Cathie Wood's ARK ETFs once again saw significant transactions on Tuesday, August 12, 2025, with a focus on technology and biotech stocks. The largest transaction of the day was the purchase of 738,367 shares of The Trade Desk Inc ( $TTD (+1,25 %) ) with a total value of $39,266,357. This move underscores ARK's continued confidence in the digital advertising platform, where the fund had already significantly increased its positions in recent days.

Another notable transaction involved Block Inc ( $SQ (+0,83 %) ), formerly known as Square. Here ARK sold 215,543 shares, representing a sizable value of $15,741,105. This sale represents one of the larger divestitures of the day and could indicate a strategic realignment of ARK's position towards the financial services and digital payments company.

ARK also made a significant purchase of 643,406 shares of Pinterest Inc ( $PINS ) worth $21,998,051. The social media company has repeatedly been in ARK's focus in the past, as evidenced by the continuous purchases over the past week. This trend points to a bullish assessment of Pinterest's growth prospects on the part of ARK.

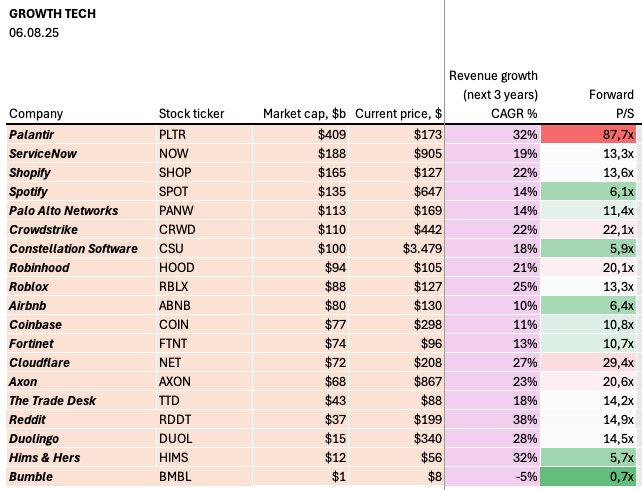

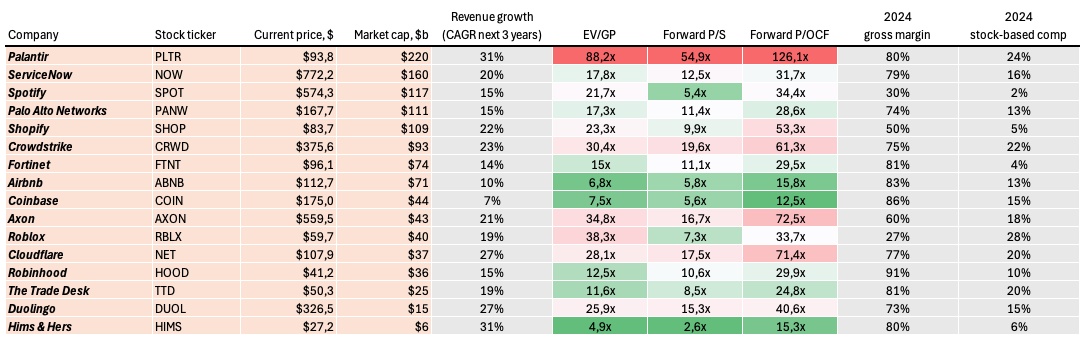

In the biotech sector, ARK's ARK ETF purchased 128,896 shares of CRISPR Therapeutics AG ( $CRSP (+2,94 %) ) for a total value of $714,567, continuing its investment in the gene-editing company. On the flip side, various ARK ETFs divested shares of DraftKings Inc ( $DKNG (+0,38 %) ), Guardant Health Inc ( $GH (+1,51 %) ), Robinhood Markets Inc ($HOOD (+2,54 %) ), Palantir Technologies Inc ($PLTR (+0,5 %) ), Roblox Corp ( $RBLX ) and Shopify Inc ($SHOP (+2,01 %) ). The largest sell-off was DraftKings, with 221,203 shares worth $9,452,004 sold.

Other notable buys included Exact Sciences Corp ( $EXAS (+0,96 %) ) and Personalis Inc ( $PSNL (+3,27 %) ). ARK bought 93,753 and 134,035 shares worth $3,835,435 and $603,157 respectively. The continued purchases in these stocks could indicate a focused strategy targeting innovative healthcare companies.

Smaller transactions were also part of the day's activity. ARK bought shares in Compass Pathways PLC ( $CMPS (+3,15 %) ) and 10X Genomics Inc ( $TXG (+1,38 %) ). Despite the smaller dollar amounts, these purchases could be part of a long-term strategy that focuses on up-and-coming companies in the respective sectors.

Some of dear Cathie's transactions don't need to be understood but well, the young lady's returns speak for themselves.

$ARKK (+2,08 %) and $ARKF (+1,72 %) over 70% return since 365 days, I can only shine with +27% with my portfolio.

I will remain invested in $TTD (+1,25 %) My current portfolio has a lot of risk, as I have generated some cash.

At the moment I'm considering whether I should possibly $HMWO (+0,57 %) and $EQQQ (+0,85 %) or just the $VUSA (+0,61 %) into the portfolio.

Temporarily sold $AMD (+1,59 %) +35%, $HIMS (+1,89 %) +15%, $DOCN (+2,08 %) +9%.

I would re-enter Hims and AMD at certain prices and possibly add other companies to the portfolio if they fit my selection.

My positions:

On the watchlist