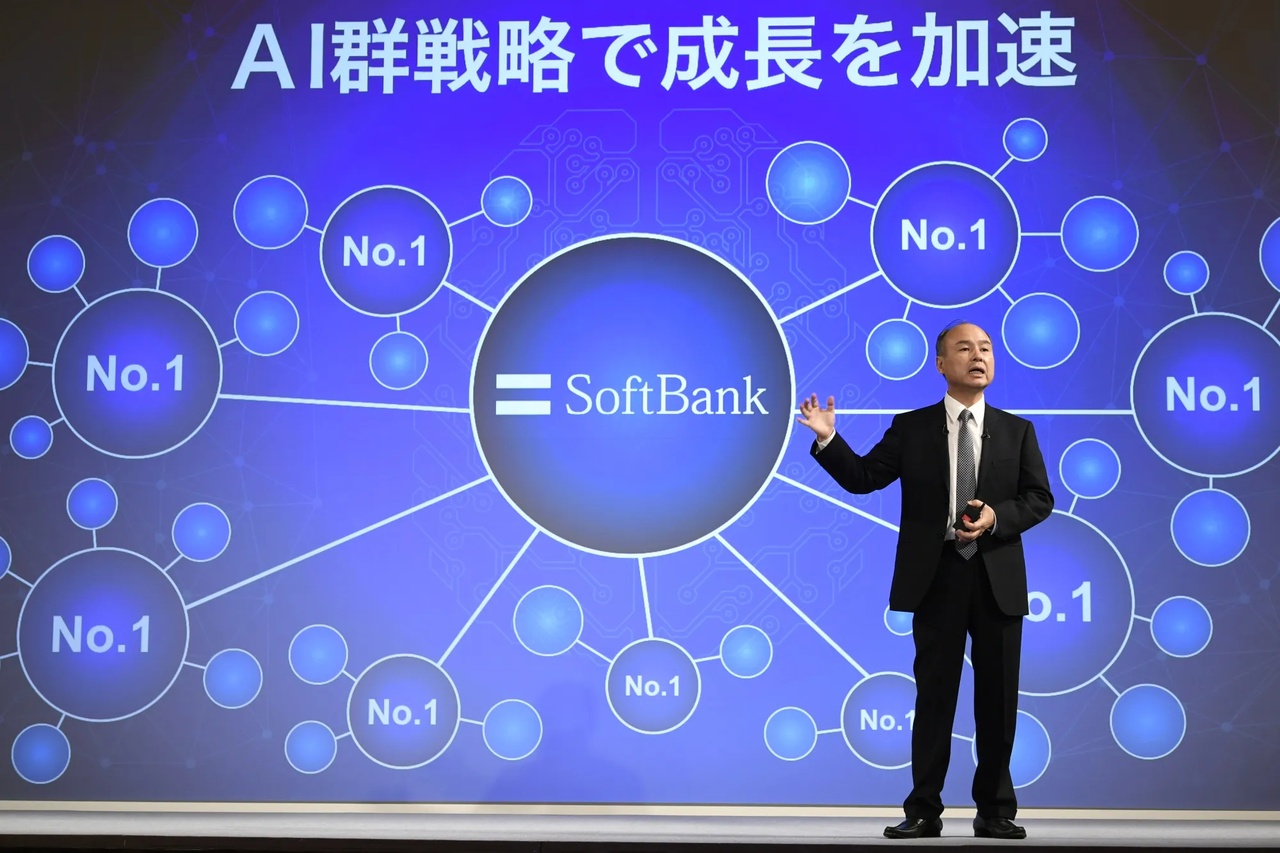

17SoftBank update ℹ️ - share price gains of over 150%

I have already described here several times this year why I think that the SoftBank Group share $9984 (+7,75 %) is a top pick when it comes to AI. Now the share price confirms this assumption with an increase of more than 150% since April.

What is the reason for the sharp rise? The answer is short and clear: AI. The reorientation towards everything to do with AI in order to "become the number 1 platform provider for AI" has caused the share price to explode.

So many new projects were announced in 2024/2025 that it was impossible to keep up. The 500 billion dollar Stargate project in the USA and the 40 billion dollar financing round for OpenAI were particularly prominent.

Added to this is a strategic investment of 2 billion dollars in Intel $INTC (+3,09 %)the announcement by the portfolio company ARM $ARM (+1,47 %) to switch from pure IP licensing to its own chip design, a JV with OpenAI for enterprise AI in Japan, a JV with TempusAI $TEM (+3,96 %) for medical AI in Japan, a JV with Intel for the development of energy-efficient memory chips (Saimemory) an IPO of the portfolio company and No. 1 fintech in Japan PayPay in New York, the plan together with NVIDIA $NVDA (-0,21 %) to convert the Japanese telecommunications network for AI workloads (AI-RAN), several data centers under construction (independent of Stargate)........ The list could go on and on, but I think the message is clear.

In my opinion, no company is so broadly positioned when it comes to AI. From energy (SoftBank Energy), to the chips used (ARM, Ampere, Graphcore), to the data center as a whole (Stargate, others), to the AI itself (OpenAI) and the AI applications (various). They are active along the entire value chain.

I was also skeptical at first about how to manage all of this at once, also in terms of the sheer amount of work involved, but the first results are becoming visible. SoftBank is building 2 data centers with a capacity of 1.5 GW with OpenAI as part of Stargate. The fact that they are only involved in part of the Stargate data centers and then only with OpenAI is very positive, as I consider the projects on this scale to be very realistic. In addition, there are no conflicts about the technology to be used and SoftBank can clearly favor its portfolio companies in everything.

It will also be interesting to see how the 40 billion financing round progresses. The second half should be invested by the end of the year. With an agreed valuation of 260 billion dollars (plus cash 300), SoftBank should hold around 10% of OpenAI after the financing round. Now that NVIDIA has announced that it will invest 100 billion in OpenAI, although it is still unclear when, how and at what valuation, this is likely to have a massive impact on the value of SoftBank's stake.

The two Vision Funds are also doing well and have recovered from the difficult years. They are now another positive influence on the company's profits. However, they are becoming less and less important as more and more staff are withdrawn from them to work on the AI projects. Fewer new positions are also being added and some older ones are being liquidated.

I am particularly interested in how SoftBank's chip design ambitions will develop over the next few years. Now already in possession of three chip designers (ARM, Ampere Computing and Graphcore), a partnership with Intel (Saimemory) and a strategic stake in the Japanese giga start-up Rapidus, the focus is becoming increasingly visible. How quickly will the restructuring of ARM take shape? Will individual portfolio companies be merged? Will Rapidus, with its impressive interim results, be a success?

These questions will continue to occupy me over the next few years and I will continue to keep a close eye on the milestones achieved so far. The 2030s could definitely be transformative for the SoftBank Group.

Share analysis

Good evening,

I would like to take a closer look at various companies. To understand, is there potential, which figures are important, price/earnings ratio, profit growth... I find it a bit difficult. Is there something like a guide or something similar for stock analysis, so that I can simplify the procedure of how to approach a stock analysis? Can you recommend anything? I would be very grateful for any tips. 😊

I would currently like to take a closer look at these: $SOFI $BMNR (+4,21 %)

$TEM (+3,96 %)

$DDOG (+0,69 %) ...

Greetings 👋🏽

2. profitability: profit growth, margins, return on equity and ROIC development

3. shareholder reward: dividends, buybacks, share price performance

4. security: debt history, interest coverage, book value and net asset value per share

5. current valuation and fair value

6. comparison of key figures with competitors in order to better classify the figures.

This is how I do it. On my YouTube channel Nicole's Stock Profiles you can see videos where I do this for various companies. However, your companies are not yet included.

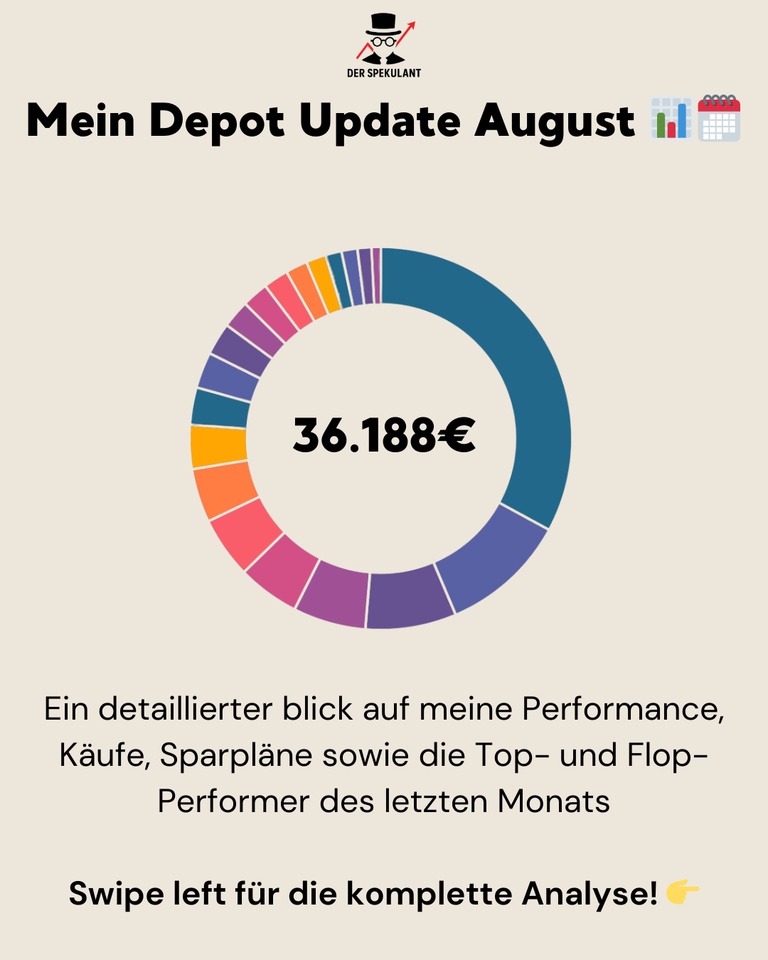

My portfolio update August 2025: Strength despite tech weakness & tactical realignment 📊🗓️

Hello Community,

August is over and it's time for the transparent monthly review. The portfolio has reached a new high of € 36,188. It was a month of contrasts, in which the strength of some satellites offset the weakness in the tech sector.

1. the performance: 🚀

Beating the market 📈

With a monthly performance of +0,94% I am very satisfied. As the chart shows, my portfolio clearly outperformed the broad market (FTSE All-World: -0.31%) and the major US indices (S&P 500: -1.11%, NASDAQ100: -2.23%). The result proves the strength of diversification: while my tech stocks corrected, other sectors carried the performance.

2. my buys & sells: 🛒

None ❌

In August, I deliberately kept my feet still and did not make any individual purchases or sales. My focus was on waiting for the important quarterly reports and preparing my tactical purchases for September.

3. my savings plans & purchases in September: Tactical allocation 💸

As you know, I take a flexible approach to my individual shares and adjust my purchases on a monthly basis. Only my ETF savings plans run consistently. My allocation for the start of September looks like this:

➡️ $ACWI

$WSML (+0,85 %) (150 €): As always, the foundation is being consistently strengthened.

➡️ $MELI (+1,22 %) (€150) & Datadog (€75): Here I continue to build on my core conviction positions.

➡️ $TEM (+3,96 %) (125 €): This is my tactical pick for the month. I am opening a position in a highly potent and diversifying bet on the AI medical revolution.

➡️ $DDOG (+0,69 %) (75 €): A core position in my cl infrastructure cluster. Digital transformation and the need for cloud monitoring and security are unwavering megatrends for me.

➡️ $NOVO B (+2,09 %) (3 €): This is not an active allocation, but the automatic reinvestment of dividends received to maximize the compound interest effect for this quality position.

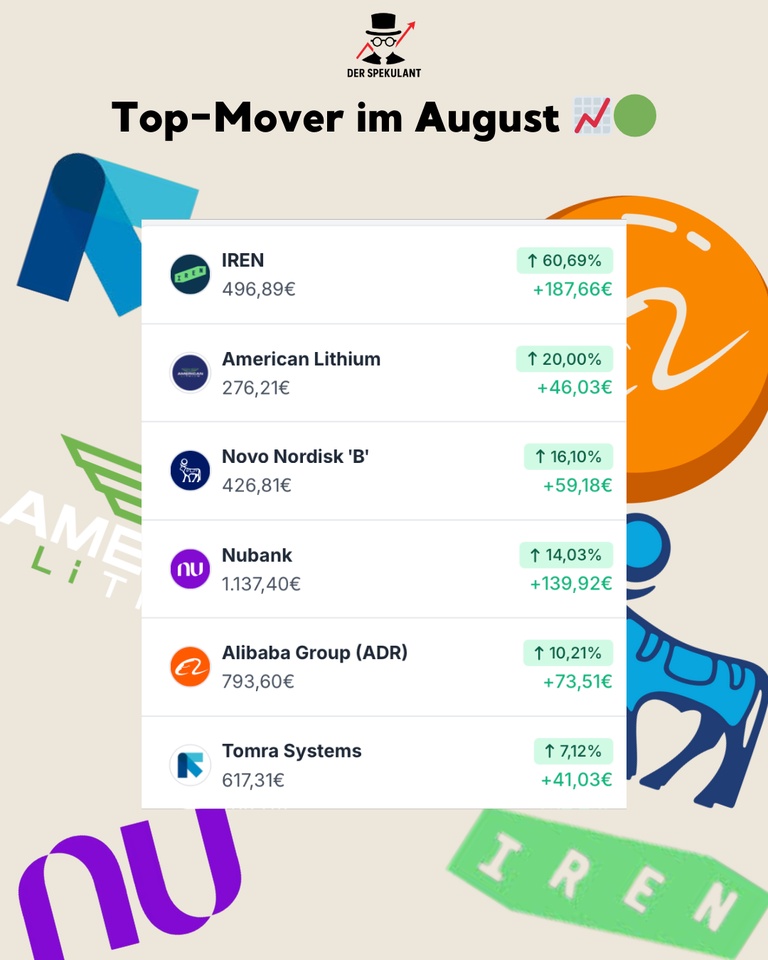

4. tops & flops: A reflection of the rotation 📉📈

Top mover: 🟢

The list was topped this month by the spectacular performance of $IREN (+4,32 %) (+60.69%), which is benefiting from the continuing demand for energy for AI data centers. My speculative bet on American Lithium (+20.00%) also showed strength. The recovery in $BABA (+0,14 %) (+10.21%) following good news on the cloud division and AI chip development.

Flop mover: 🔴

As expected, my tech stocks were hit here. $CRWD (+0,94 %) (-11.16%) and $DDOG (+0,69 %) (-5.45%) suffered and the weak market environment for growth stocks, although the quarterly figures were fundamentally good. Also $1211 (-1,35 %) (-8.22%) also suffered after disappointing figures; the situation here remains tense.

Conclusion:

August was perfect proof of why broad diversification across different sectors and themes is so crucial. Weakness in one area (US tech) was more than compensated for by strength in others (energy, China recovery). My flexible approach to monthly purchases allows me to react specifically to such market phases.

How did your August❓ go?

Which shares did you buy tactically ❓

I look forward to the exchange in the comments!

+ 2

However, I'm surprised that, despite your speech, you don't diversify either in terms of asset classes or strategies. Why not? 🤔

Derivatives must also be expanded

That's why I treated myself to the not quite so hyped $TEM (+3,96 %) with a small derivative.

Re-purchased - my current purchases at a glance

I did manage to buy some more at the end of the week (yesterday) and filled my portfolio a little more. 📈

I bought:

- 150 × $ADS (+0,77 %) at € 167.00 → € 25,050

- 40 × $ASML (+0,89 %) at € 610.00 → € 24,400

- 340 × $PYPL (+0,6 %) at € 58.80 → 19,992

- 300 × $FTNT (+0,67 %) at € 65.90 → € 19,770

- 180 × $TEM (+3,96 %) at € 54.50 → € 9,810

- 22 × $VOW3 (-0,87 %) at € 95.20 → € 2,094

Total sum: € 101,116

Let's see how this develops, in any case I'm well covered for now. 🚀

Have a nice weekend!

Tempus AI Q2’25 Earnings Highlights

🔹 Adj. EPS: $(0.22) (Est. $(0.24)) 🟢; +65.1% YoY

🔹 Revenue: $314.6M (Est. $296.85M) 🟢; P +89.6% YoY

🔹 Adj. EBITDA: $(5.6M)

FY25 Guide:

🔹 Raises Revenue to ~$1.26B (Est. $1.245B) 🟢; UP +82% YoY

🔹 Adj. EBITDA of $5M; +$110M improvement YoY

Segment::

🔹 Genomics Revenue: $241.8M; UP +115.3% YoY

🔹 Oncology Testing: $133.2M; UP +32.9% YoY; ~26% volume growth

🔹 Hereditary Testing: $97.3M; UP +33.6% YoY; ~32% volume growth

🔹 Data & Services Revenue: $72.8M; UP +35.7% YoY

🔹 Insights (Data Licensing): UP +40.7% YoY

Other Metrics:

🔹 Cash & Marketable Securities: $293.0M; +$70M QoQ

🔹 Issued $750M of 0.75% convertible senior notes to refinance higher-interest debt

CEO Commentary:

🔸 “We saw significant re-acceleration of our clinical volumes which grew 30% in the quarter, as we delivered more than 212,000 NGS tests.”

🔸 “Combined with our continued leadership in AI and progress toward building the largest foundation model in oncology, we’re hitting our stride as we approach our 10th anniversary.”

Strategic Updates:

🔹 Expanded Tempus Next™ AI-driven care pathways into breast cancer

🔹 Integrated Tempus One™ AI clinical assistant into leading EHR systems

🔹 Launched Tempus xM™ liquid biopsy assay for immunotherapy monitoring

🔹 Expanded MRD partnership with Personalis to include colorectal cancer

🔹 Reached >350 petabytes of connected clinical & molecular data from >40M patient records, ~4M sequenced samples

+++ My current watchlist +++

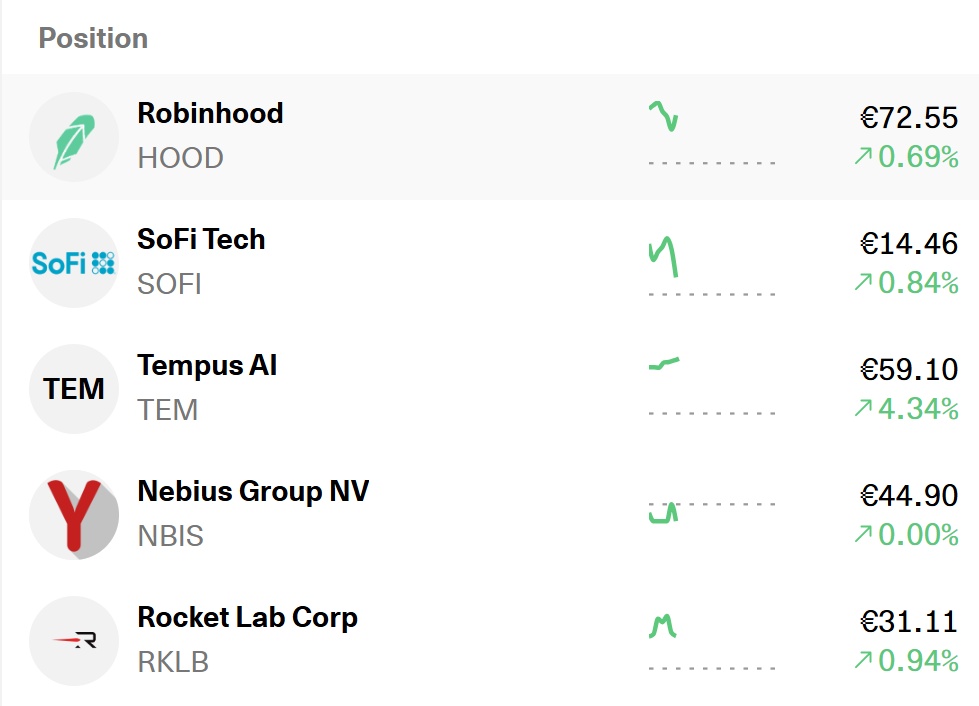

My current watchlist consists of:

My favorite is Rocket Lab, I already did an analysis last week and am waiting for an entry very shortly: Multiple and FCF for the future I would like to enter at 18-20€. If I don't succeed, there are plenty of other opportunities + I have hardly any cash at the moment anyway!

Tempus AI Q1'25 Earnings Highlights

🔹 Revenue: $255.7M (Est: $248M) 🟢

🔹 Adj EPS: ($0.24) (Est: -$0.27) 🟢

🔹 Adj EBITDA: ($16.2M) (Est: -$22M) 🟢

FY25 Guidance

🔹 Revenue: $1.25B (Est: $1.24B) 🟢

🔹 Adj EBITDA: +$5M (Est: $5M) 🟡

Other Q1 Metrics:

🔹 Net Loss: ($68.0M) (vs. $64.7M YoY)

🔹 Gross Profit: $155.2M (vs. $77.7M YoY) +99.8%

🔹 Gross Margin: ~61%

Segment Breakdown

🔹 Genomics Revenue: $193.8M (+88.9% YoY)

🔹 Oncology Testing: $119.0M (+31% YoY)

🔹 Hereditary Testing (Ambry): $63.5M (+23% unit growth)

🔹 Data & Services Revenue: $61.9M (+43.2% YoY)

🔹 Insights/Data Licensing Growth: +58% YoY

Strategic & Operational Highlights

🔸 Secured $200M in model/data licensing deals via AstraZeneca & Pathos collaboration

🔸 Completed Ambry Genetics acquisition

🔸 Announced new partnerships with Illumina & Deep 6 AI

🔸 Launched olivia, an AI-powered personal health concierge

🔸 National rollout of xT CDx test at $4,500 per test

🔸 Adj EBITDA improved by $27.8M YoY

Tempus AI Q4'24 Earnings Highlights:

🔹 Adj. EPS: -$0.18 (Est. -$0.17) 🔴

🔹 Revenue: $200.7M (Est. $202.94M) 🔴; UP +35.8% YoY

🔹 Gross Profit: $122.1M (Est. $119.64M) 🟢; UP +49.7% YoY

FY25 Guidance:

🔹 Revenue: ~$1.24B (Est. $1.048B) 🟢; UP ~79% YoY

🔹 Adjusted EBITDA: ~$5M (Improvement of ~$110M over 2024)

Segment Performance (Q4'24):

Genomics

🔹 Revenue: $120.4M; UP +30.6% YoY

🔹 Unit Growth: UP +22.5% YoY

Data & Services

🔹 Revenue: $80.2M; UP +44.6% YoY

Key Metrics:

🔹 Net Revenue Retention: 140%

🔹 Total Remaining Contract Value: $940M

🔹 Adj EBITDA: -$7.8M (Est. -$6.57M) 🔴 (Improved from -$35.1M YoY)

🔹 Net Loss: -$13M (Est. -$28.3M) 🟢 (Improved from -$50.5M YoY)

🔹 Gross Margin: 60.8% (Est. 59.08%) 🟢

Strategic Updates & Announcements:

🔸 Closed Ambry Genetics acquisition on Feb 3, 2025.

🔸 National launch of xT CDx (FDA-approved NGS-based diagnostic) with $4,500/test reimbursement.

🔸 CMS approval for Tempus ECG-AF algorithm reimbursement at $138/algorithm.

🔸 Signed in-network agreements with Blue Cross Blue Shield of Illinois, Blue Shield of California, and Avalon Healthcare.

🔸 Expanded network to ~3,000 providers in the U.S.

CEO Eric Lefkofsky Commentary:

🔸 "Our 2024 performance highlights the strength of our core businesses, with Genomics driving volume growth and Data delivering record results. AI continues to transform diagnostics, and we are well-positioned for robust revenue growth and positive Adjusted EBITDA in 2025."

Valores en tendencia

Principales creadores de la semana