Introduction:

The Sonos ($SONO (+0,5 %) ) share is fundamentally overvalued and has suffered a 70% decline since 2021. The company's growth does not exactly speak for itself and I am also unsure whether the new CEO will put the company back on a growth path why I find the current valuation with a FWD P/E of 19.89 overpriced.

Fundamentals:

At first glance, Sonos appears to be fairly valued in fundamental terms they have achieved a PS ratio of 1.1 due to the sharp fall in the share price. Nevertheless, a P/S ratio is not suitable here, if we look at the FWD PE if Sonos becomes profitable, this is 19.89 without growth, which is clearly too much without growth.

This assumption is based on two missing properties:

1: Growth

2: Profitability

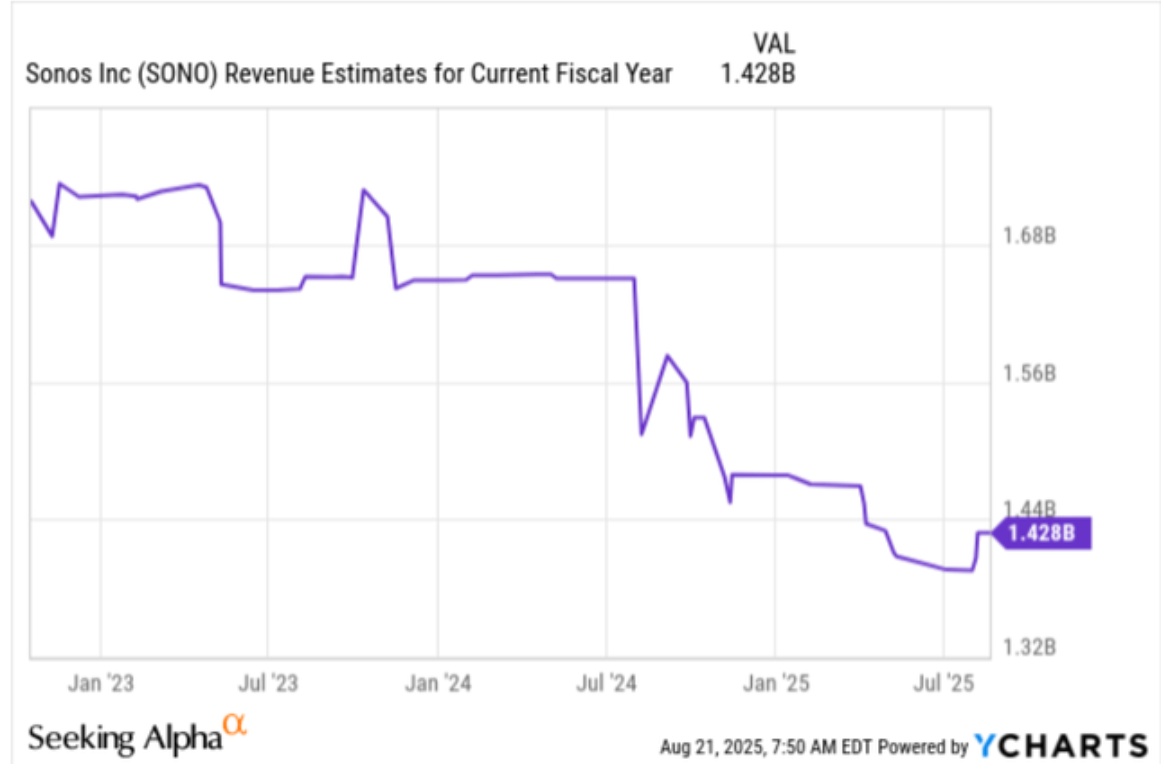

1: Let's first look at the missing growth, which has fallen in recent years to $1.41 billion and thus has a YoY decline of -10%. And I also see no potential for this turnover to rise sharply again in the coming quarters as Sonos is hardly bringing any innovation/diversification to the business and is therefore stagnating.

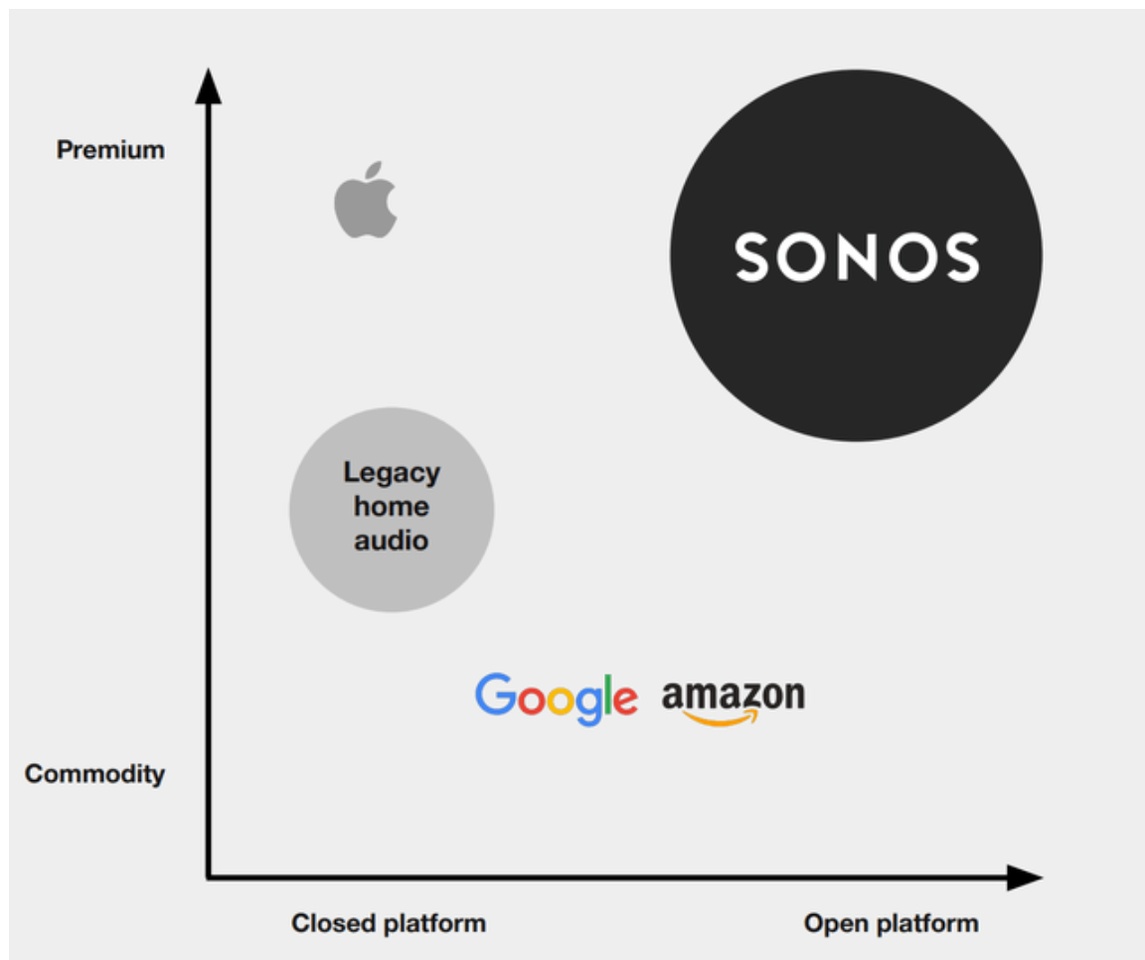

2: The catastrophic profitability of Sonos although they have been an established player in the sound business for years and see themselves as a premium manufacturer, they have not yet managed to generate a sustainable positive EPS. The current EBIT margin is currently -3.53% with a five year average of 2.63 which doesn't look rosy and to me shows too much uncertainty for the future as they are not expanding their business and are outcompeted by big competitors who have a stronger business segment such as Sony, Dolby and others. In addition, the market is expected to grow at a CAGR of 5.25% until 2035, this shows that the market is small with a lot of competition and, in my opinion, a poor market position that is degrading with slow growth.

To summarize, I think Sonos is currently valued too expensively and with a FWD P/E with a possible profitability of 20 with hardly any growth, I don't see an growing company ahead of me. In addition, the growth opportunities in the next few years are limited they are only in the speaker market, which is growing very slowly and therefore, in my opinion, will not lead to any overperformance.

Outlook:

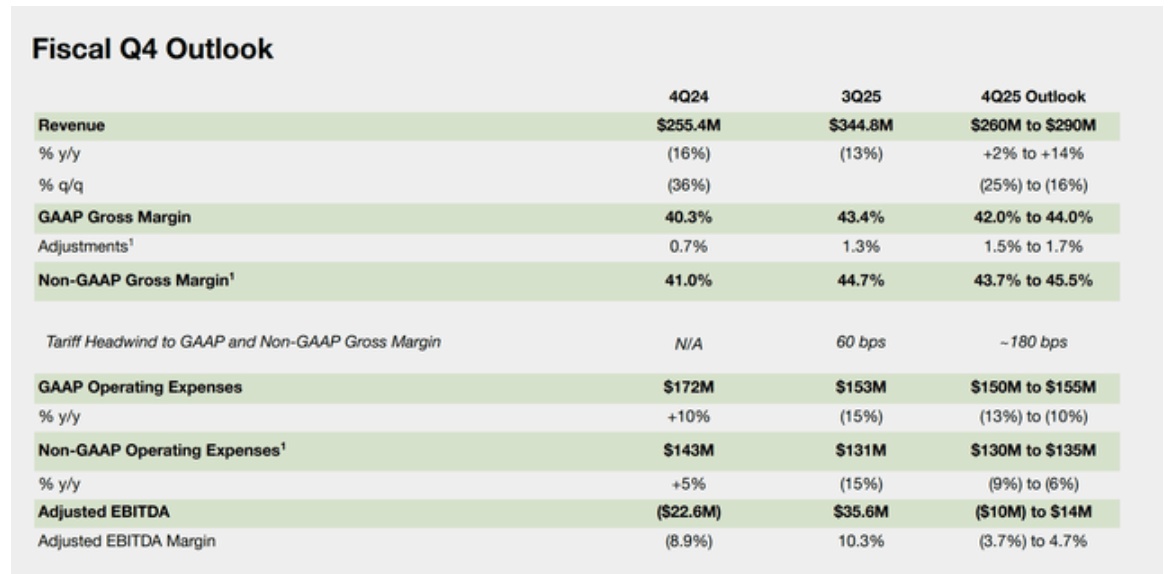

The future of Sonos doesn't look like they can deliver a future turnaround, the new CEO has been down for a year and sales are still down 16% resulting in a negative EBITDA of $22.6 million which confirms my problems to begin with.

Analyst Ratings:

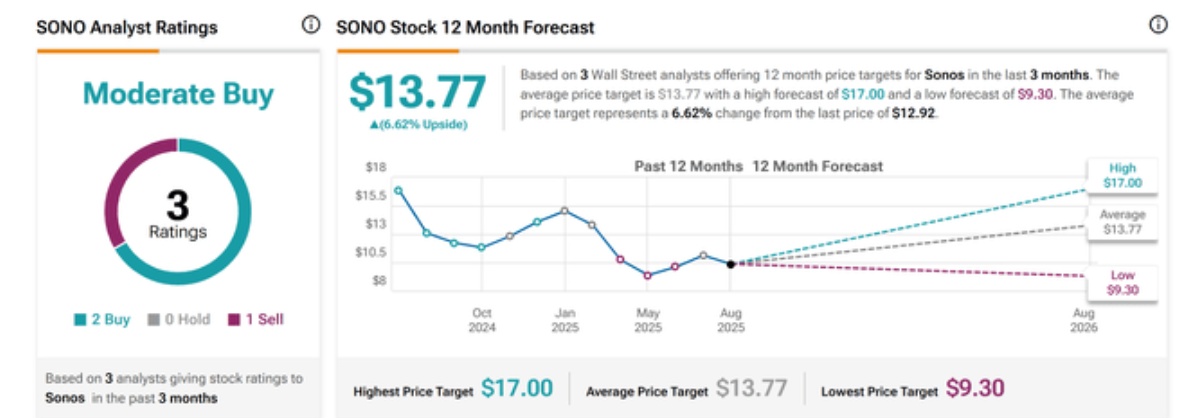

Wallstreet analyses are also not exactly bullish when it comes to the Sonos share. In total, there are currently 3 forecasts. Thereby 2 Buy/ 1 Hold with a target price of +1%. This also confirms my bearish perspective on Sonos.

Technicals:

The Sonos share does not look good the years-long downtrend confirms the current bearish momentum. For this reason and the fundamental I find Sonos unattractive. The trend is your friend and this is clearly bearish, we are at the upper end of the trend channel with an RSI of 62 and semi-good fundamental data, so the correction towards $6 can continue. This is then reinforced by the volatility spikes at $9-$11.

Bullish Risks

1: Risks that would change my thesis could be a DCF analysis at first glance. A current DCF analysis of mine suggests that the current fair value over 5 years at Sonos would be +34%, i.e. $17.9, but I do not see it that way. On the one hand, this is due to the FCF, which is very volatile at Sonos and fluctuates ennormally depending on spending and market antics. They have not managed to become sustainably profitable, which the FCF analysis thus assumes with a steady growth of 6%. For example, I have shown a negative FCF for half of the years in this period, which results in a sobering fair value of only +4% and this is already more of a positive assumption. Therefore, I do not see a DCF analysis on Sonos as 100% accurate as the company does not have a sustainable FCF, but if they could achieve this, a growth path would be possible.

2: In addition, there was a CEO change at Sonos at the beginning of 2025 and 200 employees were laid off to save costs and put Sonos back on a growth path. These changes and changes could change the business/generate sales and thus create a sustainable profit balance with a fair PE ratio.

Conclusion:

I do not invest in companies that are unprofitable and without growth so that there is no future profitability and return and therefore the company is currently unattractive. Everything is too uncertain for me Sonos has destroyed its brand in the past and they have a long way to go for a turnaround, which is why I am not buying here for the time being. In addition, there have been problems with the Sonos app for years that have made many users, including myself, dissatisfied, which is the basis for future growth. I therefore end the analysis with a bearish rating and a quote from Steve Jobs about Sonos:

No one wants what they are selling

I hope you enjoyed the analysis, I put a lot of time into it.