Very objective analysis of $NOW (-0,41 %) If you are interested in the share, please do.

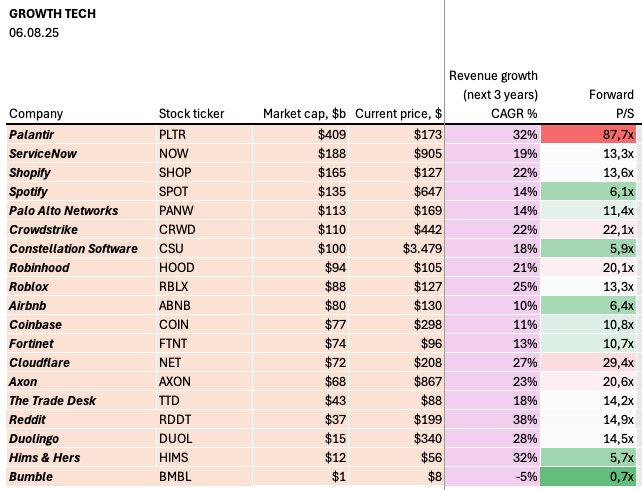

ServiceNow, Inc. (NYSE: NYSE:NOW) consolidates its position as a leader in the enterprise software market with a market capitalization of $204.5 billion. It is leveraging its strengths in artificial intelligence (AI) and workflow automation to drive growth and innovation. According to data from InvestingPro the company achieves impressive gross profit margins of 78.5% and generated revenues of USD 12.06 billion in the last twelve months. As the company expands beyond its core IT Service Management (ITSM) business into new areas such as Customer Relationship Management (CRM), investors and analysts are keeping a close eye on its performance and strategic initiatives.

Recent financial development

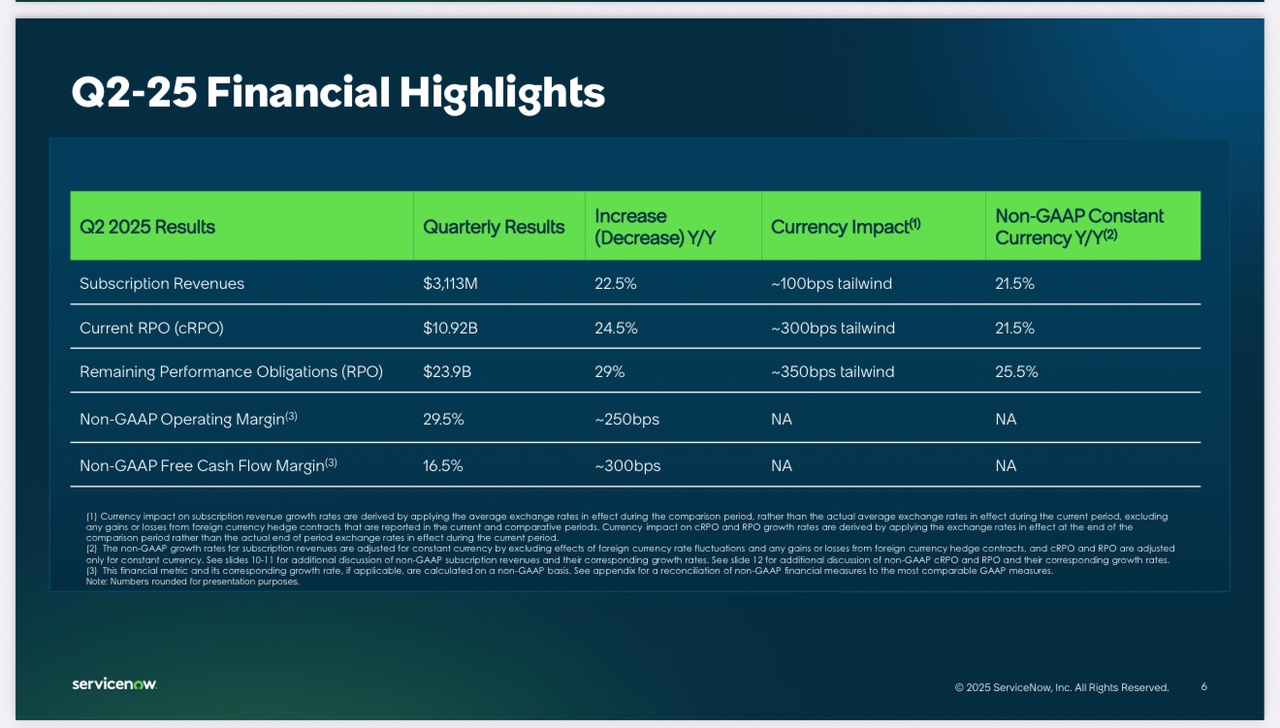

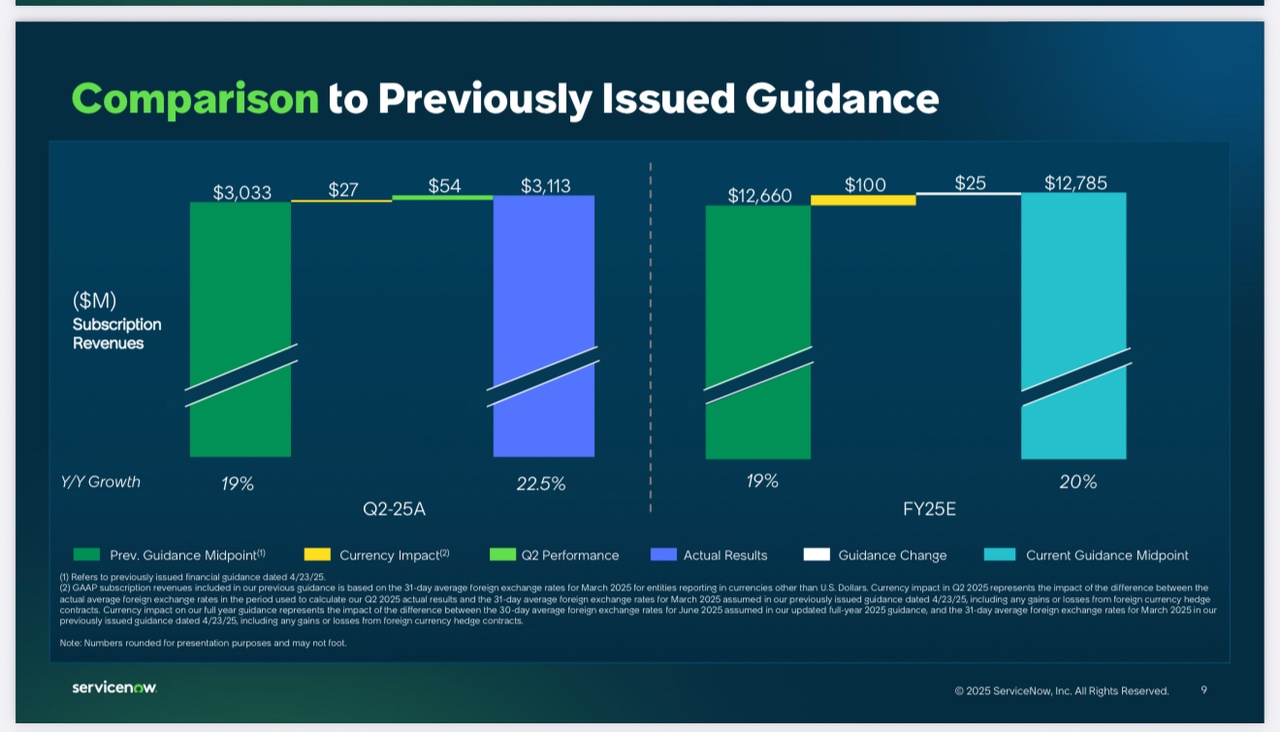

ServiceNow reported strong results for the first quarter of 2025, beating expectations on key metrics. Non-GAAP earnings per share (EPS) reached $4.04, above the consensus estimate of $3.83. Revenue for the quarter totaled $3.088 billion, representing year-over-year growth of 18.5% (adjusted) and 19.5% (constant currency). This performance is in line with the robust five-year compound annual growth rate (CAGR) of 26% reported by InvestingPro reported by Based on InvestingPro's fair value analysis, the stock currently appears slightly overvalued. Discover more insights and over 16 additional ProTips with an InvestingPro subscription.

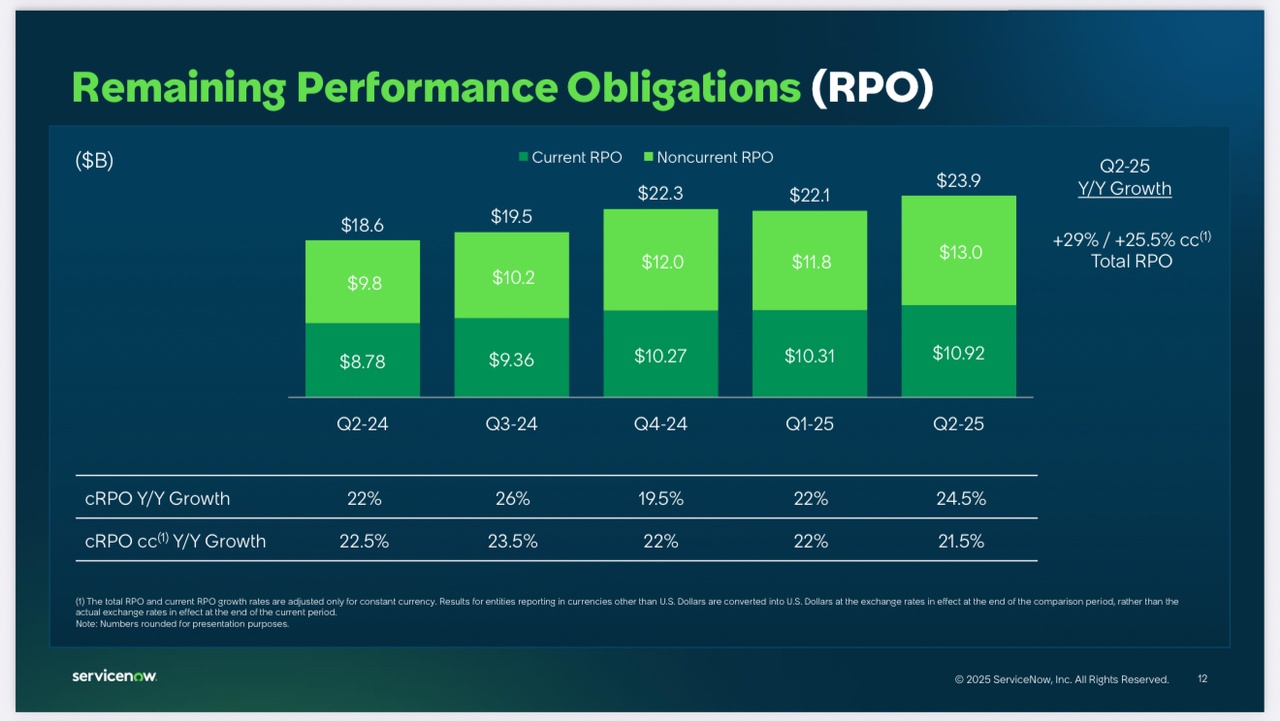

Subscription revenue, a key indicator of the company's recurring business, increased 19% year over year to $3.005 billion. The remaining performance obligations (cRPO), reflecting future contracted revenues, reached USD 10.310 billion, showing strong year-on-year growth of 22% in both reported and constant currency terms.

In response to these strong results, management slightly raised its guidance for the coming quarter and the full year. However, it took a cautious approach due to potential geopolitical risks and macroeconomic uncertainties.

AI and product strategy

ServiceNow's focus on AI has been a key driver of its recent success and future growth prospects. The strong financial condition score of 2.85 (from InvestingPro rated GOOD) and moderate leverage ratio support the company's ambitious AI initiatives. Want to dive deeper into ServiceNow's AI strategy and financials? Access our comprehensive Pro Research Report, available exclusively to InvestingPro subscribers. The company has made significant progress in integrating AI capabilities into its platform and has introduced several new AI-powered solutions:

1. Now Assist: an AI-powered assistant that has gained significant traction with over 1,000 customers using Plus SKUs and an annualized contract value (ACV) of $250 million.

2. AI Control Tower: A solution that helps organizations effectively manage and orchestrate their AI initiatives.

3. AI Agent Orchestration: A tool that facilitates the coordination and management of AI agents across different workflows.

ServiceNow's ambitious target of reaching $1 billion in AI ACV by the end of 2026 underscores the company's commitment to AI-driven growth. The recent acquisition of Moveworks, a conversational AI platform, further strengthens ServiceNow's AI capabilities and positions the company to compete more effectively in the rapidly evolving AI landscape.

Market position and competition

While ServiceNow maintains a strong leadership position in the ITSM market, the company is actively expanding into new areas, particularly CRM and industry workflows. This expansion is supported by strong fundamentals, including a solid current ratio of 1.09 and impressive revenue growth of 21.12% over the last twelve months, according to data from InvestingPro. For detailed valuation metrics, growth forecasts and expert analysis, explore our comprehensive pro research report on ServiceNow. This strategic move aims to increase ServiceNow's total addressable market (TAM), which is expected to grow from $165 billion in 2023 to $350 billion by 2027.

The CRM and Industry Workflows business has already reached an annual contract value (ACV) of USD 1.4 billion and is growing by over 30% annually. This expansion brings ServiceNow into direct competition with established providers such as Salesforce in the CRM sector. Although this move offers significant growth opportunities, it also brings new challenges as ServiceNow operates in a highly competitive market.

Growth prospects and challenges

ServiceNow's growth prospects remain strong, driven by several factors:

1. expansion of the TAM: The projected increase in ServiceNow's addressable market to $350 billion by 2027 provides ample room for growth.

2. AI adoption: The rapid adoption of AI-powered solutions such as Now Assist and the company's ambitious AI-ACV target point to significant growth potential in this area.

3. platform expansion: ServiceNow's strategy to expand beyond ITSM into CRM and industry workflows opens up new revenue streams and cross-selling opportunities.

4. strong financial profile: analysts forecast revenue growth rates of 18-20% over the coming years, with the company maintaining a robust free cash flow margin.

However, ServiceNow also faces several challenges:

1. macroeconomic uncertainties: Geopolitical risks and potential economic headwinds could impact corporate spending on software solutions.

2) Increasing competition: As ServiceNow expands into new markets such as CRM, it faces stiff competition from established providers and emerging AI-focused start-ups.

3. implementation risks: The company's ambitious AI strategy and expansion plans pose inherent implementation risks, particularly in scaling new solutions for production use.

4. valuation concerns: ServiceNow's high valuation compared to peers could make the stock vulnerable to market volatility if growth expectations are not met.

Bear Case

How could increasing competition in the CRM space affect ServiceNow's growth?

As ServiceNow expands its offering into the CRM market, it faces intense competition from established players such as Salesforce. These competitors have deep market penetration, extensive partner ecosystems and significant resources to invest in AI and other emerging technologies. ServiceNow's ability to gain market share in this highly competitive environment could prove difficult, potentially impacting growth rates and profit margins.

The company's lack of a long-standing presence in the CRM market could also lead to longer sales cycles and higher customer acquisition costs. This could put pressure on ServiceNow's operating margins and cash flow in the short to medium term as the company invests heavily in sales and marketing activities to establish its presence in the CRM space.

What risks does ServiceNow face in implementing its AI strategy?

Although ServiceNow has set ambitious goals for its AI initiatives, there are several risks associated with implementing this strategy. The rapidly evolving nature of AI technology means that ServiceNow must continually innovate to stay ahead. Any delays or missteps in product development could result in the company falling behind the competition or failing to meet customer expectations.

In addition, integrating acquired AI companies like Moveworks into ServiceNow's existing platform can present technical challenges and potential cultural clashes. If these integrations are not managed effectively, it could lead to delays in product launches, customer dissatisfaction and ultimately failure to achieve the goal of reaching $1 billion in AI ACV by 2026.

Bull Case

How could ServiceNow's AI initiatives drive long-term growth?

ServiceNow's strong focus on AI positions the company at the forefront of a transformative technology trend. As organizations increasingly look to leverage AI to increase efficiency and drive innovation, ServiceNow's AI-powered solutions could become critical components of their digital transformation strategies. The company's target of $1 billion in AI-ACV by 2026 demonstrates the significant growth potential in this area.

The integration of AI across ServiceNow's entire platform could also lead to increased customer retention and higher average revenue per user. As customers adopt more AI-powered features and realize tangible benefits, they are more likely to expand their use of the ServiceNow platform, driving upsell and cross-sell opportunities. This could lead to sustainable revenue growth and improved profitability in the long term.

What advantages does ServiceNow have in expanding beyond its core ITSM market?

ServiceNow's strong position in the ITSM market provides a solid foundation for expansion into adjacent areas such as CRM and industry workflows. The company's existing relationships with enterprise customers and its reputation for delivering robust, scalable solutions give it a significant advantage in cross-selling new offerings.

In addition, ServiceNow's platform approach enables seamless integration of different workflows across IT, customer service and other business functions. This integrated approach could be particularly attractive to organizations looking to consolidate their software stack and improve operational efficiency. As ServiceNow expands its capabilities, it has the potential to become an even more important partner for companies undergoing digital transformation, driving long-term growth and customer loyalty.

SWOT analysis

Strengths:

- Strong leadership position in the ITSM market

- Robust AI capabilities and strategic acquisitions (e.g. Moveworks)

- Consistent financial performance with high revenue growth and strong cash flow

- Expansion of the product portfolio beyond the core ITSM offering

Weaknesses:

- Dependence on US government business (approx. 15% of sales)

- Potential overvaluation compared to competitors

- Limited track record in CRM and other new markets

Opportunities:

- Expansion of the total addressable market (TAM) to USD 350 billion by 2027

- Growing demand for AI-powered business solutions

- Cross-selling opportunities in the areas of CRM and industry workflows

- Potential for further strategic acquisitions to strengthen capabilities

Risks:

- Intense competition in the CRM and AI markets

- Macroeconomic uncertainties and potential impact on corporate IT spending

- Rapid technological change that requires continuous innovation

- Implementation risks associated with expansion into new markets and AI integration

Analyst price targets (Target)

This analysis is based on information available up to July 29, 2025 and reflects the latest analyst reports and company announcements as of that date.

- Barclays: USD 1,210.00 (July 24, 2025)

- JMP Securities: USD 1,300.00 (July 24, 2025)

- D.A. Davidson: USD 1,150 (June 24, 2025)

- RBC Capital Markets: USD 1,100.00 (May 30, 2025)

- BMO Capital Markets: USD 1,150 (May 14, 2025)

- Cantor Fitzgerald: USD 1,048.00 (May 8, 2025)

- Piper Sandler: USD 1,120.00 (April 24, 2025)