05.11.2024

US elections underway + Nvidia benefits from Dow admission and processor news + PALANTIR accelerates growth thanks to AI + DHL earns less on the bottom line + Biontech increases revenue and profit

The first decisions of the US presidential election have been made: In the small town of Dixville Notch in the state of New Hampshire, Democrat Kamala Harris and her Republican opponent Donald Trump tied by 3 votes to 3, as announced on a hand-written board shortly after midnight (local time). The voter turnout was 100 percent. The polling station in Dixville Notch has been opening at midnight on election day since 1960.

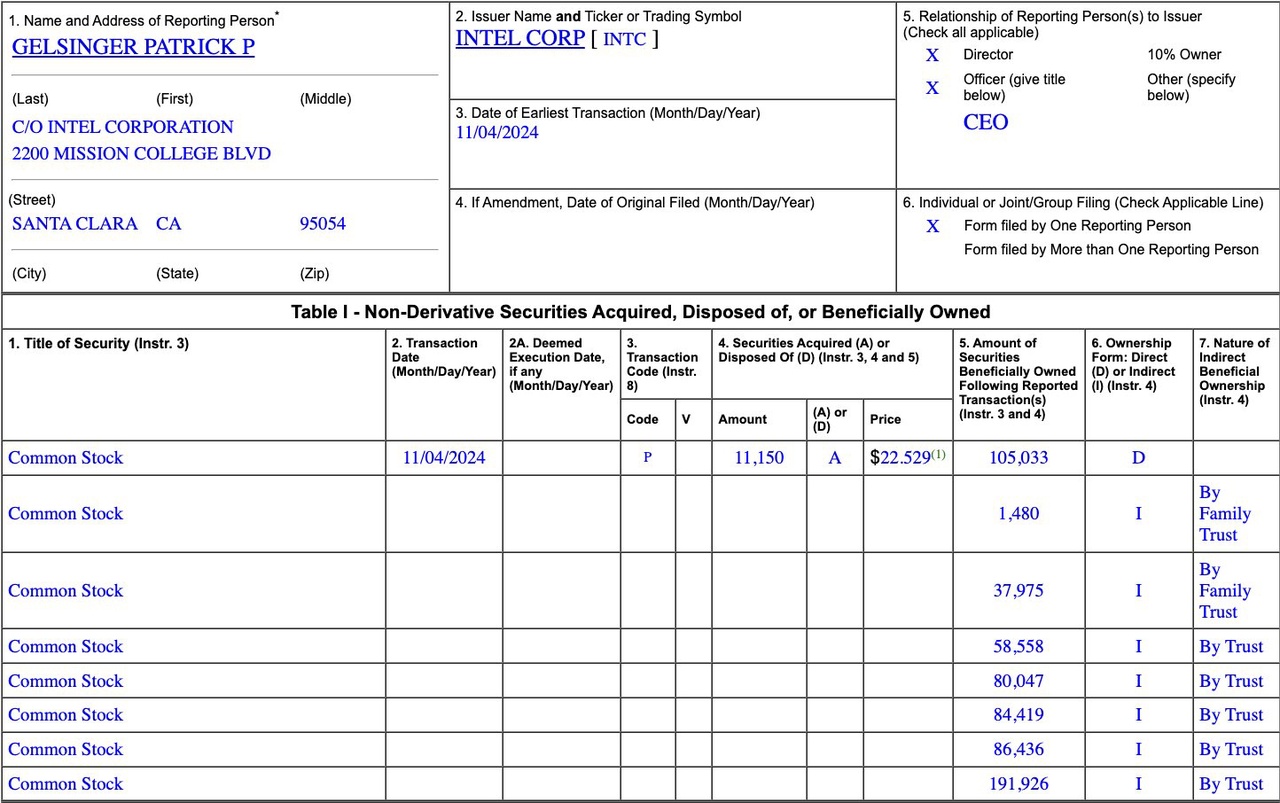

The index provider S&P Dow Jones Indices announced on Friday after the close of trading that Nvidia $NVDA (-2,11 %) will be included in the US Dow Jones Industrial index this Friday. For the manufacturer of chips related to artificial intelligence (AI), the shares of semiconductor company Inte l$INTC (+1,31 %) have to make way. Nvidia's market capitalization has increased tenfold over the past two years to around 3.3 trillion dollars, while Intel's has fallen by just under a fifth to 100 billion dollars. Various media outlets are also reporting that Nvidia is developing its own ARM processors for notebooks, which could be launched on the market in September 2025. Until now, the company was primarily known for its graphics processors in the consumer segment. ARM processors are primarily used in mobile devices such as smartphones and tablets.

Palantir $PLTR (+5,14 %) Technologies presented exceptionally strong business figures in the third quarter of 2024. The company reported year-on-year growth of 30%, bringing total revenue to USD 726 million.

This dynamic development is particularly attributable to rapid growth in the United States, where sales climbed by 44% to USD 499 million. The US commercial business in particular increased its sales by an impressive 54% to USD 179 million. The area of government contracts also contributed significantly to the success, recording an increase of 40% to USD 320 million. This dynamic development is due in particular to the rapid growth in the United States, where sales climbed by 44% to USD 499 million. The US commercial business in particular increased its sales by an impressive 54% to USD 179 million. The area of government contracts also contributed significantly to the success and recorded an increase of 40% to USD 320 million. This exceeded analysts' expectations.

The logistics group DHL $DHL (+1,15 %) earned less on the bottom line in the third quarter due to increased personnel costs, a lower number of letters sent and weak margins for air transportation, among other things. Net profit fell by almost seven percent to EUR 751 million, the Group announced on Tuesday when presenting detailed figures for the third quarter in Bonn. As has been known since the end of October, DHL was able to keep earnings before interest and taxes (EBIT) stable at just under 1.4 billion euros - thanks in part to positive special effects. When presenting the key figures, DHL also lowered its forecast for operating profit in the current year and for 2026. However, the medium-term targets for free cash flow and investments were confirmed. Compared to the previous year, revenue increased by six percent to 20.6 billion euros.

Biontech $BNTX (+4,37 %) significantly increased sales in the third quarter thanks to the successful market launch of adapted Covid-19 vaccines for the 2024/2025 vaccination season and also earned more on the bottom line. Nevertheless, the company now sees sales for the year as a whole at the lower end of the forecast range. In view of the cautious outlook, the share price held up slightly.

Tuesday: Stock market dates, economic data, quarterly figures

Quarterly figures / company dates USA / Asia

08:30 Nintendo half-year figures

13:00 Dupont quarterly figures

No time specified: USA: Yum! Brands | Cummins quarterly figures

Quarterly figures / Company dates Europe

06:45 Redcare Pharmacy quarterly figures

07:00 DHL Group | Fraport | Fresenius Medical Care | Krones | Zalando | Norma Group Quarterly figures

07:30 Hugo Boss | Uniper | Bouygues Quarterly figures

08:00 Schaeffler | Vestas Wind | AB Foods quarterly figures

08:30 DHL Group PK

09:00 Audi 9 months results | Zalando | Hugo Boss PK

09:30 Zalando Analyst Conference

10:00 DHL Group Analyst Conference

10:30 Fraport BI-PK

11:00 Hugo Boss | Schaeffler Analyst Conference

14:00 Ferrari quarterly figures

Unscheduled: Unicredit quarterly figures

Economic data

- 08:45 FR: Industrial Production September FORECAST: -0.5% yoy previous: +1.4% yoy

- 10:30 UK: Purchasing Managers' Index/PMI non-manufacturing (2nd release) October OUTLOOK: 51.8 1st release: 51.8 previous: 52.4

- 14:30 US: Trade Balance September FORECAST: -84.00 bn USD previously: -70.43 bn USD

- 16:00 US: ISM Non-Manufacturing Index October FORECAST: 53.7 points PREVIOUS: 54.9 points

- Without time US: Presidential and congressional elections