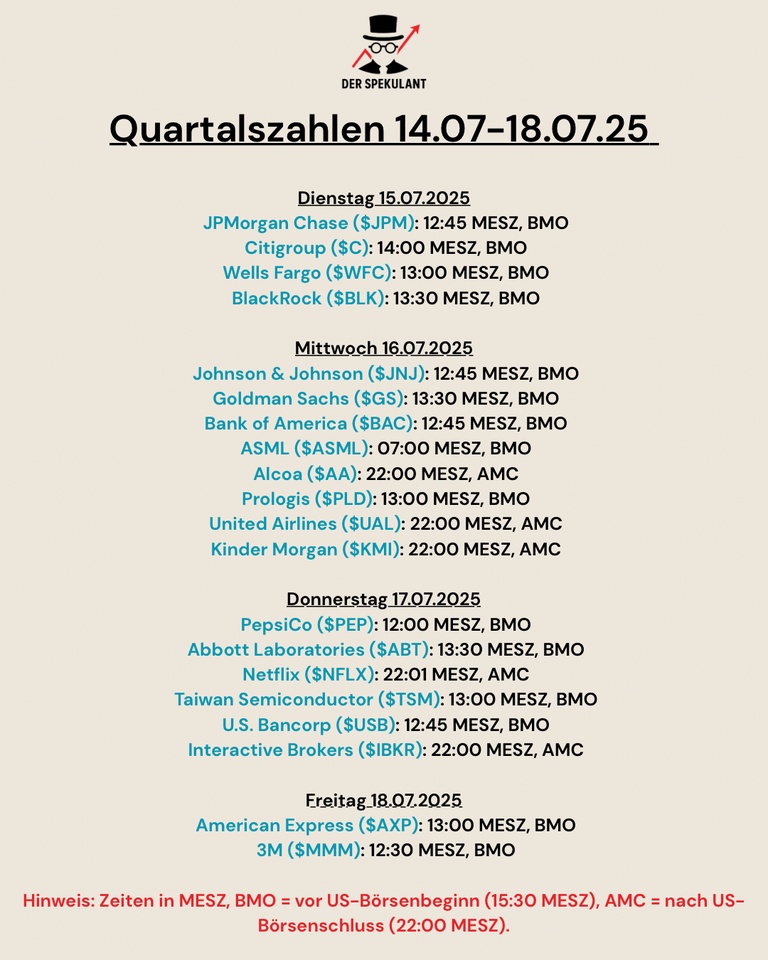

🔹 Net Revenue: $1.48B (Est. $1.38B) 🟢; UP +15% YoY

🔹 Adj EPS: $0.51 (Est. $0.46) 🟢; UP +16% YoY

🔹 Net Interest Income: $860M (Est. $794.7M) 🟢; UP +9% YoY

🔹 Commission Revenue: $516M; UP +27% YoY

🔹 Pretax Profit: $1.10B; UP +17% YoY

🔹 Pretax Margin: 75%; UP from 73% YoY

Key Customer Metrics

🔹 Customer Accounts: 3.87M (Est. 3.86M) 🟢; UP +32% YoY

🔹 Customer Equity: $664.6B; UP +34% YoY

🔹 Customer Margin Loans: $65.1B; UP +18% YoY

🔹 Avg. Customer Margin Loans: $60.93B (Est. $61.02B) 🟡

🔹 Customer Credits: $143.7B; UP +34% YoY

🔹 Daily Avg. Revenue Trades (DARTs): 3.55M; UP +49% YoY

Other Metrics

🔹 Execution, Clearing & Distribution Fees: $116M; UP +1% YoY

🔹 Other Fees & Services: $62M; DOWN -9% YoY

🔹 G&A Expenses: $61M; UP +17% YoY

🔹 Operating Income: $1.10B; UP +17% YoY

Capital & Returns

🔹 Total Equity: $18.5B

🔹 Quarterly Dividend: $0.08/share (Payable Sep 12, 2025)