I initially bought shares of Celestica $CLS (-1,61 %) because I saw it as a clear beneficiary of the AI boom. It felt like an undervalued gem:

· A pristine balance sheet

· Strong fundamentals

· A valuation that simply didn’t reflect its growth potential.

That conviction paid off: my total position was up 235% at the time of selling.

My first purchase was at €20.54 per share. I added twice more, at €48.80 and again at €90.00. I recently trimmed my position, selling part of it at €133.50.

I still believe in the company’s long-term vision. The pipeline of new products, the ramp-up in production, and the explosive growth of hyperscalers all suggest a promising future. However, valuation has run ahead of fundamentals, and that’s where I draw a line. The stock now commands a premium that no longer aligns with the initial reasons I bought in.

Additionally, Celestica still has concentrated exposure to a few large clients, both in terms of revenue and geography — a risk that’s grown too large for the current weight it had in my portfolio.

I’ve decided to keep 75% of my position. The stock remains in a strong bullish trend, and there could be further upside in the short term. But I’m also being cautious. With the potential impact of U.S. tariffs — which may or may not materialize, depending on how serious Trump’s rhetoric turns out to be — I'm choosing to de-risk a little.

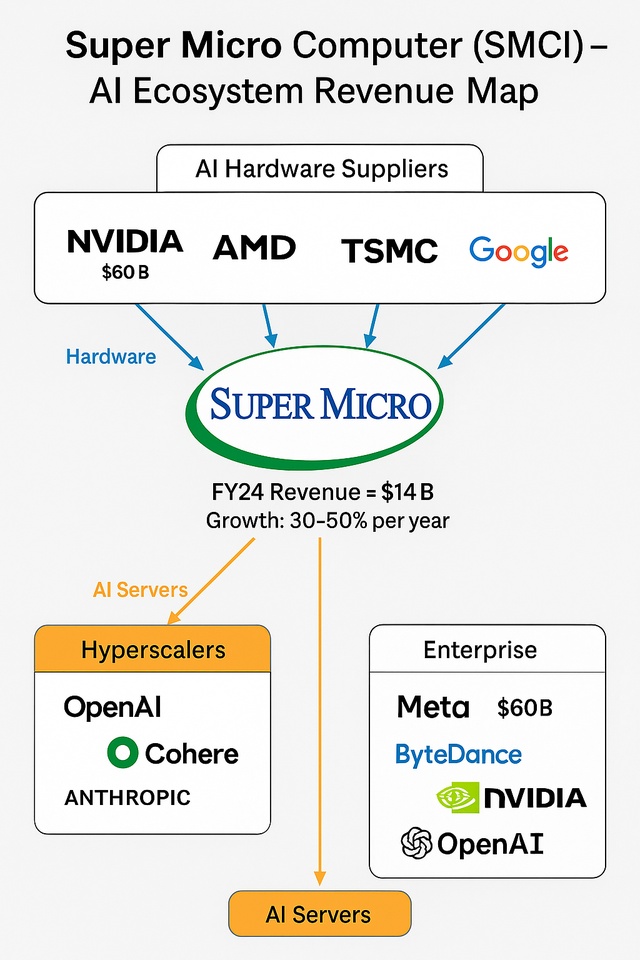

I’ve learned from past mistakes with $SMCI (-1,22 %) (sold 100% for less than half the price of its peack) and $APP (-0,36 %) (keeping 100% of it), where I held onto full positions despite feeling the stocks were clearly overvalued. I could have sold partial positions and added back later at much better prices.

If $CLS (-1,61 %) experiences another meaningful pullback, I’ll likely buy back in. For now, the proceeds from this partial sale will remain ready for better opportunities or better entry points. That said, $CLS (-1,61 %)

still holds the third-largest position in my portfolio — and for good reason.