Short Put: How I build my own entry price and make money in the process.

Reading time: 3-5 minutes

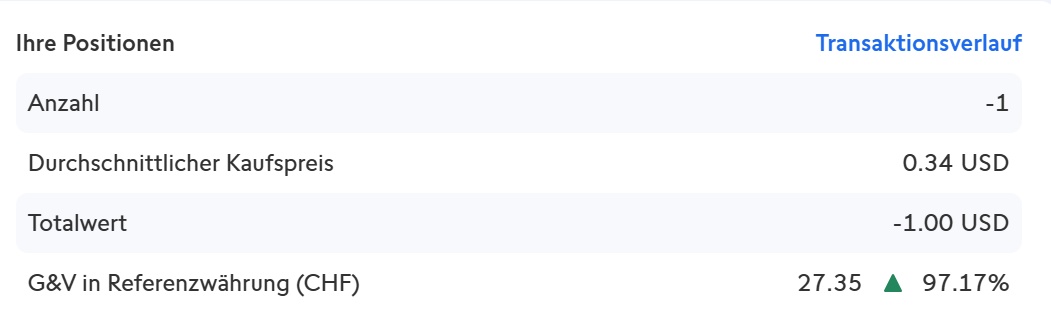

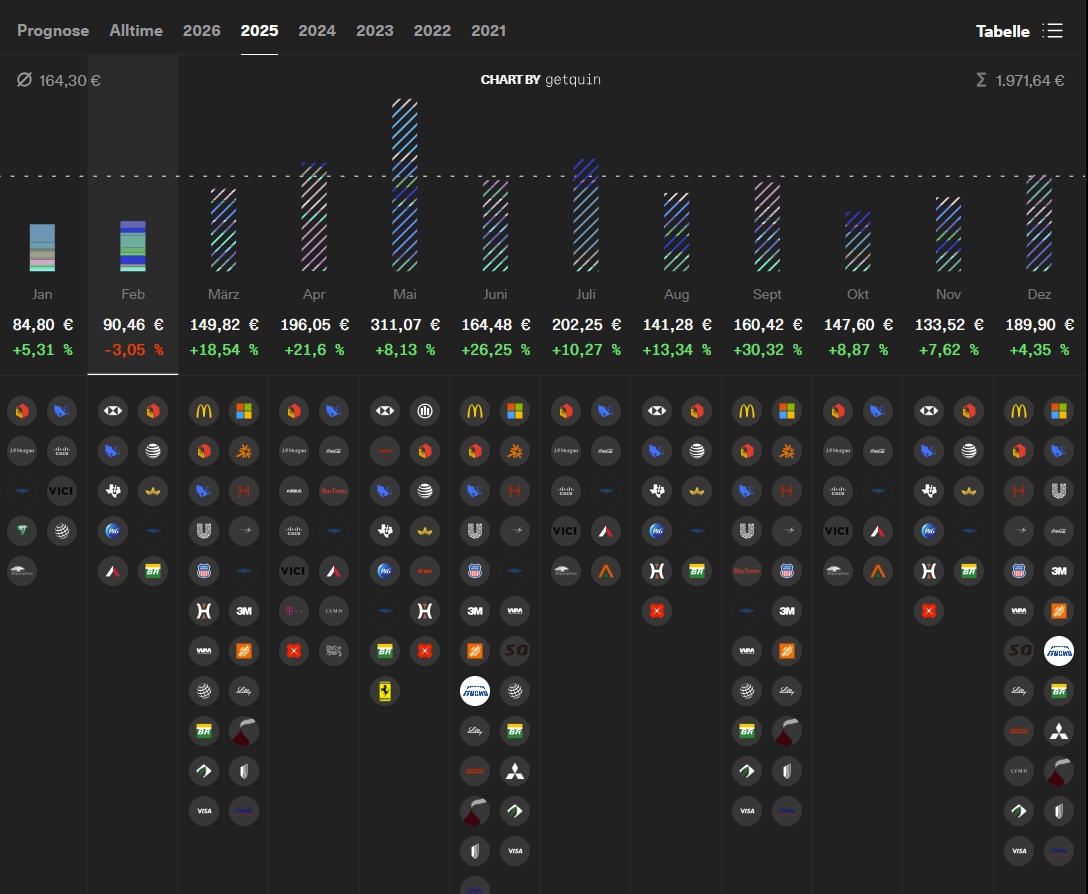

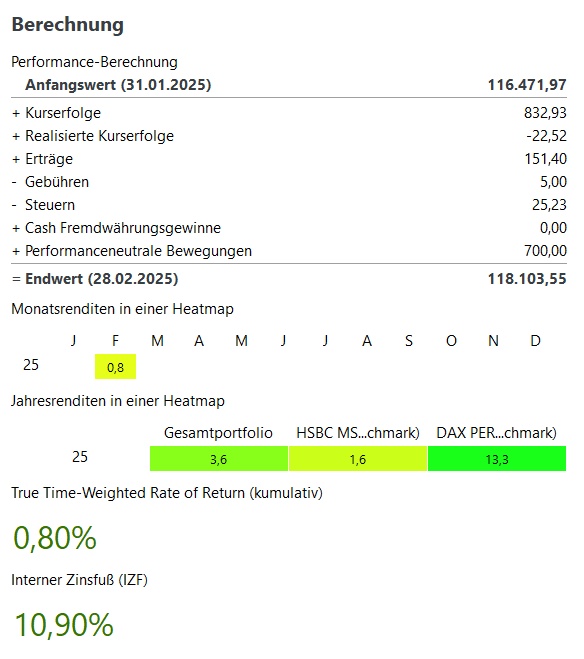

Many people think of options as a wild gambling instrument - but they can be used in a wonderfully down-to-earth way to cleverly manage your portfolio. A perfect example of this is my current short put on Arbor Realty ($ABR (+0,26 %) ), which you can also see in the embedded screenshot from my Swissquote account.

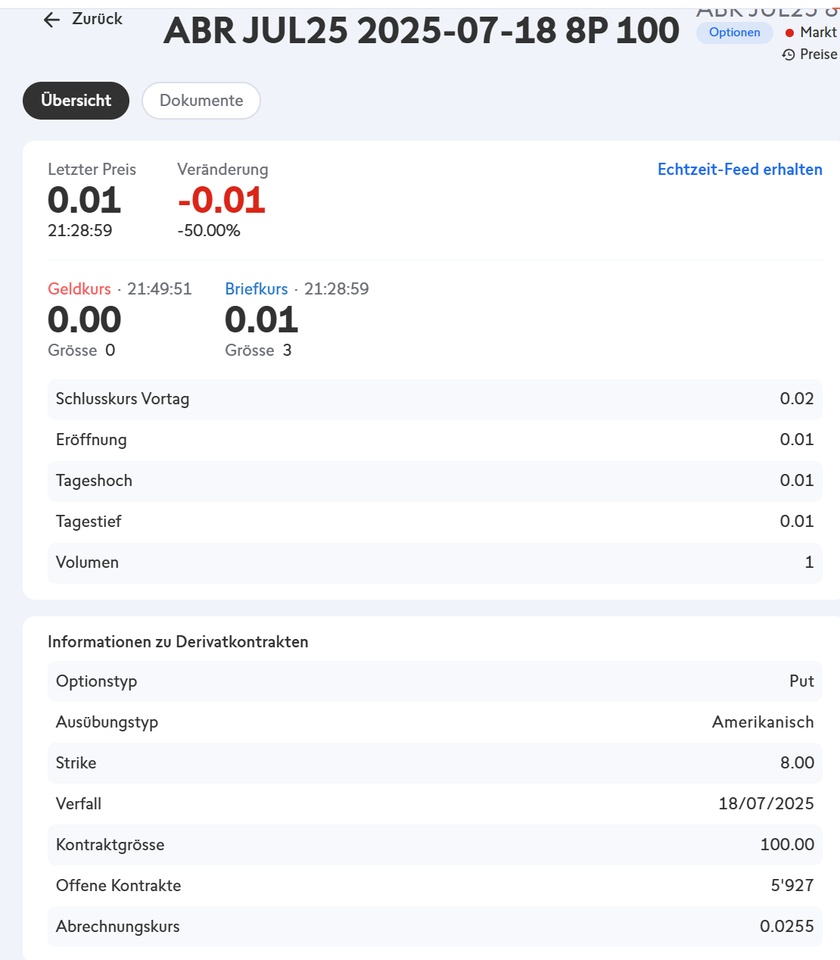

At the beginning of May, ARBOR stood at around USD 10.24. It was clear to me that I only wanted to buy more if the share fell below USD 8. Instead of placing a classic limit order, I preferred to sell a plain vanilla put option - without any frills. This was my signal to the market: If ARBOR falls below 8 dollars by mid-July, I will buy the shares at that price. I received a premium of USD 0.34 per share for this promise, which amounts to USD 34 for one contract (100 shares). (You can find out what the buyer of the option thinks at the end of the post).

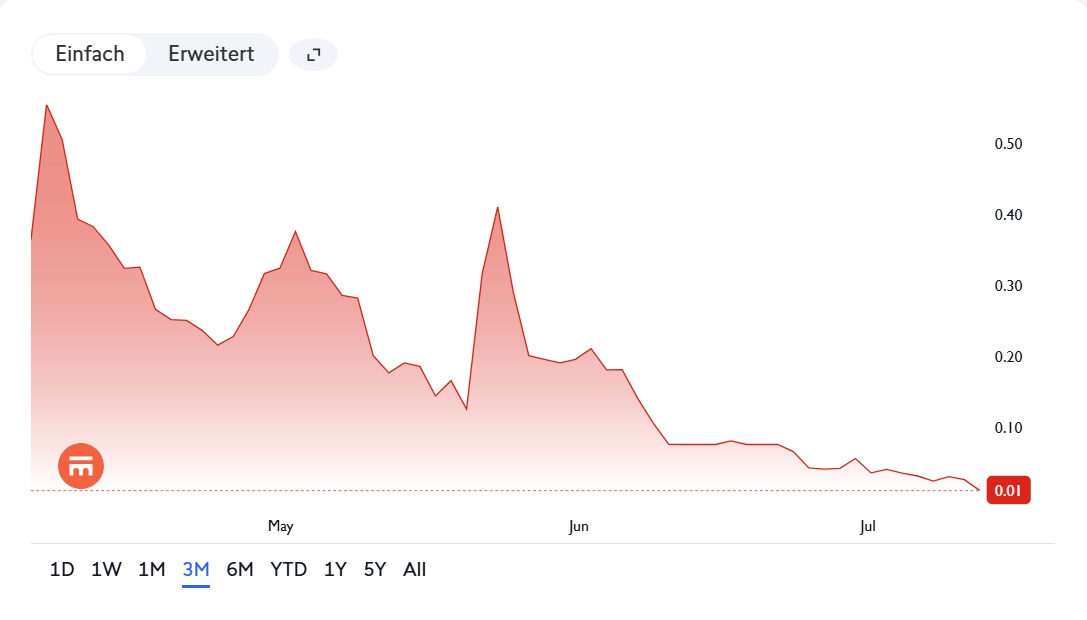

If you look at the screenshot, you can see under "Last price" the current value of the option - just USD 0.01. This means that it is extremely unlikely that the option will go into the money. It will expire worthless. The volatility is also exciting: at 97%, it is extremely high - which benefits me, because the higher the expected fluctuation, the higher the premium paid by the buyer. So I got more money for my promise thanks to the high level of uncertainty. After all, when I sold the option, it was 20% away from the strike (option price / market price = ~3% for 2.5 months)

In the screenshot you can also see the current price of ARBOR (10.99 USD) - well above my strike at USD 8. As long as this remains the case, my put option will expire worthless on July 18 and I can keep the entire premium. If ARBOR does fall below USD 8, I will have to buy - but even then, thanks to the premium, I have effectively only paid USD 7.66 per share.

This is how I use short puts: On the one hand, I control my desired entry priceon the other hand, I earn a little extra while I wait. This is exciting for me because I want to stay invested for the long term anyway. I don't want to gamble away this share, but rather add to my holdings when the price is good.

If you look closely, you can also see the key figure in the screenshot Leverage 17.29 - which shows how strongly the option reacts to price movements. For me as a seller, however, this does not play a major role because I am not speculating but "selling" the leverage: I collect the premium because someone else buys this leverage. Furthermore, the leverage is invalid at the end of an option, shortly before the practically worthless expiry.

So a plain vanilla put option is anything but complicated: fixed strike, fixed expiry, no barriers or special rules. This is precisely what makes them so easy to plan for strategies like mine: either I buy at my price - or I simply take the premium.

If you already own shares or are planning to add to them in the long term, you can cleverly boost your cash flow with short puts. Important difference to gambling: I only sell puts on shares that I really want. This keeps the risk manageable - even if the share price drops sharply.

Current puts in my portfolio:

$MAIN (+0,17 %) AUG25 49.7P & SEP25 44.4P

In the past I have successfully $HELN (+0,66 %) stocked up. With $MPW (-0,44 %) selling the puts even made up for large parts of my book losses.

So options don't have to be wild or complicated. With a simple short put, you can practically build the purchase price yourself and get paid for waiting. This is exactly what you see here in black and white in the Swissquote account.

Finally, if you're wondering whether it's worth it because of the "small" USD 34: I deposit via Lombard credit and have no liquidity to deposit as collateral. So it doesn't restrict me personally. I pay nothing for the part of the Lombard loan blocked by the option, as it is not actually used. Selecting an option doesn't take me 5-10 minutes. So it's worth the time for me. At times it was 100-150 per month as an "extra". However, as I only want to buy fewer shares at the moment, or the targeted entry prices are too far below the market price and the premium is correspondingly unattractive, there is less activity on my part. :-D

SO - What do you want to know and should I also shed more light on the put's long position? (The entry point is at the end of the post).

- The "loss" described here results from the purchase (strike 8-.) and the possible market price of e.g. 7.50 - but the option premium still has to be offset.

The buyer of the option:

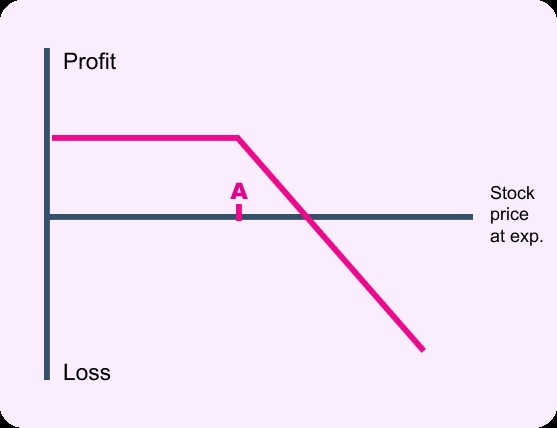

The buyer of the put expects - or wants to hedge against - the price falling below $ABR (+0,26 %) falls below 8 dollars by July. For him, the put option is something like an insurance policy. If the price falls significantly below 8 dollars, he can still sell the share at 8 dollars, even if it is only worth 6 or 7 dollars on the market. This limits his downside risk. Some also buy puts purely speculatively in order to profit from falling prices without owning the share itself. In the best case scenario, the buyer then sells the put later at a higher price if the price really does fall and the option is worth more. In any case, the following applies: I receive the premium because the buyer wants either security or speculation - and I make this option available.

----

Happy investing!

GG