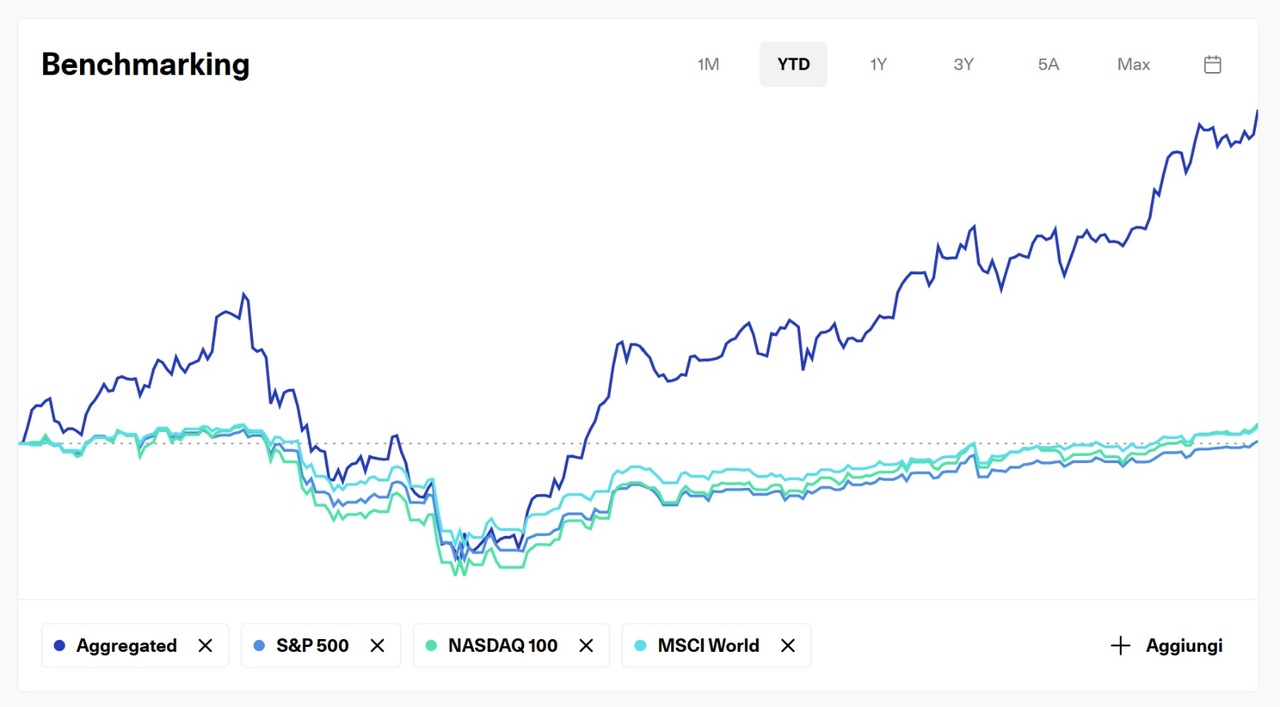

$OSCR (-1,8 %) continues to attract attention from market watchers as it pursues growth through technology innovation, financial restructuring, and market diversification. The healthcare technology company, known for its data-driven insurance models and digital-first approach, has navigated a complex landscape in 2025 with both progress and lingering challenges.

Strong Revenue Momentum

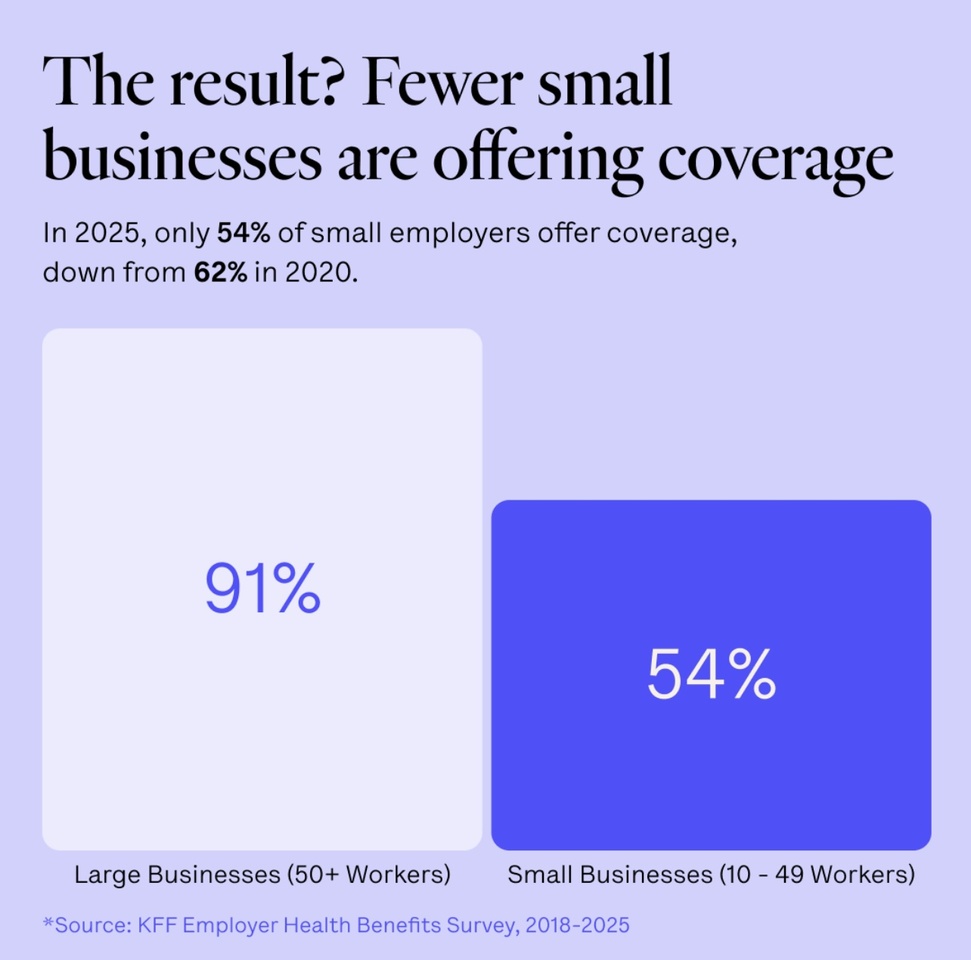

Oscar Health posted exceptional revenue growth throughout 2025, marking a year in which it reaffirmed its position as one of the rising players in the insurtech and healthtech markets. Its revenue in the first half of the year surged by over 40% year-over-year, surpassing 3 billion USD in the first quarter alone. Analysts estimate third-quarter revenue to reach roughly 3.08 billion USD, reflecting an annual growth of about 27%. This performance underscores the company’s ability to grow its membership base, which now exceeds 2 million, while expanding its presence across individual and small group segments.

Updated 2025 Guidance and Financial Outlook

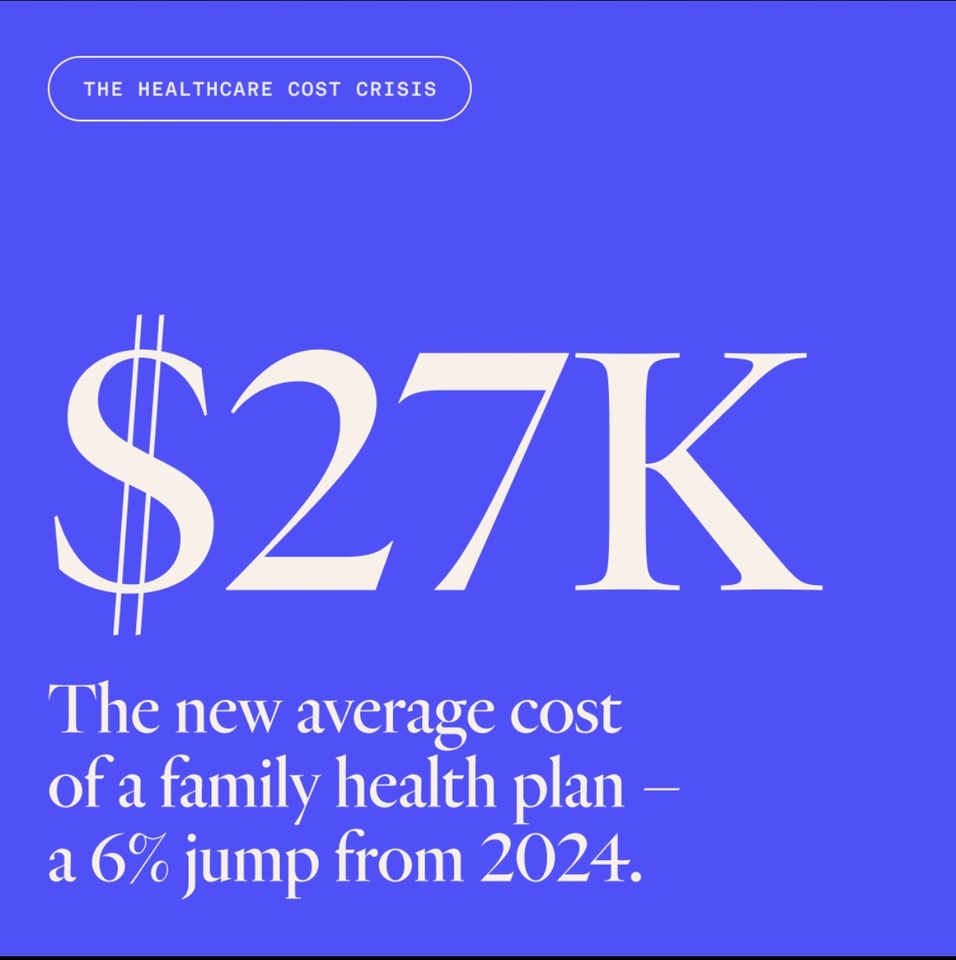

In July 2025, Oscar Health revised its full-year guidance, setting revenue expectations between 12 and 12.2 billion USD. However, it also projected operating losses between 200 and 300 million USD due to higher-than-anticipated medical claims and morbidity across Affordable Care Act marketplaces. The company raised its medical loss ratio forecast to 86–87%, indicating higher medical expenses relative to premium income. Despite these pressures, its liquidity remains robust, with more than 740 million USD in free cash flow providing flexibility for operations and investment.

Strategic Initiatives and AI Investment

Oscar Health’s most transformative moves this year revolve around artificial intelligence and strategic partnerships. The firm announced a 410 million USD convertible debt issuance to finance new AI-driven initiatives focused on claims automation, predictive analytics, and personalized member engagement. These systems are expected to streamline costs, improve accuracy in health risk management, and enhance overall member experience.

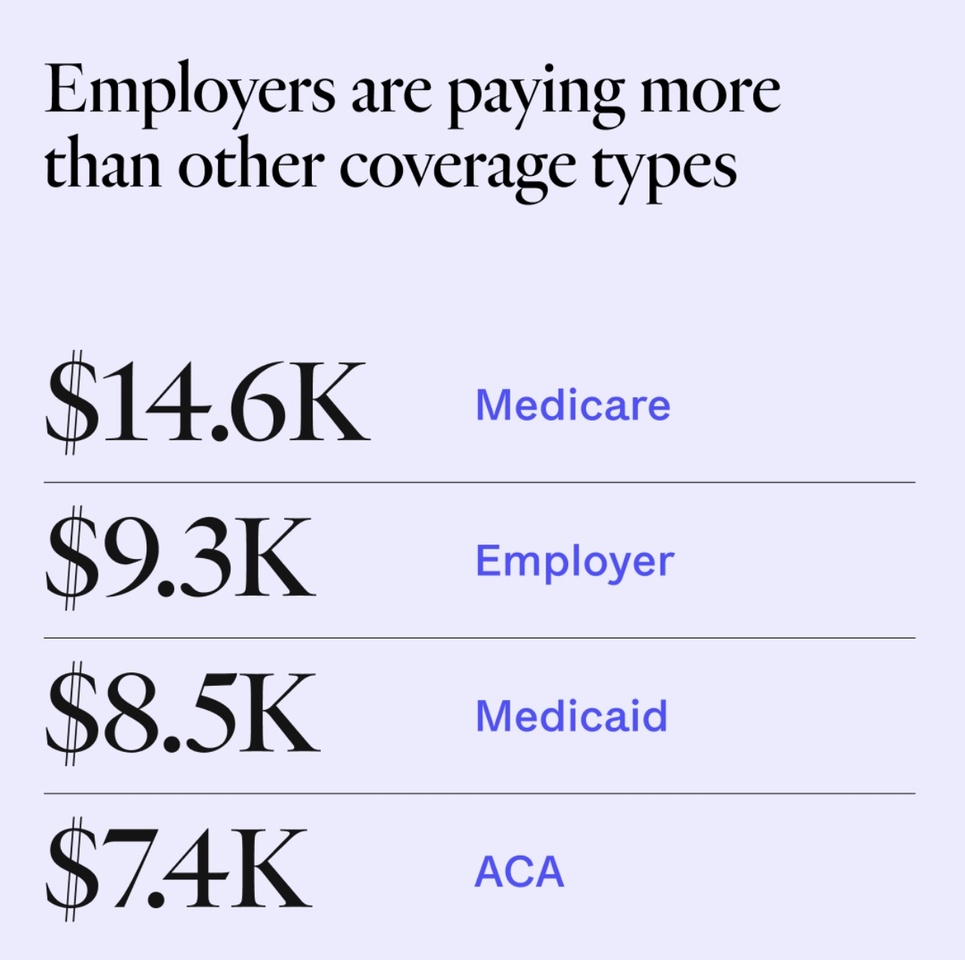

A key development is Oscar’s partnership with Hy-Vee, a major U.S. retailer, to launch an employer-sponsored health plan in 2026. This marks Oscar’s expansion beyond its traditional ACA market base into employer health coverage—a significant step toward business model diversification. By broadening its reach, the company aims to mitigate regulatory and claim-cost risks while unlocking new revenue streams.

Market Sentiment and Investment Risks

Analyst sentiment about Oscar Health remains cautious despite its growth trajectory. Current consensus classifies the stock as a “hold,” with an average target price of about 11.7 USD, implying a potential downside from its recent price near 19 USD. Investors are advised to weigh the company’s impressive revenue growth and stable liquidity against its ongoing profitability hurdles, driven by rising healthcare costs and market uncertainty.

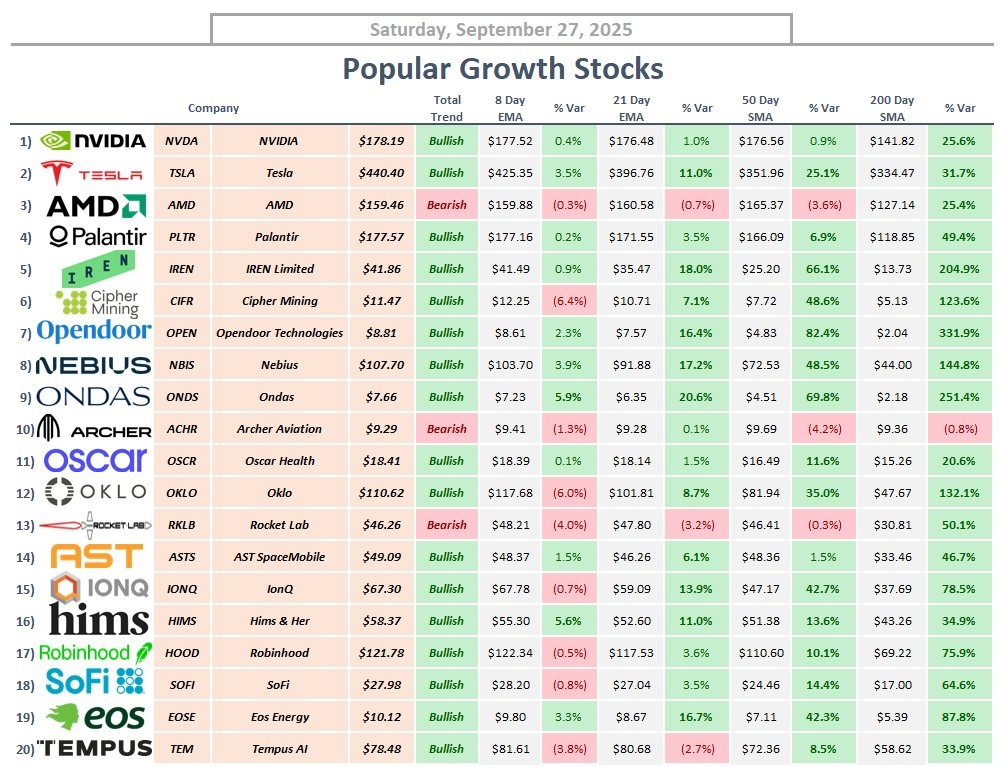

From a technical standpoint, Oscar Health’s stock trades above both its 50-day and 200-day moving averages, reflecting medium-term strength. However, its earnings per share remain negative (around -0.50 projected for Q3), and its return on equity stands at roughly -14%, emphasizing its current unprofitability.

Outlook

Oscar Health’s strategic emphasis on technology integration, especially artificial intelligence, positions it well for long-term competitiveness in a sector increasingly defined by digital innovation. While short-term profitability remains elusive, the company’s sustained revenue expansion, disciplined cost management, and expansion into new markets strengthen its long-term growth potential. Investors aligned with a technology-forward vision for healthcare may find Oscar Health a compelling, if volatile, opportunity in the evolving U.S. health insurance landscape.